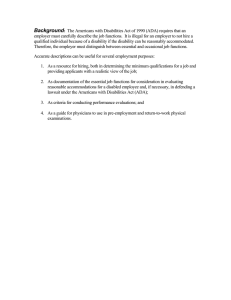

group benefit plan

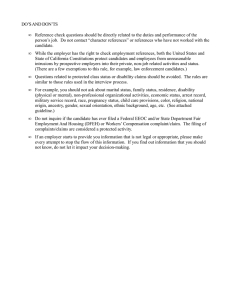

advertisement