is the customer being served?

advertisement

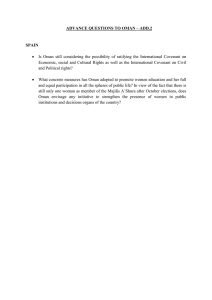

COVER STORY Is the customer being served? There is near unanimity that customer service standards in Oman need drastic improvement. While the Public Authority for Consumer Protection has stepped in to address grievances, major issues still persist. Oommen John P reports 36 June 2015 C ustomer expectations are certainly rising in the Sultanate and that is a good thing – it drives the market to innovate and improve. But does Oman have a strong customer service culture or are there gaps that need to be addressed? Has the entry of new brands across automotive, retail, banking, food, travel and hospitality sectors raised the stakes for local brands and businesses? How often has it been that you have left a showroom impressed with the service of the staff, come back home and wondered, why on earth you made a purchase? Such instances are few and rare. From experiencing poor customer service to the quality of service, consumers are unanimous in their view that the service standards in the Sultanate need to improve by a notch or two. Jose Chacko, general manager and CEO, Al Osool Al Arabia says, “I feel customer service standards in Oman need a lot of improvement. In many sectors, it is not up to expectations. It’s basically the attitude of people involved rather than the company or department. ” Education and training is necessary for people in customer service. After the introduction of consumer protection initiative, things are improving, but it is still a long way to go, he adds. Tonny George Alexander, CEO, Oman UAE Exchange, corroborates saying, “Customer service has to improve a lot in Oman with more focus on service. In many cases, it boils down to the person who is attending to you – some of them are exceptionally good and others are not. Irrespective of the person, organisations should set standards and monitor them frequently to maintain these levels. This can be achieved through constant training of the frontline staff and upgrading the standards. Customers should have a contact point to report on service related concerns which Evolution of the most important consumer rights in recent years Law of 2002 Law of 2014 The right to obtain correct information about goods and services (Maintained the same right) The right to secure health and safety of a consumer on purchase of any product or service (Maintained the same right) The right to receive compensation for any damage which a consumer may sustain due to purchase or use of any product or service (Maintained the same right) The right to freely choose a good or a service (Maintained the same right) The right to get warranty for the products purchased (Maintained the same right) The right to replace an item or return the same or retrieve the price within 10 days if it is defective This period has been extended to 15 days (Not included in the Law) The entitlement of moral right of respect to religious values, customs and traditions when the consumer is provided by any commodity or receives any service (Not included in the Law) The right to represent consumer’s interests when preparing the consumer protection policies (Not included in the Law) The right to be protected from misleading advertisements Source: PACP are to be prominently displayed at customer reception areas. Customers also have a role to play by demanding superior service and should not compromise on whatever they get. So a paradigm shift should happen.” Suliman Al Azri, commercial consultant, Middle East, ATKINS OMAN, who bought a top-end car recently says, “Customer service in Oman needs to improve drastically. Companies need to communicate with the customer to ensure loyalty to the brand. Mere selling of a car to a customer should not be end of it; companies should have adequate after-sales support.” Quality Matters Customer service is as much an art as it is a skill. Long-term client satisfaction is often sacrificed in favour of other business goals like sales targets and profit margins. This can be seen in every industry and across every segment from healthcare to hospitality, banking, retail, automobile, whether large-scale or small. Says Baby Sam Samuel, general manager, Intertech, “In the digital age where it takes just a click to vent out one’s dissatisfaction over a product or service, poor business service can leave a permanent online mark. Innovation and excellence in business is the need of the hour, not only as parameters of service quality but as benchmarks of this nation’s progress. While social media, reputation management and customer relationship management (CRM) do have a role to play in the way businesses interact with and manage COVER STORY of training and general apathy is something that needs to be explored.” However, in the recent past, some international brands have made it mandatory to get a feedback form filled by customers. This has led to marginal improvement and hopefully more is on the way. She adds, “On the other hand, there have been incidents where I have been pleasantly surprised by the enthusiasm and knowledge of the sales person; but those are still rare. With more avenues opening up and still more on the anvil, hopefully we will witness a reverse scenario.” Multiple safeguards Omar Faisal Al-Jahadmi, Deputy Chairman for Consumer Services and Market Monitoring, PACP their patrons, ultimately customer service works best when it is an attitude rather than a department.” Has quality of service suffered? Answering this question, P Pranadeesh, manager, purchasing- logistics and spares at Technique, narrates a persoanl expereince, “We bought an external hard drive from a reputed electronic store in Oman, which had a one-year warranty. All the vital data was stored on the hard drive, so that we could retrieve it any time. But after a few months, the external hard drive crashed and stopped working. We approached the store and handed over the hard drive to carry out the necessary repairs. After two weeks, when we approached the store, they informed that they cannot repair or retrieve the data stored in it. Three weeks later, they replaced the external hard drive but without any data. At the end of the day, it’s the customer, who has to suffer 38 June 2015 for buying a branded product,” However, over a period of time, customer service is showing signs of improvement in Oman. Now customers are aware of their rights, when they buy products. Most of the reputed companies have a separate division to take care of customer complaints. Since the Public Authority for Consumer Protection (PACP) has been set up, companies have become alert. “Customer service comes into prominence when there is competition. While some staff would be friendly, they are not really equipped with answers that you may pose,” says Kavita Pandit, PR and communications director, Creative Communications Advertising and Marketing. “Questions related to when the stocks will be replenished or the USP of the product are either met with a shrug or a generic ‘soon’. Whether this is due to high turnover of employees, lack Since the PACP has been set up, there has been a number of complaints registered about electronic goods, commodities, food items and faults in automobiles due to fake spare parts. The laws introduced by the government has enabled to bring awareness about the rights of the customer on the one hand and on the other hand, ensured that the service provider deals with the customer in a fair manner. One of the significant achievements of this authority is the speedy disposal of complaints and the swift action in passing strictures against the erring parties. More often, the service providers have borne the brunt of stern directives whenever consumer rights were violated or not reckoned properly. Says Omar Faisal Al-Jahadmi, deputy chairman for consumer services and market monitoring, PACP, “A majority of complaints that PACP receives are related to price hike, difference between the shelf price and the price at the cash counter, expiry of certain goods and after sale services such as vehicles, mobile phones, electronic and mechanical equipments. We seek to resolve this issue at PACP premises itself but if it does not, the case is referred to public prosecution for legal action against the violator.” (See the full interview on page 44) According to PACP annual report for the year 2013, the total number of complaints, reports and registered violations in all directorates of PACP reached 37408 during 2013. Companies were reined in for their non-conformance with consumer protection laws and regulations. Said Al Shahry, managing partner, Said Al Shahry and Partners (SASLO), a law firm providing legal services to the local and international business community in Oman since 1992 says, “With the issuance of the new consumer protection law vide Royal Decree No. 66/2014, the consumer protection –oriented legislation and policy entered into a new phase which is characterised by the development of more stringent protective measures, granting additional rights to the consumer, increasing obligations of the suppliers and expanding the powers of PACP.” The Competition Protection and Monopoly Prevention Law (Royal Decree No. 67/2014), has realistic direct implications on consumer rights. The important development in the protection of consumer rights also lies in the administrative sanctions which have fallen under the prerogatives of PACP in addition to the most stringent criminal penalties for violating the provisions of the new law. Developments in the consumer protection legislation over the recent years, which are not only confined to the rights, but also include other legal aspects such as the expansion of the concept of commodity and service to include free services, significantly and directly affects the quality, he avers. Additionally, it has directly affected the practices of suppliers and dealers due to the strict deterrent measures introduced by the law. While the regulatory body has ensured that customers’ rights are protected, a number of companies have improved customer service standards on their own. Says Greg Young, CEO of Said Al Shahry, Managing Partner, SASLO Ooredoo Oman, “Customer Experience Management (CEM) is central to the working culture of Ooredoo. We believe that while people may come to us for our market leading and competitively priced products and services, they also come and remain loyal to us, because we offer an unparalleled customer experience that cannot be found elsewhere.” For Ooredoo, customers are not simply a business prospect, they are a part of the growing Ooredoo family. Consequently, CEM comprises a priority for the company as the medium of our customer engagement. “We extend our engagement beyond the normal channels to truly understand how our customers feel, and more importantly why they feel the way they do. Our focus is on getting to the very root of what it is that our customers want. We have adopted best practices from our globally aligned network, and introduced a customer experience transformation programme, complemented by an improved customer service platform. We set a new benchmark last year as the first in the region to implement ResponseTek’s CEM software into our customer service infrastructure,” he says. The mode of mass feedback through world-class software gave Ooredoo invaluable insights into market trends, and in real time, allowing it to measure its level of consistency in service, and the evaluation of product impact in order to enrich the customer experience, a key enabler of understanding COVER STORY the needs and desires of customers. Banks too have taken earnest steps to improve customer service. “Bank Muscat is at the forefront of customer service excellence and strives to continually deliver high quality service. The bank deems service excellence, aligning customer expectations of both product and service as a vital means of achieving and surpassing customer satisfaction. All Bank Muscat products and services have evolved over the years in line with specific customer requirements, fulfilling their financial dreams and aspirations,” says Said Al Badai, DGM – branches, Bank Muscat. Bank Muscat has adopted a new line of customer care programme to ensure that the banking partner in Oman is always available to listen and more importantly respond to customer suggestions and needs in a more proactive way, rather than respond only to service-related incidents. Bank Muscat helps customers understand its systems in order to facilitate smooth transactions. This is done by constant follow-up and regular feedback on how services can be improved. The bank recognises that the essence of good customer service is forming a relationship that individual customers are happy to pursue. The bank has a feedback management system (FMS) for customers to register complaints, feedback or compliments on the bank’s products and services. The FMS is Said Al Badai, DGM – Branches, Bank Muscat linked to the bank’s website, branches and call centre wherein customers can get in touch with the customer service department. Focus group meetings involving customers and branch staff are organised by the customer service department in all regions to obtain feedback and suggestions from customers for improving services. To benchmark customer service, Bank Muscat has appointed a Cyprusbased consultancy firm to do ‘mystery shopper’ exercise. As part of this, mystery shoppers visit all Bank Muscat branches at least three times in a quarter and also competitor banks. Without the knowledge of customer care employees, mystery shoppers evaluate the customer care processes followed in the bank and staff response to customers. Aimed at encouraging service excellence, the top three branches are awarded every quarter, says Badai. Greg Young, CEO, Ooredoo 40 June 2015 David Swain, general manager – passenger cars, automotive - Zawawi Trading Company, the authorised general distributor of Mercedes-Benz in the Sultanate says, “Customers who buy a Mercedes-Benz expect MercedesBenz Class service throughout their relationship with us – that is something we feel strongly about and is at the heart of everything we do. Our exceptional service is central to the Mercedes-Benz 2020 Vision of Best Customer Service - a rigorous philosophy of excellence in customer care that is part of our DNA. Our vision of best customer service applies throughout our brand – from passenger cars and trucks to buses, the showroom and product innovation to finance options and communication. We want to be competitive for the long term and prioritising the customer is key to this. While we have achieved a great deal as far as customer service is concerned, we are aiming for more. We are determined to react even more effectively, quickly, and flexibly to the evolving needs of our customers – at all points of contact and across all channels, from the showroom and service center to online.” Connecting with customers is the new mantra for some companies. Says Rajive Ahuja, head, corporate communications, Khimji Ramdas, “With a clear focus on enhancing customer care, KR Group took a major step towards connecting better with its customers. Improving customer experience has always been at the heart of all the services we offer. The group started its Call Centre operations In June 2010. Five years on, the Tollfree helpline number today serves the people of Oman with accurate information on KR, its brands, its products and services, its personnel and promotions. Professionally adept customer care officers are trained to appraise customers with the latest at KR, helping them get what they need in that first contact.” Engaging the customers is Jawad Sultan Group’s forte. P Chandrasekr, group David Swain, General Manager – Passenger Cars, Automotive - Zawawi Trading Company general manager of the company says, “Our group has been in the forefront of customer service with stellar presence in retailing of luxury brands, mass entertainment and lately in food services. In all these businesses, we engage with the customers directly and hence, are able to decipher their needs and expectations. Mechanisms are already in place to redress any complaint and address emerging ones. Towards this end, we have introduced a constant customer engagement initiative so that we are no longer caught in the cobweb of a pure transactional relationship alone.” Consumer Rights Have the consumer protection laws of Public Authority for Consumer Protection helped in improving customer service? “Buying a vehicle is a big financial commitment and one of the biggest purchases anyone will ever make, and while customers do their research and carefully consider their options, an extra level of protection is unquestionably welcome. As a time-honoured and trusted brand, for Mercedes-Benz it is business as usual. “We have long conformed to the most stringent international standards – our pursuit of excellence in customer service and our customer-centric philosophy is on-going,” says Swain. Chandrasekr adds, “As the laws have been promulgated by way of Royal Decree only in 2011, it is quite early to judge the efficacy of the consumer protection laws that are in place and its regulatory effectiveness. However, there is complete unanimity with regard to its COVER STORY investment in social media, we keep in-touch with our customers’ thoughts and feelings and identify trends.” Says Badai, “Social media has provided another channel to communicate with customers, receive customer suggestions and feedback which eventually leads to better customer engagement. The active presence on social media channels has made Bank Muscat more approachable, personal, accountable and more closely engaged with the community. Social media has provided an engagement channel for the bank to interact with customers, receive their feedback and suggestions and provide information about the bank. In short, the reputation of the bank has been further enhanced with its accessibility on social media.” P Chandrasekr, Group General Manager, Jawad Sultan Group continued existence and successful performance. Adoption of a more balanced approach while addressing customer grievances, will go a long way and this according to me will usher in a more cooperative climate.” Social media usage Companies are increasing turning to the social media to improve customer service. Says Young, “A common and widely known paradigm in customer service suggests that a customer will share a positive brand experience with one person on average, whereas a negative experience will likely be communicated to around 10 people, if not more. In today’s globalised world this no longer applies, especially given the presence and reach of social media platforms, blogs and apps in everyday life; customers now share their experiences with an 42 June 2015 extraordinary number of people from around the world instantaneously.” Social media is a valuable means of direct contact with our customers and we continually look to advance our existing lines of communication in this regard, so that our customers can connect with us at their convenience, using mediums that they are familiar with and prefer to use. He adds, “One good example of our passion towards enhancing our relationship with customers is Ooredoo’s social media platforms, which have collectively enabled us to deliver our vibrant and impactful brand to new and existing customers. On Twitter, we now have over 170,000 followers, and across our Instagram, Facebook and YouTube accounts, Ooredoo now ranks amongst the top five social media brands in the Sultanate. Thanks largely to our The bank’s social media centre and customer service department monitor every customer post on all channels and responds to queries when required. This has helped in creating a fine net through which no customer post will be lost, ignored or forgotten. The social media customer engagement service has helped Bank Muscat to reinforce its leadership position in the banking sector. Presently, Bank Muscat is active across all the big five social media channels in Oman (Facebook, Twitter, Instagram, LinkedIn, Google+), and it is the only bank to actively use Snapchat to highlight the bank’s special events and activities, he adds. “Best Customer Experience is everything to Mercedes-Benz - and this absolutely includes social media. For us, it is opportunity to connect with our customers and fans as it’s a chance for them to experience our brand - and we do everything we possibly can to make sure our interactions reflect our culture of optimum customer care,” says Swain. Social media isn’t just about posting pictures and showcasing offers – it is an ecosystem that offers an incredible chance to engage and build direct relationships with current and future Mercedes-Benz drivers, to share with them, listen to them, respond to them and learn from them. Mercedes-Benz takes pride in being an innovator and having embraced social media early on. In fact, globally, Mercedes-Benz is the most popular and successful automobile brand on social media - not just in terms of size but also growth and engagement metrics. For example, the brand receives over two million likes, shares and comments every month on its international Facebook page. In Oman, we have been growing our fan and followers base in line with our corporate identity, working towards becoming one of the most popular social media brands in the Sultanate as well. Undeniably, social media has been key for us in reaching out to the younger market - the digital natives to whom online experiences are as important as in-person experiences – and this is strongly reflected in our increasing volume of sales in this segment, he says. “Being a socially responsible multinational business house in Oman, the idea of reaching out to the community at large and listening to customers is imperative to our business goals. Our endeavour to connect with customers in the Sultanate and people outside Oman took shape in 2007, with the setting up of KR Bright Sparks – Khimji Blog, a first of its kind social media initiative in the GCC region. Khimji Blog became the first corporate blog in Oman to connect the external world with KR. We constantly engage with our blog patrons to resolve their queries, generating leads for KR divisions and also connecting people with each other,” Rajive says. Social media has a far reaching impact, says Chandrasekr. Extensive and smart usage of the social media throws better insight into customer behaviour, enables better quality new hires, improved office productivity with internal networks thus, it will bring about a ROI that can be measurable. Rajive Ahuja, Head, Corporate Communications, Khimji Ramdas Has the region achieved all that? It’s too early to say since, in recent times, this has emerged as one of the most dynamic medium. As a group, we are quite satisfied in using social media for marketing and analysing customer behavioral pattern and thereafter devising suitable strategies for better deliverables for greater customer acceptance. In Oman, we have introduced a robust loyalty programme in our cinema operations and are constantly measuring its effectiveness and delivery. In Capital Store, we are analysing the introduction of extensive customer engagement. More such measures are planned in our Hospitality segment too. Social media is here to stay and in fact, the rules of engagement is completely rewritten in today’s times. A robust and comprehensive legal framework for consumers has un- doubtedly helped improve customer service and also increased consumer confidence and made the market more buoyant. Organisations in Oman have been facing a vigilant customer, who is not only well informed but also quite aware of the rights. HE Eng Ali bin Masoud bin Ali al Sunaidy, Minister of Commerce and Industry put it in the right perspective at the customer service celebrations in Oman, where he said, “Customer service will play an integral role in developing Oman’s economy.” Roy Hollister Williams, the best-selling author and marketing consultant known for his Wizard of Oz Trilogy says thus: “The first step in exceeding customer expectations is to know those expectations.” For every organisation, the simple mantra is “if you do not engage with your customers then, you are sure to be disengaged.” Discover interactive con COVER STORY – INTERVIEW The Public Authority for Consumer Protection is implementing laws and regulations to protect the rights of customers and ensure that the market is free of fraud and improper business practices, says Omar Faisal Al-Jahadmi, its Deputy Chairman for Consumer Services and Market Monitoring in an interview with Oommen John P CUSTOMER FOCUSSED 44 June 2015 Do fr Download the free OMAR AR App Scan this image Discover interactive content Why was the Public Authority for Consumer Protection (PACP) set up? The PACP was established to ensure social justice for consumers and protect their rights to have high quality products that meet specifications at reasonable and affordable prices. The PACP also strives to ensure that consumers are not manipulated by arbitrary terms and conditions. Further, PACP resolves disputes among service providers and consumers and deals with all types of fraud. How has PACP helped in improving the quality of products and services? Since its inception, PACP has sought to increase public awareness of consumers by initiating a number of awareness programmes through radio, TV and social media platforms. A study has been conducted to analyse the decisions that regularise the activities of PACP and ensure enforcement of the Consumer Protection Law promulgated by the Royal Decree No 81/2002. Based on the outcome of the study, several decisions were made to regularise the market practices. The new law for consumer protection issued by the Royal Decree No 66/2014 has a significant effect on improving the quality of services rendered to consumers. The PACP has also been involved in developing the standards and specifications for many commodities. This has played a significant role in improving the quality of products available in the Omani market. PACP also monitors the quality of services rendered to customers at various retail outlets to ensure that such services are compatible with the requirements of the laws and regulations. The latest addition, which has made all the sale invoices in Arabic language, is one of the main tools that informs customers regarding the services rendered. Field inspectors and law enforcement officers too play an important role in identifying violations in the Omani market. We will not remain silent if someone is trying to dump the market with inferior products or manipulate prices or cheat customers How has PACP addressed consumers’ concerns and complaints? PACP has established a dedicated unit for receiving complaints from customers through a call centre that is operating 24/7. The staff will receive complaints and will forward them to the respective officer to take necessary action. PACP has also established units and departments that investigates customers’ complaints and takes the required action to address them. What are the types of complaints received by PACP from customers? How many cases has PACP handled since inception? Major complaints that PACP receives are related to price hike, difference between the shelf price and the price at the cash counter, expiry of certain goods and after sale services such as vehicles, mobile phones, electronic and mechanical equipments as well. In the initial stage, we seek to resolve this issue at PACP premises itself but if it does not get sorted out, the case is referred to public prosecution for legal action against the violator. What legal action does the PACP take against traders indulging in unfair practices? We first conduct a meeting at our premises during which we explain the rights and obligations of each party. If the service provider is unable to sort out the issue, we will refer the case to the Public Prosecution. Does PACP have the power to detain traders/owners of establishments and seize products which are of inferior quality? We maintain cooperation with the various judicial authorities to ensure protection of the rights of the public and consumers as well. As per the provisions of the Consumer Protection Law, PACP has the right to arrest the violator if the investigation procedure requires so. In such case, the officer should listen to the defence of the arrested person immediately. If the accused person fails to justify the charges against him, he will be referred to the competent investigation authorities within 15 days of the crime and within 48 hours for other crimes. This period may be renewed only for 48 hours only subject to approval of the Public Prosecution. This also applies to fake or spoiled goods. The violating products shall be seized and the violating traders referred to the Court for an appropriate decision. Owners of certain SMEs feel that frequent PACP inspections are impacting their businesses. Your comment? The PACP is implementing laws and regulations and therefore if the trader is compliant with the laws and regulations he will not be affected. But if he is not compliant, he will be affected party because we seek to protect the rights of customers and ensure that the market is free of fraud and improper business practices. We will not remain silent if someone is trying to dump the market with inferior products or manipulate prices or cheat customers. In other words, everyone should comply with the laws and regulations, otherwise he/ she will be subject to the penalties and punishments specified by the law. Follow @pacp_oman Complaint Redressal PACP Hotline: 80079009/80077997