Bond Issuance Problem: Effective Interest Method

advertisement

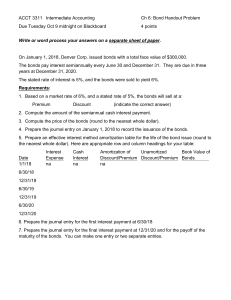

ACCT 3311 Intermediate Accounting Ch 6: Bond Handout Problem Due Tuesday Oct 9 midnight on Blackboard 4 points Write or word process your answers on a separate sheet of paper. On January 1, 2018, Denver Corp. issued bonds with a total face value of $300,000. The bonds pay interest semiannually every June 30 and December 31. They are due in three years at December 31, 2020. The stated rate of interest is 5%, and the bonds were sold to yield 6%. Requirements: 1. Based on a market rate of 6%, and a stated rate of 5%, the bonds will sell at a: Premium Discount (indicate the correct answer) 2. Compute the amount of the semiannual cash interest payment. 3. Compute the price of the bonds (round to the nearest whole dollar). 4. Prepare the journal entry on January 1, 2018 to record the issuance of the bonds. 5. Prepare an effective interest method amortization table for the life of the bond issue (round to the nearest whole dollar). Here are appropriate row and column headings for your table: Date 1/1/18 Interest Expense na Cash Interest na Amortization of Unamortized Book Value of Discount/Premium Discount/Premium Bonds na 6/30/18 12/31/18 6/30/19 12/31/19 6/30/20 12/31/20 6. Prepare the journal entry for the first interest payment at 6/30/18 7. Prepare the journal entry for the final interest payment at 12/31/20 and for the payoff of the maturity of the bonds. You can make one entry or two separate entries.