Unit 10-11 Compensation ,Incentives,benefits

advertisement

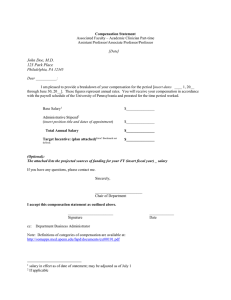

Unit 7 Compensation and benefits Compensation, job evaluation, concept, process and significance, components of employee remuneration, base and supplementary, Pay for performance and Financial Incentives, Maintenance, Overview of employee welfare, health and safety, social security. Compensation is typically defined as “The money received by an employee from an employer as a salary or wages”. Reward, on the other hand, is defined as “A thing given in recognition of service, effort, or achievement” we are witnessing a shift to use of the term “Reward Management” increasingly. COMPONENTS OF TOTAL REWARD STRATEGY Best rewards management practices Compensation & Benefits are also known as Total Rewards Compensation System Components Benefits Pay Source of figure: Fisher, Schoenfeldt, & Shaw (2006), Figure 11.1, p. 485 Extrinsic vs. Intrinsic Compensation Extrinsic Compensation. Core Compensation 1) 2) Salaries (Monthly). Wages (Hourly, Daily, or Weekly). Cost-of-Leaving Adjustment (COLAs). 1) 2) 3) 4) 5) Consumer Price Index (CPI). Seniority Pay. Merit Pay. Incentive Pay. Person-focused Pay (Pay-for-Knowledge and Skill-Based Pay) Employee Benefits: Legally Required Benefits 1) 2) Discretionary Benefits (not legally obligatory): 1) 2) 3) 4) 9 Social Insurance Sick leave. Health Insurance Life Insurance. Retirement Plans. Paid time-off. Job Satisfaction & Pay Satisfaction Pay and job satisfaction are entirely different but they interact and influence each other. A positive view of one can improve the other. Reward Systems should be designed, developed, and implemented in a way leading to improved employee pay, job, and organizational satisfaction. Compensation: A money value is presented in return of an employee efforts doing certain tasks or jobs for definite or indefinite time frame . It varies in terms of formation and type presenting based on the nature of job. It is an obligatory right forced by law. Benefits: A certain type of financial or non financial rewards are presented for the purpose of rewarding & recognition, to the employee in returns of his efforts doing a job. Some benefits are obligatory and some are not forced by Law. Salary: A money value is presented in return of an employee efforts doing certain tasks or jobs, on monthly or annually basis. Manly are given to white collars. Wage: A money value is presented in return of an employee efforts doing certain tasks or jobs, on hourly or daily basis. Manly are given to Blue collars. Objectives of Compensation Administrative efficiency Legal compliance Acquire personnel Retain employees Effective Compensation Control costs Reward behaviour Ensure equity 16-2 INTRODUCTION Compensation is what employees receive in exchange for their contribution to the organization. Generally speaking, employees offer their services for three types of rewards Base pay Variable pay Benefits The most important objective of any pay system is fairness or equity, generally expressed in three forms. Equity Equal pay for work of equal value. Internal equity: Requires that pay be related to the relative worth of a job so that similar jobs get similar pay. External equity: Paying worker what other firms in the labor market pay .The external equity is established through wage and salary surveys.ex-Hewitt Associates, Kelly . Individual equity: where equal pay is ensured for equal value of work. Pay Equity An employee’s perception that compensation received is equal to the value of the work performed. Equity and Its Impact on Pay Rates Forms of Compensation Equity External equity Internal equity Individual equity Procedural equity 16-3 Objectives of compensation planning Attract talent Retain talent Ensure equity Reward appropriately(loyalty, commitment, experience, risk raking and other behaviours) Control costs Comply with legal rules Ease of operation Compensation Administration desired 16-5 Components of Pay Structure The two essential components of pay structure are; basic wages and dearness allowance .the basic wage rate is fixed taking the skill needs of the job, experience needed, difficulty of work, training required, responsibilities involved and the hazardous nature of the job. Dearness allowance is paid to employees in order to compensate them for the occasional or regular rise in the price of essential commodities. Important Compensation Related Acts in India Under the Workmen's Compensation Act,1923. Wages for leave period, holiday pay, overtime pay, bonus, attendance bonus and good conduct bonus. Workers' compensation replaces income that is lost because of a job-related injury or illness. Disability insurance covers income lost due to injuries and illnesses that are not job related. Under the Payment ofWages Act, 1936 Retrenchment compensation, payment in lieu of notice , gratuity payable on discharge Compensation Administration Base Pay Structure (Fixed component) 18 Salaries and wages are the periodic assured payments made to the employees. Salaries are generally paid to the permanent employees on the monthly basis, whereas wages are paid to temporary or contractual workers on the daily basis. Base Pay is the fixed component and generally consists of the following: Basic Component HRA (House Rent Allowance) DA (Dearness Allowance) Leave Travel Allowance Mobile Expenses Medical Allowance/Reimbursements, etc. Variable Pay Programs Variable Pay Plans for Sales Variable pay plans for sales represents a pay-mix that may be a 70-30 or 60-40 or 50-50 plan. Here the 30, 40 or 50 represents the variable portion of the pay and is linked to the targets. Variable Pay Plans for Non-Sales The variable pay is based on jobs and levels of job. may be broken under employee performance based on quality of work,absense of complaints etc 19 Bonus The bonus can be paid in different ways. It can be fixed percentage on the basic wage paid annually or in proportion to the profitability. The Government also prescribes a minimum statutory bonus for all employees and workers. Commissions Commission to Managers and employees may be based on the sales revenue or profits of the company. It is always a fixed percentage on the target achieved. For taxation purposes, commission is again a taxable component of compensation. 20 Mixed Plans Incentives Incentive is clearly defined, target-related and upfront. Piece rate wages are prevalent in the manufacturing wages. Sign on Bonuses The latest trend in the compensation planning is the lump sum bonus for the incoming employee. A person, who accepts the offer, is paid a lump sum as a bonus. Profit Sharing Payments Profit sharing is again a novel concept nowadays. This can be paid through payment of cash or through ESOPS. 21 Benefits Types of Benefits i. Paid time off (also referred to as PTO) It is earned by employees while they work. They may be a) holidays (governed by the law), b) Leaves (governed by the shop and establishment act) like Casual Leaves, Sick Leaves, Earn or privilege leaves, etc. ii. Insurance Programs The insurance programs may include health insurance, life insurance, personal accident insurance, disability insurance, family-health insurance, etc. 22 iii. Fringe Benefits Fringe benefits include a variety of non-cash payments that are used to attract and retain talented employees and may include educational assistance, flexible medical benefits, child-care benefits, and nonproduction bonuses (bonuses not tied to performance). iv. Social Security Social security benefits are aimed at protecting employees against all types of social risks that may cause undue hardships to them in fulfilling their basic needs. ex: Old-age Insurance Benefits, Housing Benefits. 23 Rewards & Recognition Recognition is non-monetary reinforcement for good performance. It has a psychological benefit to the employee. Rewards are monetary reinforcement for individual or company target accomplishment for the current quarter or year. Awards are tokens of appreciation, which are given to individuals for their personal achievements. It can be called as symbol of recognition to an individual for their personal achievements. Tailor-made Rewards • • • • • • Junior employees need more than compensation to stay on as they have lower liabilities and huge opportunities. IPhones, gadgets, fashion accessories or online vouchers are a big hit. For a senior executive at Hay Group in India, a client transferred the title of a company-owned house to him. At Coca Cola India, A tam that conceptualized a program was sent to Russia and Turkey. PepsiCo has a deferred bonus payout scheme to pep up employees. At HCL technologies, the company presented Mercedez cars to its top performers at the CEO level. At Jabong, employees can give “you make a difference” cards to their peers, subordinates or leaders. Source: http://articles.economictimes.indiatimes.com/2014-10-04/news/54626628_1_pepsico-india-rewards-job-market (Economic Times-4th October, 2014. “Firms like PepsiCo, Coca Cola, others institute rewards and recognition programmes to retain talent”) Corporate Policies, Competitive Strategy, and Compensation Aligned Reward Strategy The employer’s basic task: To create a bundle of rewards—a total reward package—that specifically elicits the employee behaviors that the firm needs to support and achieve its competitive strategy. The HR or compensation manager along with top management creates pay policies that are consistent with the firm’s strategic aims. Compensation Policy Issues • Pay for performance • Pay for seniority • The pay cycle • Salary increases and promotions • Overtime and shift pay • Probationary pay • Paid and unpaid leaves • Paid holidays • Salary compression • Geographic costs of living differences Compensation Policy Issues • Whether to emphasize seniority or performance is a compensation policy issue. • seniority-based pay may be of advantage to the extent that employees seek seniority as an objective standard yet a disadvantage is that top performers may get the same raises as poor ones. • Salary Compression is a salary inequity problem generally caused by inflation resulting in longer-term employees in a position earning less than workers entering the firm today. • Prices go up faster than company's salaries and firms need a policy to handle it, One policy is to install a more aggressive merit pay program, Others authorize supervisors to recommend equity adjustments for selected employees who are both highly valued and victims of pay compression.. • Geography : cost of living differences between cities can be considerable; employers handle cost of living differences to give the transferred person a nonrecurring payment, others pay a differential ongoing cost in addition to one time allocation, while others simply raise the employee's base salary. • Compensating Expatriates employees: multinational companies compensate expatriate employees those who are sent overseas using two basic international compensation policies; home-based and host-based plans. Compensation Related Acts in India Minimum Wages Act, 1948 Payment of Wages Act, 1936 Equal Remuneration Act, 1976 Companies Act, 1956 Payment of Bonus Act Payment of Gratuity Act Employee Stock Scheme (ESOS) Employee Stock Purchase (ESPS) Pricing the Jobs Pricing the jobs simply means determining the compensation for a particular job. Job evaluation is the process by which the relative worth of various jobs in an organization is determined. Job Evaluation Job evaluation is a process of determining the relative worth of various jobs in an organization. Establishing Pay Rates Steps in Establishing Pay Rates 1 Conduct a salary survey of what other employers are paying for comparable jobs (to help ensure external equity). 2 Determine the worth of each job in your organization through job evaluation (to ensure internal equity). 3 Group similar jobs into pay grades. 4 Price each pay grade 5 Fine-tune pay rates. Step 1.The Salary Survey Step 1. The Wage Survey: Uses for Salary Surveys To price benchmark jobs To market-price wages for jobs To make decisions about benefits Step 2: Job Evaluation Identifying Compensable Factors Skills Effort Responsibility Working conditions Compensable Factors Factors in a particular jobs which should be compensated for they directly or indirectly contribute in successful completion of that particular job are called compensable factors. Establishing Pay Rates (continued) Preparing for the Job Evaluation 1 Identifying the need for the job evaluation 2 Getting the cooperation of employees 3 Choosing an evaluation committee 4 Performing the actual evaluation Job Evaluation Methods Methods for Evaluating Jobs Ranking Job Classification Point Method Non Quantitative Techniques –Ranking, Job Classification Method Quantitative Techniques –Point Method,Factor Comparison Factor Comparison Step 3: Grouping Jobs Point Method Grouping Similar Jobs into Pay Grades Ranking Method Classification Methods Job Evaluation Methods: 1. Ranking Perhaps the simplest method of job evaluation is the ranking method. According to this method, jobs are arranged from highest to lowest, in order of their value or merit to the organization. Jobs can also be arranged according to the relative difficulty in performing them. The job at the top of the list has the highest value and the job at the bottom of the list will have the lowest value. 2.Job Classification Method According to this method, a predetermined number of job groups or job classes are established and jobs are assigned to these classifications. This method places groups of jobs into job classes or job grades. Separate classes may include office, clerical, managerial, personnel, etc. Following is a brief description of such a classification in an office. Class I - Executives: Manager, Deputy manager, Office superintendent, Departmental supervisor, etc. Class II - Skilled workers: Under this category may come the Purchasing assistant, Cashier, Receipts clerk, etc. Class III - Semiskilled workers: Under this category may come Steno typists, Machine-operators, Switchboard operator etc. Class IV - Unskilled workers 3.Job Evaluation Methods: Point Method A quantitative technique that involves: Identifying Compensable Factors for the Benchmark Jobs Assigning Point Values to Compensable Factors Calculating a total point value for the job by adding up the corresponding points for each factor. Find the maximum number of points assigned to each job. This would help in finding the relative worth of a job Factor Comparison Method Jobs are ranked according to a series of factors. These factors comprise of 1. Mental Requirements, 2. Skill Requirements 3. Physical Requirements 4. Responsibilities 5. Working Conditions. The jobs under consideration are evaluated using factor-by factor in relation to the key jobs on job comparison scale. Pay will be assigned in this method by comparing the weights of the factors required for each job. Ranking Key Jobs by Factors1 Mental Requirements Physical Requirements Skill Requirements Responsibility Working Conditions Welder 1 4 1 1 2 Crane operator 3 1 3 4 4 Punch press operator 2 3 2 2 3 Security guard 4 2 4 3 1 11 is high, 4 is low. Market Pricing/ Benchmarking Market pricing is the process for determining the external value of jobs, allowing you to establish wage and salary structures and pay rates that are market sensitive. Market pricing or benchmarking is a comprehensive and timeconsuming process. Generally market pricing/Benchmarking is done through job matching sessions, salarysurveys, done by third party like Mercer, Hewitt,kelly The market pricing or benchmarking is done through following steps – i. Defining the jobs (Job analysis) ii.Deciding the job families. Similar jobs in the same family 42 iii. iv. v. vi. 43 Identifying a third party for carrying out the salary surveys. Matching the job analysis information with the standard job descriptions available with the third party and deciding appropriate scale of each job. Choosing the benchmark companies. Generally for each job-family separate set of benchmarking companies are chosen. Survey & sharing of information – the third-party consultant conducting the survey operates on strict confidentiality and does not disclose any company-specific information to the clientcompany. Then how is the information shared? Step 4: Price Each Pay Grade The Wage Curve Shows the pay rates paid for jobs in each pay grade, relative to the points or rankings assigned to each job or grade by the job evaluation. Shows the relationships between the value of the job as determined by one of the job evaluation methods and the current average pay rates for your grades. Competency-Based Pay Competencies Demonstrable characteristics of a person, including knowledge, skills, and behaviors, that enable performance What is Competency-Based Pay? Paying for the employee’s range, depth, and types of skills and knowledge, rather than for the job title he or she holds The Pay Gap Factors Lowering the Earnings ofWomen: 1. Women’s starting salaries are traditionally lower. 2. Salary increases for women in professional jobs do not reflect their above-average performance. 3. In white-collar jobs, men change jobs more frequently, enabling them to be promoted to higher-level jobs over women with more seniority. 4. In blue-collar jobs, women tend to be placed in departments with lower-paying jobs. Types of Employee Incentive Plans Individual Employee Incentive and Recognition Programs Sales Compensation Programs Pay-for-Performance Plans Team/Group-based Variable Pay Programs Organizationwide Incentive Programs Executive Incentive Compensation Programs Performance-based Pay/ Variable Pay Performance-based pay is also called as Variable pay. Variable pay is used to recognize and reward employee contribution towards company productivity, profitability, or some other metric deemed important. Variable pay is awarded in a variety of formats including profit sharing, bonuses, holiday bonus, deferred compensation, cash, and goods and services such as a company-paid trip etc. 17-3 Variable Pay Or Pay For Performance Systems /Types of performance-based Pays Here the pay is linked to individual, group or organisational performance. Employees have to compete and deliver results. Three types of variable pay are commonly used: Individual incentives: they link individual effort to pay Group incentives: they link pay to the overall performance of the entire group Organisation-wide incentives: here employees are rewarded on the the success of the organisation over a specified time period. Compensation Administration basis of 17-18 Organization Wide Incentive Plans These plans reward employees on the basis of the success of the organization over a specified time period. Profit sharing: Here the organization agrees to pay a particular portion (given in cash or in the form of shares) to eligible employees. of net profits Gain sharing: It is based on a mathematical formula that compares a baseline of performance with actual productivity during a given period. When productivity exceeds the base line an agreed upon savings is shared with employees. Employee stock ownership plan: It provides a mechanism through which certain eligible employees (based on length of service, contribution to the department etc) may purchase the stock of the company at a reduced rate. Individual vs. Team-based Incentives Individual Team-based • Team results • Piecework • Production incentives • Production bonuses • Profit-sharing • Commissions • Stock ownership (ESOP) • Executive incentives • Cost reduction plans Individual Incentives Individual incentives are lump sum payments like sales commission, worker incentives etc. based on standard piece-rate system or standard hour system. Individual incentive plans include Piece-work Plans, Management incentive plans, etc. Piecework Plans: Incentive Piecework is a type of incentive program whereby the employee is paid based on each unit of output. Management Incentive Plan: The Management Incentive Plan generally applies to the senior executives with a significant level of responsibility within the organization. The Incentive Plan contains both an annual and a long term incentive element. Executive Compensation Executive compensation covers employees that include presidents of company, chief executive officers (CEOs), chief financial officers (CFOs), vice presidents, occasionally directors of the company, and other upper-level managers. It is usually the members of the “C-Suite.” (A widely-used slang term used to collectively refer to a corporation's most important senior executives. C-Suite gets its name because top senior executives' titles tend to start with the letter C, for chief, as in chief executive officer, chief operating officer and chief information officer.) What Are the Components of Executive Compensation? Base salary Incentive pay, with a short-term focus, usually in the form of a bonus Incentive pay, with a long-term focus, usually in some combination of stock awards, option awards, non-equity incentive plan compensation Enhanced benefits package that usually includes a Supplemental Executive Retirement Plan (SERP) Extra benefits and perquisites, such as cars and club memberships Deferred compensation earnings Apple CEO Tim Cook's salary doubled in 2014 Apple CEO Tim Cook got a fat cash bonus that brought his total compensation to $9.2 million in 2013. That's more than double what he received in the previous year (2013), as the company enjoyed a upsurge in sales and profit fueled by the popularity of its new, over-sized iPhone 6 models. Cook's pay for fiscal 2014 included $1.7 million in salary and $6.7 million in incentive pay that was awarded by Apple's board after he beat the performance goals that directors had set for him, according to a regulatory filing. He also received $774,176 in other compensation, including a 401k contribution, company-paid insurance premiums and security expenses. Facebook reveals salaries of top execs, including Mark Zuckerberg's In Feb, 2012, Facebook Inc. said in a filing with the Securities and Exchange Commission that it will pay Zuckerberg, 27, a base salary of $500,000 per year. Zuckerberg's 45 per cent target bonus will be based on his performance. Chief Operating Officer Sheryl Sandberg received a base salary of $300,000. Her target bonus is also 45 per cent. Compensation Trends • Broad banding – Broad banding is defined as a strategy for salary structures that consolidate a large number of pay grades into an extremely wide salary bands called "broad bands.“ – Broad banding evolved because organizations want to flatten their hierarchies and move decision-making closer to the point where necessity and knowledge exist in organizations. Pros In flattened organizations, fewer promotional opportunities exist so the broad banding structure allows more latitude for pay increases and career growth without promotion. For example, organizations that had eight levels of management could eliminate four levels, widen the salary ranges of the remaining four levels, and simply slot each manager into one of those ranges. Cons Lack of permanence in job responsibilities can be unsettling to new employees. Expatriate compensation Three types of premiums to expatriates: foreign-service premium hardship premium and cost-of-living adjustment (COLA). New Approaches to Pay Skill- or knowledge-based pay Based on the employee’s skills or knowledge Variable pay Performance-linked approach Broadbanding Consolidation of pay grades Tailor-made perks Employees choose International pay Need to develop polices to meet global needs