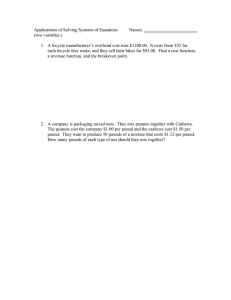

CIP

advertisement

LECTURE Sept 19th Hamza Ali Malik Econ 3114: International Finance Fall 2006 Covered Interest Parity (CIP) An investor is indifferent between placing an extra $1 into home or foreign bonds when the rates of return on them are equal and risk-free. i = interest rate in Canada i* = interest rate in UK F = forward ER ($/₤) E = spot ER ($/₤) 1$(1 + i ) = (1 + i )$ . • If invest 1$ in Canada, get: • If invest in UK: o first obtain pounds → o then get → 1$ 1 = ₤ E E 1+ i *⎞ 1 ₤ × (1 + i *) = ⎛⎜ ⎟₤ E ⎝ E ⎠ o Convert it back into $’s. o But do not know future spot ER? Can eliminate the uncertainty by “covering” the ₤ investment with a forward contract. How? 1 1+ i *⎞ By selling ⎛⎜ ⎟ ₤ (to be received in the future period) in the forward market ⎝ E ⎠ 1+ i *⎞ today. The “covered return” = ⎛⎜ ⎟F $ ⎝ E ⎠ Arbitrage between the two investment opportunities results in: 1 + i = (1 + i *) F E which can be approximated as: ⎛F −E⎞ i = i * +⎜ ⎟ ⎝ E ⎠ (1) (Forward premium or discount - cost of covering, ρ ) Note: interest rates are normally quoted as annual percentages, while forward exchange rates are reported on monthly basis; need to reconcile the difference ---- F − E 12 * * 100 N= number of months of the forward contract N E Discussion – Why the CIP would hold: If i < i* ⇒ covered funds flow to UK (everybody wants to invest in pounds) ⇒ price of ₤ in the spot market ↑ (or price of $ ↓ ) ⇒ E ↑ (depreciates). While in the forward market, the selling of the forward pound (to bring funds home) will strengthen the forward $ ⇒ F ↓ . With E ↑ while F ↓ ⇒ ‘ ρ ’ will become negative — the ₤ is at a discount (or the $ is at a premium). Let CIP = i − i * − ρ . If CIP > 0 ⇒ capital inflow; if CIP < 0 ⇒ capital outflow. 2 Example: Use the following information to calculate the forward exchange rate. i = 15%, i* = 10%, E = 2.00 ($/₤), F=? Answer: 0.15 − 0.10 = F − 2.00 or F = 2.10 2.00 What if F = 2.15 ? What would profit seeking arbitragers do? Buy ₤ spot, invest and sell ₤ forward because the future price of ₤ is higher than that implied by CIP. Example: Suppose the interest rate on British pound is 12% in London, and the interest rate on a comparable Canadian dollar investment in Thunder Bay is 7%. The pound spot rate is $1.75, and the one-year forward rate is $1.68. Calculate the implied forward discount on pounds. According to the covered interest parity relationship, is there an arbitrage profit opportunity? If yes, then calculate the profits from the discrepancy in effective returns based on a $1000 borrowed from the financial market at the given interest rate. i = i* + Answer: The forward F−E E discount F − E 1.68 − 1.75 = = −0.04 E 1.75 or on pound can be calculated as: − 4% . Therefore, the covered return on pound investment would be 12% – 4% = 8%. Thus, according to the covered interest parity relationship, there is a differential of ⎛F−E⎞ i − i* − ⎜ ⎟ or 7% – 8% = – 1% in favor of London; funds will flow from Thunder Bay ⎝ E ⎠ to London. 3 In order to calculate the profits first note that given the 7% interest rate, the arbitrageur must repay $1000 (1+0.07) = $1070. ⎛ $1000 ⎞ Now, convert $1000 to pounds at the spot rate $1.75. This yields ₤571.43 ⎜ ⎟ . Invest ⎝ 1.75 ⎠ this amount in London at 12% and earn ₤571.43*(1+0.12) = ₤640 at the end of the year. Simultaneously, sell ₤640 forward at a rate $1.68 for delivery in one year. This transaction will yield $1075.2. Use $1070 to repay the loan and earn $5.2 as profit. CIP does not hold exactly in the real world because: - cost of transacting in FOREX markets - differential taxation - government control - political risk - time lags between observing profit opportunity and actually trading to realize the profit Uncovered Interest Parity (UIP) Suppose that six month F = 1.475 $/₤ and E = 1.500 $/₤. Forward discount = F − S 12 * * 100 = −3.33% 6 S Now assume that an investor expects that $ will appreciate by 1% to 1.485 = E e . The trader’s expectation of future depreciation of the pound is different from the forward discount of the pound; will try to make a profit. 4 Buy pounds in the forward market, (say for 1 million $’s). Six months from now, he will receive ₤677,966. If his expectations are correct, sell ₤’s in the spot market and obtain $1,006,780. Profit = $6,780 So, equilibrium for speculation (i.e. when an additional forward contract will not be bought or sold) is when: F − E Ee − E = E E (2) or simply, F = E e If F < E e ⇒ speculators will buy forward (at F) now and sell spot in the future at E e until (2) holds. So, using (1) and (2) can write: i = i*+ Ee − E E Let UIP = i − i * - expected ∆ in the domestic currency. If UIP > 0 ⇒ capital inflow; if UIP < 0 ⇒ capital outflow 5 Exchange Rates, Interest Rates, and Inflation The interest rate is basically the price at which purchasing power can be shifted from the future into the present. Economists prefer to focus on the real interest rate (r) rather than the nominal interest rate. The nominal interest rate (i) is the interest rate expressed in terms of money while the real interest rate is expressed in terms of goods and services and measures the return after adjusting for inflation ( π ). The expected effect of inflation on the nominal interest rate is often called the Fisher effect, and the relationship between inflation and interest rates is given by the Fisher equation: i = r +π An increase in π tends to increase i. Consider the Fisher equation for the home and foreign economy respectively: i = r +π i∗ = r∗ + π ∗ Assuming that the real interest rates are the same internationally, then r = r ∗ . 6 Thus, can write: i − π = i∗ − π ∗ or i − i∗ = π − π ∗ But from UIP we know: i − i∗ = ⇒ Ee − E E π −π∗ = Ee − E E (which is simply relative PPP) Remember that in the real world, the above interrelationships are determined simultaneously, because interest rates, inflation expectations, and exchange rates are jointly affected by new events and information. 7