Integrated Long-Range Plan

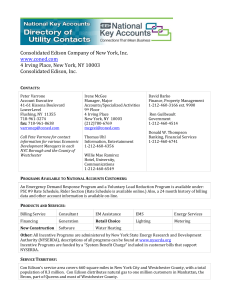

advertisement