The Band Plays On

advertisement

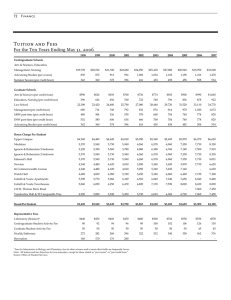

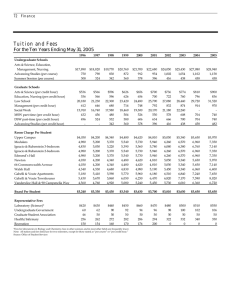

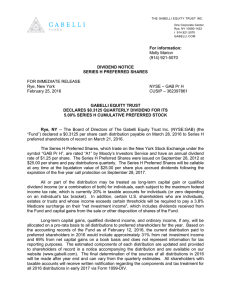

G.research, Inc. One Corporate Center Rye, NY 10580-1422 Tel (914) 921-5398 May 8, 2014 Gabelli & Company www.gabelli.com The Band Plays On Source:Rationalwalk.com Reflections from the 2014 Annual Meeting (BRK.A - $191,550 - NYSE) (BRK.B - $127.45 " ) Macrae Sykes ©2014 Gabelli & Company (914) 921-5398 -Please Refer To Important Disclosures On The Last Page Of This Report- May 8, 2014 G.research, Inc. One Corporate Center Rye, NY 10580-1422 Tel (914) 921-5398 Gabelli & Company www.gabelli.com Berkshire Hathaway Inc. (BRK.A - $191,550 - NYSE) Year 2016P 2015P 2014E 2013A EPS $13,300 12,000 10,900 11,850 P/E 14.3x 15.9 17.5 16.1 ’14 Annual Meeting - NR Dividend: N/A Current Return: Nil Common Shares “A”: 0.9 billion (a) “ “ “B”: 1.2 “ (b) 52-Week Range “A” Shares: $194,670 - $163,039 (a) One Class “A” Share can be converted into 1,500 “B” Shares. Class “A” Shares have 10,000 votes per share. (b) Warren Buffett owns 336,000 of “A” Shares and 1,425,727 “B” Shares. SUMMARY AND OPINION Berkshire Hathaway Inc., based in Omaha, NE is a holding company for a diverse group of operating subsidiaries including insurance, freight rail transportation, utilities and energy, finance, services and retailing. The subsidiaries operate in an autonomous fashion, while investment and capital allocation decisions are managed by Warren Buffett (83) in consultation with Vice Chairman, Charlie Munger (90). As of December 31, 2013 and from 1965, the firm had an annual compounded gain on book value of 19.7%. On May 3, 2014, Mr. Buffett (WB) and Mr. Munger (CM) hosted the firm’s 48th annual meeting at the CenturyLink Center in Omaha. Speculated attendance was approximately 38,000 out of the roughly one million Class B shareholders. True to form, the management duo, presided over an active Q&A of several distinguished financial journalists, institutional analysts and members of the public. For the most part, the discussion focused on the firm’s operating businesses and investment wisdom, with some questions around more recent events including the Coke compensation plan. Not surprising, the managers showed little sign of aging over the past year and remained as dogged as ever in communicating the virtues of the Berkshire Hathaway culture. Takeaways: - At last year’s meeting in May, Buffett alluded to the early trajectory of the S&P 500 Index and suggested for the first time in the company’s history that the increase in book value for the trailing 5-years could trail the S&P 500 Index. (Buffett: “It will not be a happy day, but it will not totally discourage us.” Munger: “We’re slowing down, but it will still be very pleasant. . . .I want to say to the Mungers in the audience, don’t be so stupid as to sell these shares.”) For 2013, BRK book value increased 18.2% vs. the 32.4% for the S&P 500 and for the period the index outperformed Mr. Buffett’s metric for returns four out of five years. Going forward, WB expects similar return attribution differences when the market has strong returns, but over time Berkshire’s set of businesses and unique structure should outperform the passive market index. Additionally, Mr. Munger pointed out the headwind associated with being graded on after-tax returns. “Warren Buffett talks about returns after-tax – indices do not pay any taxes. That is a pretty high standard. If this is failure – I want more of it.” - Not surprising, the shareholder proposal to initiate a dividend was voted down by roughly 97% of the Class B holders including Mr. Buffett, who stated that he “stuffed the ballot box.” - Intrinsic value estimates are impacted by accounting standards which in some cases may underestimate true net worth. For instance, the carrying value for GEICO is $1 billion over tangible assets. However, WB stated it may be worth over $20 billion over tangible assets given its client base and market share. Additionally, the $77 billion of insurance float is carried as a liability and subtracted from net worth, when the long-time ability to generate investment results is clearly an asset. Net/net, BRK’s intrinsic value is much higher than its stated book value, which Mr. Buffett uses to measure annual results. The firm uses a current threshold of 120% of book value to repurchase shares, with the notion that this is a level desirable below estimated intrinsic value. In terms of one aspect of financial engineering, the company has no plans to IPO any of its units. - Berkshire partnered with private equity firm 3G Capital last year to purchase H.J. Heinz Company (closed in June). WB commented that the principals are “marvelous partners, and more than fair with us” and see more opportunities to partner with 3G in the future. However respectful WB is of 3G in terms of running businesses, their management techniques differ from Berkshire’s and would not “blend well.” -1- Gabelli & Company - With $48 billion of cash “dry-powder,” (excluding significant investments in liquid investment securities) the firm is well positioned to make new investments and acquisitions (announced a $3 billion investment in a Canada energy firm over the weekend). Given the capital size, elephant hunting continues to be a priority, but only at the right price. The firm now has significant internal businesses to reinvest in as well. There is no pressure to put the capital to work. CM: “Our acquisitions were irregular in the past and they will be irregular in the future. Our energy and train business do offer recurring demand for future capital and that is positive for shareholders.” - In true humbling style and in response to a direct question, Mr. Buffett stated that the holding company has some weak points. First, management could be more efficient with operating cash flows in terms of sweeping cash balances from subsidiaries and trying to enhance yield (he did note that monetary effects are less impactful in current interest rate environment). WB and CM also acknowledged that they may be slow to make management changes and that the decentralized structure may lead to occasional negative effects from supervision. There is no central human resources component or general counsel in the corporate office. Despite these unique attributes, they remain confident in the culture and structure of the firm. CM: “By the standards of the world – we over trust, but our results show it. We have a good system.” - Todd Combs and Ted Weschler are now managing close to $7 billion each, still less than 10% of potential investable assets. Although both beat returns on S&P 500 Index in 2013, Mr. Buffett contends that they are finding it more difficult with larger sums of capital. Additionally, both have contributed (no specifics) to the organization outside of their normal investment vocations and continue to be “terrific additions to the business.” - Taxes always remain a hot topic. - According to WB corporate taxes have come down historically as a percentage of GDP and that corporate America is doing well producing extraordinary returns on tangible assets. - Berkshire has never considered an “inversion” (see Pfizer proposed $100 billion takeover of AstraZeneca in Britain and then reincorporation there from the United States). Berkshire’s model wouldn’t have been possible to create outside of the United States. - WB: “Berkshire plans to pay its fair share of taxes, but not more than that.” - Berkshire may stand-out in its success relative to other conglomerates. Some of those firms were run with the idea of rolling up assets with cheaper multiples than issued shares. One company mentioned by Mr. Buffett was Tyco and that company had some issues several years ago. On the positive side, the Dow Jones Index is a compilation of companies that have generated positive returns over the last fifty years with a makeup of core American businesses. Berkshire is similar with respect to many of those businesses, but with a single owner that can strategically allocate capital, which is an important strategic aspect to the firm. CM: “We have a couple of differences between us and other failed conglomerates. We can reinvest in the insurance business. We are more like the Mellon Brothers – they made smart, minority investments.” - The strong performance of the public markets in 2013 increased Mr. Buffett’s advantage (1) over Ted Seides of Protégé Partners as the passive vehicle of the S&P 500 Index beat the proprietary fund of hedge funds basket. After liquidating the fixed income securities of the original wager proceeds, the investment was put into Berkshire Hathaway shares and now that balance exceeds the original expected settlement of $1 million (to the winner’s charity). Table 1 Protégé Partners Wager 2008-2013 Year 2008 2009 2010 2011 2012 2013 Cumulative (1) Berkshire (9.60%) 19.80 13.00 4.60 14.40 18.20 S&P 500 (36.97%) 26.50 15.10 2.10 16.00 32.30 43.80% FoHF (23.90%) 15.92 8.46 (1.86) 6.46 11.80 12.50% Source: Berkshire Annual Meeting 2014. In 2008, Protégé Partners and Warren Buffett made a $1 million wager to go to the winner’s chosen charity. Mr. Buffett bet that the 10-year returns on the S&P 500 Index fund would eclipse those of a proprietary fund of hedge funds portfolio selected by Protégé Partners, LLC. -2- Gabelli & Company ANNUAL MEETING Following an abbreviated wait outside the CenturyLink Center, the doors opened at 7:00am. The exhibition hall was filled with many of the Berkshire Companies including BNSF, Borsheims, and GEICO. Exhibit 1 Source: Gabelli & Company. Consistent with previous years, shareholders sat down at 8:30am to witness the creative efforts of management in several short movies as well as some commercials around notable brands including Coke and GEICO. This year included a Olympic Hockey parody of “Team Berkshire” with Bill Gates, Charlie Munger and Tony Nicely among others. The message reflected the self-deprecating humor of its leader and demonstrated the confidence in the firm’s execution as the unique bunch from Omaha outplaying the larger, more experienced Russian national team. Following that cartoon was a vignette with the Chairman and two characters from the cable hit, Entourage. Last, Mr. Buffett performed a duet with notable singer, Paul Anka which was much less satirical and actually a touch emotional as almost alluding to a last call. At 9:30am, the formal program began. WB&CM provided some brief comments, introduced the Directors and then commenced the Q&A session, which lasted until 3:30pm. In addition, to the three financial journalists, Carol Loomis, Becky Quick and Andrew Sorkin, other panelists included research analysts Jonathan Brandt, Jay Gelb and Greg Warren. Quotes from the Meeting: In addition to the financial and economic commentary that is standard for the annual meeting, the two leaders are known for their quick-witted and inspirational comments. This year was no different. Warren Buffett: - “American business is doing very well.” - “If Charlie and I wrote down our estimate of value for Berkshire, we would be within 5% of each other, but never say as close as 1%.” - “Not a good use of capital to buy back options that you have just issued.” - “I have been on a compensation committee just once. They don’t want Dobermans – they look for Chihuahuas with their tails wagging.” - On cost of capital – “The real test – does the capital we retain make more than the value we put in – we will keep doing it. We think we can evaluate businesses and we have capital. We are consistently evaluating our opportunity cost.” - On his personal holdings. “Every share that I have will go to five different charities. They will be distributed over ten years – I have told the trustees to not sell those shares until they have to.” - “Charlie is my canary in the coal mine. He just turned 90 and I am impressed by how he is handling middle age.” - On what stock to put 100% of your net worth into – “Great question, but I am not going to give you an answer.” (Charlie: “I think you have given the right answer.”) -3- Gabelli & Company - “We are very disciplined by some standards and sloppy by some standards. I am slow to make personnel changes.” “We want to try to add earnings power every day.” “Bernanke did a terrific job. Most of the Fed didn’t really understand just how serious things were.” “If you read about either one of us buying a sports team, it may be time to talk about a successor.” “My life would be worse with 6 or 8 homes.” On 3G Capital – “They’re very smart, they’re very focused. They’re very determined. They’re never satisfied. And as I said earlier, when you make a deal with them, you make a deal with them.” Charlie Munger: - “We never have had a policy that loved over-staffing. The love of great businesses – they don’t want to be fanatic – don’t need the last nickel out of staffing costs.” - “WB talks about returns after-tax – indices do not pay any taxes. That is a pretty high standard. If this is failure – I want more of it.” - On the subject of taxes and President Obama. “I am going to avoid this one.” - “We don’t ever want to get the stock over intrinsic value to issue stock. We are not in the game of ballooning our stock. Over the long-term our stock will work pretty well.” - On being consistent with acquisitions – “We behave the way we do because we like it. We are not likely to change.” - With respect to questions about Warren and Howard (Buffett) on the Coke compensation plan. “Warren was totally voted down at Solomon. They were like what does he know about Wall Street. Knowing both Howard and Warren – they won’t go soft, just because they don’t shout all the time. If we all did that we couldn’t hear each other. I offend more people than you (Warren) and I am comfortable with your level.” - “The phrase ‘cost of capital’ means silly things. Especially those that teach it in business school.” - “Warren is peculiar about how he gives money to his family and he is entitled to do so in any way he wants to. WB is really a meritocrat – he wants his money to go back to the civilization from which it was earned. I like being associated with him.” - “I wish the main problems in life were fears about the succession issues at Berkshire – we are in good shape.” - “Well, you (Warren) once called me the Abominable No Man.” - “You still have to keep trying. We have a lot of ignorance left at Berkshire.” - On copying Berkshire Hathaway – “I think it is too hard to do. . . .It means you’ll be dead before you’re finished.” - “It’s not a tragedy to have so much success that future returns go down.” - “We took a man from the executive chair directly to the Alzheimer’s home.” - “We are very lucky to have these businesses to employ capital at such nice returns – we are way better off now. It is a blessing. We love the opportunity to invest in our businesses.” -4- Gabelli & Company COMPANY OVERVIEW Berkshire Hathaway Inc., based in Omaha, NE is a holding company for a diverse group of operating subsidiaries including insurance, freight rail transportation, utilities and energy, finance, services and retailing. The subsidiaries operate in an autonomous fashion, while investment and capital allocation decisions are managed by Warren Buffett in consultation with Charlie Munger. As of December 31, 2013 and from 1965, the firm had an annual compounded gain on book value of 19.7%. In 2013, Berkshire completed two large acquisitions and purchased additional shares in two businesses already controlled by the holding company, spending almost $21 billion. - Purchased $8 billion of Heinz preferred stock that carries a 9% coupon and $4.25 billion of the common stock (the same amount as 3G Capital). Berkshire intends to increase its position in the company over time when certain 3G investors decide to sell. - MidAmerican Energy (now Berkshire Hathaway Energy) purchased NV Energy for $5.6 billion. - Invested $3.5 billion to bring the ownership up to 100% of both Marmon (original investment in 2008) and Iscar (first investment in 2006). Insurance Exhibit 2 Berkshire operates several insurance ($77 billion of insurance float as of March 31, 2014 and up from $39 million as of 1970) subsidiaries including, but not limited to Berkshire Hathaway Primary Group, Berkshire Hathaway Reinsurance Group, GEICO and General Re. The collection of businesses generated an underwriting profit in 2013 for the 11th year in a row. GEICO is perhaps the most public identifiable brand with its charming and comedic commercials featuring the “Gekko.” Through persistent share gains, GEICO, has grown to the second-largest (#7 in 1996) private passenger auto insurer in Source: Geiconow.com. the United States passing Allstate recently. Exhibit 3 Railroad Following the acquisition of Burlington Northern in February 2010 for approximately $26.5 billion in cash and stock, Berkshire became one of the largest operators of railroad systems in the United States with approximately 32,500 miles of track in 28 states (~15% of all inter-city freight) and two Canadian provinces. In serving primarily the Midwest, Pacific Northwest and Western and Southwestern parts of the United States, the company transports a range of products and commodities related to manufacturing, agricultural and natural resources industries. Source: Specialhappens.com. Utilities MidAmerican Energy Holdings Company (now Berkshire Hathaway Enerrgy) represents Berkshire Hathaway’s main utility holding company. The firm’s many operating subsidiaries including MidAmerican Energy Company, Pacific Energy and Rocky Mountain Power provide power transmission and energy services. In addition, the Holdco. owns HomeServices of America, a real estate brokerage firm. Other Businesses Berkshire has many other operating businesses. Notable companies include: - Acme Brick – industrial manufacturer of bricks and masonary products - IMC International Metalworking Companies (Iscar) – metal cutting and tools business - McLane Company – wholesale distributor of groceries and nonfood items to discount retailers - Shaw Industries – largest manufacturer of tufted broadloom carpet - The Lubrizol Company – speciality chemicals -5- Gabelli & Company Table 2 Berkshire Operating Businesses 2011-2013 ($, millions) 2013 Operating Businesses: Insurance group: Underwriting: GEICO General Re Berkshire Hathaway Reinsurance Group Berkshire Hathaway Primary Group Investment income Total insurance group BNSF Finance and financial products Marmon McLane Company MidAmerican Other businesses Reconciliation of segments to consolidated amount Investment and derivative gains/losses Interest expense, not allocated to segments Eliminations and other Revenues 2012 2011 2013 EBIT 2012 2011 $18,572 5,984 8,786 3,342 4,735 $41,419 $16,740 5,870 9,672 2,263 4,474 $39,019 $15,363 5,816 9,147 1,749 4,746 $36,821 $1,127 283 1,294 385 4,713 $7,802 $680 355 304 286 4,454 $6,079 $576 144 (714) 242 4,725 $4,973 22,014 4,291 6,979 45,930 12,743 42,382 $175,758 20,835 4,110 7,171 37,437 11,747 38,647 $158,966 19,548 4,014 6,925 33,279 11,291 32,202 $144,080 5,928 985 1,176 486 1,806 5,080 $23,263 5,377 848 1,137 403 1,644 4,591 $20,079 4,741 774 992 370 1,659 3,675 $17,184 6,673 3,425 (830) (281) 72 438 6,673 (303) (837) 3,425 (271) (997) (830) (221) (819) $182,150 $162,463 $143,688 $28,796 $22,236 $15,314 Source: Company data. Capital allocation and Investments Berkshire benefits from strong cash flows and significant long-term float from the insurance businesses. These cash flows have been invested in a wide variety of financial instruments including derivatives, equities and fixed income. The investment companies reflect similar traits to the firm’s collection of operating companies in terms of strength of brands, strong competitive industry positions and significant cash flow generation. Todd Combs joined the corporate investment team in October 2010, with Ted Weschler coming on board in September 2011. Both managers have been assuming larger investment responsibilies ($7 billion each as of May 2014) and have recorded positive results relative to the S&P 500 index. Table 3 Major Investments as of 12/2013 ($, millions) Shares 151,610,700 400,000,000 22,238,900 41,129,643 13,062,594 68,121,984 24,669,778 20,060,390 20,668,118 52,477,678 22,169,930 301,046,076 96,117,069 56,805,984 483,470,853 Company American Express Company The Coca-Cola Company DIRECTV Exxon Mobil Corp. The Goldman Sachs Group, Inc. International Business Machines Corp. Moody's Corporation Munich Re Phillips 66 The Procter & Gamble Company Sanofi Tesco plc U.S. Bancorp Wal-Mart Stores, Inc. Wells Fargo & Company Others Total Common Stocks Carried at Market Percentage of Company Owned 14.2 % 9.1 4.2 0.9 2.8 6.3 11.5 11.2 3.4 1.9 1.7 3.7 5.3 1.8 9.2 Source: Company data. Cost Market $1,287 $13,756 1,299 16,524 1,017 1,536 3,737 4,162 750 2,315 11,681 12,778 248 1,936 2,990 4,415 660 1,594 336 4,272 1,747 2,354 1,699 1,666 3,002 3,883 2,976 4,470 11,871 21,950 19,894 11,281 $56,581 $117,505 Exhibit 3 Source: American Express. Exhibit 4 Source: Coca-Cola. -6- Gabelli & Company PERFORMANCE Since taking over Berkshire Hathaway in 1965, Warren Buffett has built the company into the eighth largest in the United States based on market capitalization. Cumuluative return of book value has been 693,518% vs. just 9.841% for the S&P 500. The long-term success has been built on several distinct advantages. Warren Buffett’s investment record and timing have really been unmatched during this time frame. As a holding company, Berkshire is also able to reallocate its significant capital generation to highest return opportunities. As a master of tax strategy, WB has more than demonstrated his ability to “pay less, pay later” philosophy to successfully structure transactions. Table 4 Year 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 Berkshire Corporate Performance 1965-2013 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire Included 23.8% 10.0% 20.3 (11.7) 11.0 30.9 19.0 11.0 16.2 (8.4) 12.0 3.9 16.4 14.6 21.7 18.9 4.7 (14.8) 5.5 (26.4) 21.9 37.2 59.3 23.6 31.9 (7.4) 24.0 6.4 35.7 18.2 19.3 32.3 31.4 (5.0) 40.0 21.4 32.3 22.4 13.6 6.1 48.2 31.6 26.1 18.6 19.5 5.1 20.1 16.6 44.4 31.7 Relative Results 13.8% 32.0 (19.9) 8.0 24.6 8.1 1.8 2.8 19.5 31.9 (15.3) 35.7 39.3 17.6 17.5 (13.0) 36.4 18.6 9.9 7.5 16.6 7.5 14.4 3.5 12.7 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire Included 7.4 (3.1) 39.6 30.5 20.3 7.6 14.3 10.1 13.9 1.3 43.1 37.6 31.8 23.0 34.1 33.4 48.3 28.6 0.5 21.0 6.5 (9.1) (6.2) (11.9) 10.0 (22.1) 21.0 28.7 10.5 10.9 6.4 4.9 18.4 15.8 11.0 5.5 (9.6) (37.0) 19.8 26.5 13.0 15.1 4.6 2.1 14.4 16.0 18.2 32.4 Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 CAGR 1965-2013 Overall Gain - 1964-2013 19.7% 693518% 9.8% 9841% Relative Results 10.5 9.1 12.7 4.2 12.6 5.5 8.8 0.7 19.7 (20.5) 15.6 5.7 32.1 (7.7) (0.4) 1.5 2.6 5.5 27.4 (6.7) (2.1) 2.5 (1.6) (14.2) 9.9 Source: Company data. VALUATION Management often refers to Berkshire’s change in book value as a proxy for evaluating the progress at Berkshire Hathaway especially against the returns of the S&P 500 Index. Book value at the end of December 2013 was $134,973 per Class A Share or approximately 1.4x at the current price. Since 1990, price-to-book value has fluctuated between 1 and 2.6x. Exhibit 5 Berkshire Class A Price-To-Book Ratio March 31, 1990 - May 2014 Source: Bloomberg. -7- Gabelli & Company CONCLUSION The 48th annual meeting marked another year of absolute progress for the company, while demonstrating again the important attributes that make Berkshire Hathaway a unique entity. In spite of all the generic worries that come up each year including management succession, sourcing large acquisitions, and generating above average growth, we believe several subtle positives emerged providing more clarity this year. First, newer investment managers, Mr. Combs and Mr. Weschler have further cemented an ability to generate alpha while handling larger allocations of capital. Second, by teaming with 3G Capital on Heinz, Berkshire showed the ability to increase its deal network, while gaining exposure to private equity financial engineering not core to its normal acquisition culture. Additionally, the relationship may provide a larger ability to find new candidates in the international community something that was noted as a challenge by Mr. Buffett. (“I am a little disappointed that we haven’t had as much luck outside the country.”) The firm’s timely acquisition of BNSF (2010) and increasing scale in its energy operations have helped create more opportunities for “internal” investment on businesses that are already well known as a core competency. For instance, capital expenditures in its train operations are expected to exceed almost $5 billion in 2014, further increasing the firm’s competitive advantages (#1 in spend among major competitors). Net/net these ongoing capital opportunities should assuage investor concerns around the efficient allocation of the significant cash flow generation by the holding company. Of note this meeting was the focus on the trailing 5-year record which for the first time in the company’s history did not exceed the stated performance benchmark of the S&P 500 Index. Mr. Buffett alluded to this potential at last year’s meeting and made essentially no defense this year stating that it will be difficult to eclipse the market that has been as strong as the previous five years. Mr. Munger did point out Berkshire’s embedded challenge of using after-tax gains for comparisons, while Mr. Buffett previously highlighted in the firm’s annual report that some gains in the insurance business would not be fairly depicted given the nature of GAAP accounting. Regardless, the duo seemed unfazed by the near-term performance (similar to the late 90s) cosmetics and undeterred in its outlook to reward shareholders with superior returns. We are reminded by Mr. Buffett’s comments about 3G Capital, which seem introspective. “They’re (3G Capital) very smart, they’re very focused. They’re very determined. They’re never satisfied.” With the 50th meeting in sight and another year behind them, both Mr. Buffett and Mr. Munger showed no signs of changing intensity (or considering perhaps more healthier foods than Cherry Coke and See’s Peanut Butter Brittle!). Clearly their spirit remains extraordinary and yet unflappable in spite of the many challenges identified during the weekend. If history is any guide to future operating execution, than investors should continue to look to partner (through their share ownership) with this unique and entrepreneurial organization. -8- Gabelli & Company Other Companies Mentioned: Allstate Corp. American Express Company AstraZeneca PLC The Coca-Cola Company DirecTV Exxon Mobile Corp. Goldman Sachs Group International Business Machines Moody’s Corp. Munich Re (ALL (AXP (AZN (KO (DTV (XOM (GS (IBM (MCO (MUV2 - NYSE) " ) " ) " ) NASDAQ) NYSE) " ) " ) " ) MU) Pfizer Inc. Phillips 66 Procter & Gamble Co. Sanofi Tesco PLC Tyco International US Bancorp. Wal-Mart Stores Inc. Wells Fargo Company (PFE (PSX (PG (SNY (TLSO (TYC (UB5 (WMT (WFC - NYSE) " ) " ) " ) LSE) NYSE) HM) NYSE) " ) I, Macrae Sykes, the Research Analyst who prepared this report, hereby certify that the views expressed in this report accurately reflect the analyst’s personal views about the subject companies and their securities. The Research Analyst has not been, is not and will not be receiving direct or indirect compensation for expressing the specific recommendation or view in this report. Gabelli & Company 2014 Macrae Sykes (914) 921-5398 Important Disclosures ONE CORPORATE CENTER RYE, NY 10580 GABELLI & COMPANY TEL (914) 921-5130 FAX (914) 921-5098 Gabelli & Company is the marketing name for the registered broker dealer G.research, Inc., which was formerly known as Gabelli & Company, Inc. Gabelli & Company ("we or "us") attempts to provide timely, value-added insights into companies or industry dynamics for institutional investors. Our research reports generally contain a recommendation of "buy," "hold," "sell" or "non-rated.” We do not undertake to "upgrade" or "downgrade" ratings after publishing a report. We currently have reports on 578 companies, of which 47%, 37%, 3% and 14% have a recommendation of buy, hold, sell or non-rated, respectively. The percentage of companies so rated for which we provided investment banking services within the past 12 months is 0%, 0%, 0% and less than 1%. Ratings Analysts’ ratings are largely (but not always) determined by our “private market value,” or PMV methodology. Our basic goal is to understand in absolute terms what a rational, strategic buyer would pay for an asset in an open, arms-length transaction. At the same time, analysts also look for underlying catalysts that could encourage those private market values to surface. A Buy rated stock is one that in our view is trading at a meaningful discount to our estimated PMV. We could expect a more modest private market value to increase at an accelerated pace, the discount of the public stock price to PMV to narrow through the emergence of a catalyst, or some combination of the two to occur. A Hold is a stock that may be trading at or near our estimated private market value. We may not anticipate a large increase in the PMV, or see some other factors at work. A Sell is a stock that may be trading at or above our estimated PMV. There may be little upside to the value, or limited opportunity to realize the value. Economic or sector risk could also be increasing. We prepared this report as a matter of general information. We do not intend for this report to be a complete description of any security or company and it is not an offer or solicitation to buy or sell any security. All facts and statistics are from sources we believe to be reliable, but we do not guarantee their accuracy. We do not undertake to advise you of changes in our opinion or information. Unless otherwise noted, all stock prices reflect the closing price on the business day immediately prior to the date of this report. We do not use "price targets" predicting future stock performance. We do refer to "private market value" or PMV, which is the price that we believe an informed buyer would pay to acquire 100% of a company. There is no assurance that there are any willing buyers of a company at this price and we do not intend to suggest that any acquisition is likely. Additional information is available on request. As of March 31, 2013 our affiliates beneficially own on behalf of their investment advisory clients or otherwise approximately 1.25% of DirecTV and less than 1% of American Express, AstraZeneca PLC, Berkshire Hathaway Class A, Berkshire Hathaway Class B, The Coca-Cola Company, Exxon Mobile Corp., Goldman Sachs Group, International Business Machines, Moody’s Corp., Pfizer Inc., Phillips 66, Procter & Gamble Co., Sanofi, Tesco plc, Tyco International, US Bancorp, Wal-Mart Stores and Wells Fargo Company. Because the portfolio managers at our affiliates make individual investment decisions with respect to the client accounts they manage, these accounts may have transactions inconsistent with the recommendations in this report. These portfolio managers may know the substance of our research reports prior to their publication as a result of joint participation in research meetings or otherwise. The analyst who wrote this report may receive commissions from our customers' transactions in the securities mentioned in this report. Our affiliates may receive compensation from the companies referred to in this report for non-investment banking securities-related services, or may be soliciting these companies as clients for non-investment banking securities-related services. The analyst who wrote this report, or members of his household, owns 100 shares of BRK’B and 6 shares of IBM. -9- Gabelli & Company GLOBAL INSTITUTIONAL EQUITY RESEARCH EQUITY RESEARCH NAME PHONE EMAIL Automotive Brian Sponheimer (914) 921‐8336 bsponheimer@gabelli.com Automotive Colin Daddino (914) 834‐7717 cdaddino@gabelli.com Basic Materials (Specialty Chemicals) Rosemarie Morbelli, CFA (914) 921‐7757 rmorbelli@gabelli.com Business Services Ashish Sinha, CFA 011‐44‐220‐3206‐2108 asinha@gabelli.co.uk Consumer Discretionary (Gaming & Lodging) Amit Kapoor (914) 921‐7786 akapoor@gabelli.com Consumer Staples (Beverages, Supermarkets, & Health & Wellness) Damian Witkowski (914) 921‐5022 dwitkowski@gabelli.com Consumer Staples (Food, Beverage & Household Products) Joseph Gabelli (914) 921‐8331 josephg@gabelli.com Consumer Staples (Food & Household Products) Sarah Donnelly (914) 921‐5197 sdonnelly@gabelli.com Energy Services Simon Wong, CFA (914) 921‐5125 swong@gabelli.com Financials Macrae Sykes (914) 921‐5398 msykes@gabelli.com Healthcare (Biotech & Pharmaceutical) Kevin Kedra (914) 921‐7721 kkedra@gabelli.com Industrials (Aerospace & Pump, Valve, Motor) James Foung, CFA (914) 921‐5027 jfoung@gabelli.com Industrials (Electrical, Building Products, Transports) Justin Bergner, CFA (914) 921‐8326 jbergner@gabelli.com Industrials (Water, Industrial Gases, Analytical Instruments) Jose Garza (914) 921‐7788 jgarza@gabelli.com Media (Entertainment) Brett Harriss (914) 921‐8335 bharriss@gabelli.com Media (Broadcasting, Publishing, Education & Motor Sports) Barry Lucas (914) 921‐5015 blucas@gabelli.com Technology Hendi Susanto (914) 921‐7735 hsusanto@gabelli.com Telecommunications Sergey Dluzhevskiy, CFA (914) 921‐8355 sdluzhevskiy@gabelli.com Global Telecommunications Evan Miller, CFA 011‐44‐203‐206‐2104 emiller@gabelli.com Utilities Timothy Winter, CFA (314) 238‐1314 twinter@gabelli.com Utilities Nick Yuelys (914) 921‐8329 nyuelys@gabelli.com Utilities Heartie Dunnan (914) 921‐5216 hdunnan@gabelli.com Waste Services Tony Bancroft (914) 921‐5083 tbancroft@gabelli.com GLOBAL INSTITUTIONAL EQUITY SALES & TRADING SALES AIM NAME PHONE EMAIL Jessica Craw GabelliJessica (914) 921‐8325 jcraw@gabelli.com Lizzie Fleishman GabelliLizzie (914) 921‐5294 Lfleishman@gabelli.com Eddie Friedmann GabelliEddie (914) 921‐7783 efriedmann@gabelli.com MaryBeth Healy GabelliMaryBeth (914) 921‐7726 mhealy@gabelli.com Lauren Lundgren GabelliLauren (914) 921‐7745 llundgren@gabelli.com C.V. McGinity GabelliCV (914) 921‐7732 cmcginity@gabelli.com Dan Miller GabelliDan (914) 921‐5193 dmiller@gabelli.com Gustavo Pifano GabelliGustavo 011‐44‐203‐206‐2109 gpifano@gabelli.com Scott Sadowski GabelliScott (914) 921‐7758 ssadowski@gabelli.com Michael Wenner GabelliMWenner (914) 921‐7731 mwenner@gabelli.com TRADING AIM NAME PHONE EMAIL Vince Amabile GabelliVince (914) 921‐5151 vamabile@gabelli.com Robert Cullen GabelliBob (914) 921‐5151 rcullen@gabelli.com Alberto Dominguez GabelliBert (914) 921‐5154 adominguez@gabelli.com Armond Forcella GabelliArmond (914) 921‐5155 aforcella@gabelli.com C.V. McGinity GabelliCV (914) 921‐5150 cmcginity@gabelli.com John Riccio GabelliJRiccio (914) 921‐5155 jriccio@gabelli.com Earl Thorpe GabelliEarl (914) 921‐5153 ethorpe@gabelli.com Louis Venturelli GabelliLou (914) 921‐5154 lventurelli@gabelli.com -10-