10180 east colfax avenue - Northstar Commercial Partners

advertisement

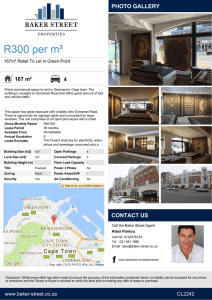

Confidential EXECUTIVE INVESTMENT SUMMARY 10180 EAST COLFAX AVENUE AURORA, COLORADO PREPARED BY: Brian Watson Founder and President Version 7.03 1225 Seventeenth Street • Suite 1860 • Denver, Colorado 80202 303.893.9500 Telephone • 303-893.9505 Facsimile • www.northstarcp.com THE OPPORTUNITY Northstar Commercial Partners (“Northstar”) is seeking equity partners for a ±56,281 SF showroom/retail building that it owns on ±1.03 acres at 10180 E. Colfax Avenue, Aurora, Colorado 80010 (the “Property”). It has already found a lending partner to finance new debt on the investment, and provide the necessary capital to refinance the asset and secure a construction line of credit to build out the space for the tenant. Northstar secured a long-term tenant for the entire premises under a 15-year Master Lease, which immediately added significant value to the investment. Additionally, due to the nature of the tenant’s use, the lease-up adds intangible value to its surrounding community and its members. The ownership entity for this investment is: 10180 E. Colfax, LLC, a Colorado limited liability company (the “LLC” or “Company”). THE PROPERTY 10180 E. Colfax totals ±56,281 SF in three stories, consisting of a main ground floor showroom with ±26,504 SF, a 2nd story retail/mezzanine space with ±14,994 SF, and an unfinished 3rd floor that totals ±14,783 SF with an upper mechanical penthouse. The Property sits on ±1.03 acres, which is comprised of two separate lots with ±0.64 acres in Lot 1 (improved) and ±0.39 acres in Lot 2 (parking). It offers 119 feet on Colfax Avenue, the main street that runs west-east through the Denver-Aurora metropolitan area, and the longest commercial street in the USA running 26 miles total. The frontage on Colfax Avenue offers high traffic counts with ±31,899 cars/day at Colfax west of Havana, and ±4,870 cars/day at Del Mar Parkway just south of Colfax. Its proximity to downtown Denver (6.3 miles) creates numerous options for public transit, and RTD bus stops for Line 15 are within a one minute walk. The Property is situated in a City of Aurora urban renewal area (Fletcher Plaza), which is considered a historic center of original Aurora. Its flexible commercial zoning of B-2 (downtown business) in Arapahoe County allows for many permitted uses including, but not limited to: retail, office, indoor, recreational facilities, meeting, banquet and conference facilities, medical clinics, pawn brokers and art spaces. The Property was built in 1952 and fully renovated in 2005, and has been consistently leased through the years. It was formerly occupied by the American based national department store chain JC Penney through the late 1970’s, Aaron’s Office Products in the 1980’s, Sonshine Furniture in the 1990’s, and the Broyhill Home Collection furniture store until it became vacant in 2012. Executive Investment Summary for 10180 E. Colfax, LLC Page 2 of 21 Pre-Acquisition Photo of Property Architect’s Rendering of New Façade with Tenant THE TENANT Northstar has executed a 15-year Master Lease with one tenant for 100% of the Property. This tenant is a Colorado based company inspired by the leadership of the Denver-based African community. It will provide a multipurpose building with spaces that can be rented to community members to gather, and start or run their own businesses. AfrikMall, Inc. (the “Tenant”) will oversee the operations of the building, with its main revenue generation coming from rental income for reconfigurable event rental spaces, conference rooms, offices, shops and restaurants. To date, they have finalized lease agreements with 23 tenants, who will lease space from AfrikMall, Inc. The mission of AfrikMall, Inc. is unique. In addition to providing affordable rental, office and event spaces to community members, it will also add to the diversity of cultural programs in Central Aurora and East Denver. By offering a wide range of events, it can unite the community with African cultural entertainment that will bring Africans, as well as admirers and students of African culture, together. Executive Investment Summary for 10180 E. Colfax, LLC Page 3 of 21 The Aurora, Colorado market has a large African and African American community of over 100,000 people, with an increasing need for conference facilities. According to the 2010 census, the number of African immigrants in the Denver metro area rose from approximately 9,763 in 2000 to over 40,000 in 2010. This significant rise of ±150% in African population over 10 years is directly related to the increase in the number of African businesses and activities. There is a need for a facility large enough to provide adequate space for African events, and Northstar is confident that the location and size of the Property is ideal for this use. The positive response from media contacts has been overwhelmingly supportive and interested in the development of the AfrikMall concept. RENT ROLL The Tenant, AfrikMall, is 100% reliable for covering the Master Lease obligations for the entire Property as the Master Tenant on a 15-year lease. The Master Lease has personal guaranties from five (5) of the founders, with a $52,806.82 security deposit. The Master Tenant will be fully responsible for managing and collecting rents for 100% of the Property. The following is an overview of the types of tenants that the Master Tenant has secured. TOTAL BUILDING SPACE 56,281 MASTER LEASE Tenant Name Suite AfrikMall, Inc. Full Building Lease AT&T Space 304 Total Leased Space RSF % Share Monthly Rent 34,894.38 $ Annual Rent Term 55,831 99.20% $ 450 0.80% $ 2,216.18 $ 26,594.19 56,281 100.00% $ 37,110.56 $ 445,326.69 Tenant/ Business Description 418,732.50 15 Years Master Lease; Pays 100% of Operating Expenses SUBTENANTS Subtenant Annual Lease Rate Per Sq/Ft Tenant Name Suite Afrikmall, Inc. 112,113,114,123, 206, 207,208,209 % Share Monthly Rental Income 14,230 25.28% $17,787.50 RSF $15 Annual Rental Income Term Tenant/ Business Description $213,450.00 15 Years Grocery, Event center, Hair Salon, Cultural Center and Offices Abyssinian Family 105 430 0.76% $537.50 $6,450.00 3 years Ethiopian Clothing and Accessories Niamkey, LLC 109 475 0.84% $593.75 $7,125.00 3 Years Sale of African fabrics, shoes, etc. Afraccino 101 200 0.36% $250.00 $3,000.00 3 Years Coffee brewing and sales Ama Beauty Supply 110 600 1.07% $750.00 $9,000.00 3 Years Beauty Supply Store Oumar Ndiaye Restaurant 122 445 0.79% $556.25 $6,675.00 3 Years Oumar Ndiaye Arts and Craft 102 1,115 1.98% $1,393.75 $16,725.00 3 Years Mary's Fabric 107 465 0.83% $581.25 $6,975.00 3 Years Fabric African Fashion and Arts 108 465 0.83% $581.25 $6,975.00 3 Years Fashion Akapoko Restaurant 120 445 0.79% $556.25 $6,675.00 3 Years Ethnic restaurant - Ghananian Konjo Catering 119 445 0.79% $556.25 $6,675.00 3 Years Sankofo Lounge & Bar 111 1,675 2.98% $2,093.75 $25,125.00 3 Years Lounge and bar BG Ice Cream, LLC. 116 420 0.75% $525.00 $6,300.00 3 Years Ice Cream Shop Ama Beauty Supply 103 450 0.80% $562.50 $6,750.00 3 Years Beauty Supply Store La Cuisine Parfaite 121 445 0.79% $556.25 $6,675.00 3 Years Restaurant - Ivorian cuisine 201, 202 495 0.88% $618.75 $7,425.00 3 Years Fashion and Tailoring Congolese Restaurant 118 445 0.79% $556.25 $6,675.00 3 Years Ethnic restaurant - Congolese Congolese Retail 203 340 0.60% $425.00 $5,100.00 3 Years Retail - Shoes, Clothes etc Senaki Designs 204 270 0.48% $337.50 $4,050.00 3 Years GWP Wireless 104 875 1.55% $1,093.75 $13,125.00 3 Years Malian Customs 131 38 0.07% $46.88 $562.50 3 Years Trend of Africa 115 420 0.75% $525.00 $6,300.00 3 Years African and European Clothing and Music CDs Girmai B. Gebrehiwet Restaurant 117 445 0.79% $556.25 $6,675.00 3 Years Restaurant with Sudan, Somalia, Morocco, Eritrea cuisines $32,165.63 Monique Fashion Total Subtenant Lease (To Date) 25,733 45.72% Total Rentable Space Vacant (Subtenancy) 30,549 54.28% Grand Total 56,281 100.00% Restaurant - West African food African art and design Ethnic restaurant - Ethiopian IT Shop Wireless Sales & Services and Barbar Shop Malian clothing $385,987.50 Executive Investment Summary for 10180 E. Colfax, LLC Page 4 of 21 INVESTMENT HIGHLIGHTS • Tenant Now In Place: The 15-year Master Tenant lease is for 100% of the Property, providing Northstar the option to hold for a long-term, cash flow investment property. Immediate value was added by securing this lease prior to closing. Additionally, there is a long-term cell tower lease with AT&T. • Easy Access: Located approximately 6 miles to the east of downtown Denver, the Property offers direct access to the Central Business District via Colfax Avenue. It is located 2.5 miles from Interstate 225 (the north-south connector from Aurora to the Denver Tech Center), and under 3 miles from the state’s main west-east Interstate 70. The location is approximately 18 miles southwest from Denver International Airport, and 11 miles northeast from Denver Tech Center. Central Business, Denver, Colorado MARKET DESCRIPTION The Property is located in the City of Aurora, and is ideally situated approximately six miles to the east of downtown Denver and the Central Business District. As of 1st Quarter 2014, the vacancy rate for Retail in the Aurora submarket was 5.4%, which was slightly lower the Metro Denver overall vacancy rate for Retail of 6.0% (source: Cassidy Turley Metro Denver Retail Market Snapshot 1Q2014). The Aurora and Metro Denver vacancy has been consistently decreasing as the economy continues to improve. The City of Aurora is one of the most expansive cities in the state, and spans over the three counties of Arapahoe, Adams and Douglas. Aurora covers ±154 square miles and this vast area of the city covers many types of demographics and submarkets within its boundaries. Original Aurora on Colfax Avenue Executive Investment Summary for 10180 E. Colfax, LLC Page 5 of 21 ENVIRONMENTAL INVESTIGATION A Phase I Environmental Site Assessment was conducted during Northstar’s inspection period, and no environmentally hazardous conditions were identified at the Property. Copies of this report can be made available upon request. TENANT IMPROVEMENTS An amount of $1,116,620 ($20.00/SF) has been allocated for Tenant Improvements for the Master Lease at the Property. VALUATION The 15-year Master Lease for ±56,281 SF creates an income of $418,733 (at the base rental rate of $7.50/SF/Year NNN), covers 100% of operating expenses, and has personal guaranties from five (5) of the founders. The AT&T cell tower lease for 450 SF adds an annual income of $26,594, for a total annual income of $445,327. Northstar estimates an exit value of $5,239,141 based on an 8.5% Capitalization Rate. EQUITY REQUIREMENT Based on this valuation of $5,239,141, Northstar has already secured financing and seeks a capital partner for the remaining equity amount of $1,500,000. Executive Investment Summary for 10180 E. Colfax, LLC Page 6 of 21 PROPERTY DETAILS Property Location: 10180 E. Colfax Avenue, Aurora, CO 80010 Building Size: 1st Floor 2nd Floor 3rd & 4th Floor Total Area Site Size: Property Information: Property Information: Lot 1 Lot 2 Total ±26,504 SF ±14,994 SF ±14,783 SF ±56,281 SF ± 0.64 Acres (±27,747 SF) ± 0.39 Acres (±17,236 SF) ±1.03 Acres (±44,983 SF) Showroom Retail/Mezzanine Unfinished Improved Parking County: Arapahoe Zoning: B2 (downtown business) Flood Plain: Zone X (no flood insurance required) Year of Construction: 1952, renovated in 2005 Property Type: Retail On-Site Parking Spaces: 30 On-Site Handicap-Designated Spaces: 2 Parking Garage/Carports: None Number of Floors/Stories: 3-story, plus mechanical penthouse Building Construction: Masonry Superstructure: CMU, brick pilasters and concrete (assumed) Foundation Type: Spread footing and slab-on-grade (assumed) Exterior Facade(s): Painted CMU and EIFS Roof(s): Modified bitumen with smooth cap sheet and gravel surfaced builtup Heating: Steam boiler that provides heat to a loop for a large air handler, baseboard and unit heaters Air-conditioning: Two Trane chillers/cooling tower and air handler Hot Water: Central domestic water heater Electrical Wiring: Copper Plumbing: Copper and Cast Iron Elevators: One hydraulic freight Fire Sprinkler: None Property Status: 100% leased with Tenant in-place on a 15-year Master Lease. Additionally, there was a long-term cell tower lease with AT&T already in place. Replacement Cost Value: Northstar estimates the Replacement Cost Value to be $150/SF to $175/SF ($8,442,150 to $9,849,175). Investment Strategy: AfrikMall, Inc. leases 100% of the Property under a Master Lease with personal guaranties from five (5) of the founders. The build out for this Master Tenant will soon be underway and when finished, AfrikMall will lease spaces to other tenants, which will create jobs, opportunity and African cultural awareness in the area. Currently, 23 tenant leases are in place. Executive Investment Summary for 10180 E. Colfax, LLC Page 7 of 21 Income: The Master Lease for ±56,281 SF creates an annual income of $418,733 (at the base rental rate of $7.50/SF), and has a $52,806.82 security deposit. Rate/SF/Year (NNN) Estimated Exit Value: Equity Request: Annual Rent Monthly Rent Term Dates $ 7.50 $ 418,732.50 $ 34,894.38 6/1/14 - 5/31/15 $ 7.73 $ 431,573.63 $ 35,964.47 6/1/15 - 5/31/16 $ 7.96 $ 444,414.76 $ 37,034.56 6/1/16 - 5/31/17 $ 8.20 $ 457,814.20 $ 38,151.18 6/1/17 - 5/31/18 $ 8.45 $ 471,771.95 $ 39,314.33 6/1/18 - 5/31/19 $ 8.70 $ 485,729.70 $ 40,477.48 6/1/19 - 5/31/20 $ 8.96 $ 500,245.76 $ 41,687.15 6/1/20 - 5/31/21 $ 9.23 $ 515,320.13 $ 42,943.34 6/1/21 - 5/31/22 $ 9.51 $ 530,952.81 $ 44,246.07 6/1/22 - 5/31/23 $ 9.80 $ 547,143.80 $ 45,595.32 6/1/23 - 5/31/24 $ 10.09 $ 563,334.79 $ 46,944.57 6/1/24 - 5/31/25 $ 10.39 $ 580,084.09 $ 48,340.34 6/1/25 - 5/31/26 $ 10.70 $ 597,391.70 $ 49,782.64 6/1/26 - 5/31/27 $ 11.02 $ 615,257.62 $ 51,271.47 6/1/27 - 5/31/28 $ 11.35 $ 633,681.85 $ 52,806.82 6/1/28 - 5/31/29 Northstar estimates an exit value of $5,239,141 based on an 8.5% Capitalization Rate. $1,500,000 Executive Investment Summary for 10180 E. Colfax, LLC Page 8 of 21 FLOOR PLANS The following preliminary floor plans depict the Tenant’s future use to provide rental office, shops/restaurant, and event/cultural space. 1st Floor Retail Shops and Restaurant Space 2nd Floor Event and Cultural Space Executive Investment Summary for 10180 E. Colfax, LLC Page 9 of 21 3rd Floor Office (Not pictured: Upper Mechanical Penthouse) Meeting and Event Space Meeting spaces refer to rental spaces for parties, weddings, christening, conferences, etc. This also includes a catering service operated by private outfit(s), with direct oversight by Tenant, which will be required to meet all city, state and federal regulations. Retail Shops and Restaurant Space The Tenant will rent out spaces that can be used by vendors and other activities such as office, food service, etc. All vendors will adopt a building-wide set of standards that ensure good customer service, cleanliness and attractive surroundings. In addition, vendors will be required to meet all city, state and federal regulations. Entertainment and Cultural Space The Tenant will work to maintain a resident (cultural and contemporary) entertainment group. This group will provide seasonal and/or regular entertainment to audiences. Operations involving entertainment will be maintained directly by the AfrikMall, Inc. management. Executive Investment Summary for 10180 E. Colfax, LLC Page 10 of 21 PROPERTY PHOTOS Executive Investment Summary for 10180 E. Colfax, LLC Page 11 of 21 Executive Investment Summary for 10180 E. Colfax, LLC Page 12 of 21 Executive Investment Summary for 10180 E. Colfax, LLC Page 13 of 21 Executive Investment Summary for 10180 E. Colfax, LLC Page 14 of 21 PROPERTY LOCATION CBD SITE Highland’s Ranch Regional Map View of Property SITE Regional Map View of Property Neighborhood Map View of Property Executive Investment Summary for 10180 E. Colfax, LLC Page 15 of 21 LLoott 11 ((IIm mpprroovveedd)) ±±00..6644 A Accrreess LLoott 22 ((P Paarrkkiinngg)) ±±00..3399 A Accrreess Aerial View of Property S SIITTE E RTD Bus Stops within 0.2 Miles of Property Executive Investment Summary for 10180 E. Colfax, LLC Page 16 of 21 SITE Regional Transportation District (RTD) Expansion Plan Executive Investment Summary for 10180 E. Colfax, LLC Page 17 of 21 SITE PLAN Executive Investment Summary for 10180 E. Colfax, LLC Page 18 of 21 BIOGRAPHY R. Brian Watson, Founder and CEO Mr. R. Brian Watson is the Founder and CEO of Northstar Commercial Partners. Northstar Commercial Partners is a privately held commercial real estate investment company that was founded in 2000. Northstar acquires and operates attractive commercial real estate opportunities throughout the United States. The company authors specific investment strategies for each acquisition, and orchestrates all aspects of the investment from initial concept through completion. The investor base consists of individuals and institutions with a combined buying power of several billion dollars. Northstar has purchased assets from many national companies including Allstate, Prudential, John Hancock, Shell Oil Co., Columbia House, Ball Corporation, Loomis, Cargill, and a national portfolio of real estate from The Benjamin Moore Paint Co. After graduating from Olathe High School on the Western Slope of Colorado, Mr. Watson received a Bachelor of Science degree in Real Estate from the University of Colorado at Boulder. Mr. Watson then joined Cushman & Wakefield of Colorado, Inc. (C&W), an international commercial real estate firm. During his seven-year tenure at this firm, Mr. Watson had the distinction of being the youngest broker in company history to qualify for a Directorship title, which was a direct result of his consistent high production and comprehensive understanding of commercial real estate. Though Mr. Watson performed tenant representation, he primarily focused on landlord representation for the majority of his career at C&W. He represented clients such as Lend Lease Real Estate, CarrAmerica Realty LP, P&O Investments/Denver Technological Center, Mission Viejo Companies, Shea Properties, Terrabrook, ERE/Yarmouth and acted as agent for two major Colorado office parks, Highlands Ranch and Stonegate. Mr. Watson also received C&W's prestigious Service Excellence Award for his superior ability to handle complex, high value transactions. Mr. Watson's extensive education and experience in the real estate industry has been instrumental to the success of Northstar Commercial Partners. Mr. Watson currently serves as a Board Member of the Colorado Commission on Family Medicine for the 6th Congressional District of Colorado appointed by the Governor of Colorado; a Leadership Council Member for the Colorado NFIB (National Federation of Independent Business); an A-List Member of CXO (a private collaborative executive organization of influence that connects C-level executives and owners of companies throughout the world); and is Founder and CEO of the Opportunity Coalition, which promotes collaboration among the people of Colorado and new business startups to create quality jobs throughout Colorado. Mr. Watson has also served as a Board Member and active supporter of TAPS (the Tragedy Assistance Program for Survivors) for those who have lost loved ones in U.S. Military Service; the Chairman of the Finance Committee for the Colorado Republican Party; a Member of the Board of Governors and President's Council for Opportunity International (one of the world's largest microfinance lenders providing loans to individual entrepreneurs in the developing world); an Executive Committee Member of the International Board of Directors for Mercy Ships (the world's largest non-profit medical hospital on a traveling ship, which performs over 60,000 annual life changing surgeries for free in Africa); a Republican delegate for his County, Congressional, and State political assemblies; a Board Member and President of Brokers Benefiting Kids (a Denver based non-profit that raises financial support for multiple children's charities in Colorado); a Member of the Metro Denver Executive Club; a Member of the Legacy Political organization; a Member of the Citywide Banks Advisory Board; a Member of the Republican Business Advisory Council; Chairman of the Advisory Board for the Alliance for Choice in Education (ACE Scholarships - a Denver based non-profit that provides educational scholarships and school choice programs for low-income kids grades K-12); Chairman of The Board of Directors and a mentor for Save Our Youth (a Denver-based inner city youth mentoring program); and a Member and President of the Downtowner's Toastmasters Club. Mr. Watson is a supporter of his local Christian church, resides in Greenwood Village, Colorado with his wife and two children, and has another child in college. He is passionate about creating opportunity for all citizens of Colorado and the United States, and works to enhance the business, political, and educational environments in each. Executive Investment Summary for 10180 E. Colfax, LLC Page 19 of 21 DEAL STRUCTURE Distributions of Cash Flows from Operations Each member of the LLC shall receive their proportional share of distributions from cash flows from operations until such time as they have received an 8% per annum cumulative non-compounded rate of return on their outstanding Adjusted Capital Contributions. Thereafter, each member shall receive 70% of their proportional interest of cash flows from operations, sales or refinancing proceeds, until such time as they receive a 25% cumulative non-compounded return on their adjusted capital. Thereafter, each member shall receive 50% of their proportional interest for the remainder of the investment. Distributions of Cash Flows from Sales or Refinancing Each member of the LLC shall receive their proportional share of distributions from cash flows from sales and/or refinancing until such time as they have received an 8% per annum cumulative non-compounded rate of return on their outstanding Adjusted Capital Contributions. Thereafter each member shall receive their proportional share of cash available equal to 100% of their original capital investment. Thereafter, each member shall receive 70% of their proportional interest of cash flows from operations, sales or refinancing proceeds, until such time as they receive a 25% cumulative non-compounded return on their adjusted capital. Thereafter, each member shall receive 50% of their proportional interest for the remainder of the investment. NOTICES NOTICE REGARDING FORWARD-LOOKING STATEMENTS This Request for Financing contains forward-looking statements and forecasts concerning the Company’s or management’s plans, intentions, strategies, expectations, predictions and financial forecasts concerning the Company’s future activities and results of operations and other future events or conditions. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “could,” “estimate,” “might,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. Sections of this Request for Financing containing such statements include, but are not limited to the Business Plan and the Financial Statements. The Company’s actual results or activities or actual events or conditions could differ materially from those forecasted by the Company, due to a variety of factors, some of which are beyond the control of the Company. Forecasts concerning the Company’s future results of operations and expansion plans are based on a number of assumptions and estimates made by management of the Company. These estimates and assumptions are believed by management to be reasonable, but are uncertain and unpredictable. To the extent that actual events differ materially from management’s assumptions and estimates, actual results will differ from those forecasted. The investment returns outlined on the previous pages of this Request for Financing are in no way guaranteed by Northstar Commercial Partners, 10180 E. Colfax, LLC, or any affiliate or representative thereof. NOTICE TO INVESTORS AN INVESTMENT IN THE OFFERED SECURITIES INVOLVES A HIGH DEGREE OF RISK. THE OFFERED SECURITIES HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAW. NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE REGULATORY AUTHORITY PASSED Executive Investment Summary for 10180 E. Colfax, LLC Page 20 of 21 UPON THE ACCURACY OR ADEQUACY OF THIS EXECUTIVE SUMMARY MEMORANDUM OR ENDORSED THE MERITS OF THE OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. SECURITIES PURCHASED IN THIS OFFERING WILL BE SUBJECT TO CERTAIN RESTRICTIONS ON TRANSFER, AS SET FORTH IN THE OPERATING AGREEMENT OF THE COMPANY. NOTICE TO COLORADO INVESTORS THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE COLORADO SECURITIES ACT AND MAY NOT BE SOLD WITHOUT REGISTRATION UNDER THAT ACT OR EXEMPTION THEREFROM. Executive Investment Summary for 10180 E. Colfax, LLC Page 21 of 21