Chapter 18 of the Main Board Listing Rules on Mineral

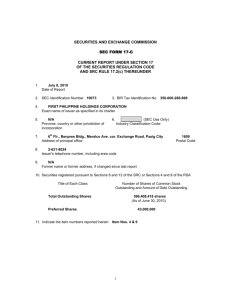

advertisement