GridPlus Whitepaper 1.4

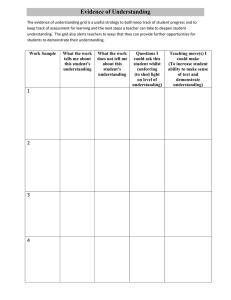

advertisement