opportunities for investment in halal industry in malaysia

advertisement

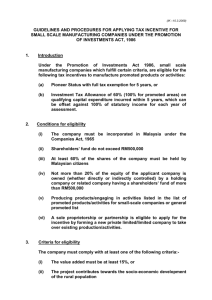

OPPORTUNITIES FOR INVESTMENT IN HALAL INDUSTRY IN MALAYSIA 1 About MIDA Malaysia Key Economic Indicators Approved Investments Opportunities for Investment in Halal Food Industry Investment Policies & Incentives Global Halal Market Why Malaysia? Ranking 2 Who Are We? The principal Malaysian Government agency responsible for the promotion of investments and coordination of industrial development and selected services sectors in the country Malaysian Industrial Development Authority - Established in 1967 under Act of Parliament, 1965 First point of contact for investors who intend to set up projects in the manufacturing and services sectors in Malaysia 3 • • • • • • Foreign Direct Investment • Domestic Investment • Manufacturing & Services Manufacturing Licenses Tax Incentives Expatriate Posts Duty Exemption Principal Hub & selected services Follow-up / Monitoring • Assist companies in the implementation & operation of their projects • Facilitate exchange & coordination among institutions engage in or connected with industrial development • Advisory Services • Planning for industrial development • Recommend policies & strategies on industrial promotion and development • Formulation of strategies, programmes and initiatives for international economic coorperation 4 MALAYSIA PRODUCTIVITY CORPORATION 5 Stockholm London San Jose Chicago Boston New York Los Angeles Houston Paris Frankfurt Munich Beijing Seoul Tokyo Shanghai Milan Osaka Guangzhou Dubai Taipei Mumbai Malaysia Singapore Sydney 23 Overseas Centres 6 Alor Setar Headquarter KL Sentral, Kuala Lumpur Kota Bharu Kuala Terengganu Penang Ipoh Kuantan Selangor Kota Kinabalu Seremban Melaka Johor Bahru Kuching 7 Based outside MIDA Immigration Department Telekom Malaysia Berhad Royal Malaysian Customs Labour Department 8 Northern Corridor Investment Authority (NCIA) Tourism Manufacturing & Design Modern Agriculture Logistics Education & Health Sabah Economic Development Investment Authority (SEDIA) East Coast Economic Region Development Council (ECERDC) • Agro-based Industry • Tourism • Logistics • Manufacturing • Tourism • Oil & Gas • Manufacturing • Agriculture • Education • Financial Services Iskandar Region • Petrochemical and Maritime Development Authority • Healthcare (IRDA) • Tourism and Logistic Industry • Manufacturing & Services InvestPerak Biotechnology Corporation Johor State Investment Centre • Resource Based Industry • Aluminum, Glass, Steel, Oilbased Industry, Palm Oil, Fishing & Aquaculture, Livestock, Timber-based, Marine • Energy • Tourism Regional Corridor Development Authority (RECODA) Now, Malaysia’s investment environment consists of multiple national, regional and state investment promotion agencies InvestMelaka Negeri Sembilan Investment Centre Pahang State Development Corporation Kedah Investment Centre InvestPenang Invest Selangor Berhad 9 Economic Sarawak Development Corp 2013 2014 2015 2016f Real GDP (%) Growth 4.7 6.0 5.0 4.0-4.5 Inflation (%) 2.1 3.2 2.1 2.0 – 3.0 10,034 10,111 9,080 9,396 3.1 2.9 3.2 2.9 134.9 115.9 95.3 NA Per Capita Income (US$) Unemployment (%) International Reserves (US$ bil) Source: MOF, BNM, Economic Report 2015/2016 10 DDI USD 35.1 bil. (81%) 81 DDI FDI FDI USD 8.4 bil. (19%) 19 81 : 19 Domestic : Foreign 4,887Projects Approved 180,244 Employment Opportunities USD1.00 = RM4.29 Source: MIDA 11 PRIMARY USD 0.89 B (2%) 19 MANUFACTURING USD 17.4 B (40%) USD43.5 BILLION SERVICES USD25.2 B (58%) USD1.00 = RM4.29 TOTAL APPROVED INVESTMENTS FOR MANUFACTURING & SEVICES SECTORS (2015) MANUFACTURING DDI USD5.1 bil (29%) FDI SERVICES USD2.8 bil (11%) USD 17.4 B USD12.3 bil (71%) USD 25.2 B USD22.4 bil (89%) USD1.00 = RM4.29 680 Projects Approved 66,494 Employment Opportunities 4,150 Projects Approved 112,194 Employment Opportunities 13 No. Industry No. of Project Approved Investment (USD Billion) 1 Petroleum Products (Inc. Petrochemicals) 12 6.29 2 Natural Gas 1 2.43 3 Electronics & Electrical Products 93 2.08 4 Transport Equipment 55 1.52 5 Non-Metallic Mineral Products 25 0.86 6 Basic Metal Products 28 0.84 51 0.62 7 Food Manufacturing 14 USD Billion 1,2 1,0 0,8 1.0 0.9 0,6 0.7 0,4 0.4 0,2 - 0.3 0.3 0.3 0.3 0.2 0.1 USD1.00 = RM4.29 15 No. of Projects No. of Employment Proposed Investment (USD billion) 2,160 254,079 31.1 16 No. of Project Approved Investment (USD million) Percentage (%) Electronics & Electrical Products 389 10,064.4 32.4 Petroleum Products (Incl. Petrochemicals) 71 7,125.7 22.9 Chemical & Chemical Products 299 3,134.6 10.1 Basic Metal Products 65 1,918.9 6.2 Transport Equipment 132 1,644.6 5.3 Machinery & Equipment 197 1,176.4 3.8 Food Manufacturing 124 1,024.4 3.3 Scientific & Measuring Equipment 61 950.1 3.1 Non-Metallic Mineral Products 143 837.1 2.7 Rubber Products 163 706.5 2.3 Industry 17 0.4 0.3 0.3 0.3 18 Switzerland Singapore JAPAN USA Food processing in Malaysia contributed about 10% to total manufacturing output. More than 3,200 establishment ; > 80% SMEs and predominantly Malaysianowned establishments Diverse production of wide variety of food products ranging from meat products, seafood products, cereal products, cocoa products, herbs and spices MNC’s in Malaysia are mainly producing palm-based products such as cooking oils, non-dairy creamer, food ingredients & seasonings and etc. Major exports of processed food: - edible products and preparations - cocoa and cocoa preparations - prepared cereals and flour preparations - sugar & sugar confectionery Sources of FDI for food products are mostly from Singapore, Netherlands, Japan, USA, Switzerland 20 WORLD’S LARGEST EXPORTER OF PALM OIL SOURCE : MPOB WORLD’S FIFTH LARGEST PRODUCER OF PEPPER SOURCE : MPIC ASIA’S LARGEST COCOA PROCESSOR WORLD’S FIFTH LARGEST COCOA PRODUCER SOURCE : MCB Availability of resources • Palm Oil Derivatives • Bio-diverse forest, flora World Recognised JAKIM Halal Certification Malaysia ASEAN • 7th largest economy in the world – combined GDP USD2.4 trillion Strategic location • Over 620 million population Dedicated Halal Parks Attractive Incentives Inside & Outside Halal Parks Pro-government Business Well developed Infrastructures • Implemented AFTA in 2010 • 7th largest economy in the world – combined GDP USD2.4 trillion • Population over 620 million people • Intra-ASEAN trade is 24% of total global trade of USD2.51 trillion in 2013 • Total FDI inflows of USD122 billion in 2015 with intra-ASEAN investments alone contributing 17% • 97.3% of products traded in the region will be duty-free • ASEAN Economic Community 2015, integrated market & production base – freer flow of goods, services, investments, skilled labour and capital 23 AEC 2025 24 THINK ASEAN THINK MALAYSIA Many sectors in Malaysia have been liberalised - a suitable location for operational headquarters, treasury functions and the seat of manufacturing and services operations. REGIONAL / BILATERAL FTAs China Japan Pakistan Korea India Australia New Zealand Chile Turkey ON-GOING FTA NEGOTIATIONS EU RCEP 25 Malaysia Has Liberal Policies on Investment OWNERSHIP Manufacturing & selected services sectors can be wholly foreign-owned CAPITAL Freedom to Repatriate Capital, Interest, Dividends and Profits – No Restrictions EXPATRIATE POSTS Liberal policy, based on merit of each case 26 Processing of Agricultural Produce Manufacture of Palm Oil & Their Derivatives 27 Less Developed Areas • Income Tax Exemption 100% up to 15 years of assessment (5+5+5) or • ITA 100% of qualifying capital expenditure incurred within 10 years (MIDA) Pioneer Status (PS) Income Tax Exemption 70 % or 100 % for 5 years (MIDA) 10 years (MOA) Investment Tax Allowance (ITA) 60 % or 100 % on qualifying capital expenditure for 5 or 10 years (MIDA) Exemption from Import Duty on Machinery & Equipment and Raw Materials / Components (MIDA) - Reinvestment Allowance (RA) of 60% for 15 consecutive year - Special RA : Another 3 years after RA expired , YA 2016 – 2018 (Budget 2016) (IRB) Incentive for Reinvestment (Section 4F PIA 1986) PS 70% for 5 years / ITA 60% for 5 years (MIDA) R&D Activity i. R&D Co. – ITA 10 years ii. Contract R&D – PS 100% for 5 years or ITA 100% for 10 years iii. In-house R&D – ITA 50% for 10 years (MIDA) INCENTIVES Investment Tax Allowance (ITA) 100% for 10 years or Income tax exemption on export sales for a period of 5 years (HALAL PARK) HDC Eligible activity/product HALAL (MIDA) • New/additional halal food products utilising modern and state-of-the-art machinery / technology Investment Tax • Allowance (ITA) 100% of qualifying capital expenditure incurred within a period of 5 years Expansion with upgrading of existing plant with additional machineries/modern technology HALAL (MIDA) HALAL USD 2.3 trillion • Approximately 67% of potentially Halal products are categorized as fast moving consumer goods (FMCG) • Food FMCG and primary meat together account for 62% of the market. Does not include Islamic Financial Services. Services involved in final product e.g. certification, logistics, R&D are included in sectoral values ** Based on sales revenue *** Halal processed food is taken as 66% of the total based on world halal meat consumption **** Only non-alcoholic beverages Source: Euromonitor reports; FAOSTAT 29 Halal Economic Landscape and Opportunities 9 8 7 6 5 4 3 2 1 - World population (1990 – 2030): Muslim versus Non-Muslim 4,8 Sizeable and growing Muslim population worldwide – the size of the global Muslim 5,8 5,4 5,0 population as at 2010 is 1.6 billion and it is 4,0 21.3% 21.5% 1,1 1,3 1,6 1990 2000 2010 Muslims 24.7% 2,2 1,9 24.2% 2020 27.5% of world population is Muslim 2030 forecasted to grow twice as fast as the nonMuslim population. Non-Muslims Source: PEW Research Centre Growing purchasing power of Muslim Gross Domestic Product (USD) Per Capita 12,000 Economic development in Muslim countries results in a faster growing gross domestic 11,042 10,000 8,000 GDP (USD) Billions Growing population of Muslim CAGR: 5.0% 6,530 6,000 4,000 counterparts. Malaysia’s Muslims rank 4th in CAGR: 6.8% 4,185 1,763 2,000 product (GDP) per Muslim capita than its global 30 terms of purchasing power amongst the global 1990 2010 Global Muslims Source: PEW Research Centre Muslim population. Malaysia exported RM 42 billion of halal products in 2015. In 2014, Malaysia exported RM 37.7 billion of halal products representing 5.1% of the total exports for the country. RM 50 billion is to be targeted for 2016. 32 Political and Economic Stability Pro-business Government Liberal Investment Policies Well Developed Infrastructure/ Connectivity Good Track Record STRATEGIC LOCATION Young, Trainable and Educated Labour Force Quality of Life Harmonious Industrial Relations Banking System 33 global offshoring destination (A.T. Kearney Global Services Location Index™ 2016) protecting investors (World Bank Doing Business 2015 Report) IMD world talent rankings (IMD's World Competitiveness Yearbook 2014) most attractive investment destination (Baseline Profitability Index (BPI) 2015) most competitive economy in overall performance (IMD's World Competitiveness Yearbook 2015) in ease of doing business (World Bank Doing Business 2015 Report) most competitive nation in the world (WEF's Global Competitiveness Report 2015-2016) 34 Malaysia Your Profit Centre in Asia Thank You Mr. Mohd. Rasli Muda Director, Food Technology & Sustainable Resources Division MIDA Sentral No. 5 Jalan Stesen Sentral 5, KL Sentral 50470 Kuala Lumpur Tel: +603 – 2267 3643 Fax: +603 – 2273 8467 Email: investmalaysia@mida.gov.my / rasli@mida.gov.my 35