Publication - Sipa Resources Limited

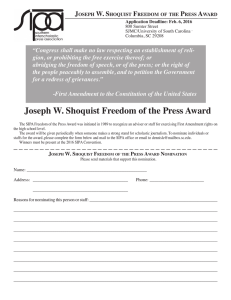

advertisement