Executive Summary of the Seventh Ticket to Work Evaluation Report

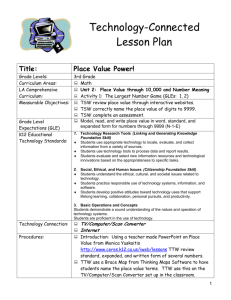

advertisement