Managerial accounting Ch11-performance measurement in Decentralized organization solutions

advertisement

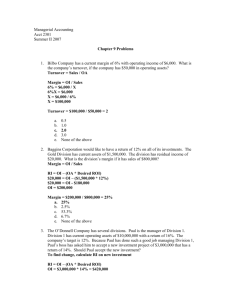

E11-1, p. 495 1 Margin = Net operating income / Sales 5,400,000 / 18,000,000 = 0.3 2 Turnover = Sales / Average operating assets 18,000,000 3 ROI = Margin x 0.3 x 36,000,000 = 0.5 0.5 = 0.15 Turnover E11-2, p. 495 Average operating assets Minimum required rate of returnreturn Residual income: Net operating income Minus Minimum required return Residual income 2,200,000 0.16 2,200,000 x 0.16 = 400,000 352,000 48,000 E11-3, p. 495 1 + + + 2 / = Throughput time: Process time Inspection time move time Queu time Manufacturing cycle efficiency (MCE): Value-added time Throughput time 2.8 0.5 0.7 4 8 2.8 8 0.35 3 Throughput time spent in value-added activities Throughput time spent in non-value-added activities 0.35 0.65 4 + Delivery cycle time: Wait time Throughput time 16 8 24 5 New MCE Throughput time without que time / The new MCE Value-added time Throughput time MCE 4 2.8 4 0.7 Exercise 11-7, p497: Contrasting Return on Investment (ROI) and Residual Income (RI) Given: Rains Nickless Ltd. Of Australia has two divisions that operate in Perth and Darwin. Selected data on the two divisions follow: Division Perth Darwin Sales $9,000,000 $20,000,000 Net operating income $630,000 $1,800,000 Average operating assets $3,000,000 $10,000,000 Required: 1. Compute the ROI for each division. a. ROI = Net operating income / Average operating assets b. ROI = margin X turnover ROI = (Net operating income / Sales) X (Sales / Average operating assets) b. a. Margin Turnover ROI ROI Perth 7% 3 21% 21% Division Darwin 9% 2 18% 18% 2. Assume that the company evaluates performance using residual income and that the minimal required rate of return for each division is 16%. Compute the residual income for each division. RI = Net operating income - Charge for use of capital RI = Net operating income - (Average operating assets X Minimum required rate of return) Minimum required rate of return Net operating income Charge for use of capital Division Perth Darwin 16% 16% $630,000 $1,800,000 ($480,000) ($1,600,000) Residual income $150,000 $200,000 Exercise 11-7, p497: 3. Is the Darwin Division's greater residual income an indication that it is better managed? Explain. No, the Darwin Division is simply larger than the Perth Division and for this reason alone one would expect that it would have a greater amount of residual income. In fact, based on the data above, the Darwin Division does not appear to be as well managed as the Perth Division. The Darwin Division has an 18% return on investment as compared to 21% for the Perth Division. Residual income can not be used to compare the performance of divisions of different sizes. Larger divisions will almost always look better. Exercise 11-9, p 498 Evaluating New Investment Using ROI and Residual Income (RI) Given: Selected sales and operating data for three divisions of three different companies are given below: Sales Average operating assets Net operating income Minimum required rate of return Division A $6,000,000 $1,500,000 $300,000 15% Division B $10,000,000 $5,000,000 $900,000 18% Division C $8,000,000 $2,000,000 $180,000 12% Company $24,000,000 $8,500,000 $1,380,000 Required: 1. Compute the ROI for each division, using the formula stated in terms of margin and turnover. a. ROI = Net operating income / Average operating assets b. ROI = margin X turnover ROI = (Net operating income / Sales) X (Sales / Average operating assets) Margin Turnover b. ROI a. ROI Division A 5.00% 4.0 20.00% 20.00% Division B 9.00% 2.0 18.00% 18.00% Division C 2.25% 4.0 9.00% 9.00% Company 5.75% 2.824 16.24% 16.24% 2. Compute the residual income for each division. RI = Net operating income - Charge for use of capital RI = Net operating income - (Average operating assets X Minimum required rate of return) Net operating income Charge for use of capital Residual income Division A $300,000 ($225,000) $75,000 Division B Division C $900,000 $180,000 ($900,000) ($240,000) $0 ($60,000) Exercise 11-9, p 498 3. Assume that each division is presented with an investment opportunity that would yield a rate of return of 17%. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? Reject? Why? Division A Division B Division C Current ROI 20% 18% 9% Investment opportunity return 17% 17% 17% Decrease Decrease Increase Effect on ROI if opportunity is accepted Accept or reject decision Reject Reject Accept b. If performance is being measured by RI, which division or divisions will probably accept the opportunity? Reject? Why? Current RI Investment opportunity return Minimum required rate of return Effect on RI if opportunity is accepted Accept or reject decision Division A $75,000 17% 15% Increase Accept Division B $0 17% 18% Decrease Reject Division C ($60,000) 17% 12% Increase Accept Exercise 11-12, p 499 Effects of Changes in Profits and Assets on Return on Investment Given: The Abs Shoppe is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on ROI. The Abs Shoppe reported the following results for the past year: Abs Shoppe Sales $800,000 Net operating income $16,000 Average operating assets $100,000 Required: The following questions are to be considered independently. Carry out all computations to two decimal places. 1. Compute the club's ROI a. ROI = Net operating income / Average operating assets b. ROI = margin X turnover ROI = (Net operating income / Sales) X (Sales / Average operating assets) b. a. Abs Shoppe 2.00% 8.00 16.00% 16.00% Margin Turnover ROI ROI 2. Assume that the manager of the club is able to increase sales by $80,000 and that as a result net operating income increases by $6,000. Further assume that this is possible without any increase in operating assets. What would be the club's ROI? Original $800,000 $16,000 $100,000 Sales Net operating income Average operating assets Margin Turnover ROI ROI Abs Shoppe 2.00% 8.00 16.00% 16.00% Changes $80,000 $6,000 $0 New $880,000 $22,000 $100,000 Abs Shoppe 2.50% 8.80 22.00% 22.00% Exercise 11-12, p 499 3. Assume that the manager of the club is able to reduce expenses by $3,200 without any change in sales or operating assets. What would be the club's ROI? Original $800,000 $16,000 $100,000 Sales Net operating income Average operating assets Margin Turnover ROI ROI Changes $0 $3,200 $0 Abs Shoppe 2.00% 8.00 16.00% 16.00% New $800,000 $19,200 $100,000 Abs Shoppe 2.40% 8.00 19.20% 19.20% 4. Assume that the manager of the club is able to reduce operating assets $20,000 without any change in sales or net operating income. What would be the club's ROI? Original $800,000 $16,000 $100,000 Sales Net operating income Average operating assets Margin Turnover ROI ROI Abs Shoppe 2.00% 8.00 16.00% 16.00% Changes $0 $0 ($20,000) New $800,000 $16,000 $80,000 Abs Shoppe 2.00% 10.00 20.00% 20.00% Problem 11-19, p 503: Perverse effects of some performance measures Given: There is often more than one way to improve a performance measure. Unfortunately, some of the actions taken by managers to make their performance look better, may actually harm the organization. For example, suppose the marketing department is held responsible only for increasing the performance measure "total revenues." Increases in total revenues may be achieved by working harder and smarter, but they can also usually be achieved by simply cutting prices. The increase in volume from cutting prices almost always results in greater total revenues; however, it does not always lead to greater total profits. Those who design performance measurement systems need to keep in mind, the managers who are under pressure to perform may take actions to improve performance measures that have negative consequences elsewhere. Required: For each of the following situations, describe actions that managers might take to show improvement in the performance measure but which do not actually lead to improvement in the organization's overall performance. The answers below are not the only possible answers. Ingenious people can figure out many different ways of making performance look better even though it really isn't. This is one of the reasons for a balanced scorecard. By having a number of different measures that ultimately are linked to overall financial goals, "gaming" the system is more difficult. 1. Concerned with the slow rate at which new products are brought to market, top management of a consumer electronics company introduces a new performance measure -- speed-to-market. The research and development department is given responsibility for this performance measure, which measures the average amount of time a product is in development before it is released to the market for sale. Speed-to-market can be improved by taking on less ambitious projects. Instead of working on major product innovations that require a great deal of time and effort, R&D may choose to work on small, incremental improvements in existing products. There is also a danger that in the rush to push products out the door, the products will be inadequately tested and developed. Problem 11-19, p 503: 2. The CEO of a telephone company has been under public pressure from city officials to fix the large number of public pay phones that do not work. The company's repair people complained that the the problem is vandalism and damage caused by theft of coins from calling boxes -- particularly in high-crime areas in the city. The CEO says she wants the problem solved and has pledged to city officials that there will be substantial improvement by the end of the year. To ensure that this is done, she makes the managers in charge of installing and maintaining pay phones responsible for increasing the percentage of public pay phones that are fully functional. Performance measures that are ratios or percentages present special dangers. A ratio can be increased either by increasing the numerator or decreasing the denominator. Usually, the intention is to increase the numerator in the ratio, but a manager may react by decreasing the denominator instead. In this case (which actually happened), the managers pulled telephones out of the high-crime areas. This eliminated the problem for the managers, but was not what the CEO or the city officials had intended. They wanted the phones fixed, not eliminated. 3. A manufacturing company has been plagued by the chronic failure to ship orders to customers by the promised do date. To solve this problem, the production manager has been given the responsibility of increasing the percentage of orders shipped on time. When a customer calls in an order, the production manager and the customer agreed to a delivery date. If the order is not completed by that day, it is counted as a late shipment. In real life, the production manager simply added several weeks to the delivery cycle time. In other words, instead of promising to deliver an order in four weeks, the manager promise to deliver in six weeks. This increase in delivery cycle time did not, of course, please customers and drove some business away, but it dramatically improved the percentage of orders delivered on time. Problem 11-19, p 503: 4. Concerned with the productivity of employees, the Board of Directors of a large multinational corporation has dictated that the manager of each subsidiary will be held responsible for increasing the revenue per employee of his or her subsidiary. As stated above, ratios can be improved by changing either the numerator or the denominator. Managers who are under pressure to increase the revenue per employee may find it easier to eliminate employees than to increase revenues. Of course, eliminating employees may reduce total revenues and total profits, but the revenue per employee will increase as long as the percentage decline in revenues is less than the percentage cut in number of employees. Suppose, for example, that a manager is responsible for business units with a total of 1,000 employees, $120 million in revenues, and profits of $2 million. Further suppose that a manager can eliminate one of these business units that has 200 employees, revenues of $10 million, and profits of $1.2 million. Before After Eliminating Eliminating the Business the Business Unit Total revenue Total employees Revenue per employee Total profits $120,000,000 1,000 $120,000 $2,000,000 Unit $110,000,000 800 $137,500 $800,000 As these examples illustrate, performance measures should be selected with a great deal of care. Managers should avoid placing too much emphasis on any one performance measure. Problem 11-22, p 505 Internal Business Process Performance Measures Given: Exeter Corporation has recently begun a continuous improvement campaign. As a consequence, there have been many changes in operating procedures. Progress has been slow, particularly in trying to develop new performance measures for the factory. Management has been gathering the following data over the past four months: Months Quality control measures: Customer complaints as a % of units sold Warranty claims as a % of units sold Defects as a % of units produced Material control measures: Scrap as a % of total cost Machine performance measures: Percentage of machine availability Use as a percentage of availability Average setup time (hours) Delivery performance measures: Throughput time Manufacturing cycle efficiency Delivery cycle time Percentage of on-time deliveries 1 2 3 4 1.40% 2.30% 4.60% 1.30% 2.10% 4.20% 1.10% 2.00% 3.70% 1.00% 1.80% 3.40% 3.20% 2.90% 3.00% 2.70% 80% 75% 2.7 82% 73% 2.5 81% 71% 2.5 79% 70% 2.6 ? ? ? 84% ? ? ? 87% ? ? ? 91% ? ? ? 95% The president has attended conferences at which the importance of throughput time, manufacturing cycle efficiency, and delivery cycle time were stressed, but no one at the company is sure how they are computed. The data to compute these measures have been gathered and appear below: Months 1 2 3 4 Wait time/order before production (in days) 16.7 15.2 12.3 Inspection time per unit (in days) 0.1 0.3 0.6 Process time per unit (in days) 0.6 0.6 0.6 Queue time per unit (in days) 5.6 5.7 5.6 Move time per unit (in days) 1.4 1.3 1.3 9.6 0.8 0.6 5.7 1.4 Problem 11-22, p 505 Required: 1. For each month, compute the following operating performance measures: a. Throughput time (manufacturing cycle time) Months 1 Process time Inspection time Move time Queue time Throughput time 2 0.6 0.1 1.4 5.6 7.7 3 0.6 0.3 1.3 5.7 7.9 4 0.6 0.6 1.3 5.6 8.1 0.6 0.8 1.4 5.7 8.5 b. Manufacturing cycle efficiency (MCE) = (Value-added time)/((Value-added time + Non-value added time) MCE = (Process time) / (Throughput time) Months 1 Process time Throughput time 2 0.6 7.7 7.79% MCE = 3 0.6 7.9 7.59% 4 0.6 8.1 7.41% 0.6 8.5 7.06% c. Delivery cycle time = Wait time + Throughput time Months 1 Wait time Throughput time Delivery cycle time = 2 16.7 7.7 24.40 3 15.2 7.9 23.10 4 12.3 8.1 20.40 9.6 8.5 18.10 Problem 11-22, p 505 2. Using the performance measures given in the problem and those you computed in (1) above, do the following: a. Identify areas where the company seems to be improving. The company seems to be improving mainly in the areas of quality control, material control, on-time delivery, and total delivery cycle time. Customer complaints, warranty claims, defects, and scrap are all down somewhat, which suggests that the company has been paying attention to quality in its improvement campaign. The fact that on-time delivery and delivery cycle time have both improved also suggests that the company is seeking to please the customer with improved service. b. Identify areas where the company seems to be deteriorating or stagnating. Inspection time has increased dramatically. "Use as % of availability" has deteriorated, and throughput time as well as manufacturing cycle efficiency (MCE) show negative trends. c. Explain why you think some specific areas are improving while others are not. While it is difficult to draw any definitive conclusions, it appears that the company has concentrated first on those areas of performance that are of most immediate concern to the customer -- quality and delivery performance. The lower scrap and defect statistics suggest that the company has been able to improve its processes to reduce the rate of defects; although, some of the improvement in quality apparently was due simply to increased inspections of the products before they were shipped to customers. Problem 11-22, p 505 3. Refer to the move time, process time, and so forth, given above for month 4. a. Assume that in month 5 the move time, process time, and so forth, are the same as for month 4, except that through the implementation of lean production, the company is able to completely eliminate the queue time during production. Compute the new throughput time and manufacturing cycle efficiency (MCE). b. Assume that in month 6 the move time, process time, and so forth, are the same as for month 4, except that the company is able to completely eliminate both the queue time during production and the inspection time. Compute the new throughput time and MCE. Months Throughout time in days: Process time Inspection time Move time Queue time Total throughput time 5 Manufacturing cycle efficiency (MCE) Process time Throughput time MCE = 6 0.6 0.8 1.4 0.0 2.8 0.6 0.0 1.4 0.0 2.0 0.6 2.8 21.43% 0.6 2.0 30.00% As non-value-added activities are eliminated, the manufacturing cycle efficiency improves. The goal, of course, is to have an efficiency of 100%. This is achieved when all non-value added activities have been eliminated and process time equals throughput time. Exercise 11A-3, p 516 1 a The lowest acceptable transfer price is greater than or equal to (>=) Variable cost per unit + ( Total contribution margin on lost sales divided by Number of units transferred ) There is enoughidle capacity to fill the entire order, there are no lost outside sales. b c d 2 a Transfer price > = 21 The Motor Division would not buy more than $38 per transformer. It is the price paid to outside supplier. Transfer price = $38 The acceptable range is 21-38 Managers should agree on a price within the range. The transfer should take place. Instead of paying $38 to the outside, the transfer cost $21. The lowest acceptable transfer price is greater than or equal to (>=) = b c d Variable cost per unit + 21 + 40 ( ( Total contribution margin on lost sales ((40-21) x 10,000)/10,000 divided by The Motor Division would not be interested in paying morre than $38. The requirements of both divisions are incompatible. Transfer should not take place. By not having an internal transfer, the company makes $2 per unit. Number of units transferred ) Exercise 11B-3 Service Department Charges Given: Gutherie Oil Company has a Transport Services Department that provides trucks to transport crude oil from docks to the company's Arbon Refinery and Beck Refinery. Budgeted costs for the transport services consist of $0.30 per gallon variable cost and $200,000 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, Arbon Refinery requires 60% of the capacity and the Beck Refinery requires 40%. During the year, the Transport Services Department actually hauled the following amounts of crude oil for the two refineries: Arbon Refinery, 260,000 gallons; and Beck Refinery, 140,000 gallons. The Transport Services Department incurred $365,000 in cost during the year, of which $148,000 was variable cost and $217,000 was fixed cost. Most common method of allocation: Actual Variable Cost Incurred Variable cost per gallon hauled Actual Fixed Costs Incurred Total Costs Incurred $148,000 $0.3700 $217,000 $365,000 Gallon hauled by Transport Services: Hauled to Arbon Refinery Hauled to Beck Refinery Total gallons hauled 260,000 140,000 400,000 Average cost per gallon hauled: $0.9125 Allocation: actual gallons X actual rate Arbon $237,250 Beck $127,750 Total $365,000 Problems: 1. Efficiencies and inefficiencies of service departments are passed on to production departments. 2. The operations of one production department affect the other departments. Exercise 11B-3 Required: 1. Determine how much of the $148,000 in variable cost should be charged to each refinery. 2. Determine how much of the $217,000 in fixed cost should be charged to each refinery. Arbon Peak period capacity needs Budgeted fixed costs Budgeted variable ($.30/gallon) Beck Total 100% 60% 40% Arbon $78,000 Beck $42,000 Total $120,000 120,000 $198,000 80,000 $122,000 200,000 $320,000 $200,000 $0.30 Allocation of Variable Costs: Allocation: actual gallons X budgeted rate Allocation of Fixed Costs: Allocation: Peak period % X budgeted FC Total Costs Allocated 3. Will any of the $365,000 in the Transport Services Department cost not be charged to the refineries? Variable Costs Fixed Costs Total $148,000 $217,000 $365,000 Total Transport Services Department Costs Incurred $120,000 200,000 $320,000 Total Transport Services Department Costs Assigned $28,000 $17,000 $45,000 Total Transport Services Department Costs Unassigned The overall spending variance of $45,000 represents costs incurred in excess of the budgeted $.30 per gallon variable cost and budgeted $200,000 in fixed costs. This $45,000 in unallocated cost is the responsibility of the Transport Services Department. Exercise 11B-2 Sales Dollars as an Allocation Base for Fixed Costs Given: Lacey's Department Store allocates its fixed administrative expenses to its four operating departments on the basis of sales dollars. During 2009, the fixed administrative expenses totaled $900,000. These expenses were allocated as follows: Total sales -- 2009 Percentage of total sales Allocation (based on the above percentages) Men's $600,000 10% Women's $1,500,000 25% $90,000 $225,000 Shoes Housewares $2,100,000 $1,800,000 35% 30% $315,000 Total $6,000,000 100% $270,000 $900,000 During 2010, the following year, the Women's Department doubled its sales. The sales levels in the other three departments remained unchanged. The company's 2010 sales data were as follows: Total sales -- 2010 Percentage of total sales Men's $600,000 8% Women's $3,000,000 40% Shoes Housewares $2,100,000 $1,800,000 28% 24% Fixed administrative expenses remained unchanged at $900,000 during 2010. Total $7,500,000 100% $900,000 Required: 1. Using sales dollars as an allocation base, show the allocation of the fixed administrative expenses among the four departments for 2010. Allocation for 2010 Men's $72,000 Women's $360,000 Shoes $252,000 Housewares $216,000 Total $900,000 2. Compare your allocation from (1) above to the allocation for 2009. As the manager of the Women's Department, how would you feel about the administrative expenses that have been charged to you you for 2010? Allocation for 2010 Allocation for 2009 Increase/Decrease Men's $72,000 $90,000 ($18,000) Women's $360,000 $225,000 $135,000 Shoes Housewares $252,000 $216,000 $315,000 $270,000 ($63,000) ($54,000) Total $900,000 $900,000 $0 The manager of the Women's Department undoubtedly will be upset about the increased allocation to the department but will feel powerless to do anything about it. Such an increased allocation may be viewed as a penalty for an outstanding performance. Note: The allocations to all of the other departments decreased. 3. Comment on the usefulness of sales dollars as an allocation base. Sales dollars is not ordinarily a good base for allocating fixed costs. The costs allocated to a department will be affected by the sales in other departments. In other words, how much fixed costs will be allocated to one department depends on the operations of another department. Note that if the department managers have bonus plans based on NOI, these managers will receive bonus increases because of the increased sales in the Women's Department. Problem 11A-5, p 517 Basic Transfer Pricing Given: In cases 1-4 below, assume that Division A has a product that can be sold either to Division B of the same company or to outside customers. The managers of both divisions are evaluated based on their own division's ROI. The managers are free to decide if they will participate in any internal transfers. All transfer prices are negotiated. Treat each case independently. Cases 1 2 3 4 Division A: Capacity in Units 50,000 300,000 100,000 200,000 Number of units now being sold to outside customers 50,000 300,000 75,000 200,000 Excess Capacity or Full Capacity Full Full Excess Full Selling price per unit to outside customers $100 $40 $60 $45 Variable cost per unit 63 19 35 30 Contribution per unit $37 $21 $25 $15 Fixed costs per unit (based on capacity) $25 $8 $17 $6 Division B: Number of units needed annually 10,000 70,000 20,000 60,000 Purchase price now being paid to an outside supplier $92 $39 $60 Discounted purchase price being paid to an outside supplier $57 Before any purchase discount. Problem 11A-5, p 517 Basic Transfer Pricing Required: 1. Refer to case 1 above. A study has indicated that Division A can avoid $5 per unit in variable costs on any sales to Division B. Will the managers agree to a transfer and if so, within what range will the transfer price be? Explain. Transfer Price to maximize company profits: TP = Out of pocket costs / unit + (Total contribution margin given up on lost sales) / units transferred TP = ($63 - $5) + ($37 X 10,000)/10,000 = $58 + $37 = $95 Division A: Contribution margin per unit generated under the current situation Contribution margin per unit generated if a transfer takes place at $95/unit Division A manager is indifferent to selling outside or transferring to Division B Division B: Cost per unit if purchased outside Cost per unit if transferred at $95/unit Division B manager would reject internal transfer because of $3 per unit increase in cost The managers will not agree to a transfer. Division A will not accept less than $95 and Division B will not pay more than $92, the outside price. There is no possible range of negotiation within which a transfer could take place. $37 37 $0 $92 95 ($3) $100 - 63 $95 - ($63 - $5) Problem 11A-5, p 517 Basic Transfer Pricing 2. Refer to case 2 above. Assume that Division A can avoid $4 per unit in variable costs on any sales to Division B. a. Would you expect any disagreement between the two divisional managers over what the transfer price should be? Explain. Transfer Price to maximize company profits: TP = Out of pocket costs / unit + (Total contribution margin given up on lost sales) / units transferred TP = ($19 - $4) + ($21 X 70,000)/70,000 = $15 + $21 = $36 Division A: Contribution margin per unit generated under the current situation Contribution margin per unit generated if a transfer takes place at $36/unit $21 21 $0 Division A manager is indifferent to selling outside or transferring to Division B Division B: Cost per unit if purchased outside Cost per unit if transferred at $36/unit $39 36 $3 Division B manager would accept an internal transfer because of a $3 decrease in cost The managers should agree to a transfer. Division A will be willing to accept a price of $36 or higher Division B will be willing to pay no more $39, the outside price. The range of negotiation within which a transfer should take place is $39 to $36. Even though the company would be better off with any transfer price within this range, each manager will negotiate for the transfer price that benefits their division the most. Division A's manager will try to hold out for a transfer price of $39, while Division B's manager will try to hold out for a transfer price of $36 per unit transferred. b. Assume that Division A offers to sell 70,000 units to Division B for $38 per unit and that Division B refuses this price. What will be the loss in potential profits for the company as a whole? 70,000 X $3 = $210,000 Loss in potential profits Proof: Division A: TP per unit to Division B Variable cost per unit associated with transfer Benefit per unit to Division A Less CM given up to make transfer possible Net per unit benefit to Division A Number of units transferred Total increase in CM to Division A as a result of transfer $38 15 $23 21 $2 70,000 $140,000 Division B: Cost per unit if purchased outside Cost per unit if transferred at agreed upon TP Benefit per unit to Division B Number of units transferred Total increase in CM to Division A as a result of transfer $39 38 $1 70,000 $70,000 Total benefit to the company resulting from the transfer $210,000 Note: Transfer price allocates profit between Division A and Division B. $40 - $19 $36 - ($19 - $4) Problem 11A-5, p 517 Basic Transfer Pricing 3. Refer to case 3 above. Assume that Division B is now receiving a 5% price discount from the outside supplier. a. Will the managers agree to a transfer? If so, within what range will the transfer price be? Transfer Price to maximize company profits: TP = Out of pocket costs / unit + (Total contribution margin given up on lost sales) / units transferred TP = $35 + ($0 X 20,000)/20,000 = $35 + $0 = $35 Division A: Contribution margin per unit generated under the current situation (excess capacity) Contribution margin generated if a transfer takes place at $35/unit $0 0 $0 Division A manager is indifferent to selling outside or transferring to Division B Division B: Cost per unit if purchased outside Cost per unit if transferred at $35/unit $57 35 $22 $440,000 Division B manager would accept an internal transfer because of a $22 per unit decrease in cost The managers should agree to a transfer. Division A will be willing to accept a price of $35 or higher Division B will be willing to pay no more $57, the outside price. The range of negotiation within which a transfer should take place is $35 to $57. Even though the company would be better off with any transfer price within this range, each manager will negotiate for the transfer price that benefits their division the most. Division A's manager will try to hold out for a transfer price of $57, while Division B's manager will try to hold out for a transfer price of $35 per unit transferred. b. Assume that Division B offers to purchase 20,000 units from Division A at $52 per unit. If Division A accepts this price, would you expect its ROI to increase, decrease, or remain unchanged? Why? Benefit to company as a whole resulting from transfers 20,000 X $22 = Division A: TP per unit to Division B Variable cost per unit associated with transfer Benefit per unit to Division A Less CM given up to make transfer possible (excess capacity) Net per unit benefit to Division A Number of units transferred Total increase in CM to Division A as a result of transfer $440,000 $52 35 $17 0 $17 20,000 $340,000 Effect on ROI: Divisional income will increase by $340,000 with no change in investment (excess capacity). Thus, Division A's ROI will increase. Division B: Cost per unit if purchased outside Cost per unit if transferred at agreed upon TP Benefit per unit to Division B Number of units transferred Total increase in CM to Division A as a result of transfer $57 52 $5 20,000 $100,000 Total benefit to the company resulting from the transfer $440,000 Excess Capacity $35 - $35 Note: Transfer price allocates profit between Division A and Division B. Problem 11A-5, p 517 Basic Transfer Pricing 4. Refer to case 4 above. Assume that Division B wants Division A to provide it with 60,000 units of a different product from the one that Division A is now producing. The new product would require $25 per unit in variable costs and would require that Division A cut back production of its present product by 30,000 units annually. What is the lowest acceptable transfer price from Division A's perspective? Transfer Price to maximize company profits: TP = Out of pocket costs / unit + (Total contribution margin given up on lost sales) / units transferred TP = $25 + ($15 X 30,000) / 60,000 = $25 + ($450,000 / 60,000) = $25 + $7.50 = $32.50 Proof: Division A: Contribution margin generated under the current situation Contribution margin generated if a transfer takes place at $32.50 per unit Division A manager is indifferent to selling outside or transferring to Division B at a TP of $32.50. $450,000 $450,000