HOTEL MARKET REPORT: 4Q2015

2015 LODGING SECTOR RESULTS WERE

BELOW EXPECTATIONS; CAUTION ABOUNDS

DEMAND: Hotel demand recorded a new high this year with a total of 1.2 billion room

nights sold, a 2.9% increase compared to 2014, and helping to generate the highest

revenue returns on record.

OCCUPANCY: National occupancy levels posted another all-time high, ending the year at

65.6%, a 1.7% increase compared to last year. With the pace of supply expansion picking

up over the coming years, occupancy growth should continue to slow.

ADR: Rate growth disappointment persists; ADR advanced by 4.4% for the year, slightly

below 2014’s ADR growth of 4.5%. Further, transient rate growth fell to 3.7% over 2015,

the lowest level in six years. While current demand levels portend higher ADR growth,

double-digit rate growth has only been tracked in select markets.

RevPAR: Weaker than expected ADR growth, coupled with slowing occupancy have

downplayed RevPAR gains. For the year, RevPAR increased 6.3% up to $78.67, which was

below STR’s projection of 6.8%. The RevPAR deceleration has contributed to increased

investor hesitation within the lodging segment.

SUPPLY: Record demand levels, increasing room rates, and favorable financing options

have contributed to the lodging sector’s growing pipeline. Currently, STR tracks 140,703

hotel rooms under construction, a 17.2% increase compared to last year. While additions

are expected to remain below demand levels for the foreseeable future, specific markets

and segments remain a concern.

FORECAST: RevPAR gains eased over the last two quarters, with full-year growth below

original forecasts. As we move forward, supply additions are expected to play a larger

role in 2016 and 2017. This will be of particular concern within specific markets.

Currently, RevPAR projections from our sources range from 5.0% to 6.1% growth this

year, followed by a range of 4.5% to 5.8% forecast for 2017.

Prepared by:

Eileen Grimm

Real Estate Market Analytics

PNC Real Estate

The Tower at PNC

300 Fifth Avenue

Pittsburgh, PA 15222

(412) 762-5477

Eileen.Grimm@pnc.com

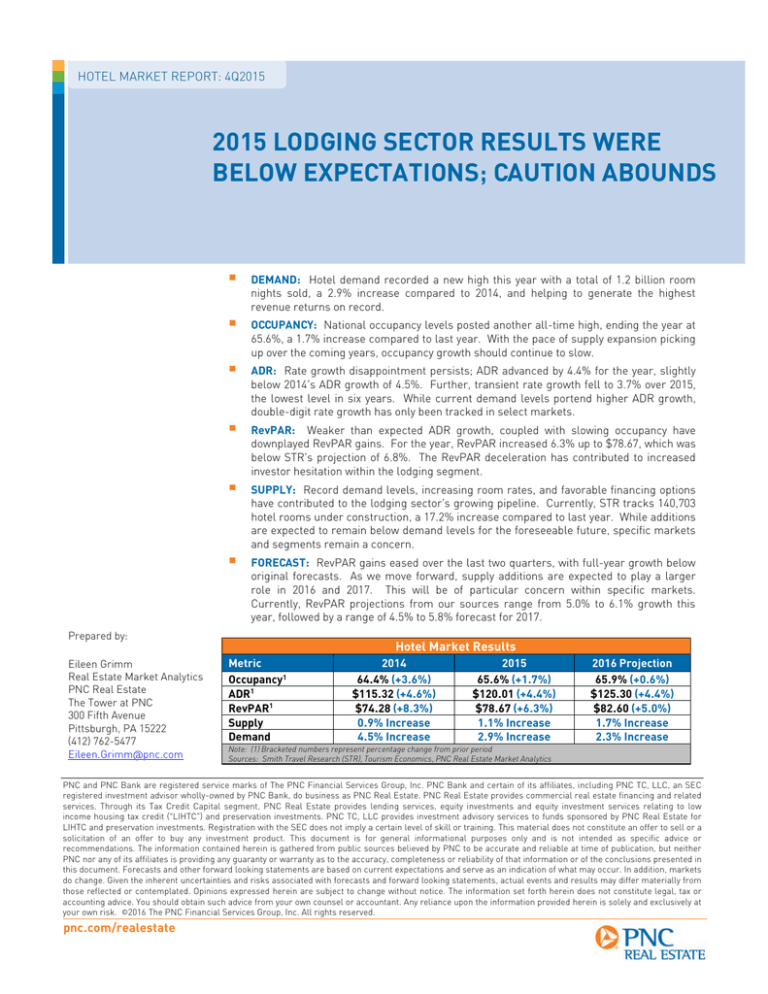

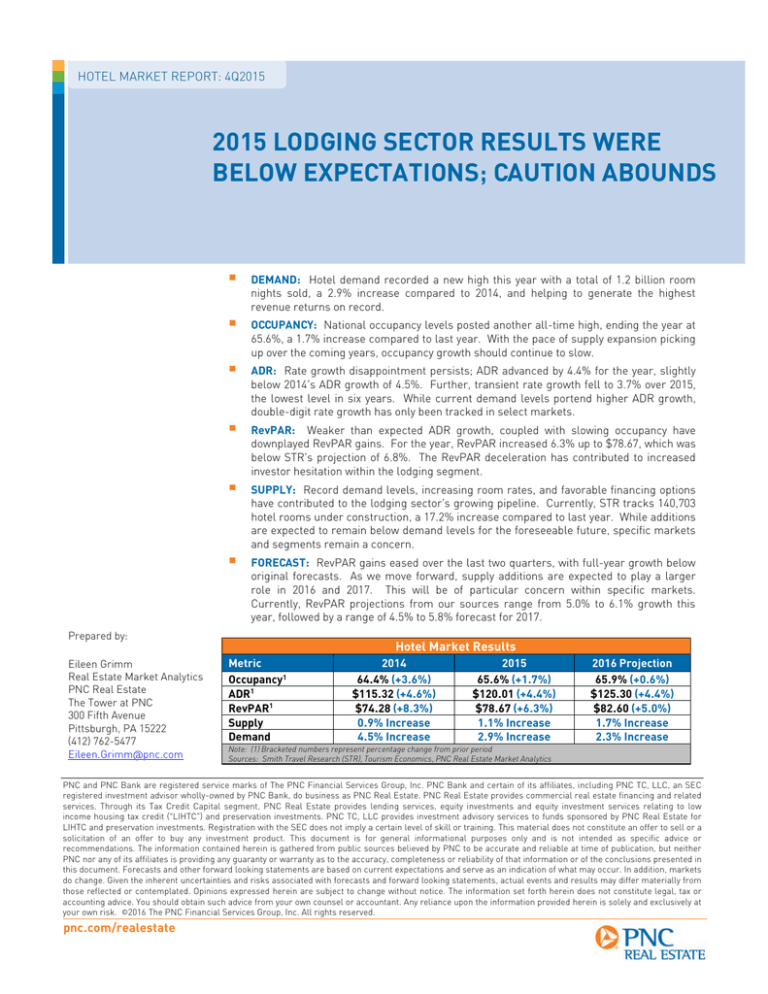

Hotel Market Results

Metric

Occupancy1

ADR1

RevPAR1

Supply

Demand

2014

64.4% (+3.6%)

$115.32 (+4.6%)

$74.28 (+8.3%)

0.9% Increase

4.5% Increase

2015

65.6% (+1.7%)

$120.01 (+4.4%)

$78.67 (+6.3%)

1.1% Increase

2.9% Increase

2016 Projection

65.9% (+0.6%)

$125.30 (+4.4%)

$82.60 (+5.0%)

1.7% Increase

2.3% Increase

Note: (1) Bracketed numbers represent percentage change from prior period

Sources: Smith Travel Research (STR), Tourism Economics, PNC Real Estate Market Analytics

PNC and PNC Bank are registered service marks of The PNC Financial Services Group, Inc. PNC Bank and certain of its affiliates, including PNC TC, LLC, an SEC

registered investment advisor wholly-owned by PNC Bank, do business as PNC Real Estate. PNC Real Estate provides commercial real estate financing and related

services. Through its Tax Credit Capital segment, PNC Real Estate provides lending services, equity investments and equity investment services relating to low

income housing tax credit (“LIHTC”) and preservation investments. PNC TC, LLC provides investment advisory services to funds sponsored by PNC Real Estate for

LIHTC and preservation investments. Registration with the SEC does not imply a certain level of skill or training. This material does not constitute an offer to sell or a

solicitation of an offer to buy any investment product. This document is for general informational purposes only and is not intended as specific advice or

recommendations. The information contained herein is gathered from public sources believed by PNC to be accurate and reliable at time of publication, but neither

PNC nor any of its affiliates is providing any guaranty or warranty as to the accuracy, completeness or reliability of that information or of the conclusions presented in

this document. Forecasts and other forward looking statements are based on current expectations and serve as an indication of what may occur. In addition, markets

do change. Given the inherent uncertainties and risks associated with forecasts and forward looking statements, actual events and results may differ materially from

those reflected or contemplated. Opinions expressed herein are subject to change without notice. The information set forth herein does not constitute legal, tax or

accounting advice. You should obtain such advice from your own counsel or accountant. Any reliance upon the information provided herein is solely and exclusively at

your own risk. ©2016 The PNC Financial Services Group, Inc. All rights reserved.

pnc.com/realestate

2015 Lodging Sector Results Were Below Expectations; Caution Abounds

2

LODGING SECTOR HIGHLIGHTS

Despite the record high room night

demand, rate growth was a

dissapointment in 2015.

While

hoteliers held out optimism for Q4,

travel growth was muted at the end

of the year. According to STR, room

rates moved up by 4.4% to $120.01

overall. Coupled with a 1.7% gain in

occupancy levels, RevPAR increased

6.3% - well below STR’s full-year

forecast of 6.8%. Moving forward,

RevPAR forecasts from our primary

sources (STR, PwC, and PKF) range

from 5.0% to 6.1% growth in 2016.

AIRBNB

AND

“DISRUPTIVE

SERVICES”

While the hotel industry’s initial

reactions to Airbnb and other

alternative accommodations were

mixed, recent reports and surveys

indicate that the services could have

a significant impact on traditional

hotels, particularly within gateway

markets. According to a January

2016 study from CBRE Hotels’

Americas Research, travelers spent

$2.4 billion on Airbnb lodging from

October 2014 to September 2015.

While the spending represents just

1.7% of the $141.0 billion generated

by the hotel industry, it is a

significant increase compared to the

same period one year ago. Further,

over the study period, more than 55%

of the $2.4 billion was within five U.S.

cities including NYC, Los Angeles,

San Francisco, Miami, and Boston.

Interestingly, the report also points

out that Airbnb rooms are not always

the lower-priced option. Over the 12

month period, the average rate paid

for an Airbnb unit was $148.42,

which is 25% higher than STR’s

average hotel ADR of $119.11

tracked over the same period. The

price disparity may be due to the higher-end amenties at Airbnb units, such as access to a kitchen, washing machine, and

free parking. Further, the majority of Airbnb listings tend to be within pricier downtown markets.

A February 2016 Goldman Sachs survey also points to an increasing consumer sentiment for “peer-to-peer” lodging like

Airbnb. The survey (2,000 respondents) indicated that if a consumer stayed at a sharing-economy accommodation during

the last five years, the liklihood that they prefer traditional hotels is halved (79% vs. 40%).

There is no shortage of coverage on the ongoing impacts from the non-hotel accommodations, which also includes

additional concerns such as taxes, safety, and zoning. However, as services like Airbnb continue to increase their market

share, traditional hotels must recognize the threat – especially as the industry braces for uncertain times ahead.

pnc.com/realestate

2015 Lodging Sector Results Were Below Expectations; Caution Abounds

3

SEGMENT PERFORMANCE METRICS

Source: Smith Travel Research

Demand – A total of 1.2 billion rooms nights were sold in 2015, a 2.9% increase compared to 2014. Although the pace of

demand growth is slowing, gains remain positive across all scales and locations. Among the chain scales, the Upscale

category was the winner with a 4.8% increase in rooms sold. However, this segment also saw the largest supply

expansion at 4.7%, with a significant number of new hotels still underway for 2016 and 2017 (see table below). Resort

hotels tracked an overall room night demand increase of 3.2%, the highest among the locational sub-classifications.

Suburban (+3.1%) and Urban (+3.0%) hotel locations were not far behind.

In February 2016, the U.S. Travel Association released its first Travel Trends Index (TTI), an indicator developed by the

organization’s economic research team to track and predict the volume and pace of travel to and within the U.S. The TTI

research indicates that travel growth leveled off at the end of the year, but is expected to pick up in early 2016. According

to the report, domestic leisure travel is increasing due to higher wages and lower gas prices. Business travel contracted

in late 2015, due to volatile markets and rising interest rates; however, a slight recovery is predicted for the first half of

2016. Finally, the report also noted that inbound international travel is still increasing slightly, but has leveled off due to

the strong U.S. dollar.

Occupancy – National hospitality occupancy levels reached 65.6%, an all-time high. However, growth continued to slow

with full-year 2015 occupancy up by just 1.7%; comparatively, occupancy gains over 2010 to 2014 averaged 3.4% annually.

For the year, all segments showed occupancy growth, with Independents again with the highest gain of 2.5%. Although the

upper tier scales (Luxury, Upper Upscale, and Upscale) report the highest occupancies, gains continue to slow with all

three segments well below 1.0% during 2015.

ADR – Forecasts for rate growth in 2015 were aggressive due to the record room night demand and occupancy levels;

however, ADR gains for the year were up 4.4%, well below STR’s forecast of 5.1%. Economy scale hotels proved the

highest returns, with rates increasing 5.0% YOY. Upscale hotels were a close second, up 4.9%. The lowest ADR growth

was among the Luxury and Upper Upscale segments, which tracked YOY growth of 4.2% and 4.0%, respectively. Among

the locational classifications, Airport hotels showed the highest ADR gain of 6.5%, well above the second place Suburban

hotels with an increase of 5.2%.

RevPAR – Over 2015, RevPAR increased 6.3% to $78.67, below full-year forecasts. Despite the lower

than expected results, 46 of STR’s Top 50 Markets displayed positive RevPAR growth in 2015. Top

performers included San Jose (+17.3%), Oakland (+15.7%), Portland (+14.2%), and Tampa (+13.8%).

Looking forward, RevPAR forecasts for the upcoming year are positive, with our hospitality sources

reporting a range of 5.0% to 6.1% growth in 2016. We also reviewed guidance from several public

hotel companies including Marriott International (MAR), Hilton Worldwide (HLT), Hyatt Hotels

Corporation (H), Starwood Hotels & Resorts Worldwide (HOT), Choice Hotels (CHH), FelCor Lodging

Trust (FCH), and Host Hotels & Resorts Inc. (HST). Please see adjacent table for details.

2016 RevPAR

Guidance

3.0%-5.0%

MAR

3.0%-5.0%

HLT

3.0%-5.0%

H

2.0%-4.0%

HOT

2.0%-3.0%

CHH

3.5%-5.5%

FCH

3.0%-4.0%

HST

Supply – According to STR’s December 2015 Pipeline Report, there are 3,881 hotel projects totaling 469,139 rooms under

contract within the U.S. The total activity represents a 13.6% increase year-over-year. Looking at only the hotels under

construction, the room count has reached 140,703, a 17.2% rise compared to one year ago. Among the chain scales, the

Economy segment tracked the most significant year-over-year increases in rooms under contract (+70.0%) and rooms

under construction (+130.8%).

U.S. Pipeline by Chain

Scale Segment

Luxury

Upper Upscale

Upscale

Upper Midscale

Midscale

Economy

Unaffiliated

Totals

Existing Supply

%∆ Dec14

Dec-15

108,485

+0.4%

583,906

+2.7%

660,640

+4.7%

888,843

+1.4%

479,040

-0.8%

784,149

+1.3%

1,533,422

-0.2%

5,038,485

+1.2%

In Construction

%∆ Dec14

Dec-15

7,440

+35.0%

11,524

-13.5%

49,203

+10.8%

47,954

+36.1%

5,321

+1.3%

1,512

+130.8%

17,749

+13.2%

140,703

+17.2%

Note: Under Contract pipeline includes in construction, final planning, and planning stages.

Sources: Smith Travel, CBRE-EA Pipeline, PNC Real Estate Market Analytics

pnc.com/realestate

Under Contract

%∆ Dec14

Dec-15

11,549

+18.7%

38,885

+23.4%

135,580

+18.1%

157,034

+23.9%

29,533

+17.0%

6,801

+70.0%

89,757

-11.0%

469,139

+13.6%

2015 Lodging Sector Results Were Below Expectations; Caution Abounds

4

Projections – Hotel projections provided by STR, PKF, and PwC indicate positive expectations over the coming two

years. Currently, RevPAR growth forecasts range from 5.0% to 6.1% for 2016. U.S. demand growth has outpaced

supply growth since 2010 and the forecasts indicate that this trend will continue over the coming years. According

to PwC’s updated lodging outlook (released January 25, 2016), demand trends across the U.S. are expected to

remain strong during 2016, driven by continued economic growth and improving group demand. The pace of supply

growth is forecast to increase to 1.9%, which is equivalent to the long-run average. As a result, PwC’s 2016 outlook

anticipates a marginal increase in occupancy levels to 65.7% - the highest level since 1981.

Hotel Market

Projections

Occupancy

ADR

RevPAR

Supply

Demand

STR

2016

2017

65.9% (+0.6%)

66.1% (+0.2%)

$125.30 (+4.4%)

$130.63 (+4.3%)

$82.60 (+5.0%)

$86.28 (+4.5%)

+1.7%

+1.9%

+2.3%

+2.1%

PKF-HR

2016

2017

66.0% (+0.6%)

66.0% (0.0%)

$126.93 (+5.5%)

$134.28 (+5.8%)

$83.81 (+6.1%)

$88.68 (+5.8%)

+1.7%

+2.1%

+2.3%

+2.2%

PwC

2016

65.7% (+0.2%)

$126.28 (+5.2%)

$82.96 (+5.5%)

+1.9%

+2.1%

2017

-

Sources: STR, Tourism Economics, PKF-HR, PwC Hospitality Directions U.S., PNC Real Estate Market Analytics

MARKET PERFORMANCE METRICS

Construction

For the overall U.S. hotel industry, STR is forecasting supply

expansion of 1.7% during 2016, still below the long-term average of

2.0%. However, the most significant risks are where the majority of

new supply is located. As of December 2015, the top markets for

construction included NYC, Houston, Los Angeles, Dallas, and

Miami, all with over 3,500 rooms underway. In total, these five

markets account for nearly one quarter of all rooms under

construction within the U.S.

As has been the case for several years, NYC maintains the top spot

in terms of number of rooms under construction. New rooms

underway currently represent 12.0% of the metro’s existing supply.

Further, Manhattan’s hotel performance has been lackluster with

decreases tracked for both occupancy and ADR over 2015, equating

to RevPAR loss of -1.7%. It is likely that supply side pressures have

been amplified by units available through Airbnb; though increasing

scrutiny from the New York Attorney General may have an impact

on Airbnb’s ability to keep growing in the future.

Construction in Top 26 Markets:

12 with 4%+ of supply

Rooms

% of

Market

U/C

Existing

New York City

14,090

12.0%

Miami

3,920

7.6%

Houston

5,710

7.1%

Seattle

2,232

5.3%

Dallas

4,177

5.3%

Philadelphia

2,343

5.1%

Nashville

1,982

5.1%

Boston

2,627

5.1%

Minneapolis/St. Paul

1,949

5.0%

Los Angeles

4,240

4.3%

Anaheim/Santa Ana

2,328

4.2%

Denver

1,794

4.1%

Note: U.S. Pipeline, Top 26 Markets, U/C Rooms as a

% of Existing Supply, December 2015. Source: STR

We continue to monitor Houston. In terms of construction, the metro is ranked second with over 5,710 rooms

underway. Over 2015, occupancy in the metro declined by -4.8%. Rates held steady, tracking a minimal +1.6%

increase; however, overall RevPAR moved downward by -3.3%, which was the largest decline among STR’s Top 50

Markets.

As noted in prior reports, Houston’s room night demand relies heavily on business from the energy

sector and the additional supply could further strain fundamentals.

pnc.com/realestate

2015 Lodging Sector Results Were Below Expectations; Caution Abounds

5

Top 50 Market Performance

The chart below plots performance metrics for the 50 largest hotel markets in the country. The YTD change in

occupancy from 2014 to 2015 is depicted along the horizontal axis and the change in ADR is along the vertical axis.

While most metros have tracked positive ADR growth, occupancy gains have clearly slowed, with a handful of

markets reporting negative returns. Over 2015, nine of the 50 markets posted negative occupancy trends. Supply

expansion has certainly played a role in the losses; the average room availability increase among the laggers was

3.0%, compared to the Top 50 average of 1.2%.

During 2015, Bay Area metros led the Top 50 for both ADR and occupancy growth. In terms of ADR growth, San

Jose and Oakland were stand-outs, with increases of 14.6% and 12.0%, respectively. These were the only two

markets among the Top 50 with double-digit rate growth. Sacramento was also a top performer for occupancy

growth, with levels rising by 6.8%. A key factor to the success of these markets has been tempered supply

expansion - room night supply among the three markets expanded by an average of just 0.3% over 2015.

pnc.com/realestate

2015 Lodging Sector Results Were Below Expectations; Caution Abounds

SALES VOLUME AND CAPITALIZATION RATES

2015Q4 Review

According to Real Capital Analytics (RCA), hotel investment

totaled $49.4 billion in 2015 – the highest annual volume

since 2007. The activity was driven by portfolio and entitylevel deal volume, which totaled $20.5 billion in sales, up

59% annually. However, deal volume was choppy over the

course of the year, with the third quarter showing a 21.0%

YOY decline in sales volume due to investor unease. The

fourth quarter of 2015 posted a sharp turnaround, with

volume growth of 47.0% YOY.

Year

2012

2013

2014

2015

Hotel Transaction Summary ($B)

Individual Portfolio

Entity

$13.8

$3.9

$3.0

$17.6

$8.4

$1.3

$21.9

$9.9

$3.0

$28.9

$12.3

$8.2

6

Total

$20.7

$27.3

$34.8

$49.4

Note: Data based on properties and portfolios $2.5M and greater.

Source: Real Capital Analytics

Based on initial estimates for Moody’s/RCA CPPI hotel index, prices have appreciated 16.0% year-over-year, which is

close to the 16.5% rate set in 2014. Blackstone’s buyout of Strategic Hotels accounted for $6.0B (approximately

$754,000 per key) of total volume during Q4. The 17-hotel portfolio included the Pennsylvania Avenue Four Seasons

in Washington DC, the Union Square Westin in San Francisco, and the beach-front Ritz Carlton in Orange County,

CA. Another significant transaction posted during the final quarter of 2015 was Maefield Development’s acquisition

of the leasehold interest in the Times Square Doubletree from Sunstone Hotel Investors for $540 million

(approximately $1.2 million per key).

Overall hotel cap rates have been flat since 2012, averaging 8.2% over the past three years according to RCA.

However, trends are evident depending on subtype and location. Looking at full-service asset types within the core

major markets, cap rates bottomed out at 6.2% in February 2015, increasing each month since then and hitting 7.1%

as of December. However, full-service assets in secondary markets have been flat at about 7.8% since mid-year

2014. The one area that compression has been tracked by RCA is within the tertiary markets. Cap rates within

these markets were 8.2% in early 2014, but declined to 7.8% as of December 2015.

pnc.com/realestate