Questions about Money

Questions about Money

1.

When you are using money to purchase a new phone, money is serving as a: a.

Store of value. b.

Unit of barter. c.

Unit of account. d.

Double coincidence of wants. e.

Medium of exchange.

2.

Double coincidence of wants problem can be solved by: a.

More resources. b.

More production. c.

Money. d.

Economic growth. e.

Lower unemployment rates.

3.

An example of double coincidence of wants is: a.

A car mechanic who wants a TV finding an owner of an electronic store who wants a car repaired. b.

A car dealer who wants a TV finding an electronics store owner who wants money. c.

An electronics store owner who wants car repairs finding a car mechanic who wants money. d.

A car dealer who wants a new employee finding a car mechanic who wants money. e.

A car mechanic who wants a TV finding an owner of an electronics store who wants a sack of potatoes.

4.

When you buy a ticket to the rodeo, you are using money as a(n): a.

Expander of economic activity. b.

Store of value. c.

Factor of production. d.

Medium of exchange. e.

Instrument of long-run economic growth.

5.

When you discover money in your coat that you placed there last winter, you unexpectedly find you were using money as a(n): a.

Medium of exchange. b.

Expander of economic activity. c.

Factor of production. d.

Store of value. e.

Instrument of barter.

6.

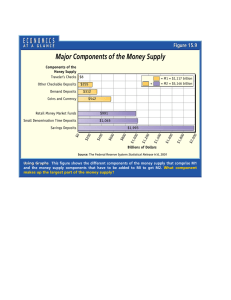

The primary difference between M1and M2 is that: a.

The dollar amount of M1 is much larger than the dollar amount of M2.

b.

M2 includes savings deposits and time deposits, but M1 does not. c.

M1 includes checkable deposits, but M2 does not. d.

M2 includes checkable deposits, but M1 does not. e.

M1 includes savings deposits and time deposits, but M2 does not.

7.

When you transfer $1,000 from your savings account to your checking account: a.

M1 decreases, and M2 increases. b.

M1 increases, and M2 decreases. c.

M1 increases, M2 doesn’t change. d.

M1 and M2 don’t change. e.

M2 decreases, M1 doesn’t change.

8.

Which of the following is a “near money”? a.

Savings account b.

Checkable deposit c.

Currency d.

Travelers’ checks e.

Coins

9.

Debit cards are: a.

Considered part of the money supply. b.

Not generally accepted as a medium of exchange. c.

Less liquid than stocks and bonds. d.

Create a liability for the card user. e.

Not considered part of money supply because not currency

10.

Suppose you transfer $500 from savings account to checking account. With this transaction M1

____ and M2 ____. a.

Increase, decrease b.

Increase, stay the same c.

decreased, decreased d.

stayed the same, decreased e.

increased, increased