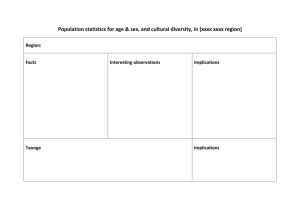

HB Reasonably Practicable Options and Preferred Option

advertisement