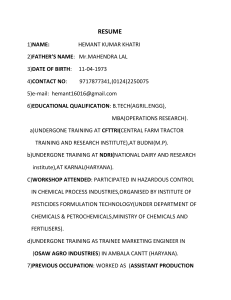

2001-2005 - Finance Department Haryana

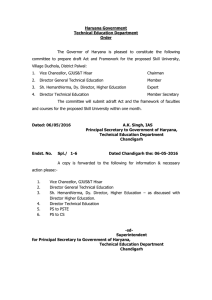

advertisement