Karnataka Petrol & Diesel Tax Hike: Economic Analysis

advertisement

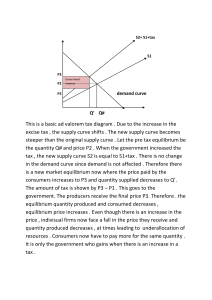

ECONOMICS COMMENTARY 1 ARTICLE : PETROL , DIESEL RATES TO GO UP IN KARNATAKA AS GOVT HIKES SALES TAX ; FALLING CRUDE RATES IMPACTS STATE’S REVENUE COLLECTION . NEWSPAPER : FIRSTPOST DATE : JAN 05 2019 Petrol and diesel are used by us in our day to day lives . Cars we use for transportation run on petrol . They are very important to the Indian economy and are used for many tasks . They power most of the equipment . The rates of petrol and diesel in Karnataka in 2017 , 2018 , 2019 have been given below . YEARS RATES OF PETROL RATES OF DIESEL ₹66.45 ₹57.02 2017 ₹ 69.39 ₹ 63.20 2018 ₹ 70.74 ₹ 64.28 2019 Therefore over the years , the rates of petrol and diesel have been increasing . This article deals with the situation where the present government of Karnataka hikes the taxes on petrol and diesel . The Congress-JDS government of Karnataka increased the taxes on petrol to 32% and 21% respectively . The government had to increase the taxes because they wanted to increase their revenue from the taxes . There was a fall in the prices of petrol and diesel in 2018 , when they reduced the taxes on petrol from 32% to 28.75% and diesel from 21% to 17.73% respectively . This lead to a fall in the state revenue and the government decided to increase the taxes again . Petrol and diesel have an inelastic demand . They have very few close substitutes , therefore an increase in the price of one good will bring forth small drop in quantity demanded . An increase in the price of petrol is likely to lead to a relatively small decrease in quantity demanded . Taxes are imposed on many goods . The taxes imposed on goods such as petrol , alcohol , Diesel are known as excuse taxes . Excise taxes are a source of government revenue . Governments collect revenues from excise taxes . Governments impose more taxes on inelastic goods because the quantity demanded is relatively unresponsive to the price . Also petrol and diesel are our necessities , so they are needed in our everyday life so they have an inelastic demand . Ad valorem taxes are taxes that have a fixed percentage of the price of the good or service . Over here the amount of tax increases as the price increases . Let us consider the price of petrol before the tax was increased was ₹70 per litre . We know that the tax increased by 3.25 % , so therefore the new price of petrol per litre will be the previous price of the petrol added to the increase in tax . Quantity Supplied (S2) 1 2 3 4 5 Quantity Supplied ( S1) 1 2 3 4 5 Price 72.25 144.45 216.825 289.1 316.37 Price 70 140 210 280 350 We can see that there is a shift in the supply curve , the new supply curve S2 is steeper than S1. Since the tax is calculated as a percentage of price , the amount of tax per unit increases as the tax increases . This is a basic ad valorem tax diagram . Due to the increase in the excise tax , the supply curve shifts . The new supply curve becomes steeper than the original supply curve . Let the pre tax equilibrium be the quantity Q# and price P2 . When the government increased the tax , the new supply curve S2 is equal to S1+tax . There is no change in the demand curve since demand is not affected . Therefore there is a new market equilibrium now where the price paid by the consumers increases to P3 and quantity supplied decreases to Q’. The amount of tax is shown by P3 – P1 . This goes to the government. The producers receive the final price P3. Therefore . the equilibrium quantity produced and consumed decreases , equilibrium price increases . Even though there is an increase in the price , indivisual firms now face a fall in the price they receive and quantity produced decreases , at times leading to underallocation of resources . Consumers now have to pay more for the same quantity . It is only the government who gains when there is an increase in a tax . It may not be a healthy idea when we say that government can increase their revenue without raising taxes . It may not be possible . Instead the consumers can switch to other alternatives and use cycles for short distances and use public transport . These solutions help prevent pollution too . Petrol and diesel are non renewable fuels . We need to conserve them for our future generations . Also an increase in the economy of the country will help overcome this problem . We , the citizens of India can work together and increase the economy of the country . BIBLIOGRAPHY : https://www.eia.gov/energyexplained/index.php?page=diesel_use http://www.sify.com/finance/petrol-price-across-all-state-capitals-on31-july-2017-news-commodities-rh5llDiiffbjd.html https://www.goodreturns.in/petrol-price-in-bangalore.html https://www.goodreturns.in/diesel-price-in-bangalore.html IB ECONOMICS CAMBRIDGE textbook .