PV POWER NT2 JOINT STOCK COMPANY

(NT2: HOSE)

BUSINESS RESULT UPDATE

NT2: BENEFICIAL FROM LOW OIL & GAS PRICE AND EL NINO

NT2 – HOLD

INFORMATION

(06/04/2016)

HOSE

April 6th 2016

Ending the fiscal year of 2015, revenue reached 6,729 billion VND (-5% yoy, 114%

of the target); net income reached 1,142 billion VND (-28% yoy, 182% of the target).

The significant rise in profits came from (1) a spread on the exchange rate was worth

VND 404 bn and (2) VND 658 bn from the retroactive revenue. Excluding (1) & (2),

the actual revenue increased by 5% and profit after tax increased by 22% compared to

2014. In addition, the market price of NT2 rose 48.6% in 2015 and 26.3% from the

beginning of 2016.

Price (VND) 33,300

Outlook for 2016: Thermal power plant will be beneficial from (1) low oil & gas price

expextation which will reduce production costs and (2) a negative outlook for hydro

power plant because of El Nino. NT2 is expected to receive VND 160 bn from the

retroactive revenue in 2016.

Average trading volume

10 days

Market Cap (billion VND)

9,203

Risk: the outstanding balance from the foreign exchange loans is about USD 124

million and EUR 113 million.Consequently, NT2 is exposed to exchange rate risk

Shares outstanding

273,919,843

Conclusion: Forecasted 2016 revenue is 6,840 billion VND (+1.6% yoy); net income is

1,195 billion VND (+5% yoy). 2016 EPS forward is 4,290 VND/share, P/E is 7.8.

Implementing comparable company analysis (PE and EV/EBITDA), the reasonable

share price for NT2 is 35,891 VND/share. Based on the good performance as well as

positive 2016 outlook, we recommend HOLD for NT2 stock

ANALYST

Truong Anh Quoc

taquoc@vcbs.com.vn

(+84) 936 769 702

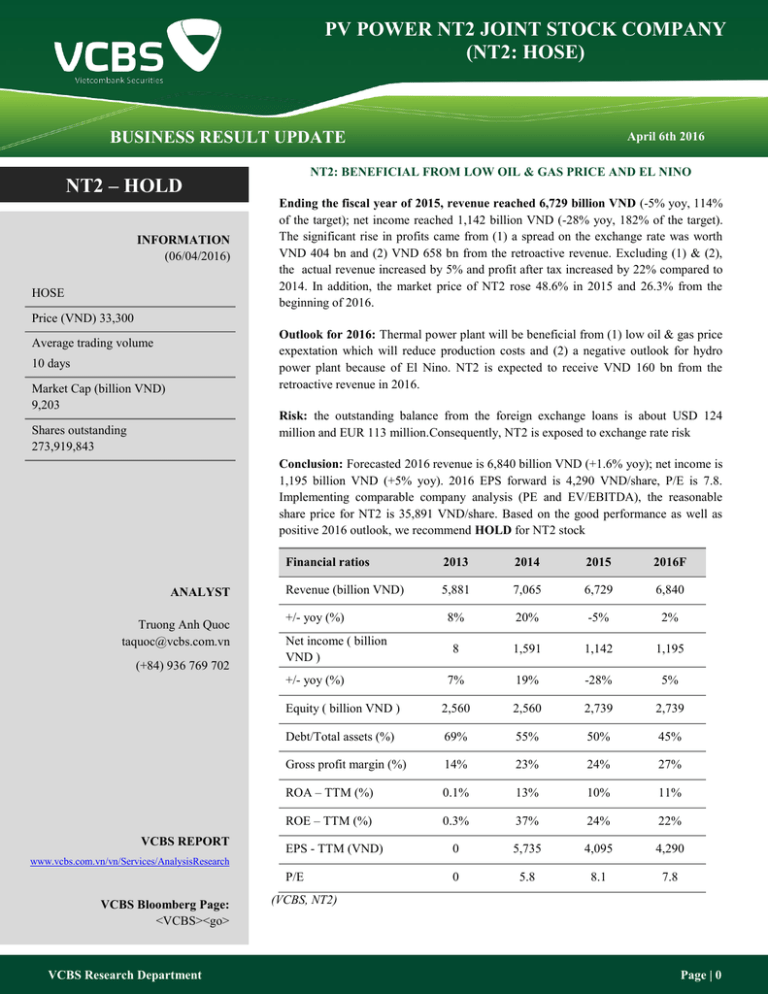

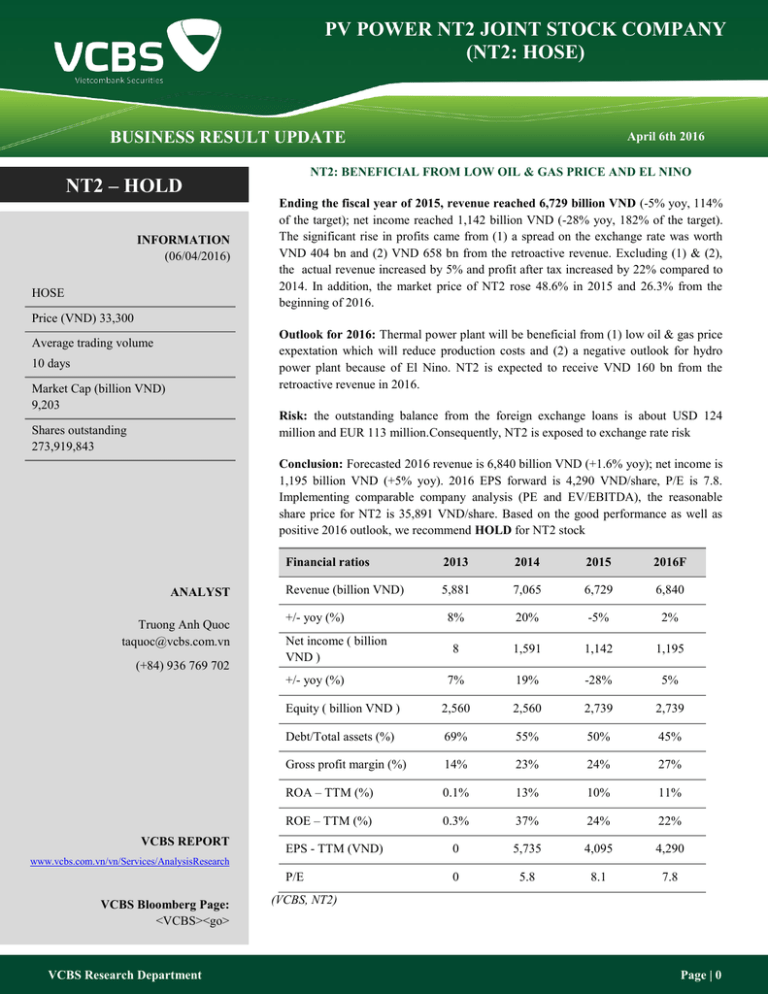

Financial ratios

2013

2014

2015

2016F

Revenue (billion VND)

5,881

7,065

6,729

6,840

8%

20%

-5%

2%

8

1,591

1,142

1,195

7%

19%

-28%

5%

Equity ( billion VND )

2,560

2,560

2,739

2,739

Debt/Total assets (%)

69%

55%

50%

45%

Gross profit margin (%)

14%

23%

24%

27%

ROA – TTM (%)

0.1%

13%

10%

11%

ROE – TTM (%)

0.3%

37%

24%

22%

EPS - TTM (VND)

0

5,735

4,095

4,290

P/E

0

5.8

8.1

7.8

+/- yoy (%)

Net income ( billion

VND )

+/- yoy (%)

VCBS REPORT

www.vcbs.com.vn/vn/Services/AnalysisResearch

VCBS Bloomberg Page:

<VCBS><go>

VCBS Research Department

(VCBS, NT2)

Page | 0

NT2 – 2015 BUSINESS RESULT UPDATE

2015 BUSINESS RESULT

Ending the fiscal year of 2015, revenue reached VND 6,729 bn (-5% yoy, 114% of the target), profit

after tax reached VND 1,142 bn (-28% yoy, 182% of the target). The significant rise in profits came

from (1) a spread on the exchange rate was worth VND 404 bn and (2) VND 658 bn from the

retroactive revenue. Excluding (1) & (2), the actual revenue increased by 5% and profit after tax

increased by 22% compared to 2014.

In 2015, NT2 generated 5.5 billion kWh (+14% yoy); the accumulated capacity until the end of 2015

was 21.3 billion kWh. NT2’s net profit margin was high in 2015 thanks to (1) low oil price which

reduces production costs by 12%, (2) 30% of generated electricity was sold in the Competitive

Generation Market (CGM) with higher price and (3) the slowdown of hydro power plants’ operation

due to the severe el Nino.

Revenue/Net income 2012-2015

(billion VND)

Capacity (MW) / Electricity price

(VND)

8.000

5.600.000

1,40

7.000

5.400.000

1,35

5.200.000

1,30

5.000.000

1,25

4.800.000

1,20

4.600.000

1,15

4.400.000

1,10

6.000

5.000

4.000

3.000

2.000

1.000

-

4.200.000

2012

2013

Revenue

2014

Net income

2015

1,05

2012

2013

Capacity

2014

2015

Electricity price

(NT2)

The gas turbine and combined cycle power plant which were imported from Germany helped NT2

become the most efficient thermal power plant in Vietnam.NT2 was located close to the economic zone

of the South, which was very advantageous since the cost of input gas delivery and power transmission

could be significantly reduced. Also, NT2 is located near the river which is convenient for both

equipment transportation as well as water cooling solution.

VCBS Research Department

Page | 1

NT2 – 2015 BUSINESS RESULT UPDATE

FINANCIAL HEALTH

Profitability ratios

2014 net income was high because of (1) 404 billion VND of earnings came from the spread of foreign

exchange and (2) 658 billion VND from retroactive revenue. In the period of 2012 – 2013, ROE was

low due to high depreciation when the power plant just started, ROE inceresed in 2014 and decreased in

2015 (24%) due to the lower net income.Also, assets turnover increased from 40% to 58% in the last

four years which indicated capital efficiency. The company also put aside 11.4 billion VND for long

term investment provision in Sopewaco; this company has recorded a loss of 310 billion VND

currently.

Revenue/Total assets

Profitability ratio

70%

40%

35%

60%

30%

50%

25%

40%

20%

ROA

15%

ROE

30%

20%

10%

10%

5%

0%

0%

2012

2013

2014

2015

2012

2013

2014

2015

(NT2)

Debt ratio and liquidity

As usual, a logistics company requires a great amount of capital investment in machinery/equipment,

NT2’s Debt/Total assets ratio is roughly 50% and tend to gradually decrease year over year. Currently,

NT2’s short term debt is around 1,000 billion VND, and long term debt is around 4,800 billion VND.

Whereas, 5,538 billion VND is borrowed from HERMES, CIRR, NEXI and Citibank according to the

credit contract signed on July 2010. Accordingly, NT2 borrowed 215 million USD and 203 million

USD in 9.5 years, interest rates were based on Euribor and Libor which is around 2.8%/year 3.6%/year.

The total outstanding loans at 31st December 2016 is $124 million and €113 million. In case VND

depreciate against USD, NT2 will lose around 25 billion VND for every 1% depreciation of VND.

Whereas, thanks to the economic stimulus program of Europe, EUR/VND exchange rate might not

have significant fluctuation this year, and therefore the foreign exchange risk of Euro loans can be

mitigated.

As estimated, every year, the company has to pay roughly 1,200 billion VND including the loan

pricipal (1,000 billion VND) and interest expense (200 billion VND). With the strong cash flow from

operation activities, NT2 is able to pay off its loan obligation. Without any unexpected events, the

outstanding loans may decrease around 1,000 billion VND/year, and the loan will be completely paid

VCBS Research Department

Page | 2

NT2 – 2015 BUSINESS RESULT UPDATE

off in 5 years. It is expected that 2016 principal and interest will decrease by 10% compared to 2015.

VCBS assumes that the Debt/Total assets ratio will not increase in the near future because NT2 has no

investment plan.

Cash flow from

operation/Loan principal

and interest

Foreign currency debt

Debt/Total assets

80%

2.500.000

70%

5%

60%

2.000.000

50%

1.500.000

48%

40%

47%

1.000.000

30%

500.000

20%

0

10%

VND

0%

USD

2012 2013 2014 2015

2012

2013

2014

2015

Cash flow from operation

Loan principal and interest

EUR

(NT2)

Cash flow from operation

NT2 has a stable cash flow from operation in the period 2012-2015. In general, the company has strong

financial health, stable cash flow as well as ability to pay off due debts.

Cash flow from operation/Net income

2.500.000

2.000.000

1.500.000

1.000.000

500.000

0

2012

2013

Cash flow from operation

2014

2015

Net income

(NT2)

VCBS Research Department

Page | 3

NT2 – 2015 BUSINESS RESULT UPDATE

2016 OUTLOOK

In 2016, NT2 is expected to have significant growth due to:

1. El Niño in 2016 caused severe drought in many areas. Several hydro power plants had to cease their

operations in order to save water for the coming dry season. As a result, power shortage from hydro

power plant will lead to higher capacity from thermal power plants.

2. Vietnam economy is on the recovery process, recently signed free trade agreements such as

FTA/PPT is the catalyst for GDP growth forecast of 6.8% - 7%. Accordingly, the electricity demand

is expected to grow by 12% - 15%. Inadditon, in 2016, NT2 has the opportunity to sell electricity

directly to households and factories according to the liberalization program from EVN.

3. The power plant is located close to the economic zone in the South, which is convenient and

economical for input gas delivery as well as power transmission

4. Input gas price decreased from $6/million BTU to $4/million BTU in 2015. In 2016, oil & gas price

is expected to be low which helps reduce production costs. Since August 2015, NT2’s gas price

contracts will be based on FO oil in Singapore (46% of FO oil price in Singapore).

5. Several thermal power plant projects have been delayed or newly operated which leads to power

shortage across the country, especially in the dry season starting this May.

Based on last year capacity/revenue as well as other growth forecast, NT2 is expected to generate 5,562

billion kWh (+1.1% yoy), targeting 6,840 billion VND in revenue (+1.6% yoy), and 1,195 billion

VND in net income (+5% yoy). Although it is hard for the capacity to have a significant growth, net

profit margin is expected to increase due to low oil & gas price.

In 2016, NT2 and the Ministry of Industry & Commerce will consider the new pricing policy so that

power plant can transfer 100% of the foreign exchange profit/loss to the electricity price. In this case,

NT2 will no longer be exposed to the exchange rate risk. Inaddition, the company is expected to receive

160 billion VND from retroactive revenue in 2016.

Capacity (MW)/Revenue (million VND)

5.800.000

8.000.000

5.600.000

7.000.000

5.400.000

6.000.000

MW

5.200.000

5.000.000

5.000.000

4.000.000

4.800.000

3.000.000

4.600.000

4.400.000

2.000.000

4.200.000

1.000.000

4.000.000

2012

2013

Capacity

2014

2015

Revenue

(Nguồn NT2)

VCBS Research Department

Page | 4

NT2 – 2015 BUSINESS RESULT UPDATE

2016 activities

NT2 plans to issue 3 million ESOP shares for employees - 1.1% of the chartered capital. With 274

million shares outstanding in the market, the risk of diluted EPS after the share issuance is not

significant. In addition, although the company confirmed that minimum dividend yield in 2016 will be

20%, we expect that the actual dividend yield will not be lower than 22%.

NT2 continues to complete the procedures for the project “Nhon Trach 2 expansion” which has the

capacity of 750MW-800MW. The power plant is planned to be built on a 20,000 ha land with the total

investment of around $900 million. When completed, the power plant is expected to generate roughly 5

billion kWh and consume about 840 million m3 of gas per year.

The Board of Directors continues evaluating the project “Extracting CO2 from power plant exhaust”.

Accordingly, NT2 will extract CO2 from the exhaust during electricity generation process. The project

compromises to generate economic efficiency and reduce CO2 pollution – one of the most important

factors that foreign investors will consider before making investment. Currently, Vietnam still imports

CO2 from China with high costs. Exhaust from NT2 is advantageous for extracting CO2 because of (1)

high CO2 content – 5% and (2) higher purity compared to exhaust from coal-power-plant.

The company will consider the “Misting-cooling-system” project in order to add 40 MW to the current

capacity. The project is expected to upgrade the power plant capacity with lowest costs – around

$400.000 /MW (construction expenditure for a new power plant is around $1 million/MW).

PRICING METHOD

Comparable company

analysis

Implementing comparable company analysis (PE and EV/EBITDA), the reasonable share price for NT2

is 35,891 VND/share.

Company

Price

(VND/share)

Shares

outstanding

(million)

Market Cap

(billion VND)

EV/EBITDA

PE

PPC

18,800

318.1

5,981

8.3

8.2

NBP

19,800

12.9

255

2.9

6.2

BTP

16,700

60.5

1,010

5.7

8.7

NT2

33,200

273.9

9,094

4.7

4.2

TMP

27,500

70

2,100

3.7

7.41

5.1

7.0

Average

(VCBS)

VCBS Research Department

Page | 5

NT2 – 2015 BUSINESS RESULT UPDATE

Reasonable share price for NT2:

Method

Price (VND/share)

Weight

PE analysis

28,499

25%

EV/EBITDA analysis

38,355

75%

Reasonable price

35,891

(VCBS)

CONCLUSION

Recommendation: Hold

NT2 is expected to growrapidly in 2016 due to (1) a negative outlook for hydro power plant because of

drought and (2) low oil & gas price which will reduce production costs. Also, it is expected that NT2

will receive 160 billion VND in 2016 from retroactive revenue. Currently, NT2 is exposed to the

exchange rate risk with outstanding loans of $124 million and €113 million. In case VND depreciates

against USD, NT2 will lose around 25 billion VND for every 1% depreciation of VND against USD.

Based on last year capacity/revenue as well as other growth forecast, 2016 revenue is expected to reach

6,840 billion VND (+1.6% yoy), net income is 1,195 billion VND (+5% yoy). EPS forward is 4,290

VND/share, P/E is 7.8. Implementing comparable company analysis (PE and EV/EBITDA), the

reasonable share price for NT2 is 35,891 VND/share. We recommend HOLD for NT2 stock.

APPENDIX

VCBS Research Department

Page | 6

NT2 – 2015 BUSINESS RESULT UPDATE

Income statement

2015

2016F

2017F

2018F

2019F

2020F

Revenue

6,729

6,840

6,856

7,341

7,461

7,583

Cost of goods sold

5,088

4,985

5,082

5,551

5,841

5,984

Gross profit

1,642

1,856

1,774

1,790

1,620

1,600

146

205

206

220

224

228

1,495

1,650

1,568

1,570

1,396

1,372

65

56

60

58

59

59

1,385

1,419

1,487

1,486

1,313

1,289

183

161

132

102

73

43

1,142

1,195

1,287

1,314

1,147

1,152

60

63

68

69

93

93

Net income

1,142

1,195

1,287

1,314

1,147

1,152

Attributable to parent company

1,142

1,195

1,287

1,314

1,147

1,152

2015

2016F

2017F

2018F

2019F

2020F

Cash and cash equivalent

1,109

1,311

1,971

2,406

2,886

3,710

Account receivables

General & Admin expenses

Operating income

Financial income/expense

EBIT

Interest expense

EBT

Income tax expenses

Balance sheet

1,464

1,612

1,615

1,730

1,758

1,787

Inventories

288

287

292

319

336

344

Other current assets

(27)

(25)

(29)

(27)

(27)

(28)

Current assets

2,981

3,334

4,003

4,595

5,128

5,993

Tangible fixed assets

7,624

6,682

6,387

6,243

6,150

6,348

673

775

724

749

736

743

Non-current assets

8,664

7,867

7,522

7,433

7,335

7,546

Total assets

11,645

11,201

11,525

12,028

12,462

13,539

Other fixed assets

Account payables

611

153

153

164

167

170

1,054

1,091

1,102

1,102

1,102

1,102

Payables to employees

30

47

47

51

51

52

Other payables

359

455

456

489

497

505

Current liabilities

2,023

1,700

1,711

1,755

1,765

1,776

Long term debt

4,812

3,938

2,826

1,724

623

-

41

11

11

12

12

12

Non-current liabilities

4,853

3,949

2,837

1,736

635

12

Liabilities

6,876

5,648

4,548

3,490

2,400

1,788

Capital

2,739

2,739

3,287

3,944

4,733

5,680

Undistributed earnings

1,950

2,734

3,610

4,513

5,249

5,991

Owner’s equity

4,768

5,553

6,976

8,537

10,063

11,751

Total resources

11,645

11,201

11,525

12,028

12,462

13,539

Short term debt

Long term provision

(VCBS, NT2)

VCBS Research Department

Page | 7

NT2 – 2015 BUSINESS

RESULT UPDATE

DISCLAIMER

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The VCBS analysts

exert their best efforts to obtain the most accurate and timely information available from various sources, including information pertaining to market

prices, yields and rates. All information stated in the report has been collected and assessed as carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at the date of

publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to buy or sell or any actions

related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that VCBS belongs to or is related to

(thereafter, VCBS), provide no warranty or undertaking of any kind in respect to the information and materials found on, or linked to the report and

no obligation to update the information after the report was released. VCBS does not bear any responsibility for the accuracy of the material posted

or the information contained therein, or for any consequences arising from its use, and does not invite or accept reliance being placed on any

materials or information so provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized representative

of VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Anh Tuan, CFA

Truong Anh Quoc

EquityAnalyst

Head of Research

taquoc@vcbs.com.vn

tatuan@vcbs.com.vn

(+84) 936 769 702

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

Ha Noi Headquarter

Floor 12th & 17th, Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi

Tel: (84-4)-39366990 ext: 140/143/144/149/150/151

Ho Chi Minh Branch

Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-8)-3820 8116

Da Nang Branch

Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City

Tel: (84-511)-3888991 ext: 801/802

Phu My Hung Transaction Unit

Lawrence Sting Building, 801 Nguyen Luong Bang Street, Phu My Hung Urban Zone, District No. 7, Ho Chi Minh City

Tel: (84-8)-54136573

Giang Vo Transaction Unit

Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi

Tel: (84-4)-37265551

Can Tho Representative Office

Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City

Tel: (84-710)-3750888

Vung Tau Representative Office

Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province

Tel: (84-64)-3513974/75/76/77/78

An Giang Representative Office

Floor 6th, Nguyen Hue Building, 9/9 Tran Hung Dao Street, My Xuyen Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office

F240-F241 Vo Thi Sau Street, 7th Block, Thong Nhat Ward, Bien Hoa City, Dong Nai Province

Tel: (84-61)-3918815

Hai Phong Representative Office

Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City

Tel: (+84-31) 382 1630

Binh Duong Representative Office

314 Binh Duong Route – Phu Hoa Ward – Thu Dau Mot City - Binh Duong Province

Tel: (+84-650) 3855 771

VCBS Research Department

Page | 8