International Trade Agreements Test Bank

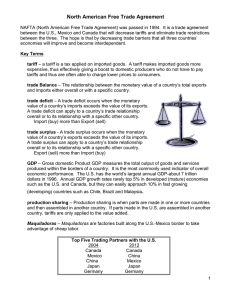

TestBanks Chapter 11: International Agreements: Trade, Labor, and the

Environment

1

2

During which round of negotiations did the WTO toughen its stance against domestic policies that limit trade?

Bretton Woods

Uruguay

Doha

The WTO never toughened its stance against domestic policies.

Where was the Climate Summit held in December 2009?

3

4

5

6

7

Brussels

New York

Seattle

Copenhagen

What was the result of the Climate Summit held in December

2009?

All countries signed binding agreements to reduce their greenhouse gases by 20% during the next 10 years.

No country signed binding agreements to reduce their greenhouse gases.

Only developed industrialized countries agreed to reduce their greenhouse gases by 20% during the next 10 years.

Only China and India agreed to reduce their greenhouse gases by 20% during the next 10 years.

The World Trade Organization is called _______________ because it involves many, if not most, of the nations in the world.

a bilateral trade organization

a trilateral trade organization

a multilateral trade agreement

a quasipolitical trade organization

A regional trade agreement involves:

Most, if not all, the nations in the world.

several nations, usually trading partners, with a common agenda or geographically linked.

nations that agree to trade only with nations in their region.

a region of the world with not only trade issues but also political cohesiveness.

Which of the following is NOT a regional trade agreement currently (2014) being considered?

the TransPacific Partnership

the TransAtlantic Trade and Investment Partnership

the North American Free Trade Area

the EuropeJapan Free Trade Area

Many regional trade agreements include other provisions that are not part of the treaty, but they are addons that might be

8

9

10

11

12 important to trade issues. These are called:

addenda.

side agreements.

environmental pacts.

worker rights documents.

In which type of trade agreement does the WTO allow exclusions to the most favored nation principle?

multilateral trade agreements

freetrade areas

customs unions

freetrade areas and customs unions

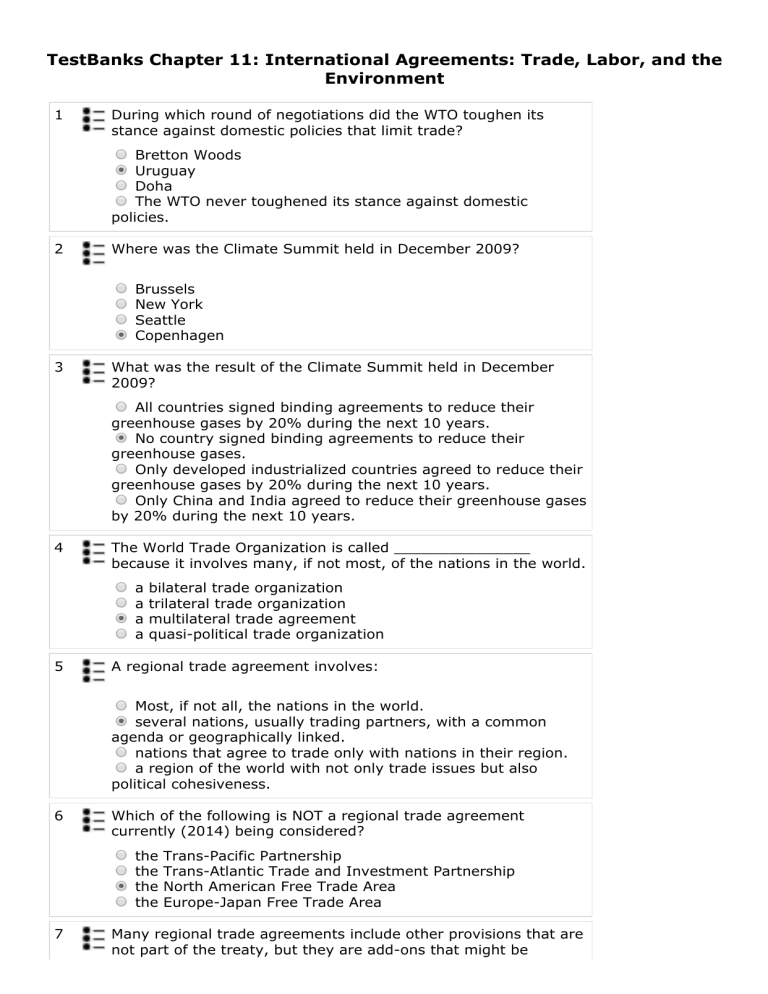

Which of the following is NOT part of the NAFTA?

tariff elimination on trade between member nations

an agreement on worker rights in each country

an agreement on environmental conditions in each country

elimination of restrictions on movement of labor between member countries

Which of the following features is included in the NAFTA

Agreement?

I. a common tariff structure adopted by Canada, Mexico, and the

United States

II. elimination of tariffs on trade among Canada, Mexico, and the

United States

III. free mobility of labor and capital among Canada, Mexico, and the United States

I

II

III

I, II, and III

What is the “most favored nation” principle of the WTO?

Trading partners may choose a favorite nation to trade with.

Any nation can refuse to trade with another that is not its most favored nation.

The WTO has the right to choose the nation that has performed best within the WTO guidelines as its most favored nation.

Every nation must grant the same rights and treatment to other nations in the WTO as its “most favored nation.”

The “most favored nation principle” means:

that member countries can enter into exclusive favorable agreements with some countries.

that member countries are barred from forming agreements outside their geographic vicinity.

that member countries must apply the same low tariffs to all

WTO member countries.

that member countries must apply differential tariffs on imports from nonWTO countries.

13

14

15

16

17

18

19

The WTO is considered _________, whereas NAFTA and the

European Union are __________.

a freetrade area; cartels

a cartel; multilateral agreements

a freetrade area; multilateral agreements

a multilateral agreement; regional trade agreements

Of the following, which is NOT a regional trade agreement?

the World Trade Organization

the European Union

the North American Free Trade Agreement

the Central American Free Trade Agreement

In a largecountry case, an optimal tariff would be:

one that increases the producer surplus.

one that raises the price of the product imported.

one in which the termsoftrade gain exceeds the deadweight loss.

one that easily passes the legislative process.

In a largecountry case, an optimal tariff is one for which the termsoftrade gain exceeds the:

producer surplus.

increased price of the product imported.

deadweight loss.

consumer surplus.

In the largecountry case, when a tariff is imposed, the country:

sees a termsoftrade gain.

is able to reduce world price of the imported good.

is going to experience an increase in consumer surplus.

sees a termsoftrade gain and is able to reduce world price of the imported good.

When a large nation imposes a tariff, which of the following is

NOT a cost incurred?

deadweight efficiency loss

reduced consumer surplus

deterioration of terms of trade for the trading partners

falling government revenues for the nation imposing the tariff

Figure: The Home and World Market

20

Reference: Ref 111

(Figure: The Home and World Markets) The graphs show the case for a tariff imposed by a large country. According to these graphs, if the world price of the product is given as $30, then home market firms will produce _______ and the total demand for the good will be _______.

40; 100

20; 80

20; 100

40; 80

Figure: The Home and World Market

21

Reference: Ref 111

(Figure: The Home and World Markets) Using the graphs, the amount imported by the home market under free trade is:

20.

40.

60.

80.

Figure: The Home and World Market

22

Reference: Ref 111

(Figure: The Home and World Markets) If a tariff of $10 is imposed by the home country, it causes a loss in the world market of:

$240.

$160.

$200.

$80.

Figure: The Home and World Market

23

Reference: Ref 111

(Figure: The Home and World Markets) The loss of consumer surplus in the home country is:

$480.

$540.

$160.

$600.

Figure: The Home and World Market

24

25

26

27

Reference: Ref 111

(Figure: The Home and World Markets) The termsoftrade gain is

_______, and the deadweight loss is _____.

$120; $160

$160; $160

$160; $120

$120; $120

Suppose that a large country imposes optimal tariffs on imports from another large country. The second country then responds with optimal tariffs on imports from the first country. For these two countries, the Nash equilibrium results in ___________ for the first country and __________ for the second country.

losses; losses

gains; gains

losses; gains

gains; losses

What happens when two countries apply tariffs against each other in an attempt to capture their termsoftrade gain?

Both countries lose because the termsoftrade gain for one country is canceled by the tariff in the other country.

Both countries gain because the termsoftrade gain for one country is canceled by the tariff in the other country.

Neither country gains nor loses because the termsoftrade gain for one country is canceled by the tariff in the other country.

The country initially applying the tariff gains because it captures the termsoftrade gain; the other country neither gains nor loses.

Using game theory as an analytical tool, if one large nation imposes tariffs, the total cost is small; however, when several trading partners do the same:

the costs are even smaller.

the costs balance out and there is no harm.

the costs are the same but the potential gains are much smaller.

then all nations gain.

In a prisoner's dilemma:

28

29

30

31

32

33

all competing parties gain.

one competitor gains at the expense of another.

all competing parties lose.

one competitor loses.

It can be shown that the Nash equilibrium would indicate that without any agreements, the best outcome for each large nation would be to:

not impose a tariff.

impose a tariff.

find other ways to reward their domestic firms.

impose a consumption tax.

Which is a better outcome for income and standard of living levels for large nations?

no tariffs

low tariffs

high tariffs

equal tariffs for all nations

A “prisoner's dilemma” can arise when:

two large countries simultaneously and independently apply tariffs on imports from each other.

two large countries simultaneously and independently eliminate tariffs on imports from each other.

one large country eliminates tariffs on imports from another large country.

one small country eliminates tariffs on imports from a large country.

Which of the following is(are) the effect(s) of an international trade agreement that provides an incentive and reward for nations NOT to impose tariffs?

I. an increase in world welfare and standard of living

II. an opportunity for lowincome nations to exploit the gains from trade.

III. an opportunity for large countries to improve their terms of trade

I

I and II

I and III

I, II, and III

The WTO (under the GATT agreement) provides that nations may enter into regional trade agreements as long as they:

limit such agreements to one.

extend the provisions to all other nations in the WTO.

do not jointly increase tariffs against outside countries.

make sure they include smaller nations in their regions.

Which principle of the GATT/WTO do regional trade agreements violate?

the principle of first mover

34

35

36

37

38

39

the targeting principle

the most favored nation principle

the principle of comparative advantage

Which of the following is often used to describe regional trade agreements that discriminate, giving better tariff treatment to other nations in the agreement over outside nation?

superregionals

preferential trade agreements

exclusive trade arrangements

equity trade agreements

A freetrade area is:

a group of countries that agrees there will be “no rules” about trade—anything goes.

a group of countries that agrees to eliminate customs fees and containerized shipping charges on goods traded among them.

a group of countries that agrees to eliminate barriers to trade between themselves while keeping tariffs in place against the rest of the world.

a group of countries that eliminates trade barriers among themselves and erects a common tariff against all other nations.

Which of the following statements characterizes NAFTA's economic arrangements among its member countries (Canada,

Mexico, and the United States)?

There are no restrictions on the movement of labor from one country to another.

There are no restrictions on the movement of capital from one country to another.

All three countries have adopted the same identical tariff system.

There is free trade among the three member countries.

Which of the following agreements signed in 1989 is the precursor to NAFTA?

the U.S.Mexico Free Trade Agreement

the CanadaMexico Free Trade Agreement

the CanadaU.S. Free Trade Agreement

the CanadaMexicoU.S. Free Trade Agreement

A customs union is:

a group of countries that agrees there will be “no rules” about trade—anything goes.

a group of countries that agrees to eliminate customs fees and containerized shipping charges on goods traded among them.

a group of countries agreeing to eliminate barriers to trade between themselves but keeping tariffs in place against the rest of the world.

a group of countries that eliminates trade barriers among themselves and erects a common tariff against all other nations.

Which of the following statements about the European Union (EU)

40

41

42

43

44

45 is CORRECT?

EU member countries maintain separate tariff schedules.

There is free trade among EU member countries.

All EU member countries use a common currency (the euro).

All EU member countries have eliminated tariffs on imports from nonEU member countries.

What is the main difference between a customs union and a free trade area?

There are no restrictions on the movement of labor and capital among customs union member countries, whereas labor and capital cannot move freely among freetrade member countries.

Customs union member countries use identical tariffs, whereas freetrade area member countries have different tariff structures.

There is free trade among customs union member countries but not among freetrade area member countries.

Customs union member countries have adopted a common currency, whereas freetrade member countries use their separate national currencies.

A customs union is a trade agreement:

in which member countries are free to set their separate tariffs on other countries.

in which members agree to set similar tariffs on nonmembers.

in which resources are free to move between member countries.

in which member countries have common currency.

Which of the following regional trade agreements is a freetrade area?

NAFTA

the European Union

Mercosur

NATO

To be able to enforce the rules of a freetrade area, goods from outside the region imported into the lowesttariff nation cannot be shipped ________ into another nation in the area.

with no transportation costs

without a labor certificate

with no customs inspection

duty free

What complex set of freetrade area regulations prohibits non member country imports to a hightariff member country via a lowtariff member country?

environmental certification

rules of origin

health and safety standards

a codified trade agreement

Automobiles imported from Canada or Mexico must have 60%

46

47

48

49

50

51

North American content to be eligible for tariff elimination under

NAFTA rules. This is an example of:

a rules of origin requirement.

an environmental standard.

a health and safety requirement.

a preferential trade agreement.

Why is NAFTA a freetrade area requiring rules of origin rather than a customs union?

A freetrade agreement allows politically sensitive tariffs of each nation to remain unchanged.

A customs union also requires rules of origin.

The overall level of U.S. tariffs was much higher than the overall level of tariffs in Mexico and Canada.

The overall levels of tariffs in Canada, Mexico, and the United

States are similar, making rules of origin irrelevant.

In which of the following forms of regional trading agreement are rules of origin required?

a freetrade area

a customs union

a common market

an economic union

Which of the following represents the stage where economic integration is LEAST complete?

freetrade area

customs union

common market

economic union

Implementing a regional freetrade agreement may have an effect in which, due to reduced tariffs, a nation in the agreement begins to import a product it had previously produced itself. This effect is called:

trade creation.

trade diversion.

reciprocal trade agreements.

the employment effect of FTAs.

Implementing a regional freetrade agreement may have an effect in which, due to reduced tariffs, a nation begins to import a product from another member country that it had previously imported from outside the new trade region. This effect is called:

trade creation.

trade diversion.

reciprocal trade agreements.

the employment effect of FTAs.

When products from a highcost country within a customs union replace imports from a lowcost country that is not a member of the union, this is called:

trade creation.

trade diversion.

trade deflection.

trade development.

52

53

54

55

56

A customs union will increase the welfare of its members and the rest of the world if:

trade creation is greater than trade diversion.

trade creation is less than trade diversion.

trade creation is positive.

trade diversion is positive.

Suppose country X currently produces widgets. Then it establishes a preferential trading agreement with country Y.

Following the formation of the PTA, country X no longer produces widgets and imports widgets from country Y. What has occurred?

There is trade diversion and a welfare gain for both country X and country Y.

There is trade diversion, a welfare gain for country Y, and a welfare loss for country X.

There is trade creation and a welfare gain for both country X and country Y.

There is trade creation, a welfare gain for country Y, and a welfare loss for country X.

Suppose country X currently does not produce widgets. Instead, it imports widgets from country Z. Then country X establishes a preferential trading agreement with country Y. Following the formation of the PTA, it imports widgets from country Y. What has occurred?

There is trade diversion and a welfare loss for country X.

There is trade creation and a welfare loss for country Y.

There is trade diversion and a welfare gain for country X.

There is trade creation and a welfare gain for country Y.

An example of how trade diversion results in a suboptimal situation is auto parts trade between Mexico and the United

States. After NAFTA:

Mexico decreased its sales of auto parts to the United States.

the United States purchased more auto parts from Mexico due to the elimination of tariffs and reduced purchases from East

Asia, which was the lowestcost producer.

the United States brought a complaint against Mexico for low quality auto parts.

the United States purchased fewer auto parts from Mexico due to the elimination of tariffs and increased purchases from East

Asia, which was the lowestcost producer.

SCENARIO: ELECTRIC FAN TRADE

U.S. firms can produce and sell electric fans for $25. The United

States can also import electric fans from China at $40 each and from Canada at $45 each. Electric fans made in the United

States, China, and Canada are identical. Currently, the United

States imposes a 30% tariff on imported electric fans.

Reference: Ref 112

(Scenario: Electric Fan Trade) From which of the following countries will the United States import fans?

China

Canada

It will import fans from neither China nor Canada.

It will import fans from both China and Canada.

57

58

59

60

SCENARIO: ELECTRIC FAN TRADE

U.S. firms can produce and sell electric fans for $25. The United

States can also import electric fans from China at $40 each and from Canada at $45 each. Electric fans made in the United

States, China, and Canada are identical. Currently, the United

States imposes a 30% tariff on imported electric fans.

Reference: Ref 112

(Scenario: Electric Fan Trade) Now suppose that the United

States forms a freetrade area (NAFTA) with Canada and Mexico.

From which country will the United States import fans?

China

Canada

It will import fans from neither China nor Canada.

It will import fans from both China and Canada.

SCENARIO: ELECTRIC FAN TRADE

U.S. firms can produce and sell electric fans for $25. The United

States can also import electric fans from China at $40 each and from Canada at $45 each. Electric fans made in the United

States, China, and Canada are identical. Currently, the United

States imposes a 30% tariff on imported electric fans.

Reference: Ref 112

(Scenario: Electric Fan Trade) For the United States, are there trade diversion losses, trade creation gains, or both as a result of the formation of NAFTA?

There are only trade diversions losses

There are only trade creation gains.

There are neither trade creation gains nor trade diversion losses.

There are both trade creation gains and trade diversion losses.

SCENARIO: ELECTRIC FAN TRADE

U.S. firms can produce and sell electric fans for $25. The United

States can also import electric fans from China at $40 each and from Canada at $45 each. Electric fans made in the United

States, China, and Canada are identical. Currently, the United

States imposes a 30% tariff on imported electric fans.

Reference: Ref 112

(Scenario: Electric Fan Trade) Suppose that the United States levied a 10% tariff on imported electric fans (rather than the

30% tariff described in the scenario). For the United States, would there be trade diversion losses, trade creation gains, or both as a result of the formation of NAFTA?

There would be only trade diversions losses.

There would be only trade creation gains.

There would be neither trade creation gains nor trade diversion losses.

There would be both trade creation gains and trade diversion losses.

In terms of efficiency, trade diversion is a _____ desirable outcome of a regional freetrade agreement, because trade is diverted from the ___________ producer to the __________ producer.

more; highcost; lowcost

61

62

63

more; less deserving; more deserving

less; lowcost; highcost

less; foreign; domestic

Table: Demand and Supply for Gloves

Price $1 $2 $3 $4 $5 $6 $7 $8 $9 $10

Quantity

Supplied

5 6 7 8 9 10 11 12 13 14

Quantity

Demanded

Reference: Ref 113

20 19 18 17 15 14 13 12 11 10

(Table: Demand and Supply for Gloves) The United States can also import gloves from China at $4 per pair and from Mexico at $5 per pair. Currently, the United States imposes a specific tariff of $2 on its glove imports. Suppose that the United States and Mexico form a free trade area. How much trade in gloves is created?

zero pairs of gloves

6 pairs of gloves

2 pairs of gloves

4 pairs of gloves

Table: Demand and Supply for Gloves

Price $1 $2 $3 $4 $5 $6 $7 $8 $9 $10

Quantity

Supplied

5 6 7 8 9 10 11 12 13 14

Quantity

Demanded

Reference: Ref 113

20 19 18 17 15 14 13 12 11 10

(Table: Demand and Supply for Gloves) The United States can also import gloves from China at $4 per pair and from Mexico at $5 per pair. Currently, the United States imposes a specific tariff of $2 on its glove imports. How much trade in gloves is diverted in the U.S.

Mexican freetrade area?

zero pairs of gloves

6 pairs of gloves

2 pairs of gloves

4 pairs of gloves

Table: Demand and Supply for Gloves

Price $1 $2 $3 $4 $5 $6 $7 $8 $9 $10

Quantity

Supplied

5 6 7 8 9 10 11 12 13 14

Quantity

Demanded

Reference: Ref 113

20 19 18 17 15 14 13 12 11 10

(Table: Demand and Supply for Gloves) The United States can also import gloves from China at $4 per pair and from Mexico at $5 per pair. Currently, the United States imposes a specific tariff of $2 on its glove imports. Is the United States better off or worse off in its trade in gloves following the freetrade agreement with Mexico?

It is better off because trade creation gains exceed trade diversion

64

65

66

67 losses.

It is worse off because trade diversion losses exceed trade creation gains.

It is worse off because trade creation losses exceed trade diversion gains.

It is better off because trade diversion gains exceed trade creation losses.

Table: Demand and Supply for Gloves

Price $1 $2 $3 $4 $5 $6 $7 $8 $9 $10

Quantity

Supplied

5 6 7 8 9 10 11 12 13 14

Quantity

Demanded

Reference: Ref 113

20 19 18 17 15 14 13 12 11 10

(Table: Demand and Supply for Gloves) The United States can also import gloves from China at $4 per pair and from Mexico at $5 per pair. Currently, the United States imposes a specific tariff of $2 on its glove imports. Suppose instead that the United States negotiated a freetrade agreement with China. Will the United States be better off or worse off as a result of its trade in gloves in the freetrade area with China?

It is better off because there are no trade diversion losses.

It is worse off because there are no trade creation gains.

It is worse off because trade creation gains exceed trade diversion losses.

It is better off because trade diversion gains exceed trade creation losses.

If a regional trading agreement causes products from member countries to replace imports from nonmember countries, then the regional trading agreement will experience:

economic gains.

trade creation gains.

trade diversion losses.

trade perversion.

If a customs union includes the lowestcost world producer of a product, then member countries:

will always be better off in trade with that product.

will always be worse off in trade with that product.

can be better off or worse off depending on the strengths of the trade diversion and trade creation effects for that product.

will no longer export or import that product.

The customs union could lead to losses for the home country if:

the other country in the customs union is the most efficient producer.

the other country in the customs unions is not the most efficient producer.

there are other countries outside the customs union that are inefficient.

all countries are efficient producers.

68

69

70

Indian exporters are concerned about trade diversion because

_________ made an agreement with the ASEAN freetrade area.

India

China

the United States

Mexico

India is not a member of the ChinaASEAN (Association of South

East Asian Nations) freetrade area implemented on January 1,

2010. As a result, India fears that some of its:

exports to China will be diverted to ASEAN countries.

exports to the United States will be diverted to China.

exports to China and to ASEAN countries will be diverted to trade among members of the ChinaASEAN freetrade area.

imports from ASEAN countries will be diverted to China.

Figure U. S. Imports from Mexico and Asia

71

Reference: Ref 114

(Figure: U.S. Imports from Mexico and Asia) The graph illustrates a customs union between the United States and Mexico.

According to the graph, under free trade the United States will import ________ units of the good from _______ at the price of

_______.

600; Mexico; $150

600; China; $250

350; China; $150

500; China; $250

Figure U. S. Imports from Mexico and Asia

72

Reference: Ref 114

(Figure: U.S. Imports from Mexico and Asia) Suppose the United

States imposes a tariff of $100; then the total imports will be:

600.

250.

400.

500.

Figure U. S. Imports from Mexico and Asia

73

Reference: Ref 114

(Figure: U.S. Imports from Mexico and Asia) With the $100 tariff, the United States will import ______ from Mexico and _______ from China.

400; 100

250; 250

250; 500

400; 200

Figure U. S. Imports from Mexico and Asia

74

Reference: Ref 114

(Figure: U.S. Imports from Mexico and Asia) The $100 tariff by the United States results in a tariff revenue of:

$25,000.

$5,000.

$50,000.

$2,500.

Figure U. S. Imports from Mexico and Asia

75

Reference: Ref 114

(Figure: U.S. Imports from Mexico and Asia) If the United States forms a customs union with Mexico, it will result in a(n) _______ in producer surplus of ______ for Mexico.

increase; $25,000

increase; $50,000

increase; $32,500

decrease; $50,000

Figure U. S. Imports from Mexico and Asia

76

77

78

79

Reference: Ref 114

(Figure: U.S. Imports from Mexico and Asia) The combined welfare of the United States and Mexico is _______ by ______.

lower; $7,500

higher; $10,000

lower; $25,000

higher; $25,000

Suppose initially there is no customs union and that the $100 tariff is imposed by the United States. Now, Mexico invests in productive technology and it shifts the Mexican supply curve to

S

Mex

. The United States now forms a customs union with Mexico.

This will result in a price of _______ and imports of _______.

$250; 500

$250; 400

$150; 600

$150; 500

Trade diversion may be such that the combined welfare of two nations in the agreement actually ____ because of ____, not completely offset by the _____.

falls; loss of tariff revenue for the importing nation; gain in the exporting nation's producer surplus

rises; gains from trade; loss of jobs in the importing industry

rises; gain in tariff revenue; gain in jobs

remains the same; loss of tariff revenue; gains from product variety

Trade diversion is one reason that some economists:

believe we should not even bother to promote free trade.

recommend we change our focus from regional trade agreements to the WTO, a multilateral trade agreement.

recommend we reinstate some tariffs that were actually beneficial to all nations.

think we should exclude lowwage nations from trade agreements.

Which of the following statements is(are) FALSE?

I. Trade creation is always bad for countries.

II. Trade diversion is always good for countries.

III. Regional trade agreements never cause welfare losses.

80

81

82

83

84

I

II

III

I, II, and III

The negative effects of trade diversion are reduced when:

trade diversion is more than offset by trade creation.

consumers in the importing nation have a change in their buying habits.

there is a cost increase in nations outside the region.

the freetrade agreement includes more members.

Because it is difficult to negotiate multilateral trade agreements, some economists argue that preferential trade agreements are always beneficial since they represent a movement toward freer trade, which is better than no movement at all. Is this argument always correct?

Yes; any movement toward freer trade is better than no movement at all.

No; some preferential trade agreements may have higher trade diversion costs than trade creation gains.

Yes; all preferential trade agreements have higher trade creation gains than trade diversion losses.

No; all preferential trade agreements have higher trade diversion losses than trade creation gains.

A case study of NAFTA, with regard to the benefits for Canada from U.S. trade, found that:

Canada was not able to increase its exports due to barriers still remaining.

Canada had modest gains but was harmed by immigration into the United States from Mexico.

Canada had more trade diversion than trade creation and so was harmed overall.

Canada had more trade creation than trade diversion and so benefited overall.

Professor Daniel Trefler at the University of Toronto concluded that Canada ________ from free trade with the United States because _______________.

gained; trade creation exceeded trade diversion with the

United States

lost; trade diversion exceeded trade creation with the United

States

first gained, then lost; trade diversion exceeded trade creation after NAFTA was fully implemented

neither gained nor lost; trade creation equaled its trade diversion with the United States

Which of the following is included in “labor standards”?

I. minimum wages

II. safety standards

III. child labor regulations

I

I and II

II and III

85

86

87

88

89

90

I, II, and III

Which of the following statements explains why trading partners are often concerned about each other's labor standards?

I. From a humanitarian perspective, people do not want to buy products if workers are in oppressive conditions.

II. Unions realize that low standards for labor will be less costly, and those products will compete more effectively with products produced at home.

III, Some nations do not enforce their own lax labor standards, but have also signed on to trade agreements.

I

II

II and III

I, II, and III

Why do some say labor standards are “disguised protection”?

These standards favor the nations that already have high labor standards and eliminate competition from nations who do not.

Nations with low labor standards often disguise the fact.

Raising labor standards is not the issue—it is disguised by the fact that shoddy materials are used in production.

Often children who should be in school work anyway, and their participation is “disguised” as if an adult held the job.

Why are economists sometimes skeptical about international labor standards?

They are difficult to enforce.

They create more competition for U.S. workers.

GATT does not allow labor standards.

They may be used as a rationale to protect domestic activities that can no longer compete with imports.

The purpose of the Labor Side Agreement under NAFTA is to:

increase standards in Mexico only.

increase standards throughout NAFTA.

enforce existing standards throughout NAFTA.

renegotiate standards.

There is a side agreement to _______________ that calls for the enforcement of existing worker rights in _______________.

the European Union; the European nations

the World Trade Organization; the less developed nations

NAFTA; the South American nations

NAFTA; Mexico, Canada, and the United States

Under NAFTA, labor disputes and issues will be dealt with by the:

U.S. Department of Labor.

North American Agreement on Labor Cooperation.

National Labor Relations Board.

U.S. Department of Justice.

91

92

93

94

95

96

Although it has had some criticism for ineffectiveness, in what way has the North American Agreement on Labor Cooperation had some positive benefits?

It created an institutional forum for the discussion of labor issues in Canada, the United States, and Mexico

It prohibited any one NAFTA member country from publically revealing violations of labor laws in other NAFTA member countries.

It reduced the emphasis on labor rights as a legitimate trade issue

All of these answer choices are examples of the positive benefits.

Surveys of consumers regarding labor standards indicate that they are willing to pay:

a large amount for a large improvement in working conditions.

a small amount for a large improvement in working conditions.

nothing for a large improvement in working conditions.

a small amount for a small decline in working conditions.

A study of consumers' attitudes toward labor standards for the products they buy revealed that consumers:

just do not care.

would completely change their buying patterns and want to be

100% sure that products they buy are made in foreign factories with good working conditions.

would pay a slight premium to ensure good working conditions.

are more concerned about the prices they pay than working conditions overseas.

Surveys of consumers indicate that:

they do not care at all about labor standards in other countries.

many are willing to pay at least a small amount more for imports to ensure good labor standards in other countries.

most are willing to pay a large amount more for imports to ensure good labor standards in other countries.

they will not buy imports from any country with poor labor standards.

Surveys of consumers regarding labor standards reveal that they:

treat potential losses and potential gains equally.

weigh potential losses more than potential gains.

weigh potential losses less than potential gains.

do not experience losses in gains.

What is the role of nongovernmental organizations in promoting labor standards?

They have no enforcement power, but they can investigate and bring attention to and put pressure on firms, governments, and other groups to effect change.

97

98

99

100

101

102

Because they are nongovernmental, they have no power.

They can change laws for labor in many situations.

Because they are part of the United Nations, they often report their findings and cause major policy changes.

According to one research study focusing on Indonesia, actions by nongovernmental organizations are ___________ than importing countries' threats to raise tariffs.

less effective in raising wages and limiting declines in employment

more effective in raising wages and limiting declines in employment

less effective in raising wages but more effective in limiting declines in employment

more effective in raising wages but less effective in limiting declines in employment

NGOs seem to do a better job than national policies because they:

can enforce regulations.

are better organized.

target the worst offenders.

target the worst offenders and are better organized.

Most economists are opposed to the “living wage” concept in foreign labor agreements because:

it is barely enough for survival.

most workers in lowincome nations already earn more.

workers should never earn more than the managers.

it is well above the market wage, and many workers in poor nations would lose the opportunity to be employed.

Suppose that the U.S. government required firms to pay a living wage to workers in their subsidiaries or contracting firms in developing countries. As a consequence of this requirement, wages would likely _______ to the living wage and employment would likely _________.

rise; increase

fall; increase

rise; decrease

fall; decrease

Walmart has been pursuing improvements in its reputation in response to growing criticism on environmental, labor, and social issues in its foreign supplier factories. Among others, which requirement has Walmart imposed on its Chinese suppliers?

They must demonstrate compliance with Chinese environmental laws.

There must be a 100% improvement in energy efficiency at

China's 200 largest suppliers.

They must increase their wages to the equivalent of the U.S.

minimum wage.

It has imposed all of these on its Chinese suppliers.

In what way does the high U.S. tariff (15.3%) on garments imported from Bangladesh affect Bangladeshi workers?

It lowers profits of the Bangladeshi garment industry, thus

103

104

105

106

107 making it difficult for the industry to pay higher wages.

It raises profits of the Bangladeshi garment industry, thus making it easier for the industry to pay higher wages.

It reduces exports to the United States, thus making it easier

for the Bangladeshi garment industry to export to other nations.

It has no effect on Bangladeshi workers.

What is the effect of the high (15.3%) U.S. tariff on garments imported from Bangladesh on the Bangladesh economy?

It has no effect on the Bangladesh economy, since U.S.

consumers ultimately pay the tariff.

It acts as a hidden tax of $4.61 on Bangladeshi citizens.

It improves Bangladesh's terms of trade with the United

States.

It has a very small effect on the Bangladeshi economy, since only 10% of its exports to the United States are subject to the tariff.

Why did the United States suspend its preferential trade treatment for Bangladesh in 2013?

The United States wanted to collect more tariff revenue on all imports from Bangladesh.

The United States wanted to punish Bangladesh for its poor labor practices.

The United States wanted to collect more tariff revenue on imports other than garments from Bangladesh

The United States wanted to force Bangladesh to join NAFTA.

Which of the following groups favored the suspension of preferential trade treatment for Bangladesh in 2013?

the U.S. Congress

the Bangladeshi garment industry

U.S labor leaders

U.S. consumers

With respect to environmental issues, the GATT:

does not allow countries to adopt environmental laws that affect imports.

allows countries to adopt environmental laws that affect domestic production but not imports.

allows countries to adopt environmental laws that are applied uniformly against domestic producers and imports.

allows countries to adopt more stringent laws affecting imports than domestic producers.

There is some misunderstanding of the WTO's provisions for environmental protection in trade. The WTO actually:

allows nations to bar all imports from nations that do not conform to their own standards.

provides that nations may enforce any standards for particular products as long as the standards apply equally to domestic producers and importers.

does not make any pretense of caring at all about the

108

109

110

111

112 environment.

is very inconsistent in its rulings.

Do the provisions of the GATT and WTO permit countries to apply their own environmental regulations against imports?

No; environmental regulations applying to domestic production and imports need to be negotiated internationally under treaties such as the Kyoto Protocol.

No; environmental regulations applying only to imports need to be negotiated internationally under treaties such as the Kyoto

Agreement.

Yes; and countries may require stricter environmental regulations for imports than for domestic production.

Yes; as long as environmental regulations apply uniformly to domestic production and imports.

The tunadolphin dispute was ruled by the WTO in favor of nations that _______________. The ruling said that trading partners _______________ bar imports based on

_______________.

exported tuna to the United States and Europe; could not; a production process such as the size of the nets used

imported tuna; could; the production process

cared about wildlife in the seas; could; concerns over the safety of dolphins

produced seafood products; could not; the way the products were used, such as in pet food

The ruling in the shrimpturtle case resulted in:

the United States being able to ban shrimp caught with nets unsafe for sea turtles.

the WTO upholding the environmental standard but ruling against the United States on technical grounds that it did not provide sufficient notice; after negotiation, however, the WTO reversed its decision.

the WTO refusing to hear the case.

a ruling that upheld the environmental standard.

The WTO also ruled on the U.S. restriction of gasoline imports from Venezuela and Brazil in 1994 on environmental grounds.

What was the outcome?

The United States could ban those imports because they violated the U.S. Clean Air Act.

They could not ban the imports because they had not given

Venezuela and Brazil a grace period as they had given their own

U.S. companies.

The United States could not use “environmental protection” as an excuse for every trade dispute that came along.

The United States could bring countercharges against

Venezuela and Brazil on the banana issue.

Europe had refused to import genetically modified food products.

The WTO ruled that:

if Europe was afraid of these products, it could put an import ban on them.

113

114

115

116

117

118

Europe needed to base its ban on scientific evidence rather than because of fear about something unproven.

Europe could declare a moratorium until an investigation could be undertaken.

the products could be treated and then they would be safe.

WTO rulings with respect to environmental issues have:

generally had very adverse effects on the environment.

generally increased regard for environmental protection.

caused substantial decreases in international trade.

caused countries to adopt more stringent laws more affecting imports than domestic producers.

When does an externality occur?

when one person's production or consumption of a good affects another person

when a producers longrun average costs fall

when a consumer's marginal utility from consuming a good increases

when international trade leads to improvement in a country's economic welfare

Which of the following is an example of a negative externality?

The discovery of one firm is freely copied by other firms.

A firm dumps its industrial wastes into a nearby river.

The government subsidizes research and development expenditures.

A consumer buys more units of a product than she can consume.

Suppose that production of steel in the United States involves negative externalities. Now suppose that U.S. tariffs on steel imports are eliminated and U.S. imports of steel increase. What effect does the elimination of these tariffs have on total social costs associated with steel production in the United States?

Total social costs will increase.

They will not change.

They will decrease.

They will increase but may be smaller than the private gains from increased steel imports.

Suppose that there is a negative externality associated with alcohol consumption in the United States. What does this negative consumption externality imply about the relationship between the demand curve for alcohol and the social marginal benefit (SMB) curve for alcohol?

The demand curve and the SMB curve for alcohol are identical.

The demand curve lies below the SMB curve for alcohol.

The demand curve lies above the SMB curve for alcohol.

The demand curve intersects the SMB curve at the market equilibrium price.

Suppose that there is a negative externality associated with

119

120

121

122 alcohol consumption in the United States (e.g., costs of publicly funded alcoholism treatment centers). What will happen to the social costs of this externality if the United States eliminates all tariffs on alcohol imports?

The social coasts will increase.

They will not change.

They will decrease.

The social costs will increase but be offset by the private losses associated with increased imports as the tariffs are eliminated.

Suppose that there is a negative externality associated with alcohol consumption in the United States. Will the United States be better or worse off if it eliminates all tariffs on alcohol imports?

The United States will always be better off when tariffs on imported alcohol are eliminated.

The United States will always be worse off when tariffs on imported alcohol are eliminated.

The United States will be no better or worse off when tariffs on imported alcohol are eliminated.

The United States will be better off only if the private gains from trade exceed the increased social costs of alcohol consumption when tariffs on imported alcohol are eliminated.

U.S. tire production involves large social costs from air pollution.

How will stronger U.S. environmental regulations requiring firms to reduce their air pollutants affect U.S. tire imports?

Stronger U.S. environmental regulations will cause increases in U.S. tire imports.

Stronger U.S. environmental regulations will cause decreases in U.S. tire imports.

Stronger U.S. environmental regulations will neither cause increases nor decreases in U.S. tire imports

Stronger U.S. environmental regulations will cause decreases in U.S. tire imports but not reduce tire producers' emissions of air pollutants.

Because of the relationship among ethanol production, sugar, and corn the authors of your text have concluded that:

the corn subsidy is a big problem for ethanol exports.

the sugar quota makes sugar so cheap in the United States that ethanol producers are using it instead of corn.

due to the sugar quota and its high price, there is a huge demand for less environmentally friendly corn as a substitute in food products and for ethanol.

ethanol should be imported rather than exported.

Why does the United States both import and export ethanol?

U.S. regulations require U.S. fuel companies to use both ethanol made from corn and ethanol made from other sources

(such as sugar), which has led to a surplus of corn ethanol that is exported to Brazil in return for sugar ethanol.

U.S. regulations require U.S. fuel companies to use only ethanol made from corn, which has led to a surplus of corn ethanol that is exported to Brazil.

123

124

125

126

127

Brazilian regulations require its fuel companies to use both ethanol made from corn and ethanol made from sugar, which has led to a surplus of sugar ethanol that is exported, and a need for corn ethanol, which is imported from the United States.

Brazilian regulations require its fuel companies to use only ethanol made from corn, which has led to a surplus of sugar ethanol that is exported, and a need for corn ethanol, which is imported from the United States.

Suppose that the United States allowed its domestic fuel producers to use ethanol made from any source (corn or sugar).

What is likely to happen to U.S. production of corn ethanol and

U.S. imports of sugar ethanol?

U.S. production of corn ethanol would increase, and U.S.

imports of sugar ethanol would decrease.

U.S. production of corn ethanol would decrease, and U.S.

imports of sugar ethanol would decrease.

U.S. production of corn ethanol would decrease, and U.S.

imports of sugar ethanol would increase.

U.S. production of corn ethanol would increase, and U.S.

imports of sugar ethanol would increase.

The VER between the United States and Japan was shown to

_______________ gas consumption, _______________ the use of energy, and _______________ gas mileage from automobiles.

raise; raise; lower

lower; lower; raise

raise; lower; lower

lower; raise; raise

The tragedy of the commons refers to the idea that:

trade inherently results in losses.

common property often results in an abuse of the property, such as overfishing.

trade restrictions can be useful.

common property is always beneficial for people.

The tragedy of the commons refers to:

the plight of the common people, who are doomed to low paying jobs and discrimination.

the fact that public resources are becoming scarce.

the idea that what we have in common is often not why we trade.

the idea that when everyone has free access to a resource, it will be overused and depleted.

The fundamental cause of the tragedy of the commons is:

international trade.

lack of defined property rights.

ignorance.

tariffs.

128

129

130

131

132

133

134

The phenomenon known as the tragedy of the commons occurs whenever:

the private sector owns resources and manages them tragically.

the government owns resources and manages them tragically.

there is no ownership of resources, so they become depleted due to lack of management.

two countries own the same resource and cannot agree on its management.

Which of the following is an example of the tragedy of the commons?

overproduction of Saudi Arabian crude oil

overregulation of the U.S. steel industry

overharvesting of many species of fish

U.S. farm subsidies

An example of the tragedy of the commons is:

no worldwide fuel economy standard.

overfishing in international waters.

unsafe fishing practices that trap dolphins and sea turtles.

illegal copyright infringement.

The story about the mass slaughter of buffalo in the United

States, which allowed the products to be exported during the

1870s, is an example of:

the firstmover principle.

the principle of comparative advantage.

the tragedy of the commons.

export subsidies.

Overharvesting of fish in international waters an example of what economic concept?

a production externality

a consumption externality

marginal social benefits exceeding marginal private benefits

private marginal costs exceeding marginal social costs

Which of the following is associated with increased use of solar panels?

negative production externalities

positive production externalities

negative consumption externalities

positive consumption externalities

What would happen to U.S. economic welfare if the U.S.

eliminated tariffs on solar panel imports?

U.S. economic welfare would increase because of the social gains from increased U.S. consumption of solar panels.

U.S. economic welfare would decrease because the social gains from increased U.S. consumption of solar panels would be

less than the social costs inflicted on U.S. solar panel producers.

135

136

137

138

139

U.S. economic welfare would decrease because the social gains from increased U.S. production of solar panels would be less than the social costs associated with increased U.S.

consumption of solar panels.

U.S. economic welfare would increase because the social gains from increased U.S. production of solar panels would exceed the social costs associated with increased U.S.

consumption of solar panels.

Why do the United States and the European Union governments apply tariffs to solar panel imports, even though solar panels generate positive consumption externalities?

They believe that imported solar panels' negative consumption externalities outweigh their positive consumption externalities.

They believe that domestic production of solar panels generates negative production externalities that outweigh the positive consumption externalities from imports.

They believe that domestic production of solar panels generates positive production externalities that outweigh the positive consumption externalities of imports.

They believe that imported solar panels negative production externalities outweigh their positive consumption externalities.

What type of spillovers do the United States and the European

Union governments believe are associated with their domestic solar panel production?

consumption spillovers

heating spillovers

electricity spillovers

knowledge spillovers

What is a major cause of negative production externalities associated with the mining and processing of rare earth mineral?

Processing of rare earth minerals generates radioactive wastes.

Rare earth mining is often done in lessdeveloped countries.

Processing of rare earth minerals is very costly in countries that possess rare earth mineral deposits.

Processing of rare earth minerals generates air pollutants.

A prisoner's dilemma exists for global pollutants because:

countries do not face the full cost of pollution that they generate.

countries that regulate pollution gain more than countries that do not regulate pollution.

countries that regulate pollution lose more than countries that do not regulate pollution.

no country follows international agreements to limit pollution.

International agreements to limit pollution can lead to:

a Nash equilibrium where no countries face the full cost of pollution that they generate.

a Nash equilibrium where countries that regulate pollution

140

141 gain more than countries that do not regulate pollution.

a Nash equilibrium where countries that regulate pollution lose more than countries that do not regulate pollution.

a Nash equilibrium where no country regulates pollution.

In the case of global pollution, a nation that pollutes gets benefit from production but:

has to pay for it in terms of dirty air and water.

never receives any negative consequences.

cannot control the amount of pollution by private firms.

will not suffer the full costs of its own pollution and so has little incentive to control it.

SCENARIO: PAYOFF MATRIX

The payoff matrix shows outcomes of various strategies that a

Home and Foreign country can follow to decide to regulate or not regulate pollution. The columns give Foreign's actions, and the rows give Home's actions. The values in the upper righthand side of each element give Foreign's net benefits; the values in the lower lefthand side of each element give Home's net benefits. Net benefits are the environmental benefits from regulation minus costs associated with installing pollution control equipment.

142

Reference: Ref 115

(Scenario: Payoff Matrix) How can you tell that the governments of each country favor producer profits over consumer wellbeing when net benefits are calculated?

A country's net benefits are higher when the other country regulates pollution.

A country's net benefits are lower when the other country regulates pollution.

A country's net benefits are lower when it regulates pollution than when it does not.

A country's net benefits are higher when it regulates pollution than when it does not.

SCENARIO: PAYOFF MATRIX

The payoff matrix shows outcomes of various strategies that a

Home and Foreign country can follow to decide to regulate or not regulate pollution. The columns give Foreign's actions, and the rows give Home's actions. The values in the upper righthand side of each element give Foreign's net benefits; the values in

the lower lefthand side of each element give Home's net benefits. Net benefits are the environmental benefits from regulation minus costs associated with installing pollution control equipment.

143

Reference: Ref 115

(Scenario: Payoff Matrix) What is likely to happen if there are no international agreements to limit pollution?

Foreign will regulate pollution but Home will not.

Home will regulate pollution but Foreign will not.

Neither country will regulate pollution.

Both countries will regulate pollution.

SCENARIO: PAYOFF MATRIX

The payoff matrix shows outcomes of various strategies that a

Home and Foreign country can follow to decide to regulate or not regulate pollution. The columns give Foreign's actions, and the rows give Home's actions. The values in the upper righthand side of each element give Foreign's net benefits; the values in the lower lefthand side of each element give Home's net benefits. Net benefits are the environmental benefits from regulation minus costs associated with installing pollution control equipment.

Reference: Ref 115

(Scenario: Payoff Matrix) Which of the following elements represents a Nash equilibrium?

A

B

144

145

146

147

148

149

C

D

In the case of global pollution, the Nash equilibrium shows that if one nation does not regulate its pollution, other nations:

will have to regulate even more strictly.

will not regulate either because of international price competition.

will regulate but will bring charges in the WTO against the other.

will regulate, so they will not harm their own citizens.

In a situation where there is no incentive to cut pollution because it will make domestic firms less competitive, it will improve world welfare if:

nations impose tariffs on polluters.

there is an international agreement so that every nation regulates global pollutants and no firms have competitive advantages because of lax pollution laws.

there is a ban on production until we can scientifically solve our pollution problems.

we allow the market to work in this case.

What is the Kyoto Protocol?

It is a treaty on abolishing child labor and forced labor camps.

It is a guideline for using “force” when interrogating prisoners.

It is based on the 1992 UN climate treaty that set specific air pollution reduction targets for each nation.

It is a set of rules for shipping dangerous chemicals to avoid harm and to lower the risk of a terrorist attack.

Did the United States ratify the Kyoto Protocol? Why or why not?

Yes; but it has failed to meet targets for a number of years.

No; the United States had promised to sign on January 1,

2008, but never did.

Yes; and it has met its target each year.

No; he United States believed the targets were impossible to meet without great harm to the industrial base.

Which of the following was NOT an issue that the United States.

had with the Kyoto Protocol?

Major U.S. trading partners (such as China and India) are exempt from the provisions—not fair!

Europe's targets were set ridiculously low.

We don't really know if pollution causes global warming.

There are less costly ways to deal with environmental problems.

Which of the following is NOT a reason why the United States did

NOT sign the Kyoto Protocol?

We still do not understand all the consequences of policy actions that affect global warming.

150

151

152

153

Meeting the Kyoto targets would negatively affect the U.S.

economy.

Kyoto failed to include the developing countries, especially

China and India.

There was not enough cash incentive being provided to the

United States to sign the protocol.

Which of the following was an important reason why the United

States did NOT sign the Kyoto Protocol?

It believed that exemptions for some of its major developing country trading partners (such as China and India) were unfair.

It believed that Europe's targets were set ridiculously low.

It believed that pollution does not cause global warming.

It believed that targets for some of its major developing country trading partners (such as China and India) were too low.

Unlike the Kyoto Protocol, the Copenhagen Accord will:

include India and China as participants.

strongly curtail emissions.

seek to reverse global warming.

be noncontroversial.

Two large countries are thinking of imposing a tariff on the same good.

A) What is the best possible outcome for these two large countries?

B) Is this outcome a Nash equilibrium?

Answer:

A) The best possible outcome is for both countries is not to impose a tariff, since if one country imposes a tariff, it will gain and the other will lose. So if country 1 imposes a tariff, country 2 will lose and most likely retaliate with a tariff and both will then lose.

B)The best outcome is not a Nash equilibrium. The combination of the two countries imposing the tariff is a Nash equilibrium in which there is no incentive for either to eliminate its tariff.

Suppose that the following graph gives the U.S. supply (S) of and demand (D) for auto parts (say steering wheels). U.S. automakers can also import steering wheels from Mexico at $50 each and from Japan at $40 each. Currently, there is a 60% tariff on imported steering wheels.

154

A) How many steering wheels will the United States import?

B) How much tariff revenue will the U.S. government collect?

C) Suppose that the United States and Mexico become part of NAFTA and there is free trade between the two countries. Now how many steering wheels will the

United States import?

D) Calculate the trade creation gains from free trade in steering wheels with

Mexico.

E) Calculate the trade diversion losses from free trade in steering wheels with

Mexico.

F) Does the United States gain or lose as a result of free trade in steering wheels with Mexico?

Answer:

A) 50

B) 60%($40 × 50) = $1,200

C) 150

D) 1/2(50 × $14) + 1/2(50 × $14) = $700

E) Trade diversion losses consist of the extra cost that the United States pays for steering wheels from Mexico that were formerly imported from Japan (50 steering wheels were imported from Japan at $40 each). Now these 50 steering wheels are imported from Mexico at a price of $50. The cost of these 50 steering wheels diverted to Mexico is ($50

F) It is a net gainer, since trade creation gains ($700) are more than trade diversion losses ($500).

Why do some economists prefer multilateral trade agreements over regional trade agreements?

Answer:

There is a greater opportunity for trade diversion in regional trade agreements since only the countries within the agreement have zero tariffs, while tariffs are maintained against the countries outside the agreement. This feature may cause some trade to be diverted from lowercost, thirdcountry sources to

155

156

157

158 highercost member countries. Multilateral trade agreements have few, if any, opportunities for tariff discrimination that can lead to trade diversion.

Suppose that the U.S. government required U.S. firms to pay a

“living wage” to workers in its subsidiaries or contracting firms in developing countries.

A) What are the likely consequences of this requirement?

B) How would one determine a living wage?

Answer:

A) Wages will most likely rise and employment will fall.

B) Presumably, a living wage is somewhat higher than the current market equilibrium wage. However, it is difficult to determine how much higher. If set equal to U.S. average wages, then firms are likely to close and employment will fall dramatically. It is also difficult to compare living standards across countries. What U.S. workers consider a living wage may allow them to own several automobiles, live in large homes, and avail themselves of the latest technological gadgets. The U.S.

living wage is inappropriate for developing countries that find their comparative advantage in laborintensive products and where wages are expected to be lower.

The United States imposes a high (15.3%) tariff on garments imported from Bangladesh.

A) What is the effect of the high (15.3%) U.S. tariff on garments imported from Bangladesh on the Bangladesh economy?

B) In what way does this tariff affect Bangladeshi workers?

C) Until 2013, garments imported from Bangladesh paid no U.S.

tariff. Why did the United States suspend this trade treatment?

Answer:

A) It lowers profits of the Bangladeshi garment industry, thus making it difficult for the industry to pay higher wages.

B) It acts as a hidden tax of $4.61 on Bangladeshi citizens, which of course, includes workers.

C) The United States wanted to punish Bangladesh for its poor labor practices.

Have the GATTWTO rulings on environmental cases adversely affected the U.S. environment?

Answer:

No; labeling and consumer concerns are expected to offset some adverse environmental issues (e.g., the tunadolphin case and the biotech food case), the WTO has allowed environmentally safe harvesting techniques to be enforced (the shrimpturtle case), and the United States made adjustments to the Clean Air

Act to allow imports (the VenezuelaBrazil oil case).

The U.S. sugar quota sometimes causes the U.S. domestic price of sugar to be twice as high as the world price. How does the sugar quota affect the U.S. price of corn and the U.S.

environment?

Answer:

One demand for imported sugar cane originates from firms that

159

160

161 produce ethanol, an alternative (or additive) to gasoline that can be produced from sugar or corn. The high import price for sugar causes these firms to substitute corn grown by American farmers, which in turn, causes increased demand for corn and higher corn prices. Producing ethanol from corn is much less energy efficient than producing it from sugar cane. Corn also depletes the soil and requires fertilizers, which use energy in their production. The net energy savings from making ethanol from corn is poor, and it would be better to use sugar cane to produce ethanol, if it could be purchased at world prices.

Eliminating the quota and allowing free trade in sugar would benefit the environment because it would allow more sugar cane to be used to produce ethanol.

A) Why does the United States both import and export ethanol?

B) Suppose that the United States allowed domestic fuel producers to use ethanol made from any source (i.e., corn or sugar). What is likely to happen to U.S. production of corn ethanol and U.S. imports of sugar ethanol?

Answer:

A) U.S. regulations require U.S. fuel companies to use both ethanol made from corn and ethanol made from other sources

(such as sugar), which has led to a surplus of corn ethanol, which is exported to Brazil in return for sugar ethanol

B) U.S. production of corn ethanol would decrease and U.S.

imports of sugar ethanol would increase, since the higher cost domestic ethanol producers would find it difficult to compete with the lower cost imported ethanol.

Why do the U.S. and European Union governments apply tariffs to solar panel imports, even though solar panels generate positive consumption externalities?

Answer:

They believe that domestic production of solar panels generates positive production externalities via knowledge spillovers that outweigh the positive consumption externalities of imports.

SCENARIO: PAYOFF MATRIX

The following payoff matrix shows outcomes of various strategies that the countries of Home and Foreign can follow to decide to regulate or not regulate pollution. The columns show

Foreign's actions, and the rows show Home's actions. The values in the upper righthand side of each element give Foreign's net benefits; the values in the lower lefthand side of each element give Home's net benefits. Net benefits are the environmental benefits from regulation minus costs associated with installing pollution control equipment.

Reference: Ref 116

A) Using the payoff matrix, what is likely to happen if there are no international agreements to limit pollution?

B) In the payoff matrix, which element represents a Nash equilibrium?

C) Why is the element you selected in B a Nash equilibrium?

Answer:

A) Neither country will regulate pollution.

B) Element D is a Nash equilibrium.

C) D is a Nash equilibrium because both countries will eventually lose if they move from this element. For example, suppose

Home and Foreign both regulate (element A). There is an incentive for Foreign not to regulate (a move to element B). This movement then also provides an incentive for the home country not to regulate (a movement to element D). Now if Home decides to regulate, then Foreign gains (a movement to element

B) and home loses. Similarly, if foreign regulates, then Home gains (a movement to element C) and Foreign loses. In D, there is no incentive for either country to regulate.