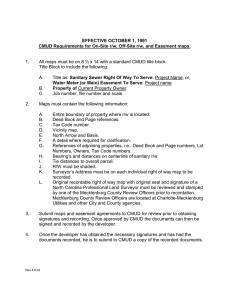

Property Law Summary

advertisement