Review of Specific Financial and Human Resource Practices at Red

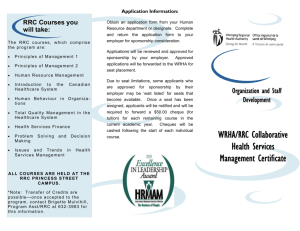

advertisement