Handbook for Reporters of Unclaimed Funds – New York State

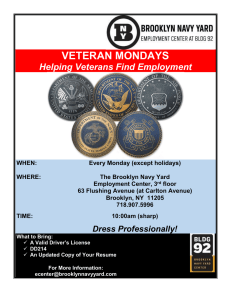

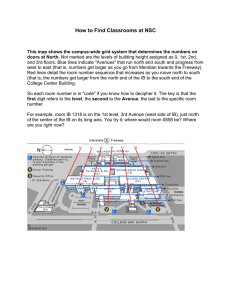

advertisement