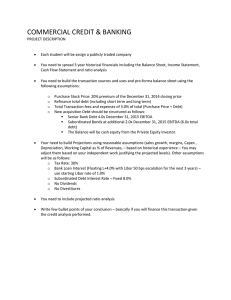

Financial Statement Analysis Training Material

advertisement

WALL ST TRAINING Providing financial training to Wall Street www.wallst-training.com ® Accounting and Financial Statements Integration Notes and Instructions Instructions: – Fill in first page of data (selected IS, BS and CF items) from financial statements attached – Enter in the ending balance of the latest available period – Round financial information to nearest millions – Write in correct formulas of ratios underneath the ratio's name on 2nd and 3rd pages – Calculate ratios using formulas and the data extracted on page 1 – Round ratios to 1 decimal Notes: Inputs (page 1) – Total Net Revenue: Sales and Revenue are generally interchangeable and synonymous. However, in certain industries, such as the retail sector, Sales is a portion of Revenue; therefore, use Total Revenue instead of Sales – Gross Profit: Calculate as Revenue less COGS – Gross Interest Expense: include capital lease interest to reflect full interest liability – Total Debt: include items such as: Commercial Paper, Short-term borrowings, Long-term debt within one year, Current portion long-term debt, Long-term debt, Minority interest Exclude capital leases in debt balance – Equity: use book value of equity – "Total Shareholders' Equity" – D&A: Obtain depreciation & amortization from Cash Flow Statement !! – CapEx: Capital expenditures, payments / expenditures / additions for property and equipment Ratios (page 2–3) – Anytime a ratio mixes Income Statement and Balance Sheet items, use average balance for Balance Sheet accounts! However, for purposes of this illustrative analysis, use ending balances from Inputs – Page 1 – Margin Ratios: Sales and Revenue are generally interchangeable and synonymous. However, in certain industries, such as the retail sector, Sales is a portion of Revenue; therefore, use Total Revenue instead of Sales WALL ST TRAINING Providing financial training to Wall Street www.wallst-training.com ® Accounting and Financial Statements Integration ($ in millions) WMT INCOME STATEMENT Total Net Revenue COGS Gross Profit (Revenue – COGS) EBIT (Operating Income) EBITDA (EBIT + D&A from below) Interest Expense (Gross if available) Net Income (Continuing Operations) BALANCE SHEET Cash A/R Inventory Current Assets Total Assets A/P Current Liabilities Total Debt Equity CASH FLOW STATEMENT D&A CapEx Fiscal Year 2005 (ending Jan 2006) TGT COST WALL ST TRAINING Providing financial training to Wall Street www.wallst-training.com ® Accounting and Financial Statements Integration ($ in millions) WMT LIQUIDITY RATIOS Current Ratio Current Assets / Current Liabilities Days Inventory Outstanding Inventory * 365 / COGS Days Receivable Outstanding A/R * 365 / Sales Days Payable Outstanding (use COGS) A/P * 365 / COGS Cash Conversion Cycle Inventory + A/R - A/P Days Outstanding Recommendation PROFITABILITY RATIOS (%age format) Gross Profit Margin Gross Profit / Sales EBITDA Margin EBITDA / Sales EBIT Margin EBIT / Sales Profit Margin Net Income / Sales Recommendation Fiscal Year 2005 (ending Jan 2006) TGT COST WALL ST TRAINING Providing financial training to Wall Street www.wallst-training.com ® Accounting and Financial Statements Integration ($ in millions) WMT ASSET MANAGEMENT RATIOS Asset Turnover Sales / Assets ROE (%age) Net Income / Equity ROA (%age) Net Income / Assets ROC (%age) Net Income / (Equity + Debt) Recommendation CREDIT RATIOS EBITDA Coverage EBITDA / Interest Expense Times Interest Earned (TIE) EBIT / Interest Expense Debt / EBITDA Net Debt / EBITDA Debt / Assets (%age) Debt / Equity (%age) Debt / Total Capitalization (%age) Debt / (Equity + Debt) Analysis Fiscal Year 2005 (ending Jan 2006) TGT COST