Intan Permata S PPT

advertisement

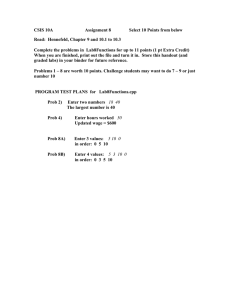

RESEARCH METHODOLOGY Quantitative Research Secondary Data Purposive Sampling Sample Sampling Criteria 1. The banking company that listed with category BUKU III. 2. The banking company that listed in IDX during 2011 to 2017. 3. The banking company that has published financial report and sustainability report annual during 2011 to 2017. 4. The banking company must have positive ROE during 2011 to 2017. Descriptive Analysis Panel Data Regression Maximum Minimum Chow Test Multiple Regression Analysis Inferential Analysis Mean Std. Deviation Hausman Test Classical Assumption Test • Normality Test • Heteroscedastici ty Test • Multicollinearit y Test Hypotheses Testing • T-Test • F-Test • Adjuste d R square Result & Discussion Panel Data Regression Model Descriptive Analysis Hausman Test 0.083>0.05 (Random Effect) *Rounded to 3 decimals points RESULT & DISCUSSION Classical Assumption Test Normality Test Heteroscedasticity Test Multicollinearity Test Autocorrelation Test *Rounded to 3 decimals points Multiple Regressions Hypotheses Testing Multiple Regressions Result: T-Test F-Test Coefficient of Determinations 1. Ho1 accepted, Ha1 rejected2(Prob. 0.705>0.05) Adjusted R = 0.141 Prob. F-stat < Sig. value 2. Ho2 accepted, Ha2 rejected (Prob. 0.488>0.05) 0.015 < 0.05 Where: Y3.=Ho3 Value accepted, rejected (Prob. 0.259>0.05) •Firm All the Ha3 variation of independent X1 = Non-Performing Loans variables in Ratio the research can explain X = Loan to Deposit 4.2 Ho4 rejected, Ha4 accepted (Prob. 0.007<0.05) 14.1% the variation of the dependent X3 = Debt to Equity Ratio variable, while the rest 85.9% X = Return on Equity 5.4 Ho5 rejected, Ha5 accepted (Prob. 0.009<0.05) Ho 7 rejected, 7 accepted explained by Ha other variables which X5 = Firm Size X = Corporate are not Social examined in (Prob. this research. 6.6 Ho6 accepted, Ha6Responsibility rejected 0.540>0.05) *Rounded to 3 decimals points