May 12th, 2012

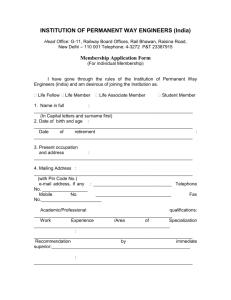

advertisement