CASE STUDY Hospital Governance PH

advertisement

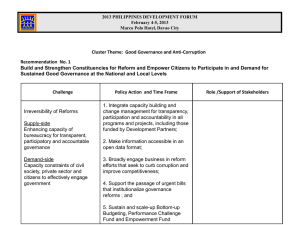

Hospital Governance Reforms in the Philippines: Four Case Studies Oscar F. Picazo COHRED Global Forum on Research and Innovation Philippine International Convention Center August 25, 2015 Health sector context 1 • ~100 million population, 12th largest in the world; high population growth (1.8% p.a.); high TFR (3.3); 49% urban • Demographic and health transitions are underway • Health MDGs likely to be met for child health; shaky for infectious diseases (TB, malaria, dengue, HIV); unmet for maternal mortality • Multiplicity of funders (National Government, local governments, PhilHealth social health insurance, HMOs, micro-insurance, employer-based, OOP); OOP has historically been very high O. F. Picazo, Hospital Governance in the Philippines Health sector context 2 • Multiplicity of providers (government, for-profit, nonprofit) • Dual health care system, access dictated largely by ability to pay • Health spending 3% of GDP; rising government health spending since 2010 • Major reforms underway to achieve UHC (width, breadth, depth); “width” reforms in Q1 and Q2 running way ahead of “breadth” (benefits improvement) and “depth” (full reimbursement and No Balance Billing). O. F. Picazo, Hospital Governance in the Philippines Growth of hospital system, 1970s to present 2500 20 18 17.5 16.9 16.3 15.9 15.5 15.115 14.9 14 2000 1812 1821 1784 1781 1921 1838 1725 1719 1739 1708 1712 1794 1713 1817 1738 1700 1571 1632 1742 1663 1733 1767 1782 1754 1846 1814 1705 1599 1607 1213 1036 1149 1483 1839 1000 500 14 13.7 12.8 12.312.3 12 11.811.7 11.711.611.8 11.411.111.2 11 10.710.9 10.710.910.4 10.6 10.2 10 1500 1713 No. of Hospitals 13 16 8 6 4 2 0 0 Hospitals Hospital Beds/10,000 Source: Philippine Statistical Yearbooks O. F. Picazo, Hospital Governance in the Philippines Hospital Beds/10,000 Population 18 18.2 17.617.817.9 Hospital by ownership, 1976-2010 Year 1976 1985 1995 2005 2010 Government Hosp- Beds Ave. itals Beds Private Hosp- Beds Ave. itals Beds 366 44,525 122 670 31,075 46 624 48,395 76 1,190 41,113 35 584 43,229 73 1,111 37,571 34 662 43,739 66 1,057 43,397 41 730 49,372 67 1,082 48,783 45 O. F. Picazo, Hospital Governance in the Philippines Government hospitals by type, 2011 Type No. % No. % Ave. No. of Beds DOH retained 75 11.0 21,819 43.4 295 LGU managed 572 83.6 22,188 44.2 39 University 5 0.7 453 0.9 91 Military 28 4.0 3,761 7.5 139 Other gov’t 4 0.7 2,011 4.0 40 684 100.0 50,232 100.0 60 All Hospitals Beds O. F. Picazo, Hospital Governance in the Philippines Government hospitals by level, 2009 Level 1 2 3 4 Total Hospitals No. % 362 271 38 50 721 50.2 37.6 5.3 6.9 100.0 Beds No. % 7,213 14,890 5,212 20,834 48,149 15.0 30.9 10.8 43.3 100.0 O. F. Picazo, Hospital Governance in the Philippines Ave. No. of Beds 20 55 137 425 68 DOH-retained hospitals: occupancy rate and patient load by level, 2011 Level Level 1 Level 2 Level 3 Level 4 All Ave. Implem. Bed Cap. 21 66 314 389 265 Bed Occ. Rate (%) Ave. Annual Patient Load 70.0 103.0 114.0 108.0 105.0 11,403 21,837 74,632 128,294 85,213 O. F. Picazo, Hospital Governance in the Philippines Four Hospital Case Studies O. F. Picazo, Hospital Governance in the Philippines Overview of case studies Items LUMC (1) Leyte (9+3) NKTI (1) SPMC (1) Location Ilocos Region, Northern Luzon Eastern Visayas Metro Manila Davao Region, Mindanao DOH or LGU hospital? LGU LGU DOH DOH Autonomy Became autonomous as part of reforms Not autonomous Autonomous before and after reforms Not autonomous O. F. Picazo, Hospital Governance in the Philippines Major reforms undertaken Reforms LUMC Leyte NKTI SPMC Autonomization Yes No No No Fee retention Yes (new) Yes (but at LGU level) Yes (not new) Yes (not new) Active claiming of Yes PhilHealth reimburse-ments Yes Yes Yes Strengthening PhilHealth eligibility verification system No Yes (LINKS call center) No No PPP on equipment acquisition Yes, but minor No Yes, major Yes, major PPP drug consignment No No No Yes O. F. Picazo, Hospital Governance in the Philippines LA UNION MEDICAL CENTER O. F. Picazo, Hospital Governance in the Philippines La Union Medical Center (LUMC) – Background • La Union, a medium-sized province in Northern Luzon (pop. 720,000) • LUMC (formerly DGMPH) served as district secondary hospital for 10 municipalities; one of 6 such hospitals owned by the province • Province faced financial difficulties in supporting these hospitals as soon as they were devolved; about 33 percent of IRA spent on their maintenance • Hospital’s annual budget of PhP35 million deemed highly inadequate; some PhP80 million to PhP100 million more needed • Poor quality of services (unfilled staff posts, drug shortage, poor patient amenities, inadequate diagnostic capacity) O. F. Picazo, Hospital Governance in the Philippines LUMC – Reforms undertaken • Construction of new facilities (EU funded) leading to 100 beds • Granting of economic enterprise status through presidential Executive Order; granting of autonomy through Congressional Republic Act; conversion into a non-stock, nonprofit government owned and controlled corporation (operating under GOCC Law) of La Union Province • Change in status from secondary to tertiary hospital • Reform of fee structure; retention of fees at facility; classification of patients; creation of paying wards • PhilHealth enrolment of members initially by the province, then by the National Government • Internal restructuring of the hospital through creation of 17 hospital committees (teams); systems improvement in procurement, financial system, HR system, and IT • Selected capital acquisition of diagnostic and imaging equipment O. F. Picazo, Hospital Governance in the Philippines LUMC – Governance structure • Evolution from a hierarchical unit of the provincial government to an autonomous unit with independent board of trustees (17 members); the only LGU hospital that has been made autonomous in the country • Governor sits as chairman of the board; ensures provincial commitment to continue its share of the subsidy • Selection and appointment of members of the board representing a range of skills • Formulation of provincial resolutions and ordinances to institutionalize reforms • Formation of internal management team O. F. Picazo, Hospital Governance in the Philippines LUMC – Results of reforms • Containment of the provincial fiscal subsidy to a manageable level (~PhP35 million a year) • Increase in total patient discharge from an annual average of 8,056 before the reforms to 11,481 after • Decline in percentage of charity patients from 84.7 percent before the reforms to 53.4 percent after; Corresponding increase in PhilHealth patients from 10.2 percent before the reforms to 38.8 percent after • Increase in PhilHealth collections from PhP1.1 million in 2002 to PhP19.1 in 2008 • Greater stability in employment among hospital staff, better employee incentives and morale • Better patient amenities (rooms, waiting areas) O. F. Picazo, Hospital Governance in the Philippines LEYTE PROVINCIAL HOSPITALS O. F. Picazo, Hospital Governance in the Philippines Leyte provincial hospitals – Background • Island province in Eastern Visayas, one of the poorest regions in the Philippines (direct path of typhoons) • Involved 12 provincial hospitals (9 secondary + 3 primary) • Province faced financial difficulty in supporting hospital services since these were turned over in 1992; 30-35 percent of IRA devoted to these hospitals • Provincial budget for hospitals in 2003 of PhP233.8 million deemed highly inadequate; very weak internal revenue mobilization (PhP7.3 million a year) • Annual provincial subsidy of PhP223.4 million deemed as “hemorrhaging” provincial finances • Poor condition of hospitals has led to declining patient census from 5,867 in 2003 to 5,531 in 2004 O. F. Picazo, Hospital Governance in the Philippines Leyte – Reforms undertaken: Hospital Enhancement for Leyte’s Progress (HELP) • Province-wide governance of 9 secondary and 3 primary hospitals, under Office of the Governor • Start of Special Service Fee (SSF) voluntary scheme with standard fees for hospitals • Enrolment of PhilHealth members through provincial premium subsidy; More active claiming of PhilHealth reimbursements • Establishment of PhilHealth LINKS as a regional call center to assist in eligibility verification of members • Establishment of paying and PhilHealth wards in all provincial hospitals • Collection of all fee revenues at the provincial level (hospital fees, professional fees), and their allocation as staff incentives, capital outlay, and maintenance and other operating expenditures (MOOE) for all provincial hospitals using set rules O. F. Picazo, Hospital Governance in the Philippines Leyte – Governance structure • Creation of an Ad Hoc Committee on Health in 2004 to implement HELP program • Visionary and transformational leadership of Gov. Jericho Petilla; active governance by the Governor’s office of the HELP program, which managed provincial hospitals like a holding corporation • Advocacy and capacity-building (including study tours domestically and abroad) of hospital directors and managers • Formulation of provincial resolutions and ordinances to institutionalize reforms O. F. Picazo, Hospital Governance in the Philippines Leyte – Results of reforms • Hospitals are in better upkeep; Patient census doubled from 5,867 in 2003 to 9,973 in 2012 • Total funding for 12 provincial hospitals increased from PhP227.3 million in 2003 to PhP272.2 million in 2012 • Income from fees and PhilHealth reimbursements increased from PhP7.3 million in 2003 to PhP118.4 million in 2012 • Provincial subsidy declined from PhP220.0 million in 2003 to PhP153.8 million in 2012, and further down to PhP100.0 million in 2013 • Doctors now much better remunerated (each earning in the range from PhP41,000 to PhP162,000 a month); medical vacancies no longer exist, and there is a queue of applicants O. F. Picazo, Hospital Governance in the Philippines NKTI-FRESENIUS HEMODIALYSIS CENTER PPP O. F. Picazo, Hospital Governance in the Philippines National Kidney and Transplant Institute (NKTI) – Background • Established in 1983 as an autonomous hospital, one of 4 premiere government hospitals; major renal hospital and transplant center in Asia • Asian financial crisis of late 1990s/early 200os turned capital outlay to zero and reduced recurrent budget • Increasing burden of renal patients > high demand for hemodialysis > high breakdown rate of equipment > overstressed HD nursing staff O. F. Picazo, Hospital Governance in the Philippines NKTI – Reforms undertaken: PPP scheme with private investor, Fresenius • PhP54 million Build-Operate-Transfer (BOT) scheme, initial contract from 2003-2008, renewed 2009-2013 • Equity participation: NKTI, 20 percent + Fresenius, 80 percent • Fresenius’ role: supply of all HD machines, state-of-the-art water treatment and dialysis reprocessing machines, service maintenance • NKTI’s role: (a) pay fee-per-treatment to Fresenius in accordance with agreed lease payment schedule; (b) provision of staff, space, and water utility supply O. F. Picazo, Hospital Governance in the Philippines NKTI – Governance structure • BOT Law (R.A. 6957) governs PPP contract • NKTI board of trustees approves all key policy decisions, including choice of investment partner and renewal of contract • NKTI management team implements decisions and carries out HD program • Unclear whether to attribute success to governance (the board) or to the management team, but senior hospital staff indicated that autonomous hospital status makes governance and management more flexible O. F. Picazo, Hospital Governance in the Philippines NKTI – Results of reforms • Quick award of contract > quick acquisition of latest HD technology at competitive cost • From 2007 to 2010, total number of patients reached 27,522 or 6,880 per year (roughly 20 a day) • Access among patients with limited ability to pay was expanded as fees remained lower (PhP2,000 per week) than commercial rates at private hospitals and dialysis centers (PhP4,000 per week) • Training and rotation of nurses improved, lessening staff stress, and lowering staff turnover • Hospital’s budget from National Government has remained fairly constant since 1998, and HD fee revenues have increased and outpaced the annual payment to the private partners O. F. Picazo, Hospital Governance in the Philippines SOUTHERN PHILIPPINES MEDICAL CENTER O. F. Picazo, Hospital Governance in the Philippines Southern Philippines Medical Center (SPMC) – Background • Located in Davao City, the metropolitan area in Mindanao, second largest island • One of 72 DOH retained hospitals; regional catchment area; tertiary facility • Inpatients (1,107 per day) far exceeds authorized bed capacity (600); 1,096 OPD patients per day • No capital outlay for the past 3 years (2010-2012); recurrent budget barely increased from PhP250 million in 2011 to PhP261 million in 2012 • Frequent drug shortage; inadequate diagnostic capability; frequent equipment breakdown O. F. Picazo, Hospital Governance in the Philippines SPMC – Reforms undertaken • Based on 2008-09 stocktaking exercise • Hospital financing reforms focusing on maximizing PhilHealth reimbursements • Staff recruitment, 7 to 40 for claims preparation; assignment of 3 doctors as claims adjudicators • Staff training on PhilHealth rules and ICD-10/11 • Quality assurance on claims preparation • Adoption of drug consignment system with private pharma providers (“pay for what you consume”) • Use of PPP to access diagnostic equipment from private sector (“cost-pertest” payment) • Chemistry and immune-assay analyzers, dialysis machines, Computed radiography and digital radiography • CT scans • Mechanical ventilators O. F. Picazo, Hospital Governance in the Philippines SPMC – Governance structure • Hospital remained non-autonomous before, during, and after reforms • Visionary and transformational leadership of hospital director (who came from the private sector) • Strong agreement among senior hospital managers on the direction and scope of reforms • Relative latitude provided by central DOH on the execution of the reforms O. F. Picazo, Hospital Governance in the Philippines SPMC – Results of reforms • PhilHealth patients increased from 32 percent in 2008 to 44 percent in 2012 • PhilHealth reimbursements increased from PhP170.4 million in 2008 to PhP436.9 million in 2012 • Most of large-scale capital investment program has been completed (buildings, equipment) • Drug consignment system has largely solved drug shortage problem; DOH Administrative Order based on SPMC experience has been approved, encouraging the practice in DOH retained and LGU hospitals O. F. Picazo, Hospital Governance in the Philippines Summing Up O. F. Picazo, Hospital Governance in the Philippines Internal environment affecting governance • Active and visionary leadership is critical, but rare • Financial difficulties frequently trigger hospital reforms. While the solution is available (PhilHealth), hospital leaders usually do not know what to do, used as they were to passively receiving budget subsidy. • No rifts were identified between reform leaders and hospital managers/staff in the 4 reform sites, but vociferous critics do abound • Successful reforms in devolved hospitals hinge on the good relationship between LGU executives and hospital managers; short tenure of office of LGU executives can be a hindrance O. F. Picazo, Hospital Governance in the Philippines Strengths and good practices • Use of provincial resolutions and ordinances to institutionalize reforms in LGUs and sustain them across administrations and local elections; use of Administrative Orders to do the same for DOH hospitals • Use of competitive PPP (lease, BOT) as a means of acquiring expensive medical equipment under conditions of limited gov’t fiscal capacity • Centrality of PhilHealth financing as the anchor of reforms; user fees, which tend to be regressive, used only as transitional mechanism • Maintenance of budget subsidy during the transition period until the reforming hospitals are able to sustain themselves with PhilHealth payments • Conduct of corresponding systems improvement, especially IT, to udergird hospital reforms O. F. Picazo, Hospital Governance in the Philippines Challenges and recommendations • Lack of an overall analysis and strategy of government hospital sector • The few reforms are sporadic and highly “individualized” (idiosyncratic) based on leaders • Poor state of government hospital data (collected but not encoded, analyzed, aggregated) • Negativity of skeptics within hospitals and public commentators • Challenge of financing both communicable and noncommunicable diseases O. F. Picazo, Hospital Governance in the Philippines