Brownian Motion and Stochastic Calculus

advertisement

Chapter 4

Brownian Motion and Stochastic Calculus

The modeling of random assets in finance is based on stochastic processes,

which are families (Xt )t∈I of random variables indexed by a time interval I. In

this chapter we present a description of Brownian motion and a construction

of the associated Itô stochastic integral.

4.1 Brownian Motion

We start by recalling the definition of Brownian motion, which is a fundamental example of a stochastic process. The underlying probability space

(Ω, F, P) of Brownian motion can be constructed on the space Ω = C0 (R+ )

of continuous real-valued functions on R+ started at 0.

Definition 4.1. The standard Brownian motion is a stochastic process

(Bt )t∈R+ such that

1. B0 = 0 almost surely,

2. The sample trajectories t 7−→ Bt are continuous, with probability 1.

3. For any finite sequence of times t0 < t1 < · · · < tn , the increments

Bt1 − Bt0 , Bt2 − Bt1 , . . . , Btn − Btn−1

are independent.

4. For any given times 0 ≤ s < t, Bt − Bs has the Gaussian distribution

N (0, t − s) with mean zero and variance t − s.

We refer to Theorem 10.28 of [36] and to Chapter 1 of [95] for the proof of

the existence of Brownian motion as a stochastic process (Bt )t∈R+ satisfying

"

N. Privault

the above Conditions 1-4. See also Problem 4.15 for a construction based on

linear interpolation.

In particular, Condition 4 above implies

IE[Bt − Bs ] = 0

and

Var[Bt − Bs ] = t − s,

0 ≤ s ≤ t,

and we have

Cov(Bs , Bt ) = IE[Bs Bt ]

= IE[Bs (Bt − Bs )] + IE[(Bs )2 ]

= IE[Bs ] IE[Bt − Bs ] + IE[(Bs )2 ]

= s,

hence

0 ≤ s ≤ t,

Cov(Bs , Bt ) = IE[Bs Bt ] = min(s, t),

s, t ∈ R+ ,

cf. also Exercise 4.1-(d).

In the sequel, the filtration (Ft )t∈R+ will be generated by the Brownian paths

up to time t, in other words we write

Ft = σ(Bs : 0 ≤ s ≤ t),

t ≥ 0.

(4.1)

A random variable F is said to be Ft -measurable if the knowledge of F

depends only on the information known up to time t. As an example, if

t =today,

• the date of the past course exam is Ft -measurable, because it belongs to

the past.

• the date of the next Chinese new year, although it refers to a future event,

is also Ft -measurable because it is known at time t.

• the date of the next typhoon is not Ft -measurable since it is not known

at time t.

• the maturity date T of a European option is Ft -measurable for all t ∈ R+ ,

because it has been determined at time 0.

• the exercise date τ of an American option after time t (see Section 11.4)

is not Ft -measurable because it refers to a future random event.

Property (iii) above shows that Bt − Bs is independent of all Brownian increments taken before time s, i.e.

78

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

(Bt − Bs ) ⊥

⊥ (Bt1 − Bt0 , Bt2 − Bt1 , . . . , Btn − Btn−1 ),

0 ≤ t0 ≤ t1 ≤ · · · ≤ tn ≤ s ≤ t, hence Bt − Bs is also independent of the

whole Brownian history up to time s, hence Bt − Bs is in fact independent

of Fs , s ≥ 0.

As a consequence, Brownian motion is a continuous-time martingale, cf.

also Example 2 page 2, as we have

IE[Bt | Fs ] = IE[Bt − Bs | Fs ] + IE[Bs | Fs ]

= IE[Bt − Bs ] + Bs

= Bs ,

0 ≤ s ≤ t,

because it has centered and independent increments, cf. Section 6.1.

For convenience we will informally regard Brownian motion as a random

walk over infinitesimal time intervals of length ∆t, whose increments

∆Bt := Bt+∆t − Bt ' N (0, ∆t)

over the time interval [t, t+∆t] will be approximated by the Bernoulli random

variable

√

(4.2)

∆Bt = ± ∆t

with equal probabilities (1/2, 1/2).

The choice of the square root in (4.2) is in fact not fortuitous. Indeed, any

choice of ±(∆t)α with a power α > 1/2 would lead to explosion of the process

as dt tends to zero, whereas a power α ∈ (0, 1/2) would lead to a vanishing

process.

Note that we have

IE[∆Bt ] =

1√

1√

∆t −

∆t = 0,

2

2

and

1

1

∆t + ∆t = ∆t.

2

2

According to this representation, the paths of Brownian motion are not differentiable, although they are continuous by Property 2, as we have

√

dBt

± dt

1

'

= ± √ ' ±∞.

(4.3)

dt

dt

dt

Var[∆Bt ] = IE[(∆Bt )2 ] =

After splitting the interval [0, T ] into N intervals

"

79

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

k−1

k

T, T ,

N

N

k = 1, . . . , N,

of length ∆t = T /N with N “large”, and letting

√

√

√

Xk = ± T = ± N ∆t = N ∆Bt

with probabilities (1/2, 1/2) we have Var(Xk ) = T and

√

Xk

∆Bt = √ = ± ∆t

N

is the increment of Bt over ((k − 1)∆t, k∆t], and we get

BT '

X

∆Bt '

0<t<T

X1 + · · · + XN

√

.

N

Hence by the central limit theorem we recover the fact that BT has a centered

Gaussian distribution with variance T , cf. point 4 of the above definition of

Brownian motion. Indeed, the central limit theorem states that given any

sequence (Xk )k≥1 of independent identically distributed centered random

variables with variance σ 2 = Var[Xk ] = T , the normalized sum

X1 + · · · + Xn

√

n

converges (in distribution) to a centered Gaussian random variable N (0, σ 2 )

with variance σ 2 as n goes to infinity. As a consequence, ∆Bt could in fact

be replaced by any centered random variable with variance ∆t in the above

description.

2

1.5

1

Bt

0.5

0

-0.5

-1

-1.5

-2

0

0.2

0.4

0.6

0.8

1

Fig. 4.1: Sample paths of a one-dimensional Brownian motion.

80

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

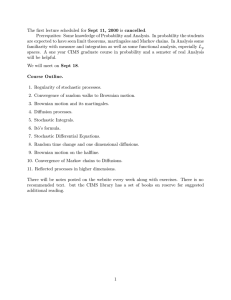

In Figure 4.1 we draw three sample paths of a standard Brownian motion

obtained by computer simulation using (4.2). Note that there is no point

in “computing” the value of Bt as it is a random variable for all t > 0,

however we can generate samples of Bt , which are distributed according to

the centered Gaussian distribution with variance t.

2

1.5

1

0.5

0

-0.5

-1

-1.5

-2

-2

-1.5

-1

-0.5

0

0.5

1

1.5

2

2.5

Fig. 4.2: Two sample paths of a two-dimensional Brownian motion.

The n-dimensional Brownian motion can be constructed as (Bt1 , . . . , Btn )t∈R+

where (Bt1 )t∈R+ , . . .,(Btn )t∈R+ are independent copies of (Bt )t∈R+ . Next, we

turn to simulations of 2 dimensional and 3 dimensional Brownian motions in

Figures 4.2 and 4.3. Recall that the movement of pollen particles originally

observed by R. Brown in 1827 was indeed 2-dimensional.

2

1.5

1

0.5

0

-0.5

-2

-1.5

-1

-1

-0.5

-1.5

-2 -2

-1.5

-1

0

0.5

-0.5

0

0.5

1

1.5

1

1.5

2

2

Fig. 4.3: Sample paths of a three-dimensional Brownian motion.

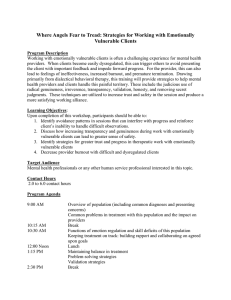

Figure 4.4 presents a construction of Brownian motion by successive linear

interpolations, cf. Problem 4.15.

"

81

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

0.0

0.5

1.0

1.5

n= 12

0.0

0.2

0.4

0.6

0.8

1.0

t

Fig. 4.4: Construction of Brownian motion by linear interpolation.∗

The following R code is used to generate Figure 4.4.

alpha=1/2;t <- 0:1;dt <- 1;z=rnorm(n=1, sd = dt^alpha)

plot(t*dt, c(0, z), xlab = "t", ylab = "", main = "", type = "l", xaxs="i")

k=0;while (k<10)

{readline("Press <return> to continue")

m <- (z+c(0,head(z,-1)))/2

y <- rnorm(n = length(t) - 1, sd = (dt/4)^alpha)

x <- m+y

x <- c(matrix(c(x,z), 2, byrow = T))

n=2*length(t)-2

t <- 0:n

plot(t*dt/2, c(0, x), xlab = "t", ylab = "", main = "", type = "l", xaxs="i")

z=x;dt=dt/2}

The next Figure 4.5 presents an illustration of the scaling property of Brownian motion.

Fig. 4.5: Scaling property of Brownian motion.†

82

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

4.2 Wiener Stochastic Integral

In this section we construct the Itô stochastic integral of square-integrable

deterministic function with respect to Brownian motion.

Recall that Bachelier originally modeled the price St of a risky asset by

St = σBt where σ is a volatility parameter. The stochastic integral

wT

0

f (t)dSt = σ

wT

0

f (t)dBt

can be used to represent the value of a portfolio as a sum of profits and

losses f (t)dSt where dSt represents the stock price variation and f (t) is the

quantity invested in the asset St over the short time interval [t, t + dt].

A naive definition of the stochastic integral with respect to Brownian motion would consist in writing

w∞

0

f (t)dBt =

w∞

0

f (t)

dBt

dt,

dt

and evaluating the above integral with respect to dt. However this definition

fails because the paths of Brownian motion are not differentiable, cf. (4.3).

Next we present Itô’s construction of the stochastic integral with respect to

Brownian motion. Stochastic integrals will be first constructed as integrals

of simple step functions of the form

f (t) =

n

X

ai 1(ti−1 ,ti ] (t),

(4.4)

t ∈ R+ ,

i=1

i.e. the function f takes the value ai on the interval (ti−1 , ti ], i = 1, . . . , n,

with 0 ≤ t0 < · · · < tn , as illustrated in Figure 4.6.

f

6

a2

a1

a4

t0

t1

t2

t3

t4

t

Fig. 4.6: Step function.

Recall that the classical integral of f given in (4.4) is interpreted as the area

under the curve f and computed as

†

The animation works in Acrobat reader on the entire pdf file.

"

83

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

w∞

f (t)dt =

0

n

X

ai (ti − ti−1 ).

i=1

In the next definition we adapt this construction to the setting of stochastic

integration with respect to Brownian motion. The stochastic integral (4.5)

will be interpreted as the sum of profits and losses ai (Bti − Bti−1 ), i =

1, 2, . . . , n, in a portfolio holding a quantity ai of a risky asset whose price

variation is Bti − Bti−1 at time i = 1, 2, . . . , n.

Definition 4.2. The stochastic integral with respect to Brownian motion

(Bt )t∈R+ of the simple step function f of the form (4.4) is defined by

w∞

0

f (t)dBt :=

n

X

ai (Bti − Bti−1 ).

(4.5)

i=1

w∞

In the next Lemma 4.3 we determine the probability distribution of

f (t)dBt

0

and we show that it is independent of the particular representation (4.4) chosen for f (t).

Lemma 4.3.

w ∞Let f be a simple step function f of the form (4.4). The stochastic integral

f (t)dBt defined in (4.5) has a centered Gaussian distribution

0

w∞

0

with mean IE

Var

hw ∞

0

hw ∞

0

w∞

f (t)dBt ' N 0,

|f (t)|2 dt

0

i

f (t)dBt = 0 and variance given by the Itô isometry

w

i

2 w ∞

∞

f (t)dBt = IE

f (t)dBt

=

|f (t)|2 dt.

0

0

(4.6)

Proof. Recall that if X1 , . . . , Xn are independent Gaussian random variables

with probability laws N (m1 , σ12 ), . . . , N (mn , σn2 ) then then sum X1 +· · ·+Xn

is a Gaussian random variable with distribution

N (m1 + · · · + mn , σ12 + · · · + σn2 ).

As a consequence, when f is the simple function

f (t) =

n

X

ai 1(ti−1 ,ti ] (t),

t ∈ R+ ,

i=1

the sum

w∞

0

f (t)dBt =

n

X

ak (Btk − Btk−1 )

k=1

has a centered Gaussian distribution with variance

84

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

n

X

|ak |2 (tk − tk−1 ),

k=1

since

Var [ak (Btk − Btk−1 )] = a2k Var [Btk − Btk−1 ] = a2k (tk − tk−1 ),

hence the stochastic integral

w∞

0

f (t)dBt =

n

X

ak (Btk − Btk−1 )

k=1

of the step function

f (t) =

n

X

ak 1(tk−1 ,tk ] (t)

k=1

has a centered Gaussian distribution with variance

Var

hw ∞

0

n

i X

f (t)dBt =

|ak |2 (tk − tk−1 )

=

k=1

n

X

|ak |2

k=1

=

=

n

w∞X

0

w∞

0

w tk

tk−1

dt

|ak |2 1(tk−1 ,tk ] (t)dt

k=1

|f (t)|2 dt.

Finally we note that

Var

hw ∞

0

w

i

2 hw ∞

i2

∞

f (t)dBt = IE

f (t)dBt

− IE

f (t)dBt

0

0

w

2 ∞

f (t)dBt

.

= IE

0

In the sequel we will make a repeated use of the space L2 (R+ ) of measurable

functions f : R+ −→ R, called square-integrable functions, endowed with the

norm

rw

∞

kf kL2 (R+ ) :=

|f (t)|2 dt < ∞, f ∈ L2 (R+ ),

(4.7)

0

which induces the distance

kf − gkL2 (R+ ) :=

"

rw

∞

0

|f (t) − g(t)|2 dt < ∞,

85

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

between two functions f and g in L2 (R+ ), cf. e.g. Chapter 3 of [98] for details.

Note that the set of simple step functions f of the form (4.4) is a linear

space which is dense in L2 (R+ ) for the norm (4.7), cf. e.g. Theorem 3.13 in

[98], namely, given f a function satisfying (4.7) and (fn )n∈N a sequence of

simple functions converging to f for the norm

rw

∞

kf − fn kL2 (R+ ) :=

0

|f (t) − fn (t)|2 dt

In order to extend the definition (4.5) of the stochastic integral

w∞

0

f (t)dBt

to any function f ∈ L2 (R+ ), i.e. to f : R −→ R measurable such that

w∞

|f (t)|2 dt < ∞,

(4.8)

0

we will make use of the space L2 (Ω) of random variables F : Ω −→ R called

square-integrable random variables, endowed with the norm

p

kF kL2 (Ω×R+ ) := IE[F 2 ] < ∞,

which induces the distance

kF − GkL2 (Ω) :=

p

IE[(F − G)2 ] < ∞,

between the square-integrable random variables F and g in L2 (Ω).

w∞

Proposition 4.4. The definition (4.5) of the stochastic integral

f (t)dBt

0

w∞

can be extended to any function f ∈ L2 (R+ ). In this case,

f (t)dBt has a

0

centered Gaussian distribution

w∞

w∞

f (t)dBt ' N 0,

|f (t)|2 dt

0

with mean IE

Var

hw ∞

0

hw ∞

0

0

i

f (t)dBt = 0 and variance given by the Itô isometry

w

i

2 w ∞

∞

f (t)dBt

=

|f (t)|2 dt.

f (t)dBt = IE

0

0

(4.9)

Proof. The extension of the stochastic integral to all functions satisfying

(4.8) is obtained by density and a Cauchy∗ sequence argument, based on

the isometry relation (4.9). Given f a function satisfying (4.8), consider a

sequence (fn )n∈N of simple functions converging to f in L2 (R+ ), i.e.

rw

lim kf − fn kL2 (R+ ) = lim

n→∞

∗

n→∞

∞

0

|f (t) − fn (t)|2 dt = 0,

See MH3100 Real Analysis I.

86

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

r∞

cf. e.g. Theorem 3.13 in [98]. The isometry (4.9) shows that 0 fn (t)dBt n∈N

is a Cauchy sequence in L2 (Ω) by the triangle inequality∗ for the L2 (Ω)-norm,

as we have

w ∞

w∞

fk (t)dBt −

fn (t)dBt 2

0

0

L (Ω)

s w ∞

2 w∞

= IE

fk (t)dBt −

fn (t)dBt

0

s

=

IE

0

w

∞

0

(fk (t) − fn (t))dBt

2 = kfk − fn kL2 (R+ )

≤ kfk − f kL2 (R+ ) + kf − fn kL2 (R+ ) ,

r∞

which tends to 0 as k and n tend to infinity. Since the sequence 0 fn (t)dBt n∈N

is Cauchy and the space L2 (Ω) is complete,

cf. e.g. Theorem

3.11 in [98] or

w

Chapter 4 of [30], we conclude that

∞

0

fn (t)dBt

n∈N

converges for the

L2 -norm to a limit in L2 (Ω). In this case we let

w∞

w∞

f (t)dBt := lim

fn (t)dBt ,

n→∞

0

0

which also satisfies (4.9) from (4.6) The uniqueness of this limit can then be

shown from (4.9).

w∞

−t

For example,

e dBt has a centered Gaussian distribution with variance

0

w∞

∞

1

1

= .

e−2t dt = − e−2t

0

2

2

0

w∞

Again, the Wiener stochastic integral

f (s)dBs is nothing but a Gaussian

0

random variable and it cannot be “computed” in the way standard integral

are computed via the use of primitives. However, when f ∈ L2 (R+ ) is in

C 1 (R+ ), i.e. when f is continuously differentiable on R+ , we have the following formula

w∞

w∞

f (t)dBt = −

f 0 (t)Bt dt,

(4.10)

0

0

provided that limt→∞ t|f (t)|2 = 0 and f ∈ L2 (R+ ), cf. e.g. Remark 2.5.9 in

[83].

On a finite interval [0, T ] we also have the integration by parts relation

The triangle inequality kfk − fn kL2 (R+ ) ≤ kfk − f kL2 (R+ ) + kf − fn kL2 (R+ ) follows

from the Minkowski inequality.

∗

"

87

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

wT

0

f (t)dBt = f (T )BT −

wT

0

Bt f 0 (t)dt.

(4.11)

4.3 Itô Stochastic Integral

In this section we extend the Wiener stochastic integral to square-integrable

adapted processes. Recall that a process (Xt )t∈R+ is said to be Ft -adapted if

Xt is Ft -measurable for all t ∈ R+ , where the information flow (Ft )t∈R+ has

been defined in (4.1).

Recall, as examples, that

- the process (Bt )t∈R+ is adapted,

- the process (Bt+1 )t∈R+ is not adapted,

- the process (Bt/2 )t∈R+ is adapted,

- the process (B√t )t∈R+ is not adapted.

In other words, a process (Xt )t∈R+ is Ft -adapted if the value of Xt at time t

depends only on information known up to time t. Note that the value of Xt

may still depend on “known” future data, for example a fixed future date in

the calendar, such as a maturity time T > t, as long as its value is known at

time t.

The extension of the stochastic integral to adapted random processes is

actually necessary in order to compute a portfolio value when the portfolio

process is no longer deterministic. This happens in particular when one needs

to update the portfolio allocation based on random events occurring on the

market.

Stochastic integrals of adapted processes will be first constructed as integrals

of simple predictable processes (ut )t∈R+ of the form

ut :=

n

X

Fi 1(ti−1 ,ti ] (t),

t ∈ R+ ,

(4.12)

i=1

where Fi is an Fti−1 -measurable random variable for i = 1, . . . , n. For example, a natural approximation of (Bt )t∈R+ by a simple predictable process can

be constructed as

ut :=

n

X

Bti−1 1(ti−1 ,ti ] (t),

t ∈ R+ ,

i=1

88

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

since Bti−1 is Fti−1 -measurable for i = 1, . . . , n.

The notion of simple predictable process is natural in the context of portfolio investment, in which Fi will represent an investment allocation decided

at time ti−1 and to remain unchanged over the time period (ti−1 , ti ].

By convention, u : Ω × R+ −→ R is denoted in the sequel by ut (ω),

t ∈ R+ , ω ∈ Ω, and the random outcome ω is often dropped for convenience

of notation.

Definition 4.5. The stochastic integral with respect to Brownian motion

(Bt )t∈R+ of any simple predictable process (ut )t∈R+ of the form (4.12) is

defined by

n

w∞

X

ut dBt :=

Fi (Bti − Bti−1 ).

(4.13)

0

i=1

The use of predictability in the definition (4.13) is essential from a financial

point of view, as Fi will represent a portfolio allocation made at time ti−1

and kept constant over the trading interval [ti−1 , ti ], while Bti − Bti−1 represents a change in the underlying asset price over [ti−1 , ti ]. See also the related

discussion on self-financing portfolios in Section 5.2 and Lemma 5.2 on the

use of stochastic integrals to represent the value of a portfolio.

The next proposition gives the extension of the stochastic integral from simple predictable processes to square-integrable Ft -adapted processes (Xt )t∈R+

for which the value of Xt at time t only depends on information contained

in the Brownian path up to time t. This also means that knowing the future

is not permitted in the definition of the Itô integral, for example a portfolio

strategy that would allow the trader to “buy at the lowest” and “sell at the

highest” is not possible as it would require knowledge of future market data.

Note that the difference between Relation (4.14) below and Relation (4.9)

is the expectation on the right hand side.

Proposition 4.6. The stochastic integral with respect to Brownian motion

(Bt )t∈R+ extends to all adapted processes (ut )t∈R+ such that

i

hw ∞

|ut |2 dt < ∞,

IE

0

with the Itô isometry

IE

w

∞

0

ut dBt

2 = IE

hw ∞

0

i

|ut |2 dt .

(4.14)

In addition, the Itô integral of an adapted process (ut )t∈R+ is always a centered random variable:

"

89

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

IE

hw ∞

0

i

us dBs = 0.

(4.15)

Proof. We start by showing that the Itô isometry (4.14) holds for the simple

predictable process u of the form (4.12). We have

!2

w

n

2 X

∞

IE

ut dBt

= IE

Fi (Bti − Bti−1 )

0

i=1

= IE

n

X

Fi Fj (Bti − Bti−1 )(Btj − Btj−1 )

i,j=1

= IE

" n

X

#

|Fi |2 (Bti − Bti−1 )2

i=1

X

+2 IE

Fi Fj (Bti − Bti−1 )(Btj − Btj−1 )

1≤i<j≤n

=

n

X

IE[IE[|Fi |2 (Bti − Bti−1 )2 |Fti−1 ]]

i=1

+2

X

IE[IE[Fi Fj (Bti − Bti−1 )(Btj − Btj−1 )|Ftj−1 ]]

1≤i<j≤n

=

n

X

IE[|Fi |2 IE[(Bti − Bti−1 )2 |Fti−1 ]]

i=1

+2

X

IE[Fi Fj (Bti − Bti−1 ) IE[(Btj − Btj−1 )|Ftj−1 ]]

1≤i<j≤n

=

n

X

IE[|Fi |2 IE[(Bti − Bti−1 )2 ]]

i=1

+2

X

IE[Fi Fj (Bti − Bti−1 ) IE[Btj − Btj−1 ]]

1≤i<j≤n

=

n

X

IE[|Fi |2 (ti − ti−1 )]

i=1

= IE

" n

X

#

|Fi |2 (ti − ti−1 )

i=1

= IE

hw ∞

0

i

|ut |2 dt ,

where we applied the “tower property” (17.36) of conditional expectations

and the facts that Bti − Bti−1 is independent of Fti−1 and

IE[Bti − Bti−1 ] = 0, IE (Bti − Bti−1 )2 = ti − ti−1 , i = 1, . . . , n.

90

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

The extension of the stochastic integral to square-integrable adapted processes (ut )t∈R+ is obtained as in Proposition 4.4 by density and a Cauchy sequence argument using the isometry (4.14), in the same way as in the proof

of Proposition 4.4. Let L2 (Ω × R+ ) denote the space of square-integrable

stochastic processes u : Ω × R+ −→ R such that

hw ∞

i

kuk2L2 (Ω×R+ ) := IE

|ut |2 dt < ∞.

0

By Lemma 1.1 of [56], pages 22 and 46, or Proposition 2.5.3 of [83], the

set of simple predictable processes forms a linear space which is dense in

the subspace L2ad (Ω × R+ ) made of square-integrable adapted processes in

L2 (Ω × R+ ). In other words, given u a square-integrable adapted process

there exists a sequence (un )n∈N of simple predictable processes converging to

u in L2 (Ω × R+ ). Since this sequence

it is Cauchy in L2 (Ω × R+ )

r n converges,

hence by the isometry (4.14),

ut dBt n∈N is a Cauchy sequence in L2 (Ω),

hence it converges in the complete space L2 (Ω). In this case we let

w∞

w∞

ut dBt := lim

unt dBt

n→∞

0

0

and the limit is

unique from (4.14) and satisfies (4.14). The fact that the ranw∞

dom variable

us dBs is centered can be proved first on simple predictable

0

process u of the form (4.12) as

" n

#

hw ∞

i

X

IE

ut dBt = IE

Fi (Bti − Bti−1 )

0

i=1

"

= IE

n

X

#

Fi (Bti − Bti−1 )

i=1

=

=

=

n

X

i=1

n

X

i=1

n

X

IE[IE[Fi (Bti − Bti−1 )|Fti−1 ]]

IE[Fi IE[Bti − Bti−1 |Fti−1 ]]

IE[Fi IE[Bti − Bti−1 ]]

i=1

= 0,

and this identity extends as above from simple predictable processes to

adapted processes u in L2 (Ω × R+ ).

Note also that by bilinearity, the Itô isometry (4.14) can also be written as

hw ∞

i

hw ∞

i

w∞

IE

ut dBt

vt dBt = IE

ut vt dt ,

0

"

0

0

91

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

for all square-integrable adapted processes u, v.

In addition, whenwthe integrand (ut )t∈R+ is not a deterministic function,

∞

the random variable

us dBs no longer has a Gaussian distribution, except

0

in some exceptional cases.

Definite stochastic integral

The definite stochastic integral of u over the interval [a, b] is defined as

wb

a

ut dBt :=

w∞

0

1[a,b] (t)ut dBt ,

with in particular

wb

a

dBt =

w∞

0

1[a,b] (t)dBt = Bb − Ba , 0 ≤ a ≤ b,

We also have the Chasles relation

wc

wb

wc

ut dBt =

ut dBt +

ut dBt ,

a

a

0 ≤ a ≤ b ≤ c,

b

and the stochastic integral has the following linearity property:

w∞

w∞

w∞

(ut + vt )dBt =

ut dBt +

vt dBt ,

u, v ∈ L2 (R+ ).

0

0

0

As an application of the Itô isometry (4.14) we note in particular that

"

2 #

w

w

wT

wT

T

T

T2

.

IE

Bt dBt

= IE

|Bt |2 dt =

IE |Bt |2 dt =

tdt =

0

0

0

0

2

Stochastic modeling of asset returns

In the sequel we will define the return at time t ∈ R+ of the risky asset

(St )t∈R+ as

dSt

= µdt + σdBt ,

St

with µ ∈ R and σ > 0. This equation can be formally rewritten in integral

form as

wT

wT

ST = S0 + µ

St dt + σ

St dBt ,

0

0

hence the need to define an integral with respect to dBt , in addition to the

usual integral with respect to dt. Note that in view of the definition (4.13),

this is a continuous-time extension of the notion portfolio value based on a

92

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

predictable portfolio strategy.

In Proposition 4.6 we have defined the stochastic integral of squareintegrable processes with respect to Brownian motion, thus we have made

sense of the equation

ST = S0 + µ

wT

0

St dt + σ

wT

0

St dBt ,

for (St )t∈R+ an Ft -adapted process, which can be rewritten in differential

notation as

dSt = µSt dt + σSt dBt ,

or

dSt

= µdt + σdBt .

St

(4.16)

This model will be used to represent the random price St of a risky asset

at time t. Here the return dSt /St of the asset is made of two components: a

constant return µdt and a random return σdBt parametrized by the coefficient

σ, called the volatility.

4.4 Stochastic Calculus

Our goal is now to solve Equation (4.16) and for this we will need to introduce

Itô’s calculus in Section 4.4 after reviewing classical deterministic calculus at

the beginning of Section 4.4.

Deterministic calculus

The fundamental theorem of calculus states that for any continuously differentiable (deterministic) function f we have

wx

f (x) = f (0) +

f 0 (y)dy.

0

In differential notation this relation is written as the first order expansion

df (x) = f 0 (x)dx,

(4.17)

where dx is “small”. Higher order expansions can be obtained from Taylor’s

formula, which, letting

df (x) = f (x + dx) − f (x),

states that

1

1

1

df (x) = f 0 (x)dx + f 00 (x)(dx)2 + f 000 (x)(dx)3 + f (4) (x)(dx)4 + · · · .

2

3!

4!

"

93

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

Note that Relation (4.17) can be obtained by neglecting the terms of order

larger than one in Taylor’s formula, since (dx)n << dx when n ≥ 2 and dx

is “small”.

Stochastic calculus

Let us now apply Taylor’s formula to Brownian motion, taking

dBt = Bt+dt − Bt ,

and letting

df (Bt ) = f (Bt+dt ) − f (Bt ),

we have

df (Bt )

1

1

1

= f 0 (Bt )dBt + f 00 (Bt )(dBt )2 + f 000 (Bt )(dBt )3 + f (4) (Bt )(dBt )4 + · · · .

2

3!

4!

From

√ the construction of Brownian motion by its small increments dBt =

± dt, it turns out that the terms in (dt)2 and dtdBt = ±(dt)3/2 can be neglected in Taylor’s formula at the first order of approximation in dt. However,

the term of order two

√

(dBt )2 = (± dt)2 = dt

can no longer be neglected in front of dt.

Simple Itô formula

For f ∈ C 2 (R), Taylor’s formula written at the second order for Brownian

motion reads

1

df (Bt ) = f 0 (Bt )dBt + f 00 (Bt )dt,

2

(4.18)

for “small” dt. Note that writing this formula as

df (Bt )

dBt

1

= f 0 (Bt )

+ f 00 (Bt )

dt

dt

2

does not make sense because the derivative

√

dBt

dt

1

'±

' ± √ ' ±∞

dt

dt

dt

does not exist. Integrating (4.18) on both sides and using the relation

94

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

f (Bt ) − f (B0 ) =

wt

0

df (Bs )

we get the integral form of Itô’s formula for Brownian motion, i.e.

f (Bt ) = f (B0 ) +

wt

0

f 0 (Bs )dBs +

1 w t 00

f (Bs )ds.

2 0

Itô formula for Itô processes

We now turn to the general expression of Itô’s formula which applies to Itô

processes of the form

wt

wt

Xt = X0 +

vs ds +

us dBs ,

t ∈ R+ ,

(4.19)

0

0

or in differential notation

dXt = vt dt + ut dBt ,

where (ut )t∈R+ and (vt )t∈R+ are square-integrable adapted processes.

Given (t, x) 7−→ f (t, x) a smooth function of two variables on R+ ×R, from

∂f

denote partial differentiation with respect to the second

∂x

∂f

denote partial differentiation with respect to the

variable in f (t, x), while

∂t

first (time) variable in f (t, x).

now on we let

Theorem 4.7. (Itô formula for Itô processes). For any Itô process (Xt )t∈R+

of the form (4.19) and any f ∈ C 1,2 (R+ × R) we have

w t ∂f

w t ∂f

f (t, Xt ) = f (0, X0 ) +

vs (s, Xs )ds +

us (s, Xs )dBs

0

0

∂x

∂x

w t ∂f

w

2

1 t

∂ f

|us |2 2 (s, Xs )ds.

+

(s, Xs )ds +

(4.20)

0 ∂s

2 0

∂x

Proof. cf. Theorem II-32, page 71 of [93].

From the relation

wt

0

df (s, Xs ) = f (t, Xt ) − f (0, X0 ),

we can rewrite (4.20) as

wt

0

"

df (s, Xs ) =

wt

0

vs

w t ∂f

∂f

(s, Xs )ds +

us (s, Xs )dBs

0

∂x

∂x

95

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

+

w t ∂f

1wt

∂2f

(s, Xs )ds +

|us |2 2 (s, Xs )ds,

0 ∂s

2 0

∂x

which allows us to rewrite (4.20) in differential notation, as

df (t, Xt )

(4.21)

2

∂f

∂f

∂f

1

2∂ f

(t, Xt )dt,

=

(t, Xt )dt + ut (t, Xt )dBt + vt (t, Xt )dt + |ut |

∂t

∂x

∂x

2

∂x2

or

df (t, Xt ) =

∂f

1

∂2f

∂f

(t, Xt )dt +

(t, Xt )dXt + |ut |2 2 (t, Xt )dt.

∂t

∂x

2

∂x

In case the function x 7−→ f (x) does not depend on the time variable t we

get

df (t, Xt ) = ut

∂f

∂f

1

∂2f

(t, Xt )dBt + vt (t, Xt )dt + |ut |2 2 (t, Xt )dt,

∂x

∂x

2

∂x

and

df (t, Xt ) =

1

∂f

∂2f

(t, Xt )dXt + |ut |2 2 (t, Xt )dt.

∂x

2

∂x

Taking ut = 1 and vt = 0 in (4.19) yields Xt = Bt , in which case the Itô

formula (4.20) reads

f (t, Bt ) = f (0, B0 ) +

w t ∂f

w t ∂f

1 w t ∂2f

(s, Bs )ds +

(s, Bs )dBs +

(s, Bs )ds,

0 ∂x

0 ∂s

2 0 ∂x2

i.e. in differential notation:

df (t, Bt ) =

∂f

∂f

1 ∂2f

(t, Bt )dt +

(t, Bt )dBt +

(t, Bt )dt.

∂t

∂x

2 ∂x2

(4.22)

Itô multiplication table

Next, consider two Itô processes (Xt )t∈R+ and (Yt )t∈R+ written in integral

form as

wt

wt

Xt = X0 +

vs ds +

us dBs ,

t ∈ R+ ,

0

0

and

96

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

Yt = Y0 +

wt

bs ds +

0

wt

0

t ∈ R+ ,

as dBs ,

or in differential notation as

dXt = vt dt + ut dBt ,

and dYt = bt dt + at dBt ,

t ∈ R+ .

The Itô formula also shows that

d(Xt Yt ) = Xt dYt + Yt dXt + dXt · dYt

where the product dXt · dYt is computed according to the Itô rule

dt · dt = 0,

dt · dBt = 0,

dBt · dBt = dt,

(4.23)

i.e.

dXt · dYt = (vt dt + ut dBt ) · (bt dt + at dBt )

= bt vt (dt)2 + bt ut dtdBt + at vt dtdBt + at ut (dBt )2

= at ut dt.

Hence we have

(dXt )2 = (vt dt + ut dBt )2

= (vt )2 (dt)2 + (ut )2 (dBt )2 + 2ut vt (dt · dBt )

= (ut )2 dt,

according to the Itô table

·

dt

dBt

dt

0

0

dBt

0

dt

Table 4.1: Itô multiplication table.

Consequently, (4.21) can also be rewriten as

∂f

∂f

1 ∂2f

(t, Xt )dt +

(t, Xt )dXt +

(t, Xt )(dXt )2

∂t

∂x

2 ∂x2

∂f

∂f

∂f

1

∂2f

=

(t, Xt )dt + vt (t, Xt )dt + ut (t, Xt )dBt + (ut )2 2 (t, Xt )dt.

∂t

∂x

∂x

2

∂x

df (t, Xt ) =

Example

Apply Itô’s formula (4.22) to Bt2 with

Bt2 = f (t, Bt ) and f (t, x) = x2 ,

"

97

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

we get

d(Bt2 ) = df (Bt )

∂f

∂f

1 ∂2f

=

(t, Bt )dt

(t, Bt )dt +

(t, Bt )dBt +

∂t

∂x

2 ∂x2

= 2Bt dBt + dt,

since

∂f

(t, x) = 0,

∂t

∂f

(t, x) = 2x,

∂x

1 ∂2f

(t, x) = 1,

2 ∂x2

and

hence by integration we find

wT

Bs dBs +

wT

wT

Bs dBs =

1

BT2 − T .

2

BT2 = B0 + 2

and

0

0

0

dt = 2

wT

0

Bs dBs + T,

Notation

We close this section with some comments on the practice of Itô’s calculus.

In some finance textbooks, Itô’s formula for e.g. geometric Brownian motion

can be found written in the notation

wT

wT

∂f

∂f

f (T, ST ) = f (0, X0 ) + σ

St

(t, St )dBt + µ

St

(t, St )dt

0

0

∂St

∂St

w T ∂f

w

T

1

∂2f

+

(t, St )dt + σ 2

St2 2 (t, St )dt,

0 ∂t

0

2

∂St

or

df (St ) = σSt

∂f

∂f

1

∂2f

(St )dBt + µSt

(St )dt + σ 2 St2 2 (St )dt.

∂St

∂St

2

∂St

∂f

(St ) can in fact be easily misused in combination with the

∂St

fundamental theorem of classical calculus, and lead to the wrong identity

The notation

df (St ) =

∂f

(St )dSt .

∂St

Similarly, writing

df (Bt ) =

df

1 d2 f

(Bt )dBt +

(Bt )dt

dx

2 dx2

is consistent, while writing

98

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

df (Bt ) =

df (Bt )

1 d2 f (Bt )

dBt +

dt

dBt

2 dBt2

is potentially a source of confusion.

4.5 Geometric Brownian Motion

Our aim in this section is to solve the stochastic differential equation

dSt = µSt dt + σSt dBt

(4.24)

that will defined the price St of a risky asset at time t, where µ ∈ R and

σ > 0. This equation is rewritten in integral form as

wt

wt

St = S0 + µ Ss ds + σ Ss dBs ,

t ∈ R+ .

(4.25)

0

0

It can be solved by applying Itô’s formula to the Itô process (St )t∈R+ as

in (4.19) with vt = µSt and ut = σSt , and by taking f (St ) = log St with

f (x) = log x, which shows that

1

d log St = µSt f 0 (St )dt + σSt f 0 (St )dBt + σ 2 St2 f 00 (St )dt

2

1

= µdt + σdBt − σ 2 dt,

2

hence

log St − log S0 =

wt

d log Sr

0

wt

wt

1

σdBr

=

µ − σ 2 dr +

0

0

2

1

= µ − σ 2 t + σBt ,

t ∈ R+ ,

2

and

St = S0 exp

1

µ − σ 2 t + σBt ,

2

t ∈ R+ .

The above provides a proof of the next proposition.

Proposition 4.8. The solution of (4.24) is given by

St = S0 eµt+σBt −σ

2

t/2

,

t ∈ R+ .

Proof. Let us provide an alternative proof by searching for a solution of the

form

St = f (t, Bt )

"

99

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

where f (t, x) is a function to be determined. By Itô’s formula (4.22) we have

dSt = df (t, Bt ) =

∂f

∂f

1 ∂2f

(t, Bt )dt.

(t, Bt )dt +

(t, Bt )dBt +

∂t

∂x

2 ∂x2

Comparing this expression to (4.24) and identifying the terms in dBt we get

∂f

(t, Bt ) = σSt ,

∂x

1 ∂2f

∂f

(t, Bt ) +

(t, Bt ) = µSt .

∂t

2 ∂x2

Using the relation St = f (t, Bt ), these two equations rewrite as

∂f

(t, Bt ) = σf (t, Bt ),

∂x

∂f

1 ∂2f

(t, Bt ) +

(t, Bt ) = µf (t, Bt ).

∂t

2 ∂x2

Since Bt is a Gaussian random variable taking all possible values in R, the

equations should hold for all x ∈ R, as follows:

∂f

(t, x) = σf (t, x),

(4.28a)

∂x

∂f

1 ∂2f

(t, x) +

(t, x) = µf (t, x).

∂t

2 ∂x2

(4.28b)

To solve (4.28a) we let g(t, x) = log f (t, x) and rewrite (4.28a) as

∂g

∂ log f

1 ∂f

(t, x) =

(t, x) =

(t, x) = σ,

∂x

∂x

f (t, x) ∂x

i.e.

which is solved as

hence

∂g

(t, x) = σ,

∂x

g(t, x) = g(t, 0) + σx,

f (t, x) = eg(t,0) eσx = f (t, 0)eσx .

Plugging back this expression into the second equation (4.28b) yields

100

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

eσx

∂f

1

(t, 0) + σ 2 eσx f (t, 0) = µf (t, 0)eσx ,

∂t

2

i.e.

∂f

(t, 0) = µ − σ 2 /2 f (t, 0).

∂t

∂g

In other words, we have

(t, 0) = µ − σ 2 /2, which yields

∂t

g(t, 0) = g(0, 0) + µ − σ 2 /2 t,

i.e.

f (t, x) = eg(t,x) = eg(t,0)+σx

2

= eg(0,0)+σx+(µ−σ /2)t

= f (0, 0)eσx+(µ−σ

2

/2)t

t ∈ R+ .

,

We conclude that

St = f (t, Bt ) = f (0, 0)eσBt +(µ−σ

2

/2)t

,

and the solution to (4.24) is given by

St = S0 eσBt +(µ−σ

2

/2)t

,

t ∈ R+ .

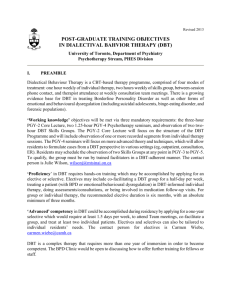

The next Figure 4.7 presents an illustration of the geometric Brownian process of Proposition 4.8.

4

St

ert

3.5

3

St

2.5

2

1.5

1

0.5

0

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

t

Fig. 4.7: Geometric Brownian motion started at S0 = 1, with r = 1 and σ 2 = 0.5.∗

"

101

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

Conversely, taking St = f (t, Bt ) with f (t, x) = S0 eσx−σ

Itô’s formula to check that

2

t/2+µt

we may apply

dSt = df (t, Bt )

∂f

∂f

1 ∂2f

(t, Bt )dt

=

(t, Bt )dt +

(t, Bt )dBt +

∂t

∂x

2 ∂x2

2

2

= µ − σ 2 /2 S0 eσBt +(µ−σ /2)t dt + σS0 eσBt +(µ−σ /2)t dBt

2

1

+ σ 2 S0 eσBt +(µ−σ /2)t dt

2

2

2

= µS eσBt +(µ−σ /2)t dt + σS eσBt +(µ−σ /2)t dB

0

t

0

= µSt dt + σSt dBt .

4.6 Stochastic Differential Equations

In addition to geometric Brownian motion there exists a large family of

stochastic differential equations that can be studied, although most of the

time they cannot be explicitly solved. Let now

σ : R+ × Rn −→ Rd ⊗ Rn

where Rd ⊗ Rn denotes the space of d × n matrices, and

b : R+ × Rn −→ R

satisfy the global Lipschitz condition

kσ(t, x) − σ(t, y)k2 + kb(t, x) − b(t, y)k2 ≤ K 2 kx − yk2 ,

t ∈ R+ , x, y ∈ Rn . Then there exists a unique strong solution to the stochastic

differential equation

wt

wt

σ(s, Xs )dBs +

b(s, Xs )ds,

t ∈ R+ ,

Xt = X0 +

0

0

where (Bt )t∈R+ is a d-dimensional Brownian motion, see e.g. [93], Theorem V7.

Next, we consider a few examples of stochastic differential equations that

can be solved explicitly using Itô calculus, in addition to geometric Brownian

motion.

∗

The animation works in Acrobat reader on the entire pdf file.

102

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

Examples

1. Consider the stochastic differential equation

dXt = −αXt dt + σdBt ,

X0 = x0 ,

with α > 0 and σ > 0.

Looking for a solution of the form

wt

Xt = a(t) x0 +

b(s)dBs

0

where a(·) and b(·) are deterministic functions, yields

Xt = x0 e−αt + σ

wt

0

e−α(t−s) dBs ,

t ∈ R+ ,

(4.29)

rt

after applying Theorem 4.7 to the Itô process x0 + 0 b(s)dBs of the form

(4.19) with ut = b(t) and v(t) = 0, and to the function f (t, x) = a(t)x.

Remark: the solution of this equation cannot be written as a function

f (t, Bt ) of t and Bt as in the proof of Proposition 4.8.

2. Consider the stochastic differential equation

dXt = tXt dt + et

2

X0 = x0 .

rt

Looking for a solution of the form Xt = a(t) X0 + 0 b(s)dBs , where

/2

dBt ,

a(·) and b(·) are deterministic functions we get a0 (t)/a(t) = t and

2

2

a(t)b(t) = et /2 , hence a(t) = et /2 and b(t) = 1, which yields Xt =

t2 /2

e

(X0 + Bt ), t ∈ R+ .

3. Consider the stochastic differential equation

dYt = (2µYt + σ 2 )dt + 2σ

p

Yt dBt ,

where µ, σ > 0.

Letting Xt =

√

Yt we have dXt = µXt dt + σdBt , hence

Yt =

"

p

2

wt

eµt Y0 + σ eµ(t−s) dBs .

0

103

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

Exercises

Exercise 4.1 Let (Bt )t∈R+ denote a standard Brownian motion.

a) Let c > 0. Among the following processes, tell which is a standard Brownian motion and which is not. Justify your answer.

(i)

(ii)

(iii)

(iv)

(Bc+t − Bc )t∈R+ .

(cBt/c2 )t∈R+ .

(Bct2 )t∈R+ .

(Bt + Bt/2 )t∈R+ .

b) Compute the stochastic integrals

wT

0

2dBt

wT

and

0

(2 × 1[0,T /2] (t) + 1(T /2,T ] (t))dBt

and determine their probability laws (including mean and variance).

c) Determine the probability law (including mean and variance) of the

stochastic integral

w

2π

0

sin(t) dBt .

d) Compute IE[Bt Bs ] in terms of s, t ≥ 0.

e) Let T > 0. Show that if f is a differentiable function with f (0) = f (T ) = 0

we have

wT

wT

f (t)dBt = −

f 0 (t)Bt dt.

0

0

Hint: Apply Itô’s calculus to t 7→ f (t)Bt .

Exercise 4.2 Consider the price process (St )t∈R+ given by the stochastic

differential equation

dSt = rSt dt + σSt dBt .

Find the stochastic integral decomposition of the random variable ST , i.e.

find the constant C and the process (ζt )t∈[0,T ] such that

ST = C +

wT

0

ζt dBt .

(4.30)

Exercise 4.3 Given T > 0, find a stochastic integral decomposition of BT3 of

the form

wT

ζt dBt ,

(4.31)

BT3 = C +

0

where C ∈ R is a constant and (ζt )t∈[0,T ] is an adapted process to be determined.

104

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

Exercise 4.4 Let f ∈ L2 ([0, T ]). Compute the conditional expectation

h rT

i

0 ≤ t ≤ T,

IE e 0 f (s)dBs Ft ,

where (Ft )t∈[0,T ] denotes the filtration generated by (Bt )t∈[0,T ] .

Exercise 4.5 Let f ∈ L2 ([0, T ]) and consider a standard Brownian motion

(Bt )t∈[0,T ] . Show that the process

w

t

1wt 2

t 7−→ exp

f (s)dBs −

f (s)ds ,

t ∈ [0, T ],

0

2 0

is an (Ft )-martingale, where (Ft )t∈[0,T ] denotes the filtration generated by

(Bt )t∈[0,T ] .

Exercise 4.6 Consider (Bt )t∈R+ a standard Brownian motion generating the

filtration (Ft )t∈R+ and the process (St )t∈R+ defined by

w

wt

t

St = S0 exp

σs dBs +

us ds ,

t ∈ R+ ,

0

0

where (σt )t∈R+ and (ut )t∈R+ are Ft -adapted processes.

a) Compute dSt using Itô calculus.

b) Show that St satisfies a stochastic differential equation to be determined.

Exercise 4.7 Compute the expectation

w

T

IE exp β

Bt dBt

0

for all β < 1/T . Hint: expand (BT ) using Itô’s formula.

2

Exercise 4.8

a) Solve the ordinary differential equation df (t) = cf (t)dt and the stochastic

differential equation dSt = rSt dt + σSt dBt , t ∈ R+ , where r, σ ∈ R are

constants and (Bt )t∈R+ is a standard Brownian motion.

b) Show that

IE[St ] = S0 ert

and

2

Var[St ] = S02 e2rt (eσ t − 1),

t ∈ R+ .

c) Compute d log St .

"

105

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

d) Assume that (Wt )t∈R+ is another standard Brownian motion, correlated

to (Bt )t∈R+ according to the Itô rule dWt · dBt = ρdt, for ρ ∈ [−1, 2],

and consider the solution (Yt )t∈R+ of the stochastic differential equation

dYt = µYt dt + ηYt dWt , t ∈ R+ , where µ, η ∈ R are constants. Compute

f (St , Yt ), for f a C 2 function of R2 .

Exercise 4.9

a) Solve the stochastic differential equation

dXt = −bXt dt + σe−bt dBt ,

t ∈ R+ ,

where (Bt )t∈R+ is a standard Brownian motion and σ, b > 0.

b) Solve the stochastic differential equation

dXt = −bXt dt + σe−at dBt ,

t ∈ R+ ,

where (Bt )t∈R+ is a standard Brownian motion and a, b, σ > 0 are positive

constants.

Exercise 4.10 Given T > 0, let (XtT )t∈[0,T ) denote the solution of the stochastic differential equation

dXtT = σdBt −

XtT

dt,

T −t

t ∈ [0, T ),

(4.32)

under the initial condition X0T = 0 and σ > 0.

a) Show that

XtT = σ(T − t)

wt

0

1

dBs ,

T −s

t ∈ [0, T ).

Hint: start by computing d(XtT /(T − t)) using Itô’s calculus.

b) Show that IE[XtT ] = 0 for all t ∈ [0, T ).

c) Show that Var[XtT ] = σ 2 t(T − t)/T for all t ∈ [0, T ).

d) Show that limt→T XtT = 0 in L2 (Ω). The process (XtT )t∈[0,T ] is called a

Brownian bridge.

Exercise 4.11 Exponential Vasicek model (1). Consider a Vasicek process

(rt )t∈R+ solution of the stochastic differential equation

drt = (a − brt )dt + σdBt ,

t ∈ R+ ,

where (Bt )t∈R+ is a standard Brownian motion and σ, a, b > 0 are positive

constants. Show that the exponential Xt := ert of rt satisfies a stochastic

differential equation of the form

106

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

dXt = Xt (ã − b̃f (Xt ))dt + σg(Xt )dBt ,

where the coefficients ã and b̃ and the functions f (x) and g(x) are to be

determined.

Exercise 4.12 Exponential Vasicek model (2). Consider a short term rate

interest rate proces (rt )t∈R+ in the exponential Vasicek model:

drt = rt (η − a log rt )dt + σrt dBt ,

(4.33)

where η, a, σ are positive parameters.

a) Find the solution (zt )t∈R+ of the stochastic differential equation

dzt = −azt dt + σdBt

as a function of the initial condition z0 , where a and σ are positive parameters.

b) Find the solution (Yt )t∈R+ of the stochastic differential equation

dYt = (θ − aYt )dt + σdBt

(4.34)

as a function of the initial condition Y0 . Hint: let zt = Yt − θ/a.

c) Let xt = eYt , t ∈ R+ . Determine the stochastic differential equation satisfied by (xt )t∈R+ .

d) Find the solution (rt )t∈R+ of (4.33) in terms of the initial condition r0 .

e) Compute the mean∗ IE[rt ] of rt , t ≥ 0.

f) Compute the asymptotic mean limt→∞ IE[rt ].

Exercise 4.13 Cox-Ingerson-Ross model. Consider the equation

√

drt = (α − βrt )dt + σ rt dBt

(4.35)

modeling the variations of a short term interest rate process rt , where α, β, σ

and r0 are positive parameters.

a) Write down the equation (4.35) in integral form.

b) Let u(t) = IE[rt ]. Show, using the integral form of (4.35), that u(t) satisfies

the differential equation

u0 (t) = α − βu(t).

c) By an application of Itô’s formula to rt2 , show that

3/2

drt2 = rt (2α + σ 2 − 2βrt )dt + 2σrt dBt .

(4.36)

α2 /2

One may use the Gaussian moment generating function IE[e ] = e

N (0, α2 ).

∗

"

X

for X '

107

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

d) Using the integral form of (4.36), find a differential equation satisfied by

v(t) = IE[rt2 ].

Exercise 4.14 Let (Bt )t∈R+ denote a standard Brownian motion generating

the filtration (Ft )t∈R+ .

a) Consider the Itô formula

w t ∂f

1 w t 2 ∂2f

∂f

(Xs )dBs + vs (Xs )ds+

u

(Xs )ds,

0

∂x

∂x

2 0 s ∂x2

(4.37)

wt

wt

where Xt = X0 +

us dBs +

vs ds.

f (Xt ) = f (X0 )+

wt

0

us

0

0

Compute St := eXt by the Itô formula (4.37) applied to f (x) = ex and

Xt = σBt + νt, σ > 0, ν ∈ R.

b) Let r > 0. For which value of ν does (St )t∈R+ satisfy the stochastic differential equation

dSt = rSt dt + σSt dBt ?

c) Let the process (St )t∈R+ be defined by St = S0 eσBt +νt , t ∈ R+ . Using the

result of Exercise A.2, show that the conditional probability P(ST > K |

St = x) is given by

log(x/K) + ν(T − t)

√

P(ST > K | St = x) = Φ

,

σ T −t

Hint: use the decomposition ST = St eσ(BT −Bt )+ν(T −t) .

d) Given 0 ≤ t ≤ T and σ > 0, let

X = σ(BT − Bt )

and

η 2 = Var[X],

η > 0.

What is η equal to?

Problem 4.15 The goal of this problem is to prove the existence of standard Brownian motion (Bt )t∈[0,1] as a stochastic process satisfying the four

properties of Definition 4.1, i.e.:

1. B0 = 0 almost surely,

2. The sample trajectories t 7−→ Bt are continuous, with probability 1.

3. For any finite sequence of times t0 < t1 < · · · < tn , the increments

Bt1 − Bt0 , Bt2 − Bt1 , . . . , Btn − Btn−1

are independent.

108

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

4. For any given times 0 ≤ s < t, Bt − Bs has the Gaussian distribution

N (0, t − s) with mean zero and variance t − s.

The construction will proceed by the linear interpolation scheme illustrated

in Figure 4.4. We work on the space C0 ([0, 1]) of continuous functions on [0, 1]

started at 0, with the norm

kf k∞ := max |f (t)|

t∈[0,1]

and the distance

kf − gk∞ := max |f (t) − g(t)|.

t∈[0,1]

The following ten questions are interdependent.

a) Show that for any Gaussian random variable X ' N (0, σ 2 ) we have

2

2

σ

e−ε /(2σ ) ,

P(|X| ≥ ε) ≤ p

ε π/2

ε > 0.

Hint: Start from the inequality IE[(X − ε)+ ] ≥ 0 and compute the lefthand side.

b) Let X and Y be two independent centered Gaussian random variables

with variances α2 and β 2 . Show that the conditional distribution

P(X ∈ dx | X + Y = z)

of X given X + Y = z is Gaussian with mean α2 z/(α2 + β 2 ) and variance

α2 β 2 /(α2 + β 2 ).

Hint: Use the definition

P(X ∈ dx | X + Y = z) :=

P(X ∈ dx and X + Y ∈ dz)

P(X + Y ∈ dz)

and the formulas

P(X ∈ dx) := √

1

2πα2

e−x

2

/(2α2 )

dx,

P(Y ∈ dx) := p

1

2πβ 2

e−x

2

/(2β 2 )

dx,

where dx (resp. dy) represents a “small” interval [x, x + dx] (resp. [y, y +

dy]).

c) Let (Bt )t∈R+ denote a standard Brownian motion and let 0 < u < v. Give

the distribution of B(u+v)/2 given that Bu = x and Bv = y.

Hint: Note that given that Bu = x, the random variable Bv can be written

as

Bv = (Bv − B(u+v)/2 ) + (B(u+v)/2 − Bu ) + x,

(4.38)

"

109

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

and apply the result of Question (b) after identifying X and Y in the

above decomposition (4.38).

d) Consider the random sequences

(0)

(0)

Z = 0, Z1

(0) (1)

(1)

Z = 0, Z1/2 , Z1

Z (2) = 0, Z (2) , Z (1) , Z (2) , Z (0)

1

1/4

1/2

3/4

(3)

(2)

(3)

(1)

(3)

(2)

(3)

(0) Z (3) = 0, Z1/8 , Z1/4 , Z3/8 , Z1/2 , Z5/8 , Z3/4 , Z7/8 , Z1

..

..

.

.

(n)

(n)

(n)

(n)

(n)

Z (n) = 0, Z1/2

n , Z2/2n , Z3/2n , Z4/2n , . . . , Z1

(n+1)

(n)

(n+1)

(n+1)

(n+1)

(n+1)

(n+1) (n+1)

Z

= 0, Z1/2n+1 , Z1/2n , Z3/2n+1 , Z2/2n , Z5/2n+1 , Z3/2n , . . . , Z1

(n)

with Z0

i)

= 0, n ≥ 0, defined recursively as

(0)

Z1

' N (0, 1),

(0)

(0)

Z + Z1

ii)

' 0

+ N (0, 1/4),

2

(1)

(1)

(1)

(0)

Z

+

Z

Z1/2 + Z1

0

1/2

(2)

(2)

iii) Z1/4 '

+ N (0, 1/8), Z3/4 '

+ N (0, 1/8),

2

2

and more generally

(1)

Z1/2

(n)

(n+1)

Z(2k+1)/2n+1 =

(n)

Zk/2n + Z(k+1)/2n

2

+N (0, 1/2n+2 ),

k = 0, 1, . . . , 2n −1,

where N (0, 1/2n+2 ) is an independent centered Gaussian sample with

(n+1)

(n)

variance 1/2n+2 , and Zk/2n := Zk/2n , k = 0, 1, . . . , 2n .

(n) In the sequel we denote by Zt

t∈[0,1]

the continuous-time random path

(n) obtained by linear interpolation of the sequence points in Zk/2n

(0) k=0,1,...,2n

(1) .

Draw a sample of the first four linear interpolations Zt t∈[0,1] , Zt t∈[0,1] ,

(2) (3) (n)

Zt t∈[0,1] , Zt t∈[0,1] , and label the values of Zk/2n on the graphs for

n

k = 0, 1, . . . , 2 and n = 0, 1, 2, 3.

e) Using an induction argument, explain why for all n ≥ 0 the sequence

110

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

(n)

(n)

(n)

(n)

(n) Z (n) = 0, Z1/2n , Z2/2n , Z3/2n , Z4/2n , . . . , Z1

has same distribution as the sequence

B (n) := B0 , B1/2n , B2/2n , B3/2n , B4/2n , . . . , B1 .

Hint: Compare the constructions of Questions (c) and (d) and note that

under the above linear interpolation, we have

(n)

(n)

Z(2k+1)/2n+1 =

(n)

Zk/2n + Z(k+1)/2n

2

,

k = 0, 1, . . . , 2n − 1.

f) Show that for any εn > 0 we have

(n+1)

(n)

P Z (n+1) − Z (n) ∞ ≥ εn ≤ 2n P |Z1/2n+1 − Z1/2n+1 | ≥ εn .

Hint: Use the inequality

P

2n

−1

[

k=0

!

Ak

≤

n

2X

−1

P(Ak )

k=0

for a suitable choice of events (Ak )k=0,1,...,2n −1 .

g) Use the results of Questions (a) and (f) to show that for any εn > 0 we

have

2 n+1

2n/2

P Z (n+1) − Z (n) ∞ ≥ εn ≤ √ e−εn 2 .

εn 2π

h) Taking εn = 2−n/4 , show that

P

∞

X

(n+1)

Z

− Z (n) ∞ < ∞

!

= 1.

n=0

Hint: Show first that

∞

X

P Z (n+1) − Z (n) ∞ ≥ 2−n/4 < ∞,

n=0

and apply the Borel-Cantelli lemma.

n

o

(n) i) Show that with probability one, the sequence Zt t∈[0,1] , n ≥ 1 converges uniformly on [0, 1] to a continuous (random) function (Zt )t∈[0,1] .

Hint: Use the fact that C0 ([0, 1]) is a complete space for the k · k∞ norm.

j) Argue that the limit (Zt )t∈[0,1] is a standard Brownian motion on [0, 1] by

checking the four relevant properties.

"

111

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

Problem 4.16 Consider (Bt )t∈R+ a standard Brownian motion, and for any

n ≥ 1 and T > 0, define the discretized quadratic variation

(n)

QT :=

n

X

(BkT /n − B(k−1)T /n )2 ,

n ≥ 1.

k=1

h

i

(n)

a) Compute IE QT , n ≥ 1.

(n)

b) Compute Var[QT ], n ≥ 1.

c) Show that

(n)

lim QT = T,

n→∞

where the limit is taken in L2 (Ω), that is, show that

(n)

lim kQT − T kL2 (Ω) = 0,

n→∞

where

s

(n)

QT − T L2 (Ω)

IE

:=

(n)

QT − T

2 ,

n ≥ 1.

d) By the result of Question (c), show that the limit

wT

0

Bt dBt := lim

n→∞

n

X

(BkT /n − B(k−1)T /n )B(k−1)T /n

k=1

exists in L2 (Ω), and compute it.

Hint: Use the identity

(x − y)y =

1 2

(x − y 2 − (x − y)2 ),

2

x, y ∈ R.

e) Consider the modified quadratic variation defined by

(n)

Q̃T :=

n

X

(B(k−1/2)T /n − B(k−1)T /n )2 ,

n ≥ 1.

k=1

(n)

Compute the limit limn→∞ Q̃T in L2 (Ω) by repeating the steps of Questions (a)-(c).

f) By the result of Question (e), show that the limit

wT

0

Bt ◦ dBt := lim

n→∞

n

X

(BkT /n − B(k−1)T /n )B(k−1/2)T /n

k=1

112

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"

Brownian Motion and Stochastic Calculus

exists in L2 (Ω), and compute it.

Hint: Use the identities

(x − y)y =

1 2

(x − y 2 − (x − y)2 ),

2

and

1 2

(x − y 2 + (x − y)2 ),

x, y ∈ R.

2

g) More generally, by repeating the steps of Questions (e) and (f), show that

for any α ∈ [0, 1] the limit

(x − y)x =

wT

0

Bt ◦ dα Bt := lim

n→∞

n

X

(BkT /n − B(k−1)T /n )B(k−α)T /n

k=1

exists in L2 (Ω), and compute it.

h) Comparison with deterministic calculus. Compute the limit

lim

n→∞

n

X

k=1

(k − α)

T

n

k

T

T

− (k − 1)

n

n

for all values of α in [0, 1].

Exercise 4.17 Let (Bt )t∈R+ be a standard Brownian motion generating the

information flow (Ft )t∈R+ .

a) Let 0 ≤ t ≤ T . What is the probability law of BT − Bt ?

b) From the answer to Exercise A.4-(b), show that

r

T − t −Bt2 /(2(T −t))

Bt

IE[(BT )+ | Ft ] =

e

+ Bt Φ √

,

2π

T −t

0 ≤ t ≤ T . Hint: write BT = BT − Bt + Bt .

c) Let σ > 0, ν ∈ R, and Xt := σBt + νt, t ∈ R+ . Compute eXt by applying

the Itô formula

wt

w t ∂f

∂f

1 w t 2 ∂2f

(Xs )dBs + vs (Xs )ds +

u

(Xs )ds

0

∂x

∂x

2 0 s ∂x2

wt

wt

vs ds,

to f (x) = ex , where Xt is written as Xt = X0 +

us dBs +

0

0

t ∈ R+ .

d) Let St = eXt , t ∈ R+ , and r > 0. For which value of ν does (St )t∈R+

satisfy the stochastic differential equation

f (Xt ) = f (X0 ) +

0

us

dSt = rSt dt + σSt dBt

"

?

113

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

N. Privault

Exercise 4.18 From the answer to Exercise A.4-(b), show that for any β ∈ R

we have

r

T − t −(β−Bt )2 /(2(T −t))

β − Bt

IE[(β − BT )+ | Ft ] =

e

+ (β − Bt )Φ √

,

2π

T −t

0 ≤ t ≤ T.

Hint: write BT = BT − Bt + Bt .

114

This version: June 23, 2016

http://www.ntu.edu.sg/home/nprivault/indext.html

"