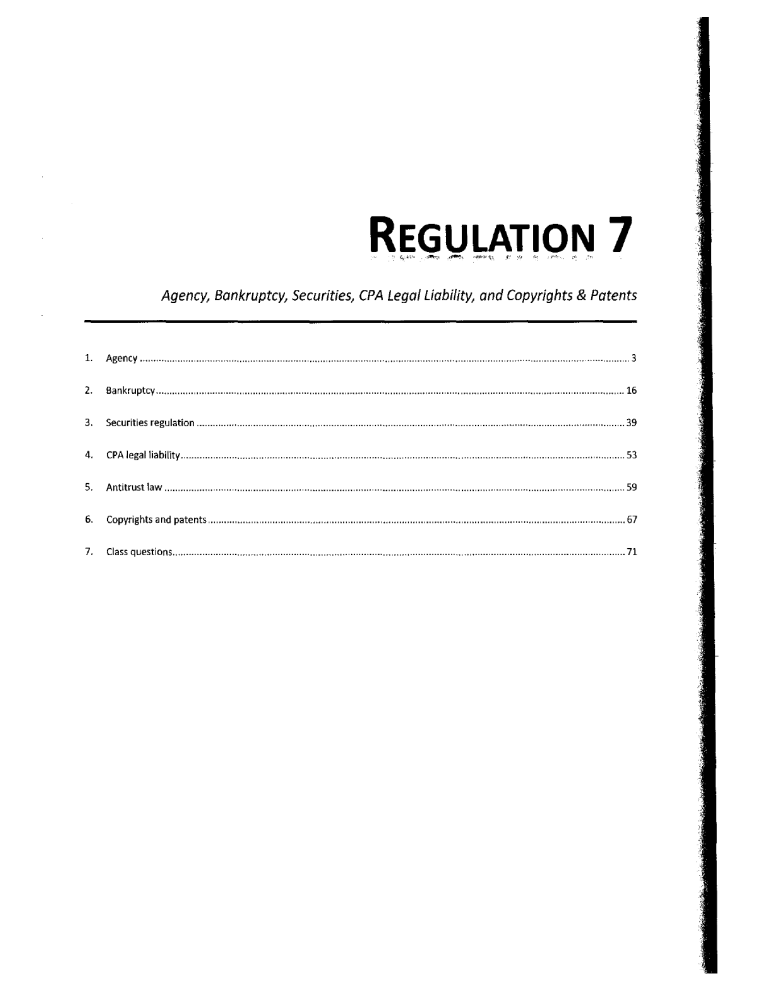

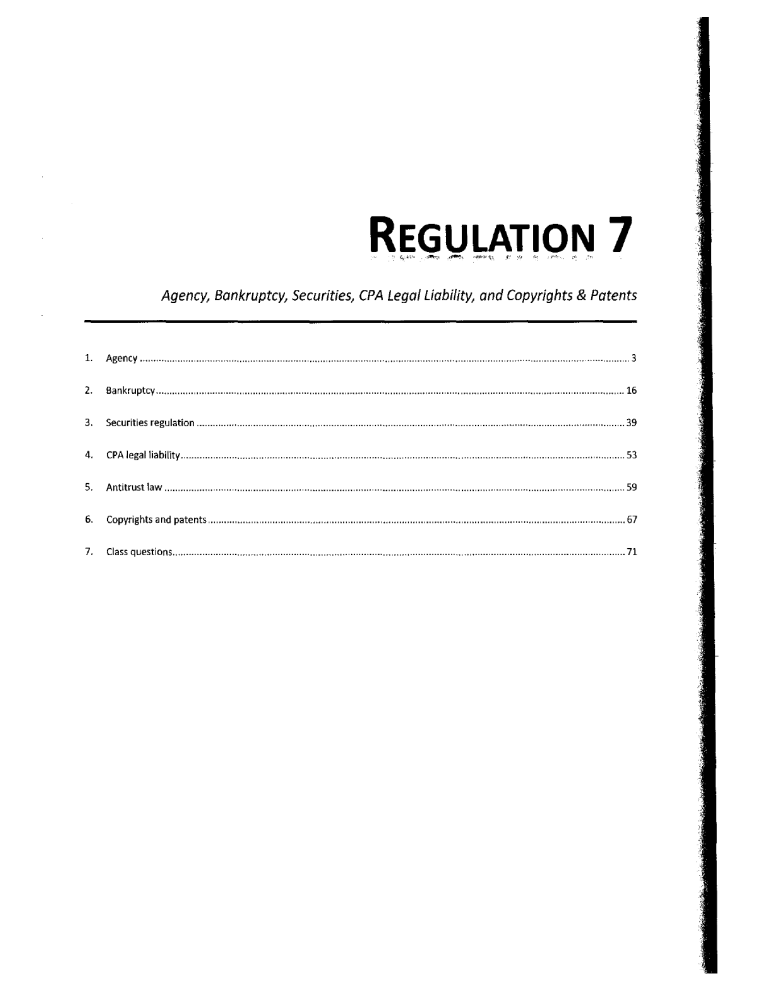

REGULATION

7

Agency, Bankruptcy, Securities, CPA Legal Liability, and Capyrights & Patents

1.

Agency

2.

Bankruptcy

3.

Securities regulation

4.

CPA legal liability

53

5.

Antitrust law

59

6.

Copyrights and patents

67

7.

Class questions

71

3

"

16

,

,

39

Becker Professional Education

Regulation 7

I CPA Exam

Review

NOTES

R7-2

V2010 DeVry!Becker Educational Development Corp. All rights res.erwd.

Becker Professional Education

I CPA Exam

Regulation 7

Review

AGENCY

I.

CREATION OF THE AGENCY RELATIONSHIP

A.

Introduction

Agency is a legal relationship in which one person or entity (the principal) appoints another

person or entity (the agent) to act on his behalf.

B.

Requisites for Creation

1.

Principal with Capacity and Consent

As a general rule, all that is required to create an agency relationship is a principal with

contractual capacity (I.e., not a minor and not incompetent) and consent of the parties

(I.e., the parties agree to act as principal and agent).

a.

b.

Writing Generally Not Required-Unless to Buy or Sell Land or Impossible

to Perform in One Year

(1)

A writing generally is not required to create an agency relationship, even if

the contract that the agent is to enter on the principal's behalf must be

evidenced by a writing under the Statute of Frauds.

(2)

However, many states require a written agency agreement if the agent is to

buy or sell an interest in land for the principal.

(3)

Note that a contract to find a buyer or seller (normal real estate broker's

agreement) and a contract to build a house are contracts for services. An

oral agency involving such transactions is valid.

(4)

Agency agreements that cannot be performed in one year must be

evidenced by a writing.

Agent Need Not Have Capacity-Minors Can Be Agents

Only the principal must be competent. The agent need not have capacity. Thus,

a minor or mentally incompetent person can be appointed as an agent.

c.

Consideration Not Required

Consideration is not required to form an agency relationship.

PASS KEY

The examiners often ask what is necessary to create an agency. Generally, all you need is consent and a principal

with capacity. A writing is necessary only if the agent will enter into land sale contracts. Thus, an answer that says a

writing is required or the agent's authority must be signed by the principal usually is wrong.

2.

Power of Attorney-Written Authorization of Agency

•

.., ..

..

a.

A power of attorney is a written authorization of agency.

b.

The agent under a power of attorney is referred to as an "attorney in fact." But

the agent need not be a lawyer. It just means that the agent has the power to act

on behalf of the principal.

c.

Generally only the principal is required to sign the power of attorney. There is no

requirement that the agent sign the instrument.

el010 DeVryjBecker Educational Development Corll. All rights reserved.

R7-3

Regulation 7

Becker Professional Education

d.

C.

I CPA Exam Review

The agent's authority is normally limited to specific transactions.

Rights and Duties Between Principal and Agent

Certain duties are implied in every agency relationship.

1.

Duties of Agent to Principal

The agent has whatever duties are expressly stated in his contract. The agent also

owes the following three duties:

a.

Duty of Loyalty-Act Solely in Principal's Interest

(1)

An agent owes her principal a duty of loyalty, i.e., the agent must act solely

in the principal's interest in connection with the agency.

(2)

An agent breaches this duty when she has interests adverse to the

principal (e.g., agent obtains kickbacks from a third party).

EXAM PLE

Petshop hired Andy as its store manager and gave Andy authority to purchase pets for the

store. Andy occasionally purchased dogs from Tremendous Dogs. When Andy bought dogs

from Tremendous, it paid Andy 5% of the purchase price as incentive to do more business.

Pets hop was unaware of the payments, which Andy kept. Andy has breached his duty of

loyalty and can be forced to turn over his profit to Petshop.

b.

Duty of Obedience-Obey Reasonable Instructions

An agent must obey all reasonable directions of his principal.

EXAMPLE

Paul hires Audrey as his purchasing agent for televisions, but instructs Audrey not to disclose to

sellers that she is working for Paul. If Audrey discloses to a seller that she is working for Paul,

she breaches her duty of obedience and will be liable to Paul for any damages the disclosure

caused.

c.

Duty of Reasonable Care-Liable if Negligent

An agent owes her principal a duty to carry out the agency with reasonable care

(i.e., the duty not to be negligent).

d.

Duty to Account

Unless otherwise agreed, the agent has a duty to account to the principal for all

property and money received and paid out when acting on behalf of the principal.

The agent cannot commingle the principal's property with the agent's property.

e.

Subagent

If an agent is authorized to hire a subagent, the subagent owes a duty of care to

both the agent and the principal.

.7.4

()2010 DeWy/Becker Educatlonal Development Corp. All rights reserved.

Becker Professional Education

2.

I CPA Exam Review

Regulation 7

Principal's Remedies

If an agent breaches the duties she owes to her principal, the principal can recover

damages from the agent:

a.

Tort Damages

The principal can recover tort damages from the agent if the agent negligently or

intentionally breached a duty owed to the principal.

b.

Contract Damages

If the agent was compensated, the principal can collect contract damages. If the

agent did not receive consideration, a contract was not formed and so contract

damages are not available.

c.

Recovery of Secret Profits

If the agent obtained a secret profit, as in the example in a., above, the principal

can recover the secret profit, usually by imposing a constructive trust on the

profit.

d.

Withhold Compensation

If the agent committed an intentional tort or intentionally breached her duty to her

principal, the principal may refuse to pay the agent.

3.

Duties of Principal to Agent

In addition to any duties expressed in the agency agreement, the principal owes the

agent the following duties:

a.

Compensation

Unless the agent has agreed to act gratuitously, the principal has an implied duty

to give the agent reasonable compensation.

b.

Reimbursement

The principal also has an implied duty to reimburse (i.e., indemnify) the agent for

all expenses incurred in carrying out the agency.

c.

4.

Remedies of the Agent

(1)

If the principal breaches her duties to the agent, the agent can bring an

action against the principal for any damages caused.

(2)

The agent has a duty to mitigate damages (e.g., a wrongfully fired agent

must seek comparable work to replace lost income).

Power to Terminate Relationship-Generally Terminable at Will

Since an agency relationship is consensual, either party generally has the power to

terminate the relationship at any time. However, the parties don't necessarily have the

right to terminate at any lime.

EXAMPLE

Porth os hires Athos as his purchasing agent for nine months, at a salary of $2,000 per month. Either

party can terminate the agency the next day, but a wrongful termination will be a breach of contract.

Cl2010 DeVIY!Becker Educational Development Corp. All righ.ts reserved.

R7-S

Becker Professional Education

Regulation 7

•

a.

I CPA Exam Review

Exception-Agency Coupled with an Interest

(1)

The principal cannot terminate an agency coupled with an interest. Only

the agent can terminate an agency coupled with an interest.

(2)

This arises where the agent has an interest in the subject matter of the

agency, such as where the agency power is given as security. In effect,

the agent has paid for the right to be appointed as the agent, usually by

giving credit.

(3)

Death, incapacity or bankruptcy of the principal will not end an agency

coupled with an interest.

EXAMPLE

P borrows $20,000 from AI promising to pay A within a year and appointing A as his agent to

sell Blackacre if P fails to pay. A's agency is coupled with an interest.

EXAMPLE

P hires A to sell Blackacre in exchange for 5% commission. P has the power to terminate the

agency at any time because A has not acquired an interest in Blackacre.

II.

AGENT'S POWER TO CONTRACTUALLY BIND PRINCIPAL

A.

B.

1*.'1

Introduction

1.

An agency relationship arises when the principal appoints an agent to act on his behalf.

By this appointment, the agent can bind the principal in contract.

2.

However, the power to contractually bind the principal can arise in several situations

where a true agency relationship does not exist-a principal may be liable even though

no consensual agency relationship was created.

3.

Agency power can arise through:

a.

A grant of actual authority,

b.

Apparent authority or estoppel, or

c.

Ratification.

Actual Authority

Actual authority (sometimes called "real authority" or simply "authority") is the authority the

agent reasonably believes he possesses because of the principal's communications to the

agent. An agent with actual authority has the power and the right to bind his principal. Actual

authority can be either express or implied.

1.

Express Actual Authority

Actual authority includes all powers that the principal expressly grants within the "four

corners" of the agency agreement.

R7-6

1:12010 DeWy/Becker Educational Development Corp, All rights reselVt'd,

Becker Professional Education

2.

I CPA Exam Review

Regulation 7

Implied Actual Authority

a.

Actual authority includes not only the authority expressed in the agency

agreement, but also any other authority that the agent could reasonably believe

is implied along with the express grant.

b.

This includes the authority to do things reasonably necessary to carry out the

agency (e.g., a person hired to manage a business will usually have authority to

hire employees, buy merchandise, etc.).

c.

Implied authority may also include things not necessary or customary, but which

the principal has repeatedly allowed the agent to do.

d.

Implied authority includes the authority to handle emergencies when no other

instructions are given.

PASS KEY

The examiners have tested on the implied authority of a business manager a number of times. The

key is to remember that the manager is there to run the business, not destroy it. Thus, she has

~

authority to hire and fire employees, purchase inventory, and pay business debts. She has no implied'

authority to sell or mortgage business fixtures or other property of the principal (other than

inventory). Also remember that generally an agent does not have implied authority to borrow money

on the principal's behalf-such authority must be expressed.

'b

3.

Termination of Actual Authority Can Occur By:

a.

Act of the Parties

(1)

Termination of an agency can occur through the acts of either the principal

(a revocation) or the agent (a renunciation). Of course, the termination

could violate the parties' contract, in which case damages could be

available.

(2)

Exception: Agency Coupled with an Interest

If the agency is coupled with an interest, only the agent, not the principal,

has the power to terminate the agency relationship.

b.

c.

Accomplishment of Objective or Expiration of Stated Period

(1)

If the agency is for a limited purpose (e.g., Phil appoints Andrea to

purchase Blackacre for him), actual authority is terminated when the

objective is accomplished (i.e., Andrea purchases Blackacre).

(2)

If the agency is for a stated period (e.g., six months), actual authority is

terminated upon expiration of the period. If no time is stated, the actual

authority terminates after a reasonable time.

Termination of Actual Authority

Actual authority is terminated by the following events:

(1)

Death of either the principal or the agent;

(2)

Incapacity of the principal:

(3)

Discharge in bankruptcy of the principal;

(4)

Failure to acquire a necessary license;

1©2010 DeVryjBecker Educational Development Corp. All rights reserved.

R7-7

Regulation 7

Becker Professional Education

I CPA Exam Review

(5)

Destruction of the subject matter of the agency (e.g., Paula hires Alex to

purchase an antique car, which is destroyed before it can be purchased);

or

(6)

Subsequent illegality (e.g., Paula hires Alex to purchase an antique

machine gun, but before the gun can be purchased Congress passes a law

prohibiting private ownership of machine guns).

PASS

KEY

Termination of agency by operation of law is a heavily tested issue. Be sure to memorize the

above list.

•

C.

Apparent Authority

Even though an agent might not have actual authority, there are situations where the agent

will nevertheless have the power (but not the right) to bind the principal, either because the

principal's conduct has caused third parties to reasonably believe the agent had authority or

because the principal was negligent and so will be estopped from denying that the agent had

authority. This power to bind the principal Is known as apparent authority.

1.

2.

3.

Principal's Conduct

a.

Note that apparent authority requires a holding out by the principal or negligent

inaction by the principal.

b.

The purported agent's mere representation that he is an agent is not sufficient to

establish apparent authority.

Distinguish from Actual Authority

a.

Apparent authority is based on the third party's reasonable belief that the agent

has the power to bind the principal.

b.

Actual authority arises from the agent's reasonable belief that he has the power

to bind the principal, not the third party's belief.

c.

In either case the principal is bound. However, if the agent lacked actual

authority, the principal can hold the agent liable for acting without authority.

Common Apparent Authority Situations

a.

Apparent Authority from Position

A principal who hoids another out as his agent vests the agent with the power to

enter into all transactions that a reasonable third party would believe a person in

the agent's position would have.

EXAMPLE

Pam hires Alex to manage her pet store. Alex has the apparent authority to hire and fire

employees, make deposits, etc.

R7-8

(l2010 DeVry{Beder EduC<ltion~1 Development Corp. All rights reserved.

Becker Professional Education

I CPA Exam

(1)

Regulation 7

Review

Secret Limiting Instructions Not Effective

Since apparent authority is based on what the third party reasonably

believes, the principal's secret limiting instructions-while effective to limit

the agent's actual authority-are not effective to limit the agent's apparent

authority.

EXAMPLE

Pam hires Alex to manage her pet store. It is customary in the area for pet store

managers to have actual authority to purchase inventory (pets). Pam tells Alex that he

may purchase pets for the store, but may not purchase a pet for more than $200. Tom,

a dog breeder, offers to sell Pomeranian puppies to the pet store for $250 each, and

Alex accepts. Alex has apparent authority to purchase the puppies, but not actual

authority. Thus, Pam will have to pay Tom for the puppies, but can hold Alex liable for

any loss that results.

(2)

General vs. Special Agent

A general agent is an agent engaged to perform a series of transactions

involving a continuity of service. A special agent is one engaged to

perform one or more transactions not involving a continuity of service. A

general agent's apparent authority is broader than a special agent's

apparent authority.

b.

Notice Generally Required to Terminate Apparent Authority

When a principal terminates an agent's actual authority, the agent will continue to

have apparent authority to perform until the principal notifies third parties who

might have known of the agency.

(1)

Actual notice must be given to terminate apparent authority to old

customers.

(2)

Constructive notice must be given to terminate apparent authority to new

customers.

EXAMPLE

Allen has been Patty's office manager for 10 years and has regularly purchased office supplies

from Terri. Patty fires Allen, but does not notify Terri. If Allen purchases more office supplies

from Terri purportedly on Patty's behalf, Terri can make Patty pay for the supplies because of

Allen's apparent authority.

4.

Termination of Apparent Authority by Operation of Law-No Notice

a.

As a general rule, to terminate an agent's apparent authority, there must be some

act that prevents the third party in question from reasonably believing that the

agent has authority. This usually requires notice of the termination, limitation on

authority, etc.

Cl2010 DeVry/Becker Educational Oevelopment Corp_ All rights reserved.

R7-9

Becker Professional Education

Regulation 7

b.

D.

I CPA [XClm

Review

However, apparent authority is terminated by operation of law, and no notice is

required, if any of the following occur:

(i)

Death of the principal or agent;

(ii)

Incapacity of the principal; or

(iii)

The principal receives a discharge in bankruptcy.

Ratification

Ratification allows a principal to choose to become bound by a previously unauthorized act of

his agent.

1.

Requirements

a.

The agent must have indicated that he or she was acting on behalf of the

principal (if the third party did not believe the agent was acting for a principal,

there can be no ratification).

b.

All material facts must be disclosed to the principal.

c.

The principal must ratify the entire transaction-there can be no partial

ratification.

Note that ratification does not require consideration and that the principal need not

notify the third party of the ratification (since the third party already thinks he has a

contract with the principal).

2.

May Ratify Expressly or Impliedly

The principal may ratify expressly, or may ratify impiiedly by accepting the benefits of

the contract when there is an opportunity to reject them.

3.

What May Be Ratified?

Generally, any act may be ratified unless:

4.

R7-10

a.

Performance would be illegal;

b.

The third party withdraws prior to ratification; or

c.

There has been a material change of circumstance so that it would not be fair to

hold the third party liable.

Only a Disclosed Principal May Ratify

a.

Only the purported principal may ratify. The agent cannot take over the contract

for himself.

b.

Only a disclosed principal may ratify. An undisclosed principal cannot ratify.

© 2010 DeVry!Becker Educational Development Corp. All rights reserved.

Becker Professional Education

E.

I CPA Exam Review

Regulation 7

Contractual Liability

1.

Principal Liable if Agent Had Authority or Principal Ratified

The principal will be bound by the agent's acts if the agent acted with actual authority or

apparent authority, or if the principal ratified the transaction.

;

WILL AGENT'S ACTS BIND THE PRINCIPAL?

..

Was there express or implied

actual autharity (authority the

agent reasonably believes he/she

possesses based on his/her

;

,

YES

The principal will

be bound.

i

dealings with the principal)?

I

NO

Was there apparent authority

(authority the third party

reasonably believes the agent

YES

The principal will

be bound.

has based on the third party's

dealings with the principal)?

,

I

NO

Did the principal ratify the

contract after the agent entered

into it on the principal's behalf

;

YES

The principal will

be bound.

and before the third party

withdrew?

I

NO

The principal will not be bound.

2.

Agent's Liability

a.

Disclosed Principal-Agent Not Liable if Authorized

(1)

If the agent discloses the existence and identity of the principal (a

disclosed principal situation), the third party cannot hold an authorized

agent liable on the contract.

(2)

Every person representing himself as an agent impliedly warrants that he

has the authority he purports to have. If in fact the agent has no such

authority, the third party can hold the agent liable for any damages caused

based on breach of this implied warranty.

C2010 DeVry/llecker Educational Development Corp. All

righl~

reserved

Becker Professional Education I CPA tx,lln Review

Regulation 7

b.

I-I

Partially Disclosed and Undisclosed Principal-Agent Liable

If the principal's identity is not disclosed to the third party (a partially disclosed

principai situation) or neither the existence nor the identity of the principal is

disclosed to the third party (an undisclosed principal situation), the agent is Hable

on the contract with the third party.

(1)

Third Party's Election

The third party can hold either the principal or the agent Hable if the

principal was undisclosed or partially disciosed, but not both. The third

party must elect whom to hold liable.

(2)

No Apparent Authority with an Undisclosed Principal

If the principal is undisclosed, there can be no apparent authority because

there is no holding out of the agent by the principal.

(3)

No Effect on Actual Authority

The fact that the principal is undisclosed has no effect on the agent's

actual authority since actual authority arises from the communications

between the principal and the agent.

PASS KEY

The examiners often ask about undisclosed principal situations. There are a few key points to

remember.

3.

•

The principal is bound if the agent had authority. It is irrelevant whether the principal was

disclosed, partially disclosed or undisclosed. If the agent did not have authority, the

principal is bound only if he ratifies.

•

The agent can be held personally liable if the principal is partially disclosed (identity is not

disclosed) or undisclosed (neither identity nor existence are disclosed).

Third Party's Liability

a.

Generally Only Principal Can Hold Third Party Liable

As a general rule, only the principal (not the agent) can hold the third party liable

on a contract the agent entered into on the principal's behalf, even if the

principal's existence or identity were not disclosed.

EXAMPLE

Ann entered into a contract with Top Corp. to purchase televisions on behalf of Paul. Paul

instructed Ann to enter into the contract in her own name without disclosing that she was

acting on behalf of Paul. If Top repudiates the contract, Paul may hold Top liable even though

it did not know it was dealing with Paul.

b.

Exceptions

The principal cannot hold the third party liable where:

(1)

R7-12

The principal's identity was fraudulently concealed (e.g., if the third party

indicates that he will not do business with the principal, the principal cannot

get around this by deaHng through an agent): or

©2010 DeV'Y/8ecker Educational Development corp. All rights reserved.

Becker Professional Education

I CPA Exam Review

(2)

111.

Regulation 1

The performance to the principal would increase the burden on the third

party (e.g., Goodyear cannot employ a small rubber manufacturer as an

agent to enter into a rubber requirements contract without disclosing that

the contract is for Goodyear).

TORT LIABILITY

A.

In General-Respondeat Superior

1.

B.

As a general rule a principal is not Hable for the torts committed by his

agent-only the agent is liable.

•

.- .... ,-

.

2.

However, there is an exception for employers. Under the doctrine of respondeat

superior, an employer can be Habie for an employee's torts committed within the scope

of employment.

3.

This does not relieve the agent of liability. The injured person may sue both the

employer under respondeat superior and the agent.

Employer.Employee Relationship

An employer (or master) is liable only for torts of an employee (or servant) and is

usually not liable for torts of independent contractors.

1.

IIIlIIII

Right to Control Manner of Performance is Key

The most important factor in determining whether a person is an employee or an

independent contractor is the right of the principal to control the manner In which the

person performs. An employer has the right to control employees, but has littie control

over the methods used by independent contractors.

2.

Additional Factors

Where right to control is not clear, the courts look to other factors, such as whether the

worker has a business of his own, provides his own tools and facilities, length of the

employment (short or definite vs. long or indefinite), basis of compensation, and the

degree of supervision.

a.

A clear example of an employee is one who works full time for the employer,

uses the employer's facilities or tools, is compensated on a time basis, and is

subject to the supervision of the principal.

b.

A clear example of an independent contractor is one who has a calling of his own

and who uses his own facilities or toois, is hired for a particular job, is paid a

given amount for that job, and who follows his own discretion in carrying out the

job.

©2010 OeVry{8ecker Educational Development Corp. All righls reselVed.

'7-13

Regulation 7

•

C.

Becker Professional Education

I CPA [x"m Review

Scope of Employment

An employer is not liable to an injured party merely because an employee caused the injurythe injury must also have occurred within the scope ofthe employment. That is, the injury

must have occurred while the employee was working for the employer within the time and

geographic area in which the employee was to work.

1.

Activities

The conduct causing the injury need not actually have been authorized by the

employer; rather the conduct need only be:

(i)

Of the same general type the employee was hired to perform; and

(ii)

Actuated, at least in part, by a desire to serve the employer.

EXAMPLE

While a bar owner might not authorize a bouncer to beat up boisterous customers, the owner

nevertheless can be held liable if this occurs, because the conduct is of the same general nature as the

bouncer's job.

a.

b.

Intentional Torts

(1)

The employer usually is liable only for an employee's negligence and is not

liable for intentional torts, since intentional torts are seldom within the

scope of employment.

(2)

However, where the tort Is authorized or where use of force is authorized

(as with a bouncer), the employer can be liable.

Crimes

An employer generally is not liable in tort for an employee's conduct that

constitutes a serious crime (e.g., carrying an illegal weapon).

PASS KEY

The examiners often ask about a principal's liability for its agent's torts. Remember, if the agent is an

employee and committed a tort while trying to serve the principal/employer, the principal/employer

generally will be liable unless the tort was unexpected (e.g., illegal conduct).

2.

Time and Geographic Area

It is not enough simply that the conduct that caused the Injury was of the same general

type the employee was hired to perform. The conduct must also have occurred within

usual employment time and space limits.

R7-14

a.

Small detours from an employer's directions (e.g., driving a few blocks out of the

way, stopping for lunch, etc.) fall within the scope of the employment.

b.

Major detours (frolic) from an employer's directions (e.g., driving 15 miles out of

the way to attend a party) fall outside the scope of employment.

© 2010 DeVry{Becker Educational Development Corp. All rights reserved.

Becker Professional Education

3.

I CPA Exam Review

Regulation 7

Cannot Limit Liability by Agreement with Employee

An agreement between the employer and employee that the employer will not be liable

for employee torts does not prevent a third party from holding the employer liable. The

employer can seek reimbursement from the employee.

AN elL L A R Y MAT E R I A l

d.

(for Independent Review)

Employer Liability for Independent Contractors

1.

II!ll!IImII

~

Although the general rule is that an employer is not liable for torts

committed by independent contractors, there are certain situations where the employer

can be held liable for torts of independent contractors.

2.

For example, an employer can be liable for the torts of an independent contractor if the

employer authorized the tortious act or if the work involved an ultrahazardous activity.

3.

These exceptions are rarely tested.

o

END OF ANCIllARY MATERIAL

LIABILITY OF PRINCIPAL FOR AGENT'S TORTS

Is the agent an employee or

an independent contractor

(look chiefly to the extent of

the principal's control over

the manner and method of

the agent's performance)?

EM~

Was the act within the scope

of employment (i.e., was the

employee where he/she was

supposed to be, doing what

he/she was supposed to be

doing, with the purposes of

the employer in mind)?

The principal

is liable.

1;)2010 DeVrv/Be<:ker Educational Development Corp. All liGhts reserved.

~

INDEPENDENT

~RACTOR

Generally, the principal is not

liable for the torts of an

independent contractor.

The principal

is not liable.

R7-15

Regulation 7

Becker Professional Education

I CPA Exam

Review

BANKRUPTCY

I.

INTRODUCTION

A.

Types of Bankruptcy Cases

1.

Five Types of Bankruptcy Cases

There are five basic types of bankruptcy cases under federai law: Chapter 7liquidation; Chapter 9-municipal debt adjustment; Chapter 11-reorganization;

Chapter 12-family farmers with regular income; and Chapter 13-adjustment of debts

of individuals with regular income.

2.

I-I

3.

4.

Chapter 7 liquidation-Trustee Appointed

a.

In a Chapter 7 liquidation case, a trustee is appointed. The trustee collects the

debtor's assets, liquidates them, and uses the proceeds to payoff creditors to the

extent possible.

b.

If the debtor is an individual (or a married couple), the debtor's debts are then

discharged, with certain exceptions.

c.

If the debtor is an artificial entity (e.g., a corporation), it is dissolved. No

discharge is given but the effect is the same-the debts are wiped out.

Chapter 13 Adjustment of Debts of Individuals with Regular Income

a.

In a Chapter 13 case, the debtor repays all or a portion of his debts over a threeyear period to a maximum of a five-year period.

b.

Although there is not a liquidation, a Chapter 13 trustee oversees the handiing of

a Chapter 13 proceeding.

c.

At the conclusion of a Chapter 13 proceeding, the remaining debts of the debtor

are discharged.

Chapter 11 Reorganization-No Liquidation, Trustee Not Required

a.

In a Chapter 11 reorganization case (usually used by businesses but aiso

available to individuals), a trustee usually is not appointed.

b.

The debtor remains in possession of his or her assets and a pian of

reorganization (i.e., a plan to payoff debts at a different time and/or different

amount than originally due) is adopted.

c.

Creditors are paid to the extent possible and the business continues.

PASS KEY

The examiners often ask if a trustee is required for a particular type of bankruptcy. There are a few key points

to remember.

R7-16

•

A trustee is required for Chapter 7 and Chapter 13.

•

A trustee is not required for Chapter 11, although the court may appoint one if one is needed.

© 2010 OeVry/Becker Educational Oevelopment Corp. All rights reserved.

Becker Professional Education

B.

I CPA Exam Review

Regulation 7

Dismissal or Conversion of a Chapter 7 Case - The Means Test

A Chapter 7 case by an individual consumer debtor may be dismissed (or with the debtor's

consent converted to a case under Chapter 13) upon a finding that granting relief under

Chapter 7 would constitute abuse. Abuse may be determined by a specific means test or by

a more general abuse test.

1.

Calculation of Debtor's Income

To determine if the debtor has sufficient income to pay some or ail of their debts under

a Chapter 13 pian, a calculation of the debtor's income is made.

a.

Current Monthly Income - Average of 6 Months Preceding Filing

The first step is to determine the debtor's current monthly income based on the

debtor's average income over the six months prior to filing. The average monthly

income is compared to the median income for a similarly sized family in the

debtor's state (determined by the Bureau of Census).

(1)

If Equal To or Less Than State Median Income - Chapter 7 Permitted

If the debtor's average monthly income multiplied by twelve plus that of the

debtor's spouse (even if the spouses do not file jointly) is at or less than

the median income for similarly sized families in the debtor's state, the

debtor can file for Chapter 7 relief.

(2)

If Debtor's Income Exceeds State Median Income - Means Test

Applied

If the debtor's average monthly income multipiied by twelve exceeds the

median family income of similarly sized families in the debtor's state, the

court, the trustee and any other interested party (e.g., a creditor) may file a

motion to dismiss based on the "means tesr' or a general finding of abuse.

(3)

Monthly Income MUltiplied by Twelve

The monthly income figure is multiplied by 12 because median family

income for the various states is determined by the Bureau of Census on an

annual basis.

b.

Means Test

The means test is designed to determine whether the debtor has sufficient

income to repay debts using a Chapter 13 plan.

(1)

Current Monthly Income Multiplied by 60

The debtor's current monthly income (using a six-month average) is

multiplied by 60. Social security payments are not included in monthly

income and certain expenses are deductible. Sixty months is used

because this is the maximum number of months a Chapter 13 plan may

last.

(2)

If Less Than $7,025 - Chapter 7 Permitted

If the debtor's average monthly Income iess ailowable expenses multiplied

by 60 is less than $7,025, the debtor may file for Chapter 7 relief.

()2010 DeVry!Becker Educational Development Corp. All rights reserved

R7-17

Regulation 7

Becker Professional Education

(3)

I CPA Exam Review

If $11,725 or More - Presumption of Abuse

If the product is $11,725 or more, a presumption of abuse occurs. Unless

the presumption is rebutted, the debtor may not file for Chapter 7, but may

file for Chapter 13.

(4)

If Less Than $11,725, but $7,025 or More - Abuse Only if Amount

Equals 25% of Non-priority Claims

If the product is iess than $11,725, but at least $7,025, a presumption of

abuse will arise only if this amount equals at least 25% of the debtor's

unsecured claims not entitled to priority payment (unsecured claims

entitled to priority payment will be discussed later).

0..---

AN C I I I A R V MAT E R \ A l

c.

---.

(for Independent Review)

Allowable Deductions

The debtor is allowed to deduct the following from monthly income:

(1)

Living Expenses in Amounts Set by the IRS

The debtor may deduct living expenses (e.g., food, clothing, personal care,

entertainment, transportation and housing) in amounts set by the IRS.

(2)

Health and Disability Insurance and Health Savings Accounts

Expenses for health insurance costs, disability insurance costs, and health

savings account expenses are deductible for the debtor, spouse and

dependents if reasonably necessary.

(3)

Care of Elderly, Disabled, and Chronically III

Reasonable and necessary payments are deductible for the care of

household members or immediate family members, including parents,

grandparents, siblings, children, grandchildren, dependents, and

nondependent spouses in a joint case.

(4)

Expenses to Keep Debtor of Family Safe from Family Violence

Expenses are deductible that are reasonabiy necessary to keep the debtor

and family safe from family violence.

(5)

Actual Expenses to Administer a Chapter 13 Plan

If the debtor is eligible for Chapter 13, the actual expenses of administering

a Chapter 13 plan are deductible up to a maximum of 10% of the projected

plan payments.

(6)

Expenses for Dependents to Attend Elementary or High School - Up

to $1,775

The actual expenses (up to $1,775) for each dependent child under age 18

to attend elementary or high school are deductible.

(7)

1h

1/60 of Payments Due Secured Creditors

One-sixtieth of the payments due to secured creditors during the five years

after filing are deductible. This also includes past due amounts secured by

property necessary to support the debtor or the debtor's family.

R7-18

e 2010 OeVry!Be,ker Educational Development Corp. All rishts re~rved.

Becker Professional Education

I CPA Exam Review

(8)

Regulation 7

lh

1/60 of Amount of Priority Claim Payments

One-sixtieth of the amount of priority claim payments is deductible. (Priority

claims are discussed below, in the Chapter 7 material.)

2.

Rebutting the Presumption of Abuse

a.

Rebuttal by Showing Special Circumstances

The debtor may rebut the presumption of abuse by showing special

circumstances (e.g., serious illness or call to active military duty) that create

additional expenses or a need to adjust current monthly income.

b.

Additional Expense Must Place Debtor Below Threshold Amount

To rebut the presumption, the additional expenses must place the current

monthly income below the dollar amounts that trigger the presumption of abuse.

3.

Exception - No Presumption of Abuse for Disabled Veterans

A Chapter 7 case may not be dismissed or converted based on means testing if the

debtor is a disabled veteran whose indebtedness occurred primarily while he was on

active duty or performing homeland defense activities.

4.

General Abuse Test

a.

Requires Bad Faith or Totality of Circumstances Indicates Abuse

Even if the debtor qualifies for Chapter 7, relief may be denied by a showing that

the debtor acted in "bad faith" or that under the "totality of circumstances" there

is abuse.

b.

Only Raised by the Court, Trustee or Bankruptcy Administrator

If the debtor's average monthly income or the monthly income of the debtor and

debtor's spouse in a joint case is at or less than the median income in the

debtor's state, a Chapter 7 filing can only be dismissed by the general abuse test

and only by the court, trustee or bankruptcy administrator (not a creditor).

5.

Dismissal upon Conviction of Violent Crime or Drug Trafficking

A court may dismiss a Chapter 7 filing by a debtor convicted of a crime involVing

violence or drug trafficking.

o

END OF ANCILLARY MATERIAL

D.

Who May Be a Debtor

Only a person who resides, or has a place of business, in the United States is eligible to be a

debtor under the Bankruptcy Code. "Person" generally includes individuals, partnerships,

corporations, and the like.

1.

Limitation in Chapter 7 Liquidations

Railroads, savings institutions, insurance companies, banks, and small business

investment companies may not file for bankruptcy under Chapter 7.

e2010 DeVry/Becker Educational Development Corp. All rights reserved.

R7-19

Regulation 7

Becker Professional Education

2.

I CPA l.:xiHll Review

Compare Chapter 11 Reorganizations

a.

Anyone who can be a debtor (except a stockbroker or commodity broker) under

Chapter 7 may also be a debtor under Chapter 11. Additionally, railroads may be

a debtor under Chapter 11.

b.

Although Chapter 11 is intended primarily for business debtors, an individual is

eligible for relief under Chapter 11.

AN C ILL A R Y MAT E R I A L (for Independent Review)

3.

C.

Credit Counseling Required if Debtor is an Individual

a.

Counseling must occur no more than 180 days before filing the bankruptcy

petition.

b.

Pre-petition counseling may be waived if services could not be obtained within 5

days of requesting such services; however, in such a case the debtor must

receive counseling within 30 days after the petition is filed.

c.

Counseling also may be waived due to active combat duty, disability, or

incapacitation or it is determined that credit counseling agencies are not

reasonably available within the district.

d.

In addition, debtors filing under Chapter 7 or 13 must complete a financial

management course before their debts are discharged.

Duties of Debt Relief Agencies

The Bankruptcy Code imposes duties on debt relief agencies (i.e., agencies that are paid

compensation to assist consumer debtors in filing bankruptcy petitions). A debtor is

considered to be a consumer debtor if his debts are primarily consumer in nature and he has

less than $164,250 in nonexempt property.

1.

A debt relief agency must enter into a written contract with a debtor within five business

days after the first date on which the agency provides bankruptcy assistance and

before filing a petition. The contract must explain the services to be provided, fees and

charges, and payment terms.

2.

A debt relief agency may not advise a person to incur more debt in anticipation of a

bankruptcy filing.

3.

A debt relief agency that breaches the above duties may be subject to an action for

actual damages, costs, loss of fees, and/or an injunction.

END OF ANCILLARY MATERIAL

II.

COMMON FEATURES OF CHAPTER 7 AND CHAPTER 11 CASES

.1

A.

R7-20

Automatic Stay-Stops Collection Efforts

1.

When a bankruptcy petition is filed in either a voluntary case or an involuntary case, an

automatic stay becomes effective against most creditors.

2.

The stay stops almost all collection efforts (e.g., filing a law suit or simply demanding

payment).

© 2010 DeVr~IBecker Educational Development Corp. All right5 reserved.

Becker Professional Education

3.

B.

I CPA Exam Review

Regulation 7

The automatic stay does not apply to crimlnai prosecutions, paternity suits, and cases

brought to establish spousal or child support obligations.

Duties of Debtor

After a petition is filed, a debtor must file:

1.

A iist of creditors and their addresses;

2.

A schedule of assets and iiabilities;

3.

A schedule of current income and expenditures;

4.

A statement of the debtor's financial affairs;

5.

Copies of pay stubs received within 60 days before filing;

6.

An itemized statement of monthly net income;

7.

A disclosure of any reasonably anticipated increase in income or expenditures for the

twelve months after filing;

8.

Copies of federal tax returns from the iast tax year. If the debtor has not paid taxes for

the previous tax year, he or she must do so before the bankruptcy can proceed.

9.

A record of any interest that the debtor has in an education IRA or a qualified state

tuition program;

10.

If the debtor is an individual, a certificate from the nonprofit bUdget and credit

counseling agency that provided the debtor credit counseling services, along with any

plan of repayment developed by the agency; and

11.

If the debtor is an individual and has debts secured by property, a statement of her

intention with respect to the property (i.e., the debtor must specify whether she intends

to retain or surrender the property, claim it as exempt, redeem it, or reaffirm the debt).

Note: If an individual debtor in a voluntary Chapter 7 case fails to file any of the items

specified in 1-7, above, within 45 days after filing the petition, the case is automatically

dismissed on the 46th day.

C.

Chapter 7 and Chapter 11 May Be Voluntary or Involuntary

1.

Voluntary Cases

a.

Debtor Files for Order of Relief

A voluntary case under Chapter 7 or Chapter 11 is commenced by the debtor

filing a petition for relief.

b.

Debtor Need Not Be Insolvent - But Must Pass Income Tests

The debtor need not be insolvent to file. However, as previously discussed, a

Chapter 7 case may be dismissed if the debtor has too much income.

() 2010 DeVry/lle(ker Edu(ation~1 Development Corp. All rights resef\/ed

'7-21

Regulation 7

Becker Professional Education

c.

I CPA Exam Review

Spouses May File Jointly

Spouses may file jointly to avoid duplicative fees.

PASS KEY

While it may seem trivial. "spouses may file jointly" often appears as a correct answer on the

CPA examination.

d.

Voluntary Petition Constitutes an Automatic Order for Relief

A filed voluntary petition constitutes "an order for relief," which simply means a

case can proceed unless a court orders otherwise.

2.

Involuntary Case

Unsecured creditors may petition a debtor invoiuntarily into bankruptcy proceedings

under Chapter 7 or Chapter 11 .

a.

Grounds - Generally Not Paying Debts When Due

For an involuntary petition, creditors must show that the debtor generally is not

paying his or her debts as they become due.

b.

Ineligible Debtors - Farmers and Charities

Farmers and nonprofit charitable organizations may not be petitioned

involuntarily into bankruptcy.

c.

Who Must Join Petition - Owed At Least $14,425

Only creditors who are owed, individually or in aggregate, at least $14,425 in

unsecured, undisputed debt may petition a debtor involuntarily into bankruptcy.

The number of creditors who must file depends on the debtor's total number of

creditors.

(1)

Fewer Than 12 Creditors -1 or More Owed $14,425

If a debtor has fewer than 12 creditors, anyone or more creditors who are

owed at least $14,425 in unsecured debt may file.

EXAMPLE

Dee has four creditors she is not paying. Alex is owed $15,000, Bob is owed $4,000, Carla is

owed $4,000, and sam is owed $17,000, which loan is secured by Dee's $20,000 car. Alex must

join in an involuntary petition; Bob and Carla's claims are not sufficient. Sam may not file.

Sam's claim is adequately secured.

R7·22

© 2010 D~Vry/B~ck~1 Educational

O~v~lopment

Corp_ All rights r~sel'led.

Becker Professional Education

I CPA Exam

(2)

R0VievJ

Regulation 7

12 or More Creditors - 3 Owed $14,425

If a debtor has 12 or more creditors, at least three creditors who are owed

at least $14,425 in aggregate, in unsecured, undisputed debt must join in

the involuntary petition.

PASS KEY

The number of creditors and amounts owed necessary to file an involuntary petition is a

favorite exam issue. Two points should be noted:

•

•

d.

e.

Usually the examiners use this information to create "distracters" (Le., wrong answers),

such as "To file a voluntary petition, a debtor must owe at least $14A25" or "have at least

12 creditors." You should take time to memorize the $14A25 and one or three creditor

minimums. Remember, they apply only to involuntary petitions.

~

'

(

C

If a problem states the number of creditors that a debtor has, the examiners frequently

asked the number needed to file an involuntary petition. Spot in the questions statements

like "the debtor has 19 creditors" or "the debtor has 8 creditors."

An Involuntary Petition Does Not Constitute an Order for Relief

(1)

Unlike a voluntary petition, an involuntary petition does not constitute an

order for relief. There is a gap between the filing and the order of relief

called the involuntary case gap.

(2)

The court will enter an order for relief if the debtor does not object to the

petition within 20 days.

(3)

If the debtor does object, a hearing is held to determine the debtor's

solvency. The test for solvency is whether the debtor is generally paying

his debts as they become due.

(4)

Persons who become creditors of the debtor during the involuntary case

gap period are given high priority in recovering against the debtor's estate.

Dismissal of Petition - Damages

If creditors improperly filed an involuntary petition (e.g., insufficient number of

creditors, insufficient unsecured claims, debtor was paying debts as they became

due, etc.) a court may award the debtor compensatory damages, court costs,

attorney's fees, and even punitive damages if bad faith can be shown.

PASS KEY

Odd as it may seem, the Bankruptcy Code does not require a debtor to be insolvent to file for

bankruptcy. A voluntary petition may be filed by anyone who owes debts, and an involuntary

petition may be filed if the debtor is generally not paying debts as they become due,

regardless of the debtor's ability to pay. An answer choice that suggests that the debtor must

be insolvent to file for, or be petitioned into, bankruptcy is wrong, but be sure to remember

that an individual consumer debtor's Chapter 7 case may be dismissed or converted to Chapter

13 if his income is too high.

f>ZOlO OeVry/Becker EducatiOllal Oevelopmelll Corp_ All

rjchl~

reserved

'7-23

~

~

Regulation 7

D.

Becker Professional Education

I CPA Exam Review

Section 341 Meeting-Creditors' Meeting

Ordinarily, within 20-40 days after the order for relief, a meeting of the creditors (called the

"Section 341 meeting") is held. All interested parties, inciuding creditors, the bankruptcy

trustee, and the debtor must be given notice of the meeting.

1.

Notice Requirements

The notice must include the name, address, and social security number of the debtor,

as well as notice of the automatic stay and final dates for filing claims.

2.

Debtor Must Attend

The debtor must attend the Section 341 meeting. The primary purpose of the meeting

is to provide creditors an opportunity to examine the debtor.

E.

•

Property of the Bankruptcy Estate

1.

2.

Property Included

a.

The debtor's estate (Le., assets available to payoff creditors) generally includes

all of the debtor's real and personal property at the time of filing.

b.

The estate aiso includes income generated from estate property (e.g., interest

from bonds that are part of the estate).

c.

It also includes property the debtor receives from divorce, inheritance, or

insurance within 180 days after the filing of the petition.

d.

Leases of property may be assumed and retained by the trustee, assumed and

assigned to another, or rejected by the trustee.

Property Excluded from Estate

a.

•

R7-24

Post-Petition Earnings, Spendthrift Trusts, EducationallRAs and State

Tuition Programs - Excluded From Debtor's Estate

Post-petition earnings of an individual debtor, spendthrift trusts, contributions to

educationallRAs and qualified state tuition programs made at least 365 days

before the petition was filed, and contributions by employees to qualified

employee benefit plans are excluded from the estate.

b.

Exempt Property-Generally Things Necessary to Live

(1)

An individual debtor is entitled to exempt certain property under the

Bankruptcy Code. The Code also allows states to adopt their own

exemptions. About two-thirds of the states have "opted-out" of the federal

exemption system in favor of their own, but the examiners have asked a

few questions regarding what property is exempt under federal

exemptions.

(2)

The exemptions most likely to appear are: (i) homestead (up to $21,625 of

residence property); (ii) motor vehicle (up to $3,450); (iii) household goods,

crops, and animals ($550 per item, up to $11,525 in total); (iv) unmatured

life insurance contracts; (v) tools of a trade or professional books (up to

$2,175); (Vi) health aids; (Vii) government benefits, such as social security,

veteran's benefits, unemployment compensation, and disability benefits;

and (viii) alimony, support, or maintenance (reasonably necessary for

support).

() 2010 DeVry/Becker Educational Development Corp_ All right. reserved.

Becker Professional Education I CPA Exam Review

3.

Regulation 7

Trustee's Powers as a Lien Creditor

a.

b.

Trustee is a Hypothetical Lien Creditor as of Filing Date

(1)

The trustee is treated as having a lien on all of the debtor's property the

instant the bankruptcy petition is filed.

(2)

This means that the trustee has priority over all creditors except creditors

with prior perfected security interests or prior statutory or judiciai iiens.

Caution-PM51 in Noninventory Collateral May Have Priority

The trustee will not prevail against PMSls in noninventory collateral that are

validly perfected under state iaw and within 30 days after the debtor receives

possession of the collateral. Recall, however, that in most states such perfection

is not valid under state law unless it occurs within 20 days after the debtor

receives possession of the collateral.

EXAMPLE

On July 1, Sue sells and delivers to Dan on credit certain equipment and properly reserves a

security interest in the equipment. On July 5, Dan files a petition in bankruptcy. On July 9, Sue

perfects her interest in the equipment by proper filing. Sue's PM 51 prevails over the

bankruptcy trustee's interest.

4.

Power over Fraudulent Transfer

•

a.

The trustee also has power to set aside fraudulent transfers made

within two years of the filing date.

b.

A fraudulent transfer is any transfer made with intent to hinder, delay, or defraud

creditors or any transfer where the debtor received less than equivalent value

while the debtor was insolvent. (See Creditors' Rights outline for more details.)

EXAMPLE

A few days before filing a voluntary petition in bankruptcy and while Debtor was insolvent, Debtor

gave Friend a $5,000 cash gift. The gift can be set aside (recovered from Friend) as a fraudulent

transfer.

5.

Trustee Can Disaffirm Preferences

The trustee has the power to set aside preferences. When the payment is "set aside,"

the payment is taken back from the creditor who received it and becomes part of the

bankruptcy estate.

a.

~

A Preferential Payment is:

•

(1)

A transfer made to or for the benefit of a creditor;

(2)

On account of an antecedent debt of the debtor;

(3)

Made Within 90 days prior to the filing of the petition (one year if the

creditor is an insider, such as an officer of the debtor organization or a

close relative of the debtor);

(4)

Made while the debtor was insolvent; and

2010 DeVry/Becker Educational Development Corp. All rights reserved.

R7-25

Regulation 7

Becker Professional Education I CPA Lxam Review

(5)

That results in the creditor receiving more than the creditor would have

received under the Bankruptcy Code.

PASS

KEY

Preferential payment is one of the most heavily tested issues when it comes to bankruptcy

questions on the CPA Exam, Be sure to memorize the definition above and the explanations

above, Understanding this material is one of the keys to your success!

b.

Purpose: Prevent One Creditor Being Preferred Over Others

The purpose of the preferential transfer rules is to prevent one creditor from

receiving an unfairly large repayment relative to other creditors. Improper intent

is not a requirement to classify a transfer as preferential.

EXAMPLE

A few days before Deanna, a retailer, filed her bankruptcy petition, she paid in full a two-year

unsecured installment loan owed to Carla, a creditor who had been very nice to Deanna.

Deanna's assets are such that other unsecured creditors will not be paid in full. The payment

to Carla can be set aside as a preference.

c.

Transfer

A transfer includes not only the payment of money or the giving of property, but

also the giving of a security interest.

EXAMPLE

Same facts as above, but instead of Deanna paying carla in full, Deanna gives Carla a security

interest in all of Deanna's inventory, which Carla perfects, Carla's interest can be set aside as a

preference.

d.

Antecedent (Preexisting) Debt

A payment is a preference only if it is for an antecedent (preexisting) debt. A

contemporaneous exchange for value is not a preference.

EXAMPLE

A few days before Deanna, a retailer, filed for bankruptcy, she received from Alex, a supplier,

six cases of goods to be put into Deanna's inventory. Deanna paid for the goods in full on their

arrival. There is no preference here; this is a contemporaneous exchange for value.

e.

Insolvency-Presumed During 90 Days Preceding Bankruptcy

The debtor is presumed to be insolvent during the 90 days immediately

preceding the date the bankruptcy petition is filed.

f.

Receipt of Greater Share-Creditor Received More

A preference exists only if the creditor receives more than he would receive in a

bankruptcy distribution. Therefore, payment to a fUlly secured creditor is not a

preference, because the creditor would have received the collateral and been

paid in full anyway.

R7-26

© 2010 DeWy/Becker Educational Development Corp_ All rights reserved.

Becker Professional Education

I CPA Exam Review

g.

Regulation 7

Exceptions: Transfers that Cannot be Set Aside by Trustee

(1)

Transfers in the Ordinary Course of Business

A transfer made to repay a debt that the debtor incurred in the ordinary

course of business is not a voidable preference.

EXAM PlE

A regular monthly installment payment will not be set aside as a preference. Similarly,

payment of current utility bills or current lease payments do not constitute a

preference.

(2)

PMSI Perfected within 30 Days

A PMSI is not a voidabie preference if it is perfected within 30 days after

the debtor receives possession of the collateral, though it may be invalid

under state law if not perfected within 20 days of the debtor's receiving

possession.

(3)

Consumer Payments under $600

The trustee may not avoid payments or transfers of property of less than

$600 by a debtor whose debts are primarily consumer debts.

(4)

Domestic Support Obligations

Bona fide payments for domestic support obligations (e.g., spousal support

or child support) are not voidable preferences.

F.

Claims Against the Estate

Claims include all rights to payment from the debtor's estate.

1.

Unsecured Creditors and Equity Security Holders Must File

III

a.

To have a claim allowed (i.e., a right of payment against the debtor's

estate), unsecured creditors must file a proof of claim, and

shareholders must file a proof of interest with the bankruptcy court.

b.

Unless someone objects, a filed claim or interest will automatically be allowed by

the court. An unsecured creditor who fails to timely file a claim may not take part

in the distribution of the debtor's estate.

c.

Compare-Secured Claims

The general rule is that a perfected security interest passes through and survives

bankruptcy even if the creditor does not file a proof of claim.

G.

Miscellany

1.

The trustee can also serve as a professional (e.g., tax preparer, accountant or iawyer)

for the estate if the court approves.

2.

A trustee serving as tax preparer for the estate may receive compensation as a

professional in addition to the trustee's compensation, if a court approves.

Cl2010 OeVrv!Becker Educational Oe~elopment Corp. All rights reserved

.7·27

Regulation 7

III.

Becker Professional Education

I CPA EXJnl R0view

FEATURES OF A CHAPTER 7 LIQUIDATION

A.

Goal

The goal of federal bankruptcy law is to give an honest debtor a "fresh start" financially by

discharging most debts owed by the debtor.

B.

In General

In a liquidation, a bankruptcy trustee is appointed. The trustee collects all of the debtor's

nonexempt property, liquidates it, and pays off all of the debto~s creditors. Most debts of an

individual are discharged but certain debts survive bankruptcy.

C.

Objections to Discharge

Creditors often want to prevent debtors from receiving a Chapter 7 discharge. The Code

provides two kinds of ammunition for such claims: objections to discharge and

nondischargeable debts. The first type of ammunition destroys the entire Chapter 7 casenone of the debtor's debts will be discharged. The second type of ammunition prevents the

discharge of specific debts. The following will prevent the debtor from receiving any

discharge:

1.

Debtor Not an Individual

Technically, only individuais (i.e., real people as opposed to artificial entities, such as

corporations) can receive a discharge under Chapter 7. Artificial entities seeking relief

under Chapter 7 usually are dissolved at the conclusion of the case, and so their debts

are wiped out.

2.

Fraudulent Transfers or Concealment of Property

The debtor is not entitled to a discharge if she transferred, destroyed, or concealed

property in the year before or after the petition was filed with intent to hinder, delay, or

defraud creditors.

3.

Unjustifiably Failed to Keep Books and Records

The debtor is not entitled to a discharge if he unjustifiably concealed, falsified, or failed

to keep or preserve adequate books and records from which the debtor's financial

condition or business transactions might be ascertained.

4.

Prior Discharge within Eight Years

A debtor is entitled to only one discharge within an eight-year period. Eight years must

elapse before another discharge can be granted.

5.

Commission of a Bankruptcy Crime

In addition to constituting federal crimes, the following acts give rise to objections to

discharge when committed knowingly and fraUdulently in connection with the

bankruptcy case:

R7-28

a.

Making a false oath or account;

b.

Presenting or using a false claim;

c.

Giving or receiving a bribe; or

d.

Withholding records or documents.

©1010

DeVry!Be(~er Education.1

Development Corp. All rights reserved.

Becker Professional Education

6.

I CPA Exam

Review

Regulation 7

Failure to Explain Loss of Assets

A debtor who is unable to explain satisfactorily the disappearance or loss of assets is

not entitled to a discharge.

7.

Refusal to Obey Orders or to Answer Questions

If the debtor refuses to obey a lawful order of the court, a discharge is denied.

8.

Improper Conduct in an Insider's Case

If during her own bankruptcy, or within one year prior to filing, the debtor commits one

of the above prohibited acts (fraudulent conveyance, false oath, etc.) in connection with

another case concerning an insider (relative, partner, etc.), the debtor may be denied a

discharge.

9.

Waiver

The debtor is not discharged from any debts if the court approves a written waiver of

discharge executed by the debtor after the order for liqUidation.

10.

Failure to Complete Financial Management Course

An individual debtor is not entitled to discharge if, after filing the petition, she fails to

complete the required instructional course on personal financial management.

PASS KEY

The examiners sometimes ask what will prevent a party from getting a discharge in bankruptcy. Historically

on the exam, the most often tested reasons are the first five, above.

The choice that historically has appeared most often is failure to keep records.

D.

I_I

Exceptions to Discharge

Certain debts of an indiVidual are not discharged under Chapter 7 or 11. Those

debts not discharged are called the "exceptions to discharge" and are as follows:

PASS KEY

It is important to remember that a bankruptcy case does not discharge all debts. The examiners often ask a

broad question such as, "Which of the follOWing is true under the Bankruptcy Code?" and one of the choices

often is that "all debts of the debtor are discharged." This is not true. The following debts survive

bankruptcy.

1.

Taxes Due Within Three Years of Filing

Most tax claims (federal, state or local) are nondischargeable if the return for the tax

was due within three years before the bankruptcy petition was filed.

2.

Debts Incurred by Fraud

Liabilities for obtaining money, property, or services by false representation or fraud are

not dischargeable.

3.

Luxury Goods

Consumer debts incurred for luxury goods (e.g., boat, jewelry, etc.) are not

dischargeable if the debts aggregate over $600 to a single creditor and are incurred

within 90 days of the order for relief.

(12010 oeVrv/llecl:er Educational Development Corp. All right, reserved.

R7-29

~

/, /

Regulation 7

Becker Professional Education

4.

I CPA Exam Review

Open-Ended Credit to Consumers

Cash advances obtained by a consumer under an open-ended credit plan are

presumed to be nondischargeable if the debts are incurred within 70 days of the order

for relief and exceed the aggregate amount of $875. Thus, if a consumer makes

purchases on a credit card in an amount greater than $875 in the 70 days before

bankruptcy, the debt will survive bankruptcy.

5.

Debts Undisclosed in the Bankruptcy Petition

Any debt not scheduled or listed by the debtor in time to permit the creditor to file a

timely proof of claim is nondischargeable, unless the creditor had notice or actual

knowledge of the bankruptcy.

6.

Embezzlement, Larceny, and Fiduciary's Fraud

Liabilities arising from embezzlement or larceny are not dischargeable. Debts arising

from fraud by a fiduciary are also nondischargeable.

7.

Alimony, Maintenance, Support and Settlements from Marital Separation

Debts owed to the debtor's spouse, former spouse, or child (in or out of wedlock) for

alimony, maintenance, or support are nondischargeable, as are property settlements

arising out of a divorce decree or separation agreement.

8.

Willful and Malicious Injury

Liabilities arising from willful and malicious injury to another are not dischargeable.

However, liabilities arising from negligent torts are dischargeable.

9.

Operating a Vehicle While Intoxicated

Judgments rendered against the debtor for death or personal injury incurred as a result

of operating a motor vehicle, aircraft, or vessel while legally intoxicated survive the

debtor's discharge.

10.

Fines and Penalties

Any obligation to pay a fine, penalty, or forfeiture owed to a governmentai unit, such as

traffic fines, survives the debtor's discharge, as do court costs.

11.

Educational Loans

An education loan owed to a nonprofit institution of higher education or a student loan

that is made. guaranteed, insured, or funded by a government agency or commercial

entity is not dischargeable, unless it would impose an "undue hardship."

12.

Denial of Discharge in a Prior Bankruptcy

If a discharge was denied in a prior bankruptcy or a previous discharge was waived,

debts that predate the prior bankruptcy are not dischargeable in a subsequent case.

This exception does not apply if the basis for denial in the prior case was that the

debtor received a discharge within eight years.

13.

Debts Incurred to Pay Taxes

Debts incurred to pay taxes (e.g., where debtor uses credit cards to pay tax) are

nondischargeable.

14.

Debts Incurred Due to Violations of Securities Laws

Debts incurred due to violations of the securities laws are nondischargeable.

R7-30

© 2010 DeVry/Becker Educational Development Corp. All rights reserved.

Becker Professional Education

15.

I CPA Exam Review

Regulation 7

Condo, Co-op, and Homeowners' Association Fees

Condominium, cooperative corporation, and homeowners' association fees that have

become due after the order for relief are not dischargeable if the debtor has an

ownership interest in the property.

16.

Restitution for Federal Crimes

Orders to pay restitution for federal crimes are nondischargeable debts.

17.

Prisoner's Court Fees

Fees imposed on a prisoner by a court for filing a legal pieading are nondischargeable.

18.

Fines for Federal Election Law Violation

A fine or penalty imposed under a federal eiection law is not dischargeable.

19.

Debt Owed to Pension or Profit-Sharing Plan

An obligation to repay a loan to a pension, profit-sharing, or stock bonus plan is not

dischargeable.

PASS

KEY

The examiners often ask what debts will not be discharged by a bankruptcy. The key to remembering the six

nondischargeable debts that most commonly appear on the exam is the word "WAFTEDlI : Willful and

malicious injury, Alimony, Fraud, Taxes, Educational loans and Debts undisclosed in the bankruptcy petition.

E.

Reaffirmation of Discharged Debts

Sometimes a debtor does not want a particular debt discharged in bankruptcy (e.g., to

maintain good relations with a particular creditor). The debtor may reaffirm such debts only if

the following requirements are met.

F.

1.

The agreement to reaffirm the debt was made before the granting of the discharge.

2.

The agreement contains a clear and conspicuous provision that the debtor has a right

to rescind the agreement any time prior to discharge or within 60 days after the

agreement is filed by giving notice to the creditor.

3.

Upon a discharge, the debtor's attorney or the court (if the debtor is not represented by

counsel) informs the debtor that reaffirmation is not required by law and advises the

debtor of the legal effect of reaffirmation.

Revocation of Discharge

A creditor or trustee may request the discharge be revoked for the following:

1.

The debtor obtained the discharge fraudulently and the party seeking revocation did not

discover the fraud until after the discharge was granted;

2.

The debtor acquired property that would constitute property of the estate and knowingly

and fraudulently failed to disclose this fact; or

3.

The debtor failed to obey a court order or answer material questions; or

4.

The debtor has not given a satisfactory explanation for a failure to make documents

available in connection with an audit that may be ordered by the United States Trustee

or for a material misstatement in such documents.

() 2010 DeVry/Bec~er Educalional Development Corp. All rights reserved.

R7-31

~

b

Regulation 7

G.

I_I

Becker Professional Education

I CPA Ham Review

Distribution of the Debtor's Estate-Payment and Priorities

Once the debtor's assets have been collected and liquidated, and all objections have been

disposed of, the trustee will distribute the assets of the estate. There are three basic

categories of claimants, which are paid in the following order.

(i)

Secured claimants;

(ii)

Priority claimants (which itself includes nine sUbcategories); and

(iii)

General creditors who filed their claims on time.

Payments are made in full to secured claimants to the extent of the value of the collateral

securing their claims (claims in excess of the collateral are treated like claims of other general

creditors). Whatever is left over then is used to pay first priority claimants in full, then second

priority claimants in full, then third priority claimants are paid, and so on. If money is left after

paying all of the priority claimants, it is then split among the general creditors who filed their

claims on time. If there is not sufficient money to pay all creditors at a particular level, the

creditors share pro rata.

PASS KEY

The priority rules are, perhaps, the most heavily tested rules on the CPA Exam when it comes to bankruptcy

issues. Your memorization of the order of payment and the dollar limitations specified below is key for

success on the exam.

1.

First Priority: Support Obligations to Spouse and Children

First priority goes to claims for domestic support obligations that are owed to a spouse,

former spouse, or child of the debtor on the date the petition is filed. But note: If a

trustee has been appointed or elected, the trustee has superpriority over claims for

domestic support obligations for administrative expenses to the extent such expenses

were incurred in administrating assets that benefit the support claim.

2.

Second Priority: Administrative Expenses

The expenses of a bankruptcy administration receive second priority. Bankruptcy