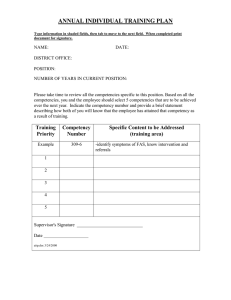

CompetencyMap

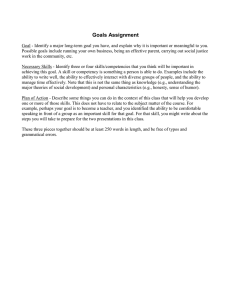

advertisement