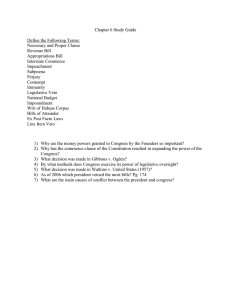

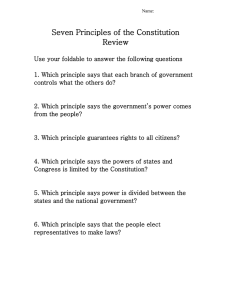

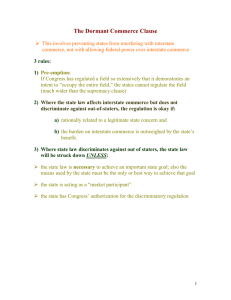

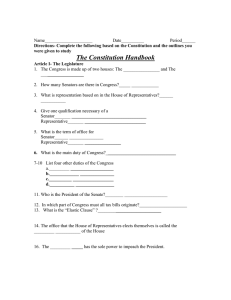

Book notes - Con law

advertisement