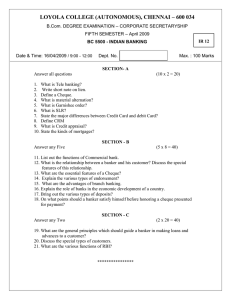

Business Studies Exam Paper: Banking & Organizations

advertisement

I. Multiple Choice Questions [20] Circle the correct answer from the given options 1. Which of the following are provided by banks? a. Buying houses for clients b. Checking imported goods c. Issuing notes and coins d. Providing traveller’s cheques 2. Which statement is true of a current account? a. All cheques presented on the account will be honoured b. Interest is always given on money deposited c. Loan facilities are automatically provided d. Withdrawals can be made on demand 3. Why are ATMs becoming widespread in many countries? a. They allow people to buy goods from abroad b. They allow people to obtain immediate loans c. They enable people to obtain services after banking hours d. They enable people to postpone the payment of debts 4. What is an advantage of internet banking to customers? a. An account holder can pay in cash and cheques b. Bank statements can be viewed at any time c. Cash can be obtained at all times d. Other people can view the progress of your bank account 1 5. What is a bank giro? a. A facility for obtaining loans b. A means of making payment c. Method of obtaining cash after hours d. A way of making savings 6. What does credit transfer service allow? a. Make payments on a regular basis b. Move funds from a current account to a savings account c. Obtain funds from other customers directly from their bank accounts d. Pay a number of creditors using one cheque for the total amount 7. Which is the speediest method of payment for international transactions? a. Bank drafts b. Cheque c. Electronic transfer d. Documentary credit 8. What is a bank draft? a. A bank statement b. A cheque issued by a bank c. A cheque issued by the account holder d. A form of bank borrowing 2 9. What is an advantage to the customer of using a debit card to buy goods and services? a. Acceptance in all shops b. Immediate ownership c. Interest paid on the transaction d. Postponement of payments 10. What is the aim of a business in the public sector? a. To reduce unemployment b. To make large profits c. To pay dividends to shareholders d. To provide essential goods and services 11. When a government takes over a well-known bank and operates it as a public corporation, that is called a. Comparative advantage b. Nationalization c. Privatisation d. Limited liability 12. Which of the following is likely to be managed by a public corporation? a. Advertising b. Banking c. Defence d. Telecommunication 3 13. Who owns a public corporation? a. Consumers b. Managers c. Shareholders d. Taxpayers 14. In a limited company, the board of directors in answerable to a. Employees b. Partners c. Shareholders d. Taxpayers 15. Which description best defines a sleeping partner a. A person who buys shares in the partnership b. A person who contributes capital but does not work in the business c. A person who is liable for all the debts of the business d. A person who makes decisions on behalf of the partners 16. A sole trader is able to compete with larger business organizations because she a. Can supervise the business personally b. Has limited liability c. Is a legal identity d. Keeps all the profits. 17. Which statement is true for both private and public limited companies? a. They are controlled by the government b. They are separate legal entities c. They sell their shares on stock exchanges d. The shareholders have unlimited liability 4 18. Why would the owners of a private limited company decide to change it into a public limited company? a. To avoid the publication of its financial affairs b. To enable its shareholders to benefit from limited liability c. To have better control over the company’s affairs d. To obtain more capital in order to expand. 19. The parent company that offers the franchise is called the a. Entrepreneur b. Franchisee c. Franchisor d. Shareholder 20. If you take out a franchise agreement what must you give to the parent company? a. A regular supply of goods b. A percentage of the revenue of the business c. Dividends at the end of the year d. Payments of rent and staff wages II. For each of the following, state the facility provided by the bank. [5] 1. To keep valuables like diamonds and important documents - ….……………………. 2. To make payments of $200 on the 4th of every month. -.....……………………. 3. To buy a laptop now and pay for it later. -…..……………………. 4. To check the account balance without going to the bank. -.……………………….. 5. Instead of carrying $3500 in cash when travelling to Europe -.……………………….. 5 III. Describe the following: [20] 1. Unlimited liability. 2. Professional partnership. 3. Board of Directors 4. Capital gains 5. Speculators 6. Public corporations 7. Investors 8. Check-outs 9. Light-pens 10. E-commerce IV. Differentiate between: [10] 1. Debenture holders and Shareholders 2. Incorporated and Unincorporated 3. Nationalized industries and Privatised industries 4. Cash cheques and Crossed cheques 5. Current accounts and fixed deposit accounts 6 IV. Short Answer Types: 1. Why is important for the retailer to understand the market before setting up their retail business? [4] 2. What is meant by franchising? [2] 3. State two advantages of being a sole trader. [2] 4. How are companies different from sole traders and partnership? [3] 5. Why is it expensive to set up a company? [2] 6. Why do people invest by buying shares in a businesses and what do they get in return? [2] 7. Explain two reasons for government involvement in the production of goods and services. [3] 8. What do you think banks do with their customers’ deposits? [2] 9. State and explain the three parties to a cheque. [6] 10. State four details that can be found on a cheque counterfoil. [4] 11. How are bank statements useful to a. an account holder b. a business [4] 12. Mention four reasons why a cheque would be dishonoured [4] 13. Explain the following services provided by banks. a. Standing order b. Direct debit [4] 14. Using an example, explain the purpose of bank drafts. [3] ~End of Paper~ 7