Section 4. IC Technology and Packaging Trends

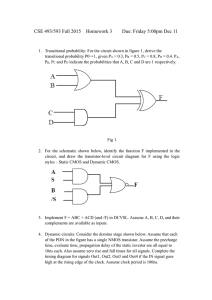

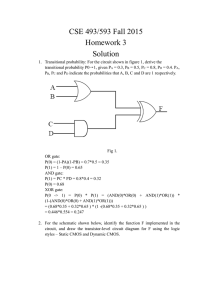

advertisement