District Attorney/Child Support Attorney Representation Unit

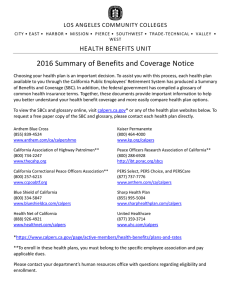

advertisement