2 November 2018

The

Environmental Impact Nursery™

“Delivering Deal Flow”

A new construct for a truly sustainable planet

"Freedom lies in being bold" Robert Frost

Contents

Abstract ........................................................................................................................................................ 4

The Challenge ............................................................................................................................................... 5

Background ............................................................................................................................................... 5

Natural Capital .......................................................................................................................................... 5

Natural Capital Accounts .......................................................................................................................... 6

Business as Usual Risk ............................................................................................................................... 7

The United Nations Sustainable Development Goals (SDG’s) .................................................................. 8

Mobilising Private Capital ......................................................................................................................... 8

Philanthropy.......................................................................................................................................... 8

Impact investing .................................................................................................................................... 8

Investment risk...................................................................................................................................... 8

Challenges ............................................................................................................................................. 9

Deal flow ............................................................................................................................................... 9

The Environmental Impact Nursery™ ........................................................................................................ 10

EIN Background ....................................................................................................................................... 10

The EIN Process ....................................................................................................................................... 11

EIN Deal Flow Development ................................................................................................................... 12

Creative Problem Solving ........................................................................................................................ 12

Initial investment themes ....................................................................................................................... 13

Accountability ......................................................................................................................................... 13

Business-for-Purpose .............................................................................................................................. 14

STEM ....................................................................................................................................................... 15

Greenwashing ......................................................................................................................................... 16

EIN Business Development ........................................................................................................................ 17

ESG .......................................................................................................................................................... 17

Governance ............................................................................................................................................. 17

Ethos ....................................................................................................................................................... 17

E-Suite ..................................................................................................................................................... 17

Regional Network.................................................................................................................................... 17

External Opportunities ............................................................................................................................ 17

The EIN Model V the incubator/accelerator models .............................................................................. 18

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

2

Marketing ................................................................................................................................................ 18

Education ................................................................................................................................................ 18

Global Network ....................................................................................................................................... 18

Valuations ............................................................................................................................................... 18

Social Impact ........................................................................................................................................... 18

The Humanities ....................................................................................................................................... 18

Investing in the EIN Model ......................................................................................................................... 19

Conclusion .................................................................................................................................................. 20

Glossary ....................................................................................................................................................... 21

References .................................................................................................................................................. 22

This whitepaper is dated 2 November 2018 and is the 10th edition.

This document is continually updated as this construct evolves.

Please visit www.naturalimpactgroup.com/whitepaper to ensure you have the latest version.

Author: R.J. Holden, Founder, CEO & Managing Director, Natural Impact Group™ Pty Ltd.

Email contact regarding this whitepaper: naturalimpactgroup@gmail.com

© 2018 Natural Impact Group™ Pty Ltd. All Rights Reserved.

Copyright Natural Impact Group™ Pty Ltd. This work is the intellectual property of the author. Permission

is granted for this material to be shared for non-commercial, educational purposes, provided that this

copyright statement appears on the reproduced materials and notice is given that the copying is by

permission of the author. To disseminate otherwise or to republish requires written permission from the

author.

Citation

Holden R.J (2018). The Environmental Impact Nursery™; delivering deal flow – A new construct for a truly

sustainable planet.20181102

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

3

Abstract

This whitepaper is based on three statements:

1. Natural Capital is the basis for all biological, social and economic activity on earthi and;

2. On the 25th of September 2015 the United Nations General Assembly adopted the Resolution

Transforming our world: the 2030 Agenda for Sustainable Development which sets out a plan to

achieve global sustainability via 17 Sustainable Development Goals (SDG’s)ii. The UN estimates

the cost to be $75 trillion to $105 trillioniii between 2015 and 2030 and;

3. The Oxford Dictionary defines the verb “risk” as “Expose (someone or something valued) to

danger, harm, or loss”iv.

Based on point 1, to achieve all 17 of the SDG’s a focus must first be made on the 11 goals that deliver the

best care and management of the world’s Natural Capital. This should enable the remaining 6 SDG’s to be

achieved more easily. But to do so, an increase in professional investor risk appetite is required.

It appears that global initiatives currently being developed will deliver a catalyst to increase investor risk

appetite as it becomes clear the cost of business as usual creates other risks far greater than the risk of

(any) return on investment. Clarity on total system failure (ecologically, economically and socially)

combined with a looming deadline to technically achieve sustainability and the time lag to scale new IP

and business models increases the risk of panicked investment, greenwashing and mission drift.

Rather than a catalyst, a better option may be a formal process to mobilise capital and address the

fundamental risks to Natural Capital now. Private capital is best placed to lead and this whitepaper

outlines a new construct designed to deliver the methodology, clarify risk & measurement metrics and a

way to determine the correct solutions that should be pursued to achieve true sustainability.

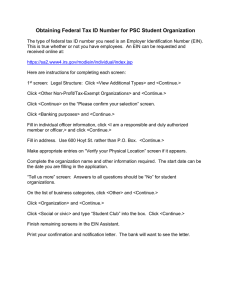

Figure 1: The 11 Sustainable Development Goals that provide the best management of Natural Capital

“We cannot solve our problems with the same thinking we used to create them”

Albert Einstein

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

4

The Challenge

Background

The start of the first Industrial Revolution (~1760) marked a major turning point in humanities use of the

earth's resources, especially fossil fuels. The next 250 years saw the development of technologies and

business models designed to extract more from the earth’s Natural Capital, under the banners of

productivity, growth and wealth generation which aimed to raise the standard of living. This has led to

overconsumption of natural resources, extreme levels of pollution, habitat loss and the spread of invasive

species.

Ironically, the process of working out how to 'extract more' has delivered an unprecedented expansion of

deep technical knowledge related to Natural Capital, Ecosystem Goods & Services and Biodiversity. Due

to this knowledge expansion, we now know that the current path is unsustainable and will end in system

failure. The evidence is already presenting in anthropogenic produced climate changevand the earth’s

sixth mass extinction eventvi

Natural Capital

Please see the glossary for a definition of Natural Capital, but essentially, it’s one of 5 capitals and

ultimately the basis for all biological, social and economic activity on Earth.

Figure 2 source Forum for the Future, 5 capitals overview

The World Forum on Natural Capital website explains the importance of Natural Capitalvii.

Why is natural capital an issue?

With financial capital, when we spend too much we run up debt, which if left unchecked can

eventually result in bankruptcy. With natural capital, when we draw down too much stock from

our natural environment we also run up a debt which needs to be paid back, for example by

replanting clear-cut forests, or allowing aquifers to replenish themselves after we have abstracted

water. If we keep drawing down stocks of natural capital without allowing or encouraging nature

to recover, we run the risk of local, regional or even global ecosystem collapse.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

5

Poorly managed natural capital therefore becomes not only an ecological liability, but a social and

economic liability too. Working against nature by overexploiting natural capital can be

catastrophic not just in terms of biodiversity loss, but also catastrophic for humans as ecosystem

productivity and resilience decline over time and some regions become more prone to extreme

events such as floods and droughts. Ultimately, this makes it more difficult for human

communities to sustain themselves, particularly in already stressed ecosystems, potentially

leading to starvation, conflict over resource scarcity and displacement of populations.

The key point is, in relation to the 5 Capitals, when Natural Capital, especially Ecosystem Services and

Biodiversity, become unavailable due to over-exploitation or system collapse, Manufactured and Financial

capital must combine with Human and Social capital to fill the gap. This adds substantial pressure to the

economics of business as productivity declines and fixed and marginal costs rise as the ecological footprint

expands. The negative impact to return on investment (ROI) of business will be significant and potentially

exponential as Natural Capital is exhausted.

Natural Capital Accounts

Wealth is what underpins the income and production (GDP) that a country generates. It includes the five

capitals and net foreign assets. The System of National Accounts (SNA) is the international standard for

measuring national income and savings and is followed by all countries, but it does not include

comprehensive cover of total wealth or natural capital.viii

Figure 3 Wealth, GDP and long-term prosperity

In 2012 the United Nations Statistical Commission adopted the System of Environmental-Economic

Accounting (SEEA)ix. SEEA contains the internationally agreed standard concepts, definitions,

classifications, accounting rules and tables for producing internationally comparable statistics on the

environment and its relationship with the economy. The SEEA framework follows a similar accounting

structure as the System of National Accounts (SNA) and uses concepts, definitions and classifications

consistent with the SNA in order to facilitate the integration of environmental and economic statistics.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

6

The SEEA Experimental Ecosystem Accounting (SEEA EEA) constitutes an integrated statistical framework

for organizing biophysical data, measuring ecosystem services, tracking changes in ecosystem assets and

linking this information to economic and other human activity. The SEEA EEA was formally published in

2014 as a joint publication of the United Nations, European Commission, Food and Agriculture

Organization of the United Nations, Organisation for Economic Co-operation and Development (OECD)

and the World Bank.

The SEEA EEA complements the SEEA Central Framework by taking a different perspective. The Central

Framework looks at “individual environmental assets”, such as water resources, energy resources, etc.

and how those assets move between the environment and the economy. In contrast, the SEEA EEA takes

the perspective of ecosystems and considers how individual environmental assets interact as part of

natural processes within a given spatial area.

The UN Committee of Experts on Environmental-Economic Accounting (UNCEEA) determined in June 2017

that a revision of the SEEA EEA was appropriate with the intention to reach agreement on as many aspects

of Ecosystem accounting as possible by 2020x. That revision has now started with Revision Issue Notexi

and Technical Recommendations available onlinexii

While these two projects are best in class, science has a very limited understanding of the

interconnectedness between all the forms of Natural Capital and anthropogenic impacts. Human caused

impacts may take hundreds of thousands or even millions of years to become apparent, especially with

the synthetic mutagens that have been introduced into the environment. Due to this fact, the final

numbers from the SEEA EEA study must be grossly underestimated in its truest sense.

“You'd be surprised how much it costs to look this cheap.” Dolly Parton

Business as Usual Risk

The complexity of natural systems and irreversibility of some environmental change mean that replacing

natural capital with other forms of capital is often impossible (a phenomenon known as nonsubstitutability) or carries significant risks. It’s clear that the risks and costs from continued degradation

of ecosystems and their services have not yet been properly integrated in our economic systems, social

systems, and decision-making.

Global use of material resources has increased ten-fold since 1900 and is set to double again by 2030.xiii

The demands of a growing global population with rapidly changing consumption patterns for food,

mobility and energy are exerting ever-increasing pressure on the Earth's natural capital.

Exacerbated by climate change and large-scale pollution, rates of global habitat destruction and

biodiversity loss are predicted to increase. Continued degradation of global ecosystems and their services

will drive the scale of poverty and inequality and drive increased migration.xiv

Recent changes in the global climate are unprecedented over millennia and will continue. Climate change

is expected to increasingly threaten natural ecosystems and biodiversity, slow economic growth, erode

global food security, harm human health and increase inequality and conflict.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

7

Globally, levels of air pollution and releases of nutrients from agriculture and wastewater remain high,

causing acidification and eutrophication in ecosystems, and losses in agricultural yield. In the coming

decades, overall pollution levels are projected to increase strongly, particularly in Asia.

The risks of pervasive and irreversible impacts are expected to increase and the cost of these impacts will

eventually outweigh the ROI of any and all current investment themes.

The United Nations Sustainable Development Goals (SDG’s)

The United Nations has set the task of achieving global sustainability through 17 goals; the SDG’s.

The challenge and cost (up to $105 trillionxv) of meeting the SDG’s is substantial, with an annual funding

gap of $2.5 trillionxvi. We now have significant technical understanding of the issues and in a lot of cases

the seeds of technological solutions may be either in development or available.

While new legislation and regulation would support achieving the SDG’s and provide significant impetus

to attract investment, the lack of political courage and vision, short election cycles, the rise in populist

politics and lobbying by vested interests means this framework is slow to move in the desired direction.

The reality of the risks of not meeting the SDG’s is gaining traction with politicians and business leaders

and it’s been shown that legislation and regulation can change quickly if political will aligns with vested

interests. A movement in the right direction should mean massively increased investment…but how?

Mobilising Private Capital

Philanthropy

Philanthropy remains an important part of funding for environmental projects and with recent advances

in impact investing; measuring environmental or social impact of grants is increasing. The key issue with

philanthropy is grant funds provide a limited pool of capital when compared to the growing demand.

Impact investing

Currently the available capital for impact investing (US$114 billion)xvii is relatively low when compared to

negative screening and environmental, social governance (ESG) investing (US$68.5 trillion AUM).xviii

Impact investing is set to increase with the UBS/PwC Billionaires Insights 2017 reportxix estimating that

the next generation (millennials) will inherit US$2.4 trillion over the next 20 years. The Morgan Stanley

Sustainable Signals 2017 reportxx found that 86% of millennials are very interested (38%) or somewhat

interested (48%) in impact investing.

Studies show that 66% of impact investors seek a risk adjusted market rate return.xxi

Approximately 60% of investors reported that they actively track the financial performance of their

investments with respect to the Sustainable Development Goals (SDGs) or plan to do so soon.xxii

Investment risk

Although very few investors report significant risk events in their impact investing portfolios, business

model execution and management is by far the most often cited contributor to risk.xxiii

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

8

Challenges

The key challenges for impact investors arexxiv:

•

•

•

•

•

•

Understanding funding gaps and related opportunitiesxxv;

Impact measurement and evaluation;

Co-investment opportunities and collaboration;

Finding good organisations to support and funding innovative solutions;

Scaling successful projects and businesses;

Mission creep and greenwashingxxvi.

Deal flow

Due to the nature of the current investment process from concept to exit, deal flow of opportunities in

any sector or industry is a disjointed, adhoc process that relies on two distinct stages coming together.

In the initial stage entrepreneurs see an opportunity, aim to get all of the factors right, survive the first

half of the ‘valley of death’ and become investment ready. In the latter stage of venture development

professional capital managers become involved due to the previous mitigation of project risk.

The entry point and participation stage of professional investors is based on the acceptable risk profiles

of the managers and owners; it’s also where most of the above challenges for impact investors originate.

On the expected trajectory, current risk profiles will become irrelevant as the real costs of business-asusual (mismanagement of Natural Capital) become known. Reassessing risk profiles now is the key to

mitigating these challenges, engaging the right deal flow and achieving the SDG’s.

Fund Manager/Private Capital participation

Figure 4 source UC Davis Graduate School of Management - Institute for Innovation and Entrepreneurship

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

9

The Environmental Impact Nursery™

The Environmental Impact Nursery™ is a business-for-purpose model implementing a goal orientated and

mandate driven methodology to deliver qualified deal flow. This allows private capital to better engage in

impact investing via the appropriate deal size and themes.

In a nutshell, for private capital to access the right deal flow it’s best to be part of the deal flow

development rather than wait for adhoc opportunities to present themselves!

Vision - To make the business of sustainability the most superior performer of any investment class

Mission - Leveraging internal capital to provide qualified SDG/ESG/RI deal flow for investors

Mandate – To develop and invest in IP and business models that decarbonise the economy and protect

biodiversity

EIN Background

The Environmental Impact Nursery™ (EIN) model is a mixture of two very successful enterprises; NASA

and the IP Group Plc. Its approach (vision) is like NASA and its method (mission) is like the IP Group.

In 1961 President John F Kennedy announced a goal of landing a man on the moon and successfully

returning him to earth within the decade. NASA implemented that goal and the Apollo Project achieved

it in 1969. Although it took only 8 years to achieve this substantial goal, the associated R&D delivered a

myriad of new technologies over the next 50 years.xxvii

The IP Group listed on AIM in 2003 with a portfolio value of £7.5m and cash of £38m. Those assets were

valued at 30 June 2016 at £880m (almost 20 X in 12 years). The IP Group works with universities and

research organisations to provide patient equity capital for the commercialisation of newly develop IP. It

provides financial capital from its balance sheet (and managed funds), strategic and commercial expertise,

E-suite services, corporate finance and a range of administrative services. xxviii

"Opportunities multiply as they are seized" Sun Tzu

Both the IP Group and the EIN model seek to unlock and commercialise IP, but the IP Group works to

commercialise already developed IP. Therefore, they must apply a backward thinking process to assess

the risk and reward potential of IP. Because the EIN models (and NASA) are essentially Creative Problem

Solvers, it naturally uses a forward-thinking process to assess the risk/reward of the same (potential) IP.

This change in mindset allows the model to understand the funding gaps, generate unique solutions to

the world’s environmental problems and minimise the business risk going forward.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

10

Figure 5 – the model comparison in deal flow development

The EIN Process

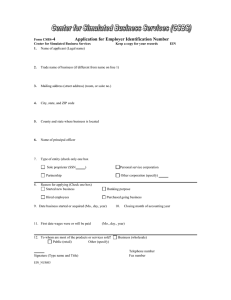

3. Incorporate a subsidary company (new Portfolio Company) and establish the board,

management teams and expert group. Keep overheads at a minimum and initiate design

thinking & lean start-up. Provide financial capital, strategic and commercial expertise, Esuite services, corporate finance and a range of administrative services.

4. The final step is to raise private capital for the Portfolio Company and, depending on

the situation, this may be debt or equity. Based on the business model and market

fundamentals, build the Portfolio Company business, enable follow-on investment and

aim for an exit within 5 to 7 years through either a trade sale or IPO.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

11

IP Group Model

2. Research the problem, seek out all the experts in each field associated with the problem,

identify potential team members and ways to collaborate with existing stakeholders. Seek

out potential technical solutions (IP) and identify where current research may be

associated with a problem. Develop a business model

NASA Model

1. Think about the environmental problems in the world. Think global and act local. Define

one where a solution could be scaled globally, determine a competitive advantage and

set a goal

EIN Deal Flow Development

The Environmental Impact Nursery™

Fund Manager/Private Capital Opportunities

Figure 6 – the EIN model value proposition – identifying SDG funding gaps/opportunities and delivering qualified deal flow

Creative Problem Solving

Creative Problem Solving (CPS) is a proven method of solving problems or identifying opportunities in an

imaginative and innovative way. It encourages us to find fresh perspectives and come up with innovative

solutions, so that we can formulate a plan to overcome obstacles and reach our goals. It adds creativity

to knowledge and thinking.

CPS has been used with great affect by people like Aristotle, Archimedes, Charles Darwin, Alexander

Graham Bell, Marie Curie, Sir Isaac Newton, Thomas Edison, Albert Einstein, Mozart, Wernher von Braun,

Benjamin Franklin, Gandhi, Leonardo da Vinci, Stephen Hawking, Galileo, Barbara McClintock, Chomsky,

Nikola Tesla, Henrietta Swan Leavitt, Johannes Kepler, Steve Jobs, Bill Gates and Elon Musk.

Although this small group of high profile people have possibly delivered greater benefits for humanity

than the rest of humanity put together, CPS has delivered successful results to the millions of people that

use it. For example, the person that started a small business service that resulted in a better community

where they live used CPS at some stage in its development; the entrepreneur that developed a new app

to address an issue used CPS; the farmer that moved the broken implement by holding it together with

fencing wire because that was all that was available in a remote location, used CPS. The famous users of

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

12

CPS spent their lives using CPS and gained widespread attention because of the global implications of their

solutions, which is why these names stand out. Anybody can use CPS to great effect.

In large complex problems, CPS requires time for solutions to evolve, so a short process of assess and then

accept or reject doesn't always allow time for this to happen. In some instances, it may take years for

solutions to evolve, so the EIN process of working on several projects at once supports this evolution. This

point is critical as of the 5 key factors that generate success in new start-up ventures, timing is rated the

most important at 42%.xxix

Initial investment themes

To identify the funding gaps and best opportunities to deliver the 11 SDG’s in focus, all projects must be

designed to directly decarbonize the economy or protect biodiversity. The following initial investment

themes broadly align with the World Bank Group Climate Change Action Planxxx. Other themes (relating

to SDG’s 3 & 4) will follow and be designed to bridge the gap for the final 6 SDG’s.

Investment themes are:

(A) Agribusiness & Natural Capital, Ecosystem Services and Biodiversity

(B) Asset Recovery & Recycling

(C) Clean Technology & Efficiency

(D) Environmental Markets & Services

(E) Remediation & Management of Natural Capital, Ecosystem Services and Biodiversity

To ensure projects and investments are designed to properly aligned to the vision, mission, and mandate

(and not "greenwashed") the selection criteria must be prioritized in the following order of importance,

with 1 being the top priority:

1. The best care of Natural Capital, Ecosystem Services and Biodiversity

2. Global scalability with a competitive advantage

3. Potential IRR of +20%

Accountability

If the mandate is followed religiously, with IP and business models that directly decarbonize the economy

or protect biodiversity, then measuring environmental impact is relatively straightforward. The opposite

is also correct. The further away from nature a project or product becomes the harder it is to measure.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

13

As impact investors, it's important to measure impact transparently. The EIN model allows this process to

start at the planning and implementation stages. Conducting regular evaluations ensures the intended

impact continues to be positive as the business builds and is readably available for due diligence purposes

when attracting new capital. The following are the preferred tools.

The SDG Compass to measure and manage the contribution against the UN

Sustainable Development Goals.

The IRIS platform for measuring and reporting environmental impacts.

The Natural Capital Protocol to measure the impact on Natural Capital.

The Gold Standard for SDG project/product certification

The B Corporation certification to provide public relations acceptance

Business-for-Purpose

The concept of a business-for-purpose model is that it uses a financial engine (business) to provide cash

flow to deliver an intended outcome (purpose). Profit is very important, and almost a dual, but second

priority; it’s simply a change in investor mindset that has the capacity to deliver above average returns

(plus a significant positive impact) via an adjusted risk/time analysis.

The structure of the EIN model is designed to deliver exponential growth of the parent entity, while

supporting new and innovative solutions identified in stages 1 and 2 in the EIN Process (page 11).

The purpose of the EIN model is to fund its own Foundation and exponentially grow its corpus for

environmental & sustainability projects that align with the Mandate. The core goals of the foundation are

to fund its own Network to drive education and innovation, give 20% of annual profit within 5 years,

increasing to 80% in 10 years. The grant funding is structured to generate deal flow back to the parent

company.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

14

Figure 7 – the EIN structure including the Foundation and Ecosystem Network

STEM

Each industrial revolution step change built on the previous revolution to generate “progress” and is

directly related to the global populationxxxi creating market opportunities. The current industrial

revolution of Science, Technology, Engineering and Maths (STEM) presents as the best opportunity and

enabler to achieve the SDG’s, although, as in the past, substantial challenges arise in this theme.

The first three Industrial Revolutions have culminated in the advent of the internet of things, artificial

intelligence, genetic modified organisms, synthetics (especially petro-chemicals and pharmaceuticals).

Generally, these technologies remove the human connection to Natural Capital and are based on

improving productivity to meet economic and population growth demands (business-as-usual). Other

STEM themes (e.g. DNA, big data, cleantech) have the potential to understand the problems in detail, and

drive solutions on the scale required to meet the required timeframe.

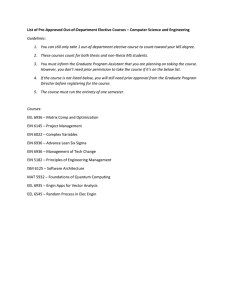

Figure 8 – is sustainability the next Industrial Revolution?

Natural Capital has evolved over billions of years to autonomously function at its highest level. The view

that humanity can economically improve on Natural Capitals function through artificial means does not

fully take into consideration the value of the interconnectedness of all forms of Natural Capital and

therefore the full costs. The true cost of the last three industrial revolutions is about to become very clear.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

15

The culmination of the last three revolutions over the last ~260 years has led to massive overconsumption

from an exponentially growing population. According to the Global Footprint Networkxxxiihumanity uses

the equivalent of 1.7 Earths to provide the resources we use and absorb our waste. This means it now

takes the Earth one year and seven months to regenerate what we use in a year. The EIN Model offers

the opportunity to take this equation back to below 1.

The ultimate aim of the EIN model is to use STEM to reconnect humanity to Natural Capital (Nature),

provide for a Fourth Industrial Revolution in true sustainability and advance humanity’s tenure on Earth

while retaining (and improving) the standard of living and quality of life of ALL its inhabitants.

The alternative can only be the collapse of civilisation as outlined in the history of Easter Island.xxxiii

Greenwashing

Green washing and mission drift are substantial risks to the successful engagement of private capital and

achieving the SDG’s. Again, it’s worth reinforcing that Humans are biological creatures that rely on Natural

Capital for its existence. Humanity has also developed various physiological, spiritual and cultural

connections to Natural Capital (Nature) and greenwashing taps into these connections to gain traction.

To mitigate greenwashing and mission drift, a litmus test process should be used in Stage 1 of the EIN

Process before a potential solution is developed further. This is carried out via 3 simple questions:

1. Does the potential solution aim to “provide the best care and management of” or “extract more

from” any form of Natural Capital and;

2. Does the solution aim to provide a “business-as-usual” advance in productivity to support growth

demands and/or capitalise on population growth or does it have at its core a new approach to

Natural Capital and;

3. Does the solution support humanity’s connection or disconnection (spiritual, cultural or

biological) to Natural Capital?

The correct answers to these questions are (1) provide the best care, (2) a new approach and (3) it

supports a human connection to nature. Having some answers incorrect may simply mean more time and

CPS is required to create the right solutions. But until it has three correct answers the solution must

remain within the Nursery. This core tenet provides the underlying integrity to the EIN Model.

“A new type of thinking is essential if mankind is to survive and move toward higher

levels…” Albert Einstein, New York Times, 1946

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

16

EIN Business Development

For Portfolio Company development a combination of CPS, Design Thinking and Lean Start-up

methodologies are used to achieve a successful solution and/or final product in the fastest and cheapest

possible way. It involves identify, empathise, define, ideate (Design Thinking) and build, measure and learn

(Lean Start-up).

Overall the EIN Model subscribes to the key findings in books like Built to Last.xxxiv

ESG

The EIN Model delivers one of the best forms of ESG investing possible as ESG (Environment, Social and

Governance) are at its centre.

Governance

Governance encompasses the system by which an organisation is controlled and operates, and the

mechanisms by which it, and its people, are held to account.

Each EIN must become a leader in governance and risk management committed to effective governance

and administration of the parent entity and its Portfolio Companies. Full and effective corporate

governance must be developed and employed at the earliest stage of the formation of the Environmental

Impact Nursery™ and each Portfolio Company.

Ethos

The ethos of the EIN Model is to be entrepreneurial with a high level of governance, ethics, integrity,

accountability and respect. Aim to lead by example and demonstrate that business will deliver the

solutions. Don't just accept the status quo, ask why? Look at all the parts and question why they exist and

can they be better. Understand risk and use it to our advantage.

E-Suite

The E-Suite (CEO, CFO, etc.) is central to the business building methodology of the parent entity and each

Portfolio Company. A core tenet is to identify the best talent for the given opportunity by using the best

practice in human resources and corporate cultural development.

Regional Network

Each EIN develops its own regional network of entrepreneurs, universities, research organisations,

incubators and accelerators to help drive opportunity to the parent company and foundation. This will

also assist in mainstreaming the model.

External Opportunities

While the EIN Model is based on starting projects from scratch an acceptable alternative is to bring

together external opportunities. Furthermore, a funded parent company may seek external opportunities

to grow its portfolio or subsidiary companies may seek vertical or horizontal growth. The key point is to

ensure that any external opportunities meet all criteria of the EIN Model.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

17

The EIN Model V the incubator/accelerator models

The EIN Model is vastly different from the incubator and accelerator models, which also operate in the

start-up space. The closest existing model is an Innovations Labxxxv, although it doesn’t include the

business-for-purpose aspect of the EIN Model.

Model

Equity

Mode*

Aim

Stage

Support

Investors

Time

EIN Model

100%

CPS

Goal

Concept

Internal

Internal

>2years

Incubator

<10%

BBS

Develop

Plan

Consultants External

<2 years

Accelerator

>10%

PC

Scale

Model

Mentors

External

<1 year

*CPS = Creative Problem Solving, BBS = Basic Business School, PC = Pressure Cooker

Marketing

Marketing of the EIN Model is important to help the model into the mainstream. The approach will use

processes outlined in Marketing without money – de Bono and Lyonsxxxvi

Education

A longer-term goal will be to drive education in Natural Capital and Sustainability at the various school

levels (primary, secondary and senior secondary) and help the development of these themes in tertiary

education. This is in line the SDG 4 Quality Education

Global Network

A global network of Environmental Impact Nurseries (under development) will assist in cross pollinating

ideas, expertise, IP, business models and investment opportunities and provide exponential growth of the

model. It will also enable effective and consistent governance across all EIN’s globally allowing for

standardised global product development and investment themes.

Valuations

The EIN Model uses the International Private Equity and Venture Capital Valuation Guidelines 2015 (The

IPEV Guidelines) to determine Fair Value for Portfolio Companies.

Social Impact

The EIN model has the benefit of providing significant social impact alongside environmental impact,

especially in developing countries (e.g. local jobs to collect plastic pollution in a vertically integrated

business model involving plastic to energy technology)

The Humanities

Valuing the humanities (see glossary) as much as STEM disciplines is a key component in building

successful teams of innovative problem-solvers. According to Eric Berridgexxxvii this mixture of STEM and

the humanities has the capacity to bring creativity and insight to technical problems.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

18

Investing in the EIN Model

The EIN model requires a founder to bootstrap at least three projects to the firm formation stage. Once

the three projects are at a reasonable development stage, the Environmental Impact Nursery™ parent

entity would be formed and attract debt funding on the basis of the 3 projects strengths. Ideally, a core

project would be developed as the financial engine of the EIN Model.

As the model requires a portfolio of at least 3 projects, the entrepreneur or team must take on significant

risk over a substantial amount of time (3 to 4 years) to build the portfolio to the investment ready stage

(unless a group of external projects are bought together). Building a project to the point where value can

be quickly added and then parking it until the other projects are ready takes patience, and includes some

risk, but ultimately develops a diversified value proposition. A parent entity is then formed and each

project is housed in a wholly owned subsidiary company.

Having a portfolio of companies, each at the start of the value curve, makes the valuation discussion

difficult, so the best option is to debt fund the parent company start-up via a convertible note. Debt

funding the parent entity allows for subsidiary valuations to be quickly built with minimal dilution to the

entrepreneur and minimum risk to the investor. It provides an immediate investment return via the

coupon, security over the assets, diversified exposure to the potential upside and priority in follow-on

investment opportunities relating to the subsidiaries. To further mitigate risk investors could come

together through a syndicate structure.

After initial due diligence, the start-up stage uses a 3-year Secured Senior Convertible Note with a coupon

rate at market rates. The note issue would be large enough in value to allow reasonable time and capital

(say $10m) to develop the value curve across the portfolio. The investor or syndicate would appoint a

single Non-Executive Director to the board of the EIN parent upon execution of the Convertible Note.

The goal is to build sufficient value in the parent entity, within 3 years, to ensure conversion of the notes

to equity. The conversion of debt to equity ratio would be based on the potential of the core projects and

reflect a reasonable and attainable valuation goal.

Upon the conversion of notes to equity investors could receive an agreed annual dividend yield at least

equal to similar alternative investments. A dividend would be based on allowing sufficient capital to

remain in the EIN for operational and growth purposes.

At the end of 10 years, the investors exit the parent company via a management buyout, trade sale or

IPO.

Variations to the above investment model should be done so within the spirit of the EIN construct, which

is to bootstrap, debt fund and convert to equity. The ultimate goal is to provide funding that allows new

project and product development that has the capacity to achieve global sustainability within the EIN

mandate, investment themes, selection criteria and overall construct.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

19

Conclusion

Private capital is best placed to show the way in achieving global sustainability, but a risk adverse financial

system has created a bottleneck for the required investment to move within the timeframe set by science.

This model demonstrates a way to clear that bottleneck.

The introduction of new environmental laws and taxes on greenhouse gas emission, as outlined by some

countries, would have the capacity to deliver a step change in mobilising the $105 trillion required to

achieve global sustainability. This model delivers a simple plan to roll out this funding with the minimal

relative investor, economic, social and ecological risk.

Currently the best attempt to value Natural Capital is through the development of new environmental

accounting methods. Unfortunately, these models must significantly underestimate that value due to

science’s limited knowledge of the vast interconnectedness of Natural Capital and the lack of

understanding of the anthropogenic impacts (>500 years) humans have created since 1760. We simply

don’t know what we don’t know. We do know that we must try and this model cuts through the need to

apply a valuation methodology to Natural Capital.

The Environmental Impact Nursery™ sets out a clear investment methodology that addresses the six core

concerns of impact investors. It addresses the understanding of funding gaps and related opportunities,

impact measurement and evaluation, co-investment opportunities and collaboration, finding good

organisations to support, funding innovative solutions, scaling successful projects and businesses and

mission creep and greenwashing.

Through a simple mandate of mitigating greenhouse gases and protecting biodiversity, following five core

investment themes and applying three simple selection criteria we can address these issues while

delivering the best care and management of Natural Capital with minimal relative risk across the

spectrum.

We have a chance to regain true sustainability for ALL species on Earth. We owe it to our children to try.

#actionnotrhetoric

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

20

Glossary

Biodiversity is the variability among living organisms from all sources, including terrestrial, marine, and

other aquatic ecosystems and the ecological complexes of which they are part. Biodiversity includes

diversity within species, between species, and between ecosystems. Biodiversity may be described

quantitatively, in terms such as richness, rarity, and uniqueness. Biodiversity provides functionality to

ecosystem services.

Ecosystem Goods and Services are the direct and indirect contributions of ecosystems to life on earth.

There are four categories Provisioning (food, raw materials, fresh water and medicinal resources),

Regulating (local climate and air quality, carbon sequestration and storage, moderation of extreme

events, waste-water treatment, erosion prevention and maintenance of soil fertility, pollinations and

biological controls), Supporting (habitats for species and maintenance of genetic diversity)and Cultural

(recreation and mental and physical health, tourism, aesthetic appreciation and inspiration for culture,

art and design and spiritual experience and sense of place).

Greenwashing is the use of marketing to portray an organization's products, activities or policies as

environmentally friendly when they are not. The act of greenwashing, also known as "green sheen,"

entails the misleading of consumers about the environmental benefits of a product or policy through

specious advertising, public relations and unsubstantiated claims. Greenwashing is a play on the term

"whitewashing," which means to gloss over wrongdoing or dishonesty or exonerate without sufficient

investigation or spurious data.

Impact Investing refers to investments made into companies, organizations, and funds with the intention

of generating a measurable, beneficial social and/or environmental impact alongside a financial return.

NASA is an independent agency of the executive branch of the United States federal government

responsible for the civilian space program, as well as aeronautics and aerospace research. It was formed

in 1958

Natural Capital is the limited stocks of physical and biological resources found on earth. It includes land,

air, water, living organisms and all formations of the Earth's biosphere that provide us with Ecosystem

Goods and Services and Biodiversity. Therefore, Natural Capital (and by extension Ecosystems Goods &

Services and Biodiversity) is imperative for the survival and well-being of all living species.

Sustainable Development is development that meets the needs of the present without compromising the

ability of future generations to meet their own needs.

The humanities is described as the study of how people process and document the human experience.

This is done through philosophy, literature, religion, art, music, history, language and other creative

endeavours.

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

21

References

i

Forum for the Future https://www.forumforthefuture.org/project/five-capitals/overview

United Nations http://www.un.org/sustainabledevelopment/sustainable-development-goals/

iii

United Nations World Investment Report 2014 - Investing in the SDGs: An Action Plan

http://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=937

iv

Oxford Online Dictionary https://en.oxforddictionaries.com/definition/risk

v

NASA Global Climate Change https://climate.nasa.gov/causes

vi

Centre for Biological Diversity

http://www.biologicaldiversity.org/programs/biodiversity/elements_of_biodiversity/extinction_crisis/

vii

World Forum on Natural Capital 2017 https://naturalcapitalforum.com/about/

viii

SNA https://unstats.un.org/unsd/nationalaccount/sna.asp

ix

UN Statistical Commission of the System for Environmental and Economic Accounts (SEEA)

https://seea.un.org/

x

SEEA EEA Revision https://seea.un.org/content/seea-experimental-ecosystem-accounting-revision

xi

SEEA EEA Revision Issue Note

https://seea.un.org/sites/seea.un.org/files/seea_eea_2020_revision_issues_note.pdf

xii

SEEA EEA Technical Recommendations in support of the System of Environmental-Economic

Accounting 2012–Experimental Ecosystem Accounting

https://seea.un.org/sites/seea.un.org/files/technical_recommendations_in_support_of_the_seea_eea_

final_white_cover.pdf

xiii

European Environment Agency - Intensified global competition for resources (GMT 7)

https://www.eea.europa.eu/soer-2015/global/competition

xiv

European Environment Agency - Growing pressures on ecosystems (GMT 8)

https://www.eea.europa.eu/soer-2015/global/ecosystems

xv

United Nations World Investment Report 2014 - Investing in the SDGs: An Action Plan

http://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=937

xvi

United Nations World Investment Report 2014 - Investing in the SDGs: An Action Plan

http://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=937

xvii

GIIN - Annual Impact Investor Survey 2017

https://thegiin.org/research/publication/annualsurvey2017

xviii

UN Principles for Responsible Investment https://www.unpri.org/about

xix

UBS/PwC Billionaires Insights 2017 https://www.ubs.com/microsites/billionaires-report/en/newvalue.html

xx

Morgan Stanley “Sustainable Signals” 2017 report

https://www.morganstanley.com/pub/content/dam/msdotcom/ideas/sustainablesignals/pdf/Sustainable_Signals_Whitepaper.pdf

xxi

GIIN - Annual Impact Investor Survey 2017

https://thegiin.org/research/publication/annualsurvey2017

xxii

GIIN - Annual Impact Investor Survey 2017

https://thegiin.org/research/publication/annualsurvey2017

xxiii

GIIN - Annual Impact Investor Survey 2017

https://thegiin.org/research/publication/annualsurvey2017

xxiv

UBS Factsheet https://www.ubs.com/global/.../philanthropy/philanthropy.../global-philanthropistsco...

ii

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

22

xxv

UBS whitepaper Mobilizing private wealth for public good

https://www.ubs.com/global/en/about_ubs/follow_ubs/highlights/mobilizing-private-wealth-for-publicgood.html

xxvi

GIIN - Annual Impact Investor Survey 2017

https://thegiin.org/research/publication/annualsurvey2017

xxvii

NASA History https://history.nasa.gov/

xxviii

IP Group website http://www.ipgroupplc.com/

xxix

Bill Gross – CEO, IdeasLab, TedTalk - The single biggest reason why startups succeed

https://www.youtube.com/watch?v=bNpx7gpSqbY&t=219s

xxx

World Bank Group Climate Change Action Plan http://www.worldbank.org/en/news/pressrelease/2016/04/07/world-bank-group-unveils-new-climate-action-plan

xxxi

World population growth https://ourworldindata.org/world-population-growth

xxxii

Global Footprint Network website https://www.footprintnetwork.org/our-work/ecological-footprint/

xxxiii

The Smithsonian Website article - The Mystery of Easter Island

https://www.smithsonianmag.com/travel/the-mystery-of-easter-island-151285298/

xxxiv

Built to Last: Successful Habits of Visionary Companies is a book written by Jim Collins and Jerry I.

Porras https://en.wikipedia.org/wiki/Built_to_Last:_Successful_Habits_of_Visionary_Companies

xxxv

Stanford’s Social Innovations Review - Innovation Labs: 10 Defining Features

https://ssir.org/articles/entry/innovation_labs_10_defining_features#

xxxvi

Marketing without money: how 20 top Australian entrepreneurs crack markets with their minds /

John C. Lyons and Edward de Bono https://trove.nla.gov.au/work/10365658

xxxvii

Eric Berridge – CEO of Bluewolf, an IBM Company - TEDTalk – Why tech needs the humanities

https://www.ted.com/talks/eric_berridge_why_tech_needs_the_humanities?utm_source=twitter.com

&utm_medium=social&utm_campaign=tedspread

THE ENVIRONMENTAL IMPACT NURSERY™ - 2 NOVEMBER 2018

23