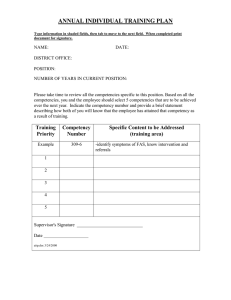

CompetencyMap

advertisement