50pcntwagededctnMADRAShc-hol;ds it unconstitutional-16 pg

advertisement

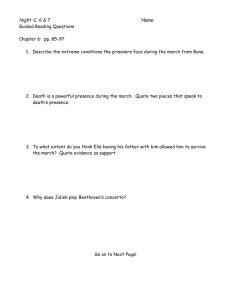

WWW.LIVELAW.IN 1 BEFORE THE MADURAI BENCH OF MADRAS HIGH COURT Date of Reservation : 15.11.2018 Date of Pronouncement : 01.02.2019 CORAM : THE HONOURABLE MR.JUSTICE K.K.SASIDHARAN and THE HONOURABLE MR.JUSTICE G.R.SWAMINATHAN W.P (MD)No.14653 of 2017 K.R.Raja ... Petitioner vs. 1.The State of Tamil Nadu, Rep.by the Home Secretary, Prison Department, Secretariat, Fort St.George, Chennai – 600 009. 2.The Additional Director General of Police, The Inspector General of Police, CMDA Tower – II, No.1, Gandhi Irwin Road, Chennai – 600 008. ... Respondents Prayer : Writ Petition is filed under Article 226 of the Constitution of India, to issue a Writ of Declaration, to declare the Rule No.481 of the Tamil Nadu Prison Rules, 1983 to the extent of 50% of the wages earned by the prisoners deducted for up keeping of the prisoners and 20% of the wages credited to prison fund to be paid to the victims, as illegal and against law and justice, consequently to direct the respondents to increase the prisoners wage in the State of Tamil Nadu credited to the http://www.judis.nic.in WWW.LIVELAW.IN 2 prisoners cash property account from 30% to at least 75% within the time stipulated by this Court. For Petitioner : Mr.R.Alagumani For Respondents : Mr.N.Shanmugaselvam, Additional Government Pleader ORDER (Order of the Court was made by G.R.SWAMINATHAN, J.) This writ petition has been filed in public interest. The petitioner seeks issuance of a writ of declaration for declaring that Rule 481 of Tamil Nadu Prison Rules, 1983 is null and void to the extent it enables deduction of 50% of the wages earned by the prisoners. The writ petitioner also questions the crediting of 20% of the wages to prison funds to be paid to the victims. 2.The government strongly opposes the prayer and has filed a detailed counter affidavit in this regard. It is the stand of the Government that the impugned Rule was amended pursuant to the directions of the Hon'ble Supreme Court in the decision reported in (1998) 7 SCC 392 (State of Gujarat and another vs. Hon'ble High Court of Gujarat). 1/5th of the wages earned by the http://www.judis.nic.in WWW.LIVELAW.IN 3 prisoners is being apportioned to the victim compensation fund payable to the victims affected by the criminal acts of the prisoners. It is further stated that the average cost of food, clothing and other amenities provided to the workers comes to Rs.153/- per day per prisoner. is deducted for Even though 50% of the wages the up keep of the prisoners, the deducted amount being Rs.100/-, Rs.90/- and Rs.80/- from the skilled, semi-skilled and unskilled prisoners respectively, is not sufficient to meet this cost. The respondents also state that the wage payable to the prisoners is being reviewed and enhanced periodically. The counter affidavit also sets out the measures taken by the authorities in reaching out to the beneficiaries of the victim compensation fund. The submission of the respondents is that the impugned rules do not deserve to be struck down. 3.The issue regarding payment of wages to prisoners came up for consideration before the Hon'ble Supreme Court in State of Gujarat and another vs. Hon'ble High Court of Gujarat (1998) 7 SCC 392). The following directions were issued by the Hon'ble Supreme Court : http://www.judis.nic.in WWW.LIVELAW.IN 4 “50.The above discussion leads to the following conclusions : (1) It is lawful to employ the prisoners sentenced to rigorous imprisonment to do hard labour whether he consents to do it or not. (2) It is open to the jail officials to permit other prisoners also to do any work which they choose to do provided such prisoners make a request for that purpose. (3) It is imperative that the prisoner should be paid equitable wages for the work done by them. In order to determine the quantum of equitable wages payable to constitute prisoners, the State concerned shall a wage-fixation body for making recommendations. We direct each State to do so as early as possible. (4)Until the State Government takes any decision on such recommendations, every prisoner must be paid wages for the work done by him at such rates or revised rates as the Government concerned fixes in the light of the observations made above. For this purpose, we direct all the State Governments to fix the rate of such interim wages within six weeks from today and report to this Court of compliance of this direction. (5)We recommend to the State concerned to make law for setting apart a portion of the wages earned by the prisoners to be paid as compensation to deserving victims of the offence, the commission of which entailed http://www.judis.nic.in WWW.LIVELAW.IN 5 the sentence of imprisonment to the prisoner, either directly or through a common fund to be created for this purpose or in any other feasible mode.” 4.As rightly contended by the Government, the provision for deduction from the prisoners' wages for the purpose of compensating the victims cannot be questioned since it was made only pursuant to and in terms of the direction given by the Hon'ble Supreme Court. We are of the view that apportioning 1/5th of the prisoners' wages for crediting to the victims compensation fund cannot be said to be unreasonable. 5.The learned counsel appearing for the writ petitioner strongly contended that the impugned Rule violates Article 14 and 23 of the Constitution of India by providing for deducting 50% of the prisoners' wages towards their upkeep. Of course, the Government endeavours to sustain the said Rule by pointing out that even this is not sufficient to meet the upkeep of the prisoners. The stand of the Government begs the question. The wages of the prisoners are fixed in terms of Rule 480 of Tamil Nadu Prison Rules, 1983. Admittedly, the statutorily fixed minimum wages are not paid to the prisoners. http://www.judis.nic.in Different WWW.LIVELAW.IN 6 parameters apply in this regard. Therefore, after fixing a wage that is not in consonance with the provisions of the Minimum Wages Act, it is not open to the respondents to now argue that even deduction of 50% of the prisoners' wages is not sufficient to meet the cost of their upkeep. Therefore, we reject the stand of the Government. The answer to the issue on hand lies in Paragraph No.44 of the aforesaid judgment of the Hon'ble Supreme Court. It reads as follows : “44.When all aspects are considered, we are inclined to think that the request of the Government to permit them to deduct the expenses incurred for food and clothes of the prisoners from the minimum wages rates is a reasonable request. There is nothing uncivilised or unsociable it it. But the government cannot deduct any substantial portion from the wages on that account. The Government can arrive at the reasonable percentage to be deducted from Minimum wages taking into account the average amount which the government is spending per prisoner for providing food, clothes and other amenities to him.” 6.What has been stated above cannot be characterized as obiter. It has been categorically laid down by the Hon'ble Supreme Court that the Government cannot deduct any http://www.judis.nic.in WWW.LIVELAW.IN 7 substantial portion from the wages of the prisoners. It can make only a reasonable deduction. But, the moot question is whether deducting 50% of the prisoners' wages can be said to constitute substantial deduction. 7.The word substantial has not been received any statutory definition. decisions However, we can usefully refer to some of the where the expression “substantially financed” occurring in the Right to Information Act, 2005 came up for consideration. The Madras High Court in the decision reported in (2010) 5 CTC 98 (New Tiruppur Area Development Corporation Ltd vs. State of Tamil Nadu) held as follows : 24.On the question of being substantially financed, there is no clear definition as to what is meant by the term “substantially financed”. The Supreme Court while dealing with the Taxation on Income (Investigation Commission) Act, 1947 (Central Act 30 of 1947), had an occasion to deal with a provision where the term substantive was attacked as vague and after its amendment indicating the quantum, the provision was held to be definite and clear vide its judgment in Shree Meenakshi Mills Ltd. v. Visvanatha Sastri, 1955 (1) SCR 787: AIR 1955 SC 13. The following passage found in paragraph 13 http://www.judis.nic.in WWW.LIVELAW.IN 8 may be usefully extracted below: “13.…It was argued in ‘Mohta’s case (A)’ as well as in these Petitions that the classification made in Section 5(1) of the impugned Act was bad because the word “substantial” used therein was a word which had no fixed meaning and was an unsatisfactory medium for carrying the idea of some ascertainable proportion of the whole, and thus the classification being vague and uncertain, did not save the enactment from the mischief of Article 14 of the Constitution. This alleged defect stands cured in the amended Section 34 inasmuch as the legislature has clearly indicated in the statute what it means when it says that the object of the Act is to catch persons who to a substantial extent had evaded payment of tax, in other words, what was seemingly indefinite within the meaning of the word “substantial” has been made definite and clear by enacting that no evasion below a sum of one lakh is within the meaning of that expression.” Since the present Act do not quantify the amount of funding required the Court will have to apply proper test in each case and apply the provisions of the RTI Act to those authorities. 25.Under the RTI Act, quantum of the finance to hold a body being considered as substantially financed is not specified. That was why this Court in Tamil Nadu Road Development Company Limited, rep. by its Director-in-charge, Chennai v. Tamil Nadu http://www.judis.nic.in WWW.LIVELAW.IN 9 Information Commission, 2008 (8) MLJ 17, which was confirmed by the Division Bench vide judgment Tamil Nadu Road Development Company Limited, rep. by its Director-in-Charge, Chennai v. Tamil Nadu Information Commission, Chennai and another, rep. by its 2008 (6) MLJ Registrar, 737, in paragraph 16 observed as follows: “16....The word “substantial” is not defined in the Act. For the word “substantial” it is not possible to lay down any clear and specific definition. It must be a relative one, however, “substantial” means real or actual as opposed to trivial.” 8.The Hon'ble Delhi High Court in the decision reported in ILR (2010) 4 Del 1 (Indian Olympic Association vs. Veeresh Malik) held as follows : “48.The next issue is the meaning of the expression “substantially financed”. This is, in the opinion of this court, crucial for a determination as to whether the body or institution is a public authority. The petitioners’ arguments on this point have been that for a body to be “substantially financed” state finance or funding has to be more than 50%; there should be an element of permanent dependence about such financing, that such financing should not be only in respect of capital expenditure, and that the body receiving the funds or finances should not be a http://www.judis.nic.in WWW.LIVELAW.IN 10 venture or ad-hoc body, but a continuous one. It is also argued that loans advanced, as in the case of commercial transactions, do not amount to “substantial financing” of the institution. 49.The term “substantially financed” has not been defined. .... Oxford’s Shorter English Dictionary defines the term “substantial” as follows: “substantial….A adjective. 3. Of ample or considerable amount or size; sizeable, fairly large. 4. Having solid worth or value, of real significance; solid, weighty; important, worthwhile.” The term “substantial” denotes something of consequence, and contrary to something that is insignificant or trivial. It implies a matter of some degree of seriousness. The question is whether the term itself suggests, in the context of “substantial financing” a predominant or overwhelming financing. In other words, does “substantial” read with “financing” mean that the major funding should from the relevant source, i.e. state or governmental source.” 9.The Hon'ble Supreme Court in the decision reported in (2013) 16 SCC 82 (Thalappalam Service Coop.Bank Ltd vs. State of Kerala) held as follows : http://www.judis.nic.in WWW.LIVELAW.IN 11 46....The expression “substantially financed”, as such, has not been defined under the Act. “Substantial” means “in a substantial manner so as to be substantial”. In Palser v. Grinling, while interpreting the provisions of Section 10(1) of the Rent and Mortgage Interest Restrictions Act, 1923, the House of Lords held that “substantial” is not the same as “not unsubstantial” i.e. just enough to avoid the de minimis principle. The word “substantial” literally means solid, massive, etc. The legislature has used the expression “substantially financed” in Sections 2(h)(d)(i) and (ii) indicating that the degree of financing must be actual, existing, positive and real to a substantial extent, not moderate, ordinary, tolerable, etc. 47.We often use the expressions “questions of law” and “substantial questions of law” and explain that any question of law affecting the right of parties would not by itself be a substantial question of law. In Black’s Law Dictionary (6th Edn.) the word “substantial” is defined as “Substantial.—Of real worth and importance; of considerable value; valuable. Belonging to substance; actually existing; real; not seeming or imaginary; not illusive; solid; true; veritable. … Something worthwhile as distinguished from something without value or merely nominal. … Synonymous with material.” http://www.judis.nic.in WWW.LIVELAW.IN 12 The word “substantially” has been defined to mean “essentially; without material qualification; in the main; in substance; materially”. In Shorter Oxford English Dictionary (5th Edn.), the word “substantial” means “of ample or considerable amount of size; sizeable, fairly large; having solid worth or value, of real significance; solid; weighty; important, worthwhile; of an act, measure, etc. having force or effect, effective, thorough”. The word “substantially” has been defined to mean “in substance; essentially, as a substantial intrinsically”. thing Therefore or being; the word “substantial” is not synonymous with “dominant” or “majority”. It is closer to “material” or “important” or “of considerable value”. “Substantially” is closer to “essentially”. Both words can signify varying degrees depending on the context. 48.Merely providing subsidies, grants, exemptions, privileges, etc. as such, cannot be said to be providing funding to a substantial extent, unless the record shows that the funding was so substantial to the body which practically runs by such funding and but for such funding, it would struggle to exist. ....” 10.Applying the principles laid down in the aforesaid decisions, one can safely come to the conclusion that deducting 50% of the wages would certainly qualify as substantial http://www.judis.nic.in WWW.LIVELAW.IN 13 deduction. Article 23 of the Constitution prohibits 'Begar'. It reads as under : 23.Prohibition of traffic in human beings and forced labour. (1) Traffic in human beings and begar and other similar forms of forced labour are prohibited and any contravention of this provision shall be an offence punishable in accordance with law. (2)Nothing in this article shall prevent the State from imposing compulsory service for public purpose, and in imposing such service the State shall not make any discrimination on grounds only of religion, race, caste or class or any of them.” 11.The Hon'ble Division Bench of the Allahabad High Court in Writ – A No.31696 of 2016 dated 13.04.2018 observed that the word 'Begar' is of indian origin and has been adopted in the English vocabulary. A labour or service which a person is forced to give without receiving any remuneration is begar. different forms. Taking work remuneration is also begar. without paying It can take adequate Likewise, making a substantial deduction from wages without any justifiable reason would also constitute begar and a violation of Article 23 of the Constitution of India. Admittedly, the prisoners in Tamil Nadu are not paid http://www.judis.nic.in WWW.LIVELAW.IN 14 the wages as prescribed in the Minimum Wages Act. Therefore, making a substantial deduction from the wages prescribed under the Prison Rules runs counter to the directions laid down by the Hon'ble Supreme Court in the decision reported in (1998) 7 SCC 392 (State of Gujarat and another vs. Hon'ble High Court of Gujarat). It violates Article 23 of the Constitution of India, besides being unreasonable. 12.We therefore hold that Rule 481 of Tamil Nadu Prison Rules, 1983 is unconstitutional to the extent it provides for deduction of 50% of the wages from the prisoners. It is open to the Government to provide for a lesser and reasonable percentage of deduction which would be in accord with the law laid down by the Hon'ble Supreme Court in the aforesaid decision. 13.This writ petition stands partly allowed. No costs. (K.K.SASIDHARAN,J.) & (G.R.SWAMINATHAN, J.) 01.02.2019 Index Internet Skm http://www.judis.nic.in : Yes / No : Yes / No WWW.LIVELAW.IN 15 To 1.The Home Secretary, Prison Department, Secretariat, Fort St.George, Chennai – 600 009. 2.The Additional Director General of Police, The Inspector General of Police, CMDA Tower – II, No.1, Gandhi Irwin Road, Chennai – 600 008. http://www.judis.nic.in WWW.LIVELAW.IN 16 K.K.SASIDHARAN, J. and G.R.SWAMINATHAN, J. Skm W.P (MD)No.14653 of 2017 01.02.2019 http://www.judis.nic.in