ROCHESTER INSTITUTE OF TECHNOLOGY

advertisement

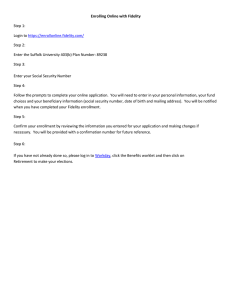

ROCHESTER INSTITUTE OF TECHNOLOGY RIT Retirement Savings Plan Fidelity is the Master Administrator for the RIT Retirement Savings Plan. This means that you have the streamlined ability to enroll in the Plan and make changes, whether you contribute to Fidelity, TIAA-CREF, or both. To view and/or change your contribution amount, and/or change your recordkeeper election, 1. Log in at www.fidelity.com/atwork. You can set up a login if you do not have one by clicking on Register Now on the left side of the page and follow the prompts. 2. Once logged in, click on the drop down arrow at the right next to Quick Links and Choose Contribution Amount. 3. There are three choices a. Contribution Amount (to view and change your contribution) b. Annual Increase Program (to enroll or change participation in this program) c. Retirement Providers (to view and change the allocation between the two recordkeepers, Fidelity and TIAA-CREF) 4. If you make any changes, be sure to submit the changes. If you prefer, you can call Fidelity at 1-800-343-0860/V and 1-800-259-9734/TTY. The Plan investments are in four tiers as outlined below; you may invest in as many tiers as you like (see the fund list on the reverse side). For Tiers 1, 2, and 4, you can make your election with Fidelity; for Tier 3, make your election with TIAA-CREF at www.tiaacref.org/rit or by phone at 1-800-842-2776/V 1-800-842-2755/TTY. The RIT Retirement Plan Investment Committee monitors investment performance and fees for Tiers 1, 2, and 3; it does NOT do this review for Tier 4. Tier 1 (Fidelity is the recordkeeper) Series of Vanguard Target Retirement Date funds Designed for retirement around the date in the fund’s title Professionally managed funds Investment allocation becomes more conservative as people move closer to retirement Plan’s default is Tier 1 fund closest to participant’s 65th birthday, or Vanguard Target Retirement Income Fund for those over age 65 Tier 2 (Fidelity is the recordkeeper) 15 highly rated mutual funds Represent key asset classes to help you achieve a diversified portfolio Passive/index vs. actively managed funds Tier 3 (TIAA-CREF is the recordkeeper) Insurance contracts issued by an insurance company Similar to mutual funds, accumulate money until retirement With TIAA-CREF annuities, you can simply convert your annuity accounts to lifetime income vs. buying an annuity from another source Tier 4 (Fidelity is the recordkeeper) Fidelity BrokerageLink Over 9,500 mutual funds from many different fund families For experienced investors who: Have knowledge and expertise to research and evaluate large number of funds Want to take personal responsibility for monitoring performance and fees of elected funds Prefers greater choice than available under Tiers 1, 2 and 3 Important: May have additional fees for investing in BrokerageLink 6/12/2014