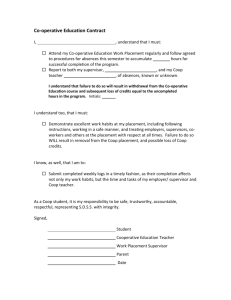

KF - Coop

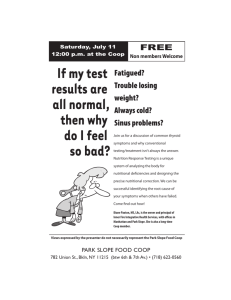

advertisement