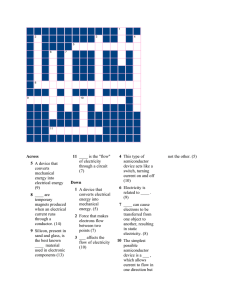

Electricity Distribution

advertisement