Pre-publication Version

advertisement

The Impact of Verifiability on Contracts

Dhananjay (Dan) K. Gode

Stern School of Business

New York University

New York, NY 10012

Ph: 212-998-0021

E-mail: dgode@stern.nyu.edu

Rajdeep Singh

Carlson School of Management

University of Minnesota

Minneapolis, MN 55455

Ph: 612-624-1061

August 26, 2004

We acknowledge the helpful comments of Kashi Balachandran (the editor), Sugato Bhattacharyya, Jonathan Glover,

Arnold Juster, Jack Kareken, Arijit Mukherji, Suresh Radhakrishnan, Stefan Reichelstein, Shyam Sunder, and the

seminar participants at Carnegie Mellon University. We are grateful for financial support from the William Larimer

Mellon Fund and the Margaret and Richard M. Cyert Family Fund. The first author also acknowledges the financial

support of the Deloitte and Touche Foundation.

ABSTRACT

We show how the verifiability of signals affects their use in mitigating adverse selection. With

verifiable signals, the observed practice of investigating agents before contracting is inferior to

writing contingent contracts. This holds regardless of the agent’s risk aversion, bounded penalties,

or investigation costs. With risk-neutral agents, contingent contracts yield first-best outcomes.

We further show that even unverifiable signals can be gainfully used in contingent contracts by

removing a principal’s incentives to distort signals or by removing an agent’s incentives to demand

verification.

JEL Classification:

C70: General Game Theory and Bargaining Theory

M41: Accounting

J33 - Compensation Packages; Payment Methods

D82 - Asymmetric and Private Information

1

1

Introduction

Verifiability is a key attribute of accounting data. APB Statement No. 4 defines verifiability as

follows: “Verifiable financial accounting information provides results that would be substantially

duplicated by independent measurers using the same measurement methods” (paragraph 90). We

provide insights into how verifiability of accounting signals about an agent’s private information

affects the design of adverse selection contracts.1 Examples of such settings include a bank analyzing

financial statements before granting a loan and regulators auditing a defense contractor or a public

utility to verify reported costs.

We start with the simplest way in which principals use signals about agents – to update their

priors before offering contracts. For example, banks analyze credit before offering a loan. We use

this ex-ante investigation as the benchmark because it is widely used. We then examine ex-post

investigation in which the principal and the agent commit to a menu of contracts before observing

the signal. A contract is selected from the menu based on the signal observed later. For example,

debt covenants in loan contracts allow banks to rescind their loans or raise the interest rate if the

borrower’s financial statements are found to be fraudulent.

Signals need not be verifiable if used for ex-ante investigation but they need to be verifiable

if used for ex-post investigation because the payoffs are contingent on signals acquired after contracting. Our analysis provides three insights into how verifiability determines contract design.2

First, contrary to the popular perception that it is better to be “armed” with information before

contracting, we show that when signals are verifiable, ex-ante investigation is strictly worse than

ex-post investigation, i.e., the principal is better off not getting signals before contracting. This is

not because ex-post investigation lowers expected investigation costs via probabilistic investigation.

The result holds because in ex-post investigation eliciting the truth is cheaper as the agent does not

know the signal when signing the contract. In contrast, in ex-ante investigation the agent can infer

the signal from the contracts offered, which reduces the signal’s effectiveness in eliciting the truth.

Ex-post investigation dominates ex-ante investigation for all levels of the agent’s risk aversion. In

fact, with risk-neutral agents, ex-post investigation enables the principal to achieve the first-best

1

For examples of adverse selection models, see analyses of the value of communication [Melumad & Reichelstein

(1987) and Fellingham & Young (1990)] participative budgeting [Demski & Feltham (1978), Baiman & Evans (1983),

Kirby, Reichelstein, Sen & Paik (1991), and Kanodia (1993)], public utilities regulation [Baron & Myerson (1982)],

defense procurement [Reichelstein (1992)], and auditors’ legal liability [Melumad & Thoman (1990)]. Our setting

differs from informed-principal settings [Demski & Sappington (1991) and Myerson (1983)] in which the principal

knows something about the agent’s type that the agent does not know.

2

Ex-ante investigation is infeasible if the signal concerns the agent’s actions taken after contracting or is reported

by the agent only after contracting. These settings cover most of the prior literature.

1

utility.

Second, we formally show the trade off between relevance and reliability in the contract design.

While ex-ante investigation can be used with unverifiable signals, ex-post investigation requires

verifiable signals because it creates a potential conflict when the signal contradicts the agent’s earlier

representations. But ex-ante investigation provides weaker incentives than ex-post investigation.

Therefore, principals may prefer less informative but verifiable signals if they can use the more

incentive efficient ex-post investigation. For example, lenders prefer financial statements that are

objective than those that can be disputed by excluding subjective items such as “intangible” assets

even if intangible assets are informative about future cash flows.

Third, we show two new ways in which ex-post contracts can be modified to use unverifiable

signals. First, if the agent does not “trust” the signal generated by the principal, the principal can

make the signal credible by designing contracts that make herself indifferent to the signal realization

after the agent has committed to a menu of contracts. That is, the principal can make the signal

credible by removing her incentives to misrepresent the signal. We show that this modification

dominates ex-ante investigation. Second, if the agent trusts the signal generated by a neutral third

party, but still demands verification when the signal contradicts him, the principal can make the

agent indifferent to the signal after the agent has committed to a menu of contracts and yet do

better than ex-ante investigation. The trick lies in making only an honest agent indifferent to the

signal. These types of contracts have not been examined in the literature before and open a new

way of understanding verifiability.

We conclude by speculating on the popularity of ex-ante investigation in spite of its theoretical

inferiority. Ex-ante investigation has three benefits. First, it allows use of a broad range of signals

– both verifiable and unverifiable. Second, designing ex-ante investigation contracts is simpler because a principal observes the signal first and need not design contracts for other signal realizations.

In contrast, ex-post investigation requires the principal to specify the complete menu of contracts

for all possible signal realizations. Third, ex-ante investigation, being similar to dominant-strategy

implementation, does not require common knowledge of beliefs, information structure, and rationality, which the ex-post investigation, being similar to Bayesian-Nash implementation, requires.

Section 2 describes ex-ante investigation, the benchmark against which contingent contracts are

compared. Section 3 proves that ex-post investigation is optimal and can achieve first-best utility

with risk-neutral agents. Section 4 proposes two new modifications to ex-post investigation to use

unverifiable signals. Section 5 describes the implications of our analysis and concludes the paper.

2

2

Getting Signals Before Contracting: The Benchmark Case

A risk-neutral principal specifies the production level (X) and compensation (R) for an agent who

knows his productivity (type), which is either θL or θH . One can view X as the interest rate and R

as the magnitude of a loan, or X as the premium and R as the amount of insurance coverage. The

principal can neither observe the agent’s type nor infer it from the output. The agent’s utility is

U (R), where U 0 > 0, U 00 ≤ 0. His reservation utility is assumed to be 0 without loss of generality.

The agent can produce X with certainty by incurring a disutility D(X, θ). D is strictly increasing and strictly convex in X and strictly decreasing in θ; i.e., a low-type agent is less productive

than a high-type agent [Dx (·, ·) > 0, Dxx (·, ·) > 0, and D(X, θL ) > D(X, θH ) ∀ X]. The agent’s indifference curves satisfy the single-crossing property. Specifically, the marginal disutility is strictly

decreasing in θ [Dx (X, θL ) > Dx (X, θH ) ∀ X]. To avoid corner solutions, we assume Dx (0, ·) = 0.

We also assume strictly convex disutility so that the agent’s indifference curves are convex.

Principals acquire signals about agents to update their priors before contracting. For example,

investors analyze financial statements before investing, employers interview employees before hiring,

and banks check credit before giving a loan. The principal gets a noisy signal S²{SL , SH } that is

positively correlated with the agent’s type θ such that prob[S=SL |θ=θL ] = prob[S=SH |θ=θH ] = p,

where p is the signal’s informativeness [0.5 < p < 1]. The output and compensation are Xij and

Rij respectively, where i refers to the signal and j refers to the agent’s type. The principal sees the

signal and offers a menu of contracts based on her updated priors. The agent then chooses.

Ex-Ante Investigation – P rogramEx−Ante : Let EP[S = Si ] be the principal’s expected profit

conditional on S = Si . She solves:

EP [S = Si ] ≡

max

Xij ,Rij

X

prob[θ = θj |S = Si ](Xij − Rij )

j=L,H

s.t. (U (Rij ) − D(Xij , θj )) ≥ 0

∀j

(IRij)

(U (Rij ) − D(Xij , θj )) ≥ (U (Rî ) − D(Xî , θj )) ̂ 6= j ∀j

(ICij)

The principal’s unconditional expected profit is EP =

P

i=L,H

{prob[S = Si ]EP [S = Si ]}. The

individual rationality constraint IRij and the incentive compatibility constraint ICij are for a j-type

agent for signal Si . The contract for each signal is similar to the second-best contract except that

the principal’s priors are updated.

3

3

Writing Contingent Contracts

Instead of investigating before contracting, the principal can offer contracts that are contingent

on the signal observed ex post, i.e., after the agent signs a contract but before he works. In expost investigation, each contingent contract is a set of two output-compensation pairs. The agent

chooses a set. The actual output-compensation pair depends on the realized signal. The agent

can neither observe nor infer the signal when choosing contracts and cannot quit after the signal is

realized. The principal solves the following program:

Ex-Post Investigation – P rogramEx−P ost−1

EP ≡

X

max

Xij ,Rij

X

s.t.

X

{prob[S = Si |, θ = θj ](Xij − Rij )}

j=L,H i=L,H

{prob[S = Si |θ = θj ](U (Rij ) − D(Xij , θj ))} ≥ 0

∀j

(IRj)

{prob[S = Si |θ = θj ](U (Rî ) − D(Xî , θj ))} ̂ 6= j ∀j

(ICj)

i=L,H

X

{prob[S = Si |θ = θj ](U (Rij ) − D(Xij , θj ))} ≥

i=L,H

X

i=L,H

Ex-post investigation weakly dominates ex-ante investigation because in P rogramEx−P ost−1 the

constraints need to be satisfied only in an expected sense, but in P rogramEx−Ante , the constraints

must be satisfied separately for every realization of the signal. The added flexibility can only benefit

the principal.3 We now separate two effects that cause ex-post investigation to strictly dominate

ex-ante investigation. This discussion lays the groundwork for our results about unverifiable signals

later in the paper.

3.1

The Incentive Effect

The incentive effect arises because in ex-post investigation the IR constraints need to be met only

in an expected sense. For a risk-neutral agent, it even enables the principal to achieve first-best

utility.4

3

This relates to the multi-agent literature [Demski & Sappington (1984) and Demski, Sappington & Spiller

(1988)], where an agent’s report serves as a signal about another agent’s type. In sequential reporting (similar to P rogramEx−Ante ), truth-telling must be a dominant strategy, while in simultaneous reporting (similar to

P rogramEx−P ost−1 ) truth-telling need only be a Bayesian-Nash equilibrium. Since dominant strategy constraints

are stricter, the result obtains.

4

Balachandran & Radhakrishnan (2004) show how ex-post investigation can be used to achieve first-best utility

in supply chain management settings.

4

Proposition 1 For a risk-neutral agent, the principal’s utility in P rogramEx−P ost−1 equals her

first-best utility, while her utility in P rogramEx−Ante is strictly less.

Proof: See the Appendix.

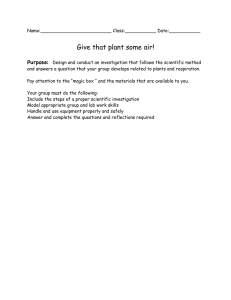

(insert Figure 1 about here.)

In P rogramEx−Ante , the IR constraints must be satisfied for each signal, so in Figure 1 both

(L,L) and (H,L) would have had to lie on or above the low type’s reservation utility curve, and

(L,H) and (H,H) would have had to lie on or above the high type’s reservation utility curve. In

P rogramEx−P ost−1 , the IR constraints need to be satisfied only in an expected sense, so in Figure

1 the principal can deviate from the solution to P rogramEx−Ante because now only the expected

utility of (L,L) and (H,L) must lie above the low types reservation utility curve. This allows her

to penalize the low-type agent if the signal contradicts his report (H,L) and reward him otherwise

(L,L).

The probability of a reward (L,L) is higher for a low type than for a high type who claims

to be a low type. That is, the agents face a lottery whose odds depend on their type; a zero

expected value lottery for the low type has a negative expected value for the high type, thereby

separating the two types. By widening the gap between (L,L) and (H,L), the principal can reduce

the high type’s rents while giving the reservation utility to the low type. Because risk-neutral agents

demand no risk premium to face the lottery, the principal achieves first-best utility by eliminating

the high type’s rents at no cost.5 Bounds on penalties limit the effectiveness of ex-post investigation

because it relies on penalizing the agent if the signal contradicts him.6 Even if first-best utility

is not achievable due to bounded penalties, ex-post investigation still strictly dominates ex-ante

investigation for risk-neutral agents.

5

Proposition 1 relates to two strands in the literature. First, Kerschbamer (1994) shows that in the Demski,

Sappington & Spiller (1988) model with risk-neutral agents the principal can costlessly replace Bayesian-Nash IC

constraints with dominant-strategy IC constraints. Proposition 1 shows that this is not true for the IR constraints.

The Bayesian-Nash IR constraints allow the principal to achieve first best, and the dominant- strategy IR constraints

do not. We thank an anonymous referee for elucidating this point. Second, the result relates to Cremer & McLean

(1988), who show that if risk-neutral bidders have correlated private values the seller can extract all the surplus from

the bidders.

6

Balachandran & Radhakrishnan (2004) discuss the “fairness” criterion that limits the penalties in ex-post investigation. Ex-post investigation, however, does not require the compensation to be negative, it only requires the utility

to be negative. As the appendix shows, the more informative the signal or the greater the difference in productivity,

the lower the needed divergence between compensation levels in the two states of the lottery. The compensation

needs to be negative to achieve first-best only when the signal is relatively uninformative or when the difference in

productivity of the two agents is high.

5

With risk-averse agents, it is unclear whether the incentive effect can make ex-post investigation

strictly superior. For example, first best is no longer feasible with risk-averse agents who must be

paid to face the lottery. The insurance effect discussed next, however, makes ex-post investigation

strictly superior even with risk-averse agents.

3.2

The Insurance Effect

The insurance effect exists because in ex-post investigation the incentive compatibility constraints

need to be met only in an expected sense.

Proposition 2 With a risk-averse agent, the principal would strictly prefer to investigate later

even if the penalties that can be imposed on the agent are bounded (R ≥ 0).

(Expected P rof it)P rogramEx−P ost−1 > (Expected P rof it)P rogramEx−Ante

Proof: See the Appendix.7

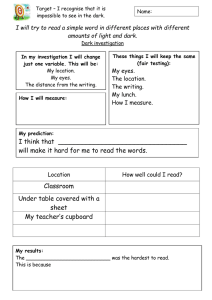

(insert Figure 2 about here.)

Figure 2 and the proof of Proposition 2 for a risk-averse agent illustrate the insurance effect.

Because in P rogramEx−Ante the IC constraints must be satisfied for each signal, a high type’s

contract for a given signal must lie on the high type’s indifference curve passing through the

low type’s contract for that signal. The flexibility of P rogramEx−P ost−1 allows the principal to

eliminate the high type’s risk by equating (H,H) and (L,H) while keeping the high type’s expected

utility unchanged. Now the high-type agent does not demand a risk premium. Bounded penalties

do not eliminate this effect because both agents get positive compensation. The insurance effect

also holds if U (R) − D(X, θ) ≥ 0 because both agents get non-negative utility in every state of the

signal.

The superiority of ex-post investigation is not based on the possibility of probabilistic investigation because in P rogramEx−P ost−1 the principal always investigates. Allowing probabilistic investigation in ex-post settings can only make them even better. In contrast, probabilistic investigation

is infeasible in ex-ante settings.

A combination of the incentive and insurance effects makes ex-post investigation, i.e., not getting

the signal earlier, optimal for the principal regardless of the agent’s risk aversion.

7

This shows that replacing Bayesian-Nash IC constraints with dominant-strategy IC constraints is not costless

with risk-averse agents, as it is with risk-neutral agents in Kerschbamer (1994).

6

3.3

The Impact of Verifiability

Why are ex-ante investigations common if they are inferior? Is this merely suboptimal behavior,

or is it driven by something else? We show that verifiability plays a key role in the use of ex-ante

investigation.

P rogramEx−Ante obviates the need for verification. The principal gets the signal before contracting. Although the contracts reflect the principal’s updated priors, they are not contingent on

a signal to be observed later. The principal therefore has no reason to manipulate the signal, and

the agent has no opportunity to demand verification.

In contrast, as shown by Figure 1, P rogramEx−P ost−1 needs a verifiable signal. The principal’s

utility if the signal is high exceeds her utility if the signal is low. (The principal’s utility increases

in the southeast direction.) Both types of agents prefer a low signal. This difference in preferences

creates a demand for verification in P rogramEx−P ost−1 .

Because ex-post investigation is more effective than ex-ante investigation, principals may prefer

a noisier but verifiable signal to a more accurate but unverifiable signal. For example, banks

routinely exclude intangible assets because their valuation is extremely subjective. The IRS does

not allow accounting that require subjective estimates such as allowance for bad debts.

Ex-post investigation appears infeasible with unverifiable signals. To the contrary, we now show

that we can modify ex-post investigation to permit the use of unverifiable signals.

4

Using Unverifiable Information in Contingent Contracts

We turn to two modifications to ex-post investigation that allow the use of unverifiable signals. In

the first setting, examined in Section 4.1, the signal is unverifiable because the principal observes

it privately. For example, it could be the principal’s subjective opinion based on an interview.

We show that the principal can use such a signal in contingent contracts by ensuring that she has

incentives to reveal the signal truthfully. In the second setting, examined in Section 4.2, the signal

is produced by a neutral third party but is unverifiable. We show that the principal can use such a

signal by removing the agent’s incentives to demand verification. To our knowledge, these settings

have not been examined in the prior literature.

7

4.1

Committing to Honest Disclosure

As discussed in Section 3.3, in P rogramEx−P ost−1 the principal has an incentive to misrepresent

the signal. The agent will therefore not trust the signal, especially because he commits before the

principal reveals the signal. (If the principal were to reveal the signal before asking the agent to

commit, we would be back to ex-ante investigation.) P rogramEx−P ost−1 thus requires a verifiable

signal. It seems, therefore, that a signal that is privately observed by the principal cannot be used

ex post. We show that a principal can still use the private signal ex post by making her report

credible via two constraints (PIj) that make her indifferent to reporting either signal.

P rogramEx−P ost−2 :

EP ≡ max

Xij ,Rij

s.t.

X

X

X

{prob[S = Si |, θ = θj ](Xij − Rij )}

j=L,H i=L,H

{prob[S = Si |θ = θj ](U (Rij ) − D(Xij , θj ))} ≥ 0

∀j (IRj)

i=L,H

X

{prob[S = Si |θ = θj ](U (Rij ) − D(Xij , θj ))} ≥

i=L,H

X

{prob[S = Si |θ = θj ](U (Rî ) − D(Xî , θj ))} ̂ 6= j

∀j (ICj)

i=L,H

XLj − RLj = XHj − RHj

∀j (PIj)

If the solution of P rogramEx−Ante were feasible under P rogramEx−P ost−2 , the weak dominance of

P rogramEx−P ost−2 over P rogramEx−Ante would have been assured. This is, however, not the case.

Suppose in P rogramEx−P ost−2 the agent is offered the contracts in P rogramEx−Ante . If the agent

reveals his type to be low, the principal has an incentive to report the signal as low to minimize

the distortion in the low type’s contract from his first-best. Similarly, if the agent reveals his type

to be high, the principal has an incentive to report the signal as high. This makes the contracts in

P rogramEx−Ante violate the PI constraints in P rogramEx−P ost−2 .

Equalizing the principal’s payoffs across the two signal realizations eliminates her incentives to

misreport a signal, but does it render the information useless? In other words, is the principal’s

utility in P rogramEx−P ost−2 the same as that in the second-best contract in which information

is not used at all? No, because the second-best contract has four implicit constraints, XLj =

XHj = Xj and RLj = RHj = Rj , ∀j, but P rogramEx−P ost−1 has only two constraints, XLj −

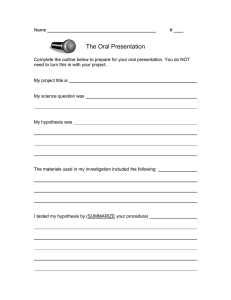

RLj = XHj − RHj , ∀j.8 Figure 3 shows the solution to P rogramEx−P ost−2 ; (XHL , RHL ) and

8

The agent is not indifferent to the signal. Constraints that make both the principal and the agent indifferent to

8

(XLL , RLL ) are constrained to lie on the principal’s indifference curve. For incentive compatibility,

the expected utility of (XHL , RHL ) and (XLL , RLL ) to the high-type agent equals his expected

utility for (XHH , RHH ) and (XLH , RLH ). [(XHH , RHH ) now equals (XLH , RLH ) because they

must now be on the same indifference line for the principal.]

(insert Figure 3 about here.)

Eliminating the need for verification in ex-post investigation is worthwhile only if it makes expost investigation better than ex-ante investigation. The following proposition shows that this is

indeed the case.

Proposition 3 For a risk-neutral agent, P rogramEx−P ost−2 strictly dominates P rogramEx−Ante .9

Proof: See the Appendix.

Figure 3 explains the intuition behind this result. We show that the principal can profitably

deviate from the ex-ante contract while meeting the constraints of P rogramEx−P ost−2 . Suppose

the principal offers the following contract to the low-type agent: X̂HL = XHL , X̂LL = XLL ,

´

´

³

³

R̂HL < RHL , and R̂LL > RLL , such that X̂LL , R̂LL and X̂HL , R̂HL are on the same indifference

curve of the principal (a 45 degree line) and the low type’s expected utility is unchanged [in

Figure 3 p ∗ b = (1 − p) ∗ a]. The principal can now offer X̂HH = XHH and R̂LH = R̂HH =

pRHH + (1 − p) RLH − γ where γ = p ∗ a − (1 − p)b. Since p ∗ b = (1 − p) ∗ a, γ =

(2p−1)a

,

p

which is positive because p > 12 . The principal therefore reduces the high type’s rents by offering a

fair lottery to the low-type agent that has a negative expected value to the high-type agent. The

principal is now indifferent to the realization of the signal for both types of agents.

4.2

Making the Agent Indifferent

The previous section showed that a principal can use a signal that she observes privately by removing

incentives to misrepresent the signal. This section shows that a principal can use an unverifiable

signal that is generated by a neutral third party by making the agent indifferent to the signal. In

P rogramEx−P ost−1 , the low-type agent has an incentive to contest the high signal realization (see

figure 3). P rogramEx−P ost−3 imposes indifference constraints IDj on P rogramEx−P ost−1 to remove

the signal render the signal useless.

9

Numerical examples showing the validity of the proposition for a risk-averse agent are available upon request.

Although we have no formal proof for a risk-averse agent, we have no counterexamples either.

9

an agent’s incentives to ask for verification. Note that, in contrast to the previous section, now

the principal is not indifferent to the signal. This is not an issue because a third party, not the

principal, reports the signal.

P rogramEx−P ost−3 :

EP ≡

s.t.

X

max

Xij ,Rij

X

X

{prob[S = Si |, θ = θj ](Xij − Rij )}

j=L,H i=L,H

{prob[S = Si |θ = θj ](U (Rij ) − D(Xij , θj ))} ≥ 0

∀j (IRj)

i=L,H

X

{prob[S = Si |θ = θj ](U (Rij ) − D(Xij , θj ))} ≥

i=L,H

X

{prob[S = Si |θ = θj ](U (Rî ) − D(Xî , θj ))} ̂ 6= j ∀j (ICj)

i=L,H

U (RLj ) − D(XLj , θj ) = U (RHj ) − D(XHj , θj )

∀j (IDj)

Do the indifference constraints render the signal useless? The proposition below shows that not

only are these contracts better than second-best, they always dominate ex-ante investigation.

If the solution of P rogramEx−Ante is feasible under P rogramEx−P ost−3 , then the weak dominance of P rogramEx−P ost−3 over P rogramEx−Ante is assured. This is, however, not the case because the high-type agent is not indifferent to the signal realization if the contracts in P rogramEx−ante

were offered in P rogramEx−P ost−3 . The high-type agent will prefer the signal to be low.

Proposition 4 P rogramEx−P ost−3 dominates P rogramEx−Ante . For a risk-averse agent, the

dominance is strict.

Proof: See the Appendix.

Making an agent indifferent to the signal after he reports his type still lowers the cost of

eliciting truth from the agent because the principal makes only an honest agent indifferent. It

dominates P rogramEx−Ante because of the insurance effect discussed in section 3.2 (see Figure 2).

Consider how P rogramEx−P ost−3 allows the principal to deviate from P rogramEx−Ante to improve

her utility. The indifference constraints require the contracts for each type of agent to lie on the

same indifference curve for both signal realizations. This already holds for the low-type agent in

P rogramEx−Ante . P rogramEx−P ost−3 allows the principal to move the high type’s contracts to

the same indifference curve while ensuring that the high-type agent gets the same expected utility.

Because the high-type agent faces no risk, the principal need not pay him a risk premium, which

benefits her.

10

We have analyzed a broad spectrum of contracts that highlight the crucial role of verifiability.

In spite of our results, we rarely observe the above schemes. The next section discusses some of

the possible reasons.

5

Summary and Implications

We study the impact of verifiability of accounting data about an agent’s type in adverse selection

settings. Previous research has not examined this issue because the agent is assumed to generate

the signal. If an agent generates an unverifiable signal about his type the signal is merely another

report of his type. We examine settings where the principal or a third party generates the signal.

We make three contributions about how the commonly observed method of gathering information before contracting (ex-ante investigation) compares with other ways of using signals. First,

contrary to the popular perception, with verifiable signals ex-post investigation strictly dominates

ex-ante investigation. All the usual suspects – bounded penalties, investigation costs, probabilistic

investigation, informativeness of the signal, and the agent’s risk aversion – do not affect this dominance, which arises because eliciting the truth is cheaper if the agent does know the signal when

signing the contract. In fact, ex-post investigation yields first best utility with risk neutral agents.

Second, we show that a principal may prefer a noisy (less relevant) but reliable signal because it

enables more efficient contingent contracts. Third, we show that even unverifiable signals can be

used in contingent contracts. A principal can use the unverifiable signal by making the contingent

payoffs such that she is indifferent to the signal once the agent chooses the contract. Alternatively,

the principal can make an honest agent indifferent to the signal.

We now speculate on why ex-ante investigation remains popular. Ex-ante investigation requires

specifying contracts only for the observed signal. In contrast, ex-post investigation requires specifying the contracts for all signal realizations. Designing ex-ante contracts is thus less costly. The

implementation literature provides further clues. Ex-ante investigation is a dominant-strategy implementation, as the agent is induced to tell the truth for every state of the signal, while ex-post

investigation is a Bayesian-Nash implementation, as truth-telling is the agent’s best response given

his beliefs about the signal and requires common knowledge of the information structure, prior

beliefs, and rationality. This is considered to be too demanding relative to the dominant-strategy

implementation (Ledyard, 1986) Ex-ante investigation is thus “easy” and “robust.”

The discussion above suggests that ex-post investigation is more likely under the following

conditions. First, when signals are verifiable, e.g., firms hire employees on the condition that

11

they will produce proof of the degrees that they claim to have. Second, when the principal can

penalize the agent, e.g., government agencies such as the IRS audit tax returns after they are filed.

Third, when investigation costs are high because ex-post investigation allows lowering expected

investigation costs by investigating with probability less than one. Fourth, when the number of

possible signal realizations is small because the cost of specifying the menu of contracts is lower.

Fifth, when a principal interacts with agents frequently because the cost of designing ex-post

contracts can be spread over a larger set of contracts.

Our analysis of verifiability also speaks to how detailed accounting disclosures should be. If

financial statements are to include information that is difficult to verify, then parties that wish

to use the more effective contingent contracts would prefer that such information be disclosed

separately so that they can exclude it from their contracts. For example, disclosing the details of the

assets enables banks to exclude intangible assets from computations of net worth in debt covenants.

Disaggregated disclosure may be necessary from a contracting perspective even if aggregate numbers

alone are sufficient for assessing stock prices.

12

Appendix

We first prove a series of lemmas that will be used in the proofs of the propositions. The following lemma shows, that a low signal makes the principal move the low type’s contract in

P rogramEx−Ante closer to his first best, and vice versa.

Lemma 1

1. XLL > XHL , RLL > RHL .

2. XLH < XHH if U 00 < 0 or XLH = XHH if U 00 = 0.

3. RLH > RHH if Dxx > 0 or RLH = RHH if Dxx = 0.

Proof of Lemma 1: Let prob[θ = θL ] = m. Let (Xj , Rj ) be the optimal contract for probability

m and (X̂j , R̂j ) be the optimal contract for probability m+δm , where δm > 0 and sufficiently small.

Because prob[θ = θL |Si = SL ] > prob[θ = θL |Si = SH ], we need to show that X̂L > XL , R̂L > RL ,

X̂H ≤ XH, and R̂H ≥ RH .

Let us now study the solution at m. It is well known that IRH and ICL are non-binding, IRL and

ICH are binding, and the following equalities hold.

U 0 (RH ) = Dx (XH , θH )

(1 −

(1 − m)

Dx (XL , θL )

)=

[Dx (XL , θL ) − Dx (XL , θH )]

0

U (RL )

mDx (XH , θH )

(1)

(2)

By using the implicit function theorem on the first-order conditions and using the binding constraints, it can be shown that X, R are continuous and differentiable in m. We will now study the

solution at m + δm . Assume the following relations:

X̂L = XL + ²

R̂L = RL + γ

X̂H = XH − β

R̂H = RH + α

Taylor expansion of IRL at m + δm implies: γ =

Dx (XL ,θL )

U 0 (RL ) ².

Taylor expansion of ICH at m + δm ,and substitution for the derivatives from Equation 1 and

Equation 2 implies:

)−Dx (XL ,θH )

α + β = [ Dx (XLD,θxL(X

]².

H ,θH )

13

Because (X̂j , R̂j ) are optimal at m + δm , the following must be true: EP (X̂j , R̂j , m + δm ) −

EP (Xj , Rj , m + δm ) > 0 or, by substitution,

² [(m + δm )[1 −

Dx (XL , θL )

Dx (XL , θL ) − Dx (XL , θH )

] − (1 − m − δm )[

]] > 0

U 0 (RL )

Dx (XH , θH )

Substitution from equation 2 gives,

²{

Dx (XL , θL ) − Dx (XL , θH ) m + δm

}[(

)(1 − m) − (1 − m − δm )] > 0

Dx (XH , θH )

m

We know from the single crossing property that Dx (XL , θL ) − Dx (XL , θH ) > 0.

m

We can also see that [( m+δ

m )(1 − m) − (1 − m − δm )] =

δm

m

> 0. Thus, for (X,R) to be optimal,

² > 0, which implies the following:

• X̂L > XL .

• γ > 0, hence R̂L > RL .

• (α + β) > 0(using the single-crossing property).

Taylor expansion of Equation 1 gives

αU 00 (RH ) = −βDxx (XH , θH ), which further implies,

– if U 00 = 0, then β = 0 and α > 0.

– if Dxx = 0, then α = 0 and β > 0

(Both U 00 and Dxx cannot be zero by assumption of convex indifference curves.)

Hence, X̂H ≤ XH and R̂H ≥ RH .

The next lemma transforms the objective function of P rogramEx−Ante to make it comparable

with P rogramEx−P ost−1 . Consider the following,

P rogramCombined−Ex−Ante

EP ≡ maxXij ,Rij

s.t.

P

j=L,H

P

i=L,H {prob[S

= Si , θ = θj ](Xij − Rij )}

U (Rij ) − D(Xij , θj ) ≥ 0

∀i, j (IRij)

U (Rij ) − D(Xij , θj ) ≥ U (Rî ) − D(Xî , θj )

̂ 6= j

∀i, j (ICij)

Note that the objective function of this program is the same as that of P rogramEx−P ost−1 .

Lemma 2 P rogramEx−Ante is equivalent to P rogramCombined−Ex−Ante above.

14

Proof: The principal’s expected profit in P rogramEx−Ante is

EP =

X

{prob[S = Si ] EP [S = Si ]},

i=L,H

where EP [S = Si ] is the maximized expected profit if the signal produced by the information

system is S = Si , subject to the four constraints [IRij,ICij for j=L,H]. The constrained problem for

Si = SL is independent of the problem for Si = SH ; i.e., the constraints and the objective function

have no common choice variables. We can thus equivalently maximize the objective function given

by EP, subject to all eight constraints [IRij,ICij for i,j=L,H], because it is a linear combination

of EP [S = SL ] and EP [S = SH ] with strictly positive weights. By using Bayes’ rule, EP can be

written as the objective function of P rogramCombined−Ex−Ante .

For the remainder of the appendix we use P rogramEx−Ante to mean P rogramCombined−Ex−Ante .

The objective functions of P rogramEx−Ante and P rogramEx−P ost−1 have the same form.

Proof of Proposition 1

We show that the principal can induce the same production as the first-best solution and make

the same expected payments as in the first-best solution.

³

´

¡ F B F B¢

¡

¢

F B be the first-best solution. Consider X

bij , R

bij for i, j ∈

Let XH

, RH

and XLF B , RL

{L, H} as a solution to P rogramEx−P ost−1 , where

bLH = X

bHH = X F B

X

H

F

b

b

XLL = XHL = X B

L

To highlight that this result is due to relaxation of IR constraints alone, we assume that the IC

constraints are the same as the ex-ante program and relax the IR constraints. We need to prove

bij for i, j ∈ {L, H} such that the following constraints are satisfied.

that there exist R

bHH − D(X F B , θH ) ≥ R

bHL − D(X F B , θH )

R

H

L

F

B

F

b

b

RLH − D(XH , θH ) ≥ RLL − D(XL B , θH )

bLL − D(X F B , θL ) ≥ R

bLH − D(X F B , θL )

R

L

H

F

B

b

b

RHL − D(X , θL ) ≥ RHH − D(X F B , θL )

(ICHH )

bHH + (1 − p)R

bLH ≥

pR

bLL + (1 − p)R

bHL ≥

pR

(IRH )

L

H

F B, θ )

D(XH

H

F

B

D(XL , θL )

15

(ICLH )

(ICLL )

(ICHL )

(IRL )

bij assuming that the ICHH , ICLH , IRH and IRL are binding and show that the

We solve for R

solution satisfies ICLL and ICHL . The binding constraints imply the following:

¡

¢

p

D(XLF B , θL ) − D(XLF B , θH )

(2p − 1)

¢

(1 − p) ¡

FB

= D(XH

, θH ) −

D(XLF B , θL ) − D(XLF B , θH )

(2p − 1)

F

B

pD(XL , θL ) − (1 − p) D(XLF B , θH )

=

(2p − 1)

F

B

pD(XL , θH ) − (1 − p) D(XLF B , θL )

=

(2p − 1)

bLH = D(X F B , θH ) +

R

H

bHH

R

bLL

R

bHL

R

By substitution (ICLL ) is satisfied if

FB

FB

D(XH

, θL ) − D(XLF B , θL ) ≥ D(XH

, θH ) − D(XLF B , θH )

Z XF B

Z XF B

H

H

FB

FB

FB

⇔ D(XL , θL ) +

DX (t, θL ) dt − D(XL , θL ) ≥ D(XL , θH ) +

DX (t, θH ) dt − D(XLF B , θH )

FB

XL

Z

⇔

FB

XH

FB

XL

Z

DX (t, θL ) dt ≥

FB

XL

FB

XH

FB

XL

DX (t, θH ) dt

F B > X F B , the last inequality is implied by the assumed single-crossing property

Given that XH

L

[DX (t, θL ) > DX (t, θH ) ∀X]. Similarly, it can be shown that (ICHl ) is also satisfied by the above

solution. We have shown that the principal can implement XH > XL and keep both IR constraints

binding. Her expected profits will be maximized at the first best output levels. Also note that,

FB

FB

bLL − R

bHL = D(XL , θL ) − D(XL , θH )

R

(2p − 1)

The numerator of RHS > 0 because the high-type agent is more productive. The denominator

bLL > R

bHL . The difference between the

of RHS > 0 because p > 12 . A feasible solution thus has R

compensation levels increases as the difference between the productivity of the two types increases

or the informativeness of the signal (p) decreases. Also note that since D(XLF B , θH ) < D(XLF B , θL ),

bHL can be less than 0. We thus have shown that by just relaxing the IR constraints a feasible

R

solution exists where the first-best production level is achieved and risk-neutral agents get no rents,

so the principal gets her first-best level of utility.

Proof of Proposition 2: The proof is based on taking suitable deviations from the optimal

solution in P rogramEx−Ante and showing that such deviations are feasible in P rogramEx−P ost−1

16

and lead to a strict improvement in the principal’s expected utility.

Let X̂ij , R̂ij be optimal

in P rogramEx−Ante . By Lemma 2, the objective function of P rogramEx−P ost−1 evaluated at

X̂ij , R̂ij is equal to that of P rogramEx−Ante . The IR constraints of P rogramEx−P ost−1 are also

P

satisfied at X̂ij , R̂ij, since IRjP rogramEx−P ost = i=L,H prob[S = Si |θ = θj ]IRijP rogramEx−Ante . The

same is true for the IC constraints. Thus, all contracts in P rogramEx−Ante are also feasible in

P rogramEx−P ost−1 . This proves weak dominance. Strict dominance is proved below.

Let m = prob[θ = θL ]. We conjecture a contract for P rogramEx−P ost−1 by equating Xij , RiL

0

U (R̂LH )

to X̂ij , R̂iL for i = L, H and RLH = R̂LH − ², RHH = R̂HH + ²( (1−p)

for ² > 0 and

p ) 0

U (R̂HH )

sufficiently small. We show that this conjectured deviation is feasible and strictly improves the

principal’s expected profit as compared to P rogramEx−Ante .

The variables in IRL , the LHS of ICL , and the RHS of ICH of P rogramEx−P ost−1 are unchanged.

Using Taylor’s expansion, it can be shown that the conjectured deviation has zero net change on

IRH and the LHS of ICH and strictly reduces the RHS of ICL . Thus, all the constraints are

satisfied and expected profit changes by (1 − m)(1 − p)[1 −

because

U 0 (R̂

LH )

U 0 (R̂HH )

U 0 (R̂LH )

]²,

U 0 (R̂HH )

which is strictly positive

< 1, from Lemma 1, for a strictly risk-averse agent and a strictly convex disutility

function.

The above deviations are feasible even if there are lower bounds on R. We know from Lemma 1

that R̂LH > R̂HH . The deviations are feasible (R ≥ 0) because they decrease R̂LH (which is higher)

and increase R̂HH .

Thus, the agent’s utility over wealth is kept constant and the payments are moved closer together; because of concavity of U(.), this increases the principal’s expected profits. Note that each of

the IR constraints in P rogramEx−Ante are still met. The insurance effect thus arises from relaxing

the IC constraints alone.

Proof of Proposition 3:

With a risk-neutral agent, let the optimal solution to the ex-ante program be (Xij , Rij ) for

³

´

i, j ∈ {L, H}. We need to show that there exist X̂ij , R̂ij that satisfy P rogramEx−P ost−2 and make

the principal better off. Using Equation (1) and the fact that U 0 (·) is constant for the risk-neutral

agent, we know that XLH = XHH = XH . Suppose the principal considers the following solution

to P rogramEx−P ost−2 . The production levels are unchanged; i.e., X̂LL = XLL , X̂HL = XHL ,

17

X̂LH = XH , and X̂HH = XH . The agent’s compensation, however, is changed as follows:

R̂HH = R̂LH = pRHH + (1 − p) RLH − γ

R̂LL = X̂LL − φL

R̂HL = X̂HL − φL

where:

φL = p (XLL − RLL ) + (1 − p) (XHL − RHL )

γ = a small positive number restricted later.

´

³

We need to check whether X̂ij , R̂ij satisfies the constraints of P rogramEx−P ost−2 . Because

X̂HH = X̂LH and R̂HH = R̂LH , PIH is trivially satisfied. PIL is also satisfied by construction

because X̂LL − R̂LL = φL = X̂HL − R̂HL .

To check IRL , substitute φL = p (XLL − RLL ) + (1 − p) (XHL − RHL ), in the expression below:

³

³

´´

³

³

´´

p R̂LL − D X̂LL , θL + (1 − p) R̂HL − D X̂HL , θL

= p (XLL − φL − D (XLL , θL )) + (1 − p) (XHL − φL − D (XHL , θL ))

= pXLL + (1 − p) XHL − φL − pD (XLL , θL ) − (1 − p) D (XHL , θL )

= pRLL + (1 − p) RHL − pD (XLL , θL ) − (1 − p) D (XHL , θL )

= p (RLL − D (XLL , θL )) + (1 − p) (RHL − D (XHL , θL ))

= p ∗ LHS of IRLL in Ex-ante + (1 − p) ∗ LHS of IRHL in Ex-ante = 0

To check IRH , note that

³

³

´´

³

³

´´

(1 − p) R̂LH − D X̂LH , θH

+ p R̂HH − D X̂HH , θH

= pRHH + (1 − p) RLH − γ − (1 − p) D (XLH , θH ) − pD (XHH , θH )

= (1 − p) (RLH − D (XLH , θH )) + p (RHH − D (XHH , θH )) − γ

= (1 − p) ∗ IRLH in Ex-ante + p ∗ IRHH in Ex-ante − γ

Because RLH > RHH (Lemma 1), XLH = XHH (a consequence of risk-neutrality discussed above),

and the IR constraints for the high-type agent are not binding in P rogramEx−Ante , there exists

γ > 0 such that IRH in P rogramEx−P ost−2 is not violated.

18

ICL is satisfied as we have fixed the low type’s utility and reduced the high type’s utility.

³

´

To check ICH , we substitute for X̂ij , R̂ij and show:

³

³

´´

³

³

´´

(1 − p) R̂LH − D X̂LH , θH

+ p R̂HH − D X̂HH , θH

³

³

´´

³

³

´´

≥ (1 − p) R̂LL − D X̂LL , θH

+ p R̂HL − D X̂HH , θH

(1 − p) (RLH − D (XLH , θH )) + p (RHH − D (XHH , θH )) − γ

≥ (1 − p) (XLL − φL − D (XLL , θH )) + p (XHL − φL − D (XHL , θH ))

= (1 − p) XLL + pXHL − φL − (1 − p) D (XLL , θH ) − pD (XHL , θH )

= (1 − p) XLL + pXHL − p (XLL − RLL ) − (1 − p) (XHL − RHL )

− (1 − p) D (XLL , θH ) − pD (XHL , θH )

= (1 − 2p) XLL − (1 − 2p) XHL + pRLL + (1 − p) RHL

+ (1 − p) (RLL − D (XLL , θH )) + p (RHL − D (XHL , θH )) − (1 − p) RLL − pRHL

= (1 − p) (RLL − D (XLL , θH )) + p (RHL − D (XHL , θH ))

− (2p − 1) [(XLL − RLL ) − (XHL − RHL )]

ICHH and ICLH of the ex-ante program ensure that ICH is satisfied as long as:

γ < (2p − 1) [(XLL − RLL ) − (XHL − RHL )]

The RHS of the expression above is positive because the principal moves the contract closer to the

low type’s first best when a low signal is observed. The principal’s utility from a low-type agent

when a low signal is observed (XLL − RLL ) is more than the principal’s utility from a low-type

agent when a high-signal is observed (XHL − RHL ). Thus, picking a gamma that is the minimum

of (2p − 1) [(XLL − RLL ) − (XHL − RHL )] and the high type’s rent (the slack in IRH ) will ensure

that all constraints are satisfied and the expected payment to the high-type agent is reduced by a

positive γ. The overall increase in the principal’s expected utility =γ ∗ prob[θ = θL ]

Proof of Proposition 4: Let X̂ij , R̂ij be optimal in P rogramEx−Ante . It is obvious that X̂ij

and R̂ij satisfy the IR and IC constraints of P rogramEx−P ost−3 . Constraint IDL (for the low-

19

type agent) is also satisfied because in P rogramEx−Ante both the LHS of IRLL and the LHS of

IRHL are equal to zero. Let U (R̂LH ) − D(X̂LH , θH ) = KL and U (R̂HH ) − D(X̂HH , θH ) = KH .

We know from Lemma 1 that KL > KH . Let RLH = R̂LH − α and RHH = R̂HH + β so that

U (RLH ) − D(X̂LH , θH ) = U (RHH ) − D(X̂HH , θH ) = K = (1 − p)KL + pKH . IRL , IRH , ICH , and

the LHS of ICL in P rogramEx−P ost−3 are unchanged. Because the RHS of ICL puts greater weight

(p) on the number that is being reduced (RLH ), it is also reduced, so the ICL is also met. Because

the agent is risk-averse and RLH > RHH, the deviation suggested reduces the risk imposed on the

agent and allows the principal to improve her utility.

20

Figure 1

The Incentive Effect

Implementing the First-best in P rogramEx−P ost−1 with a Risk-Neutral Agent

(Xij , Rij ): Output-compensation pair for signal i and agent j in P rogramEx−P ost−1

F Bj : First-best of type-j agent

1

Compensation (R)

(XLH , RLH )

2

(XLL , RLL )

F BL

F BH

(XHH , RHH )

(XHL , RHL )

Output in Dollars (X)

contract offered

agent chooses

investigation

output

compensation

1

The high-type’s indifference curve passing through the

low-type’s contract when the principal observes a low signal.

2

The high-type’s indifference curve passing through the

low-type’s contract when the principal observes a high signal.

21

Figure 2

The Insurance Effect

P rogramEx−P ost−1 Dominates P rogramEx−Ante for a Risk-Averse Agent

(Xij , Rij ): Output-compensation pair for signal i and agent j in P rogramEx−Ante

(X̂ij , R̂ij ): Output-compensation pair for signal i and agent j in P rogramEx−P ost−1

Compensation (R)

1

2

(XLH , RLH )

(X̂HH , R̂HH )

(X̂LH , R̂LH )

(XHH , RHH )

(X̂LL , R̂LL ) = (XLL , RLL )

(X̂HL , R̂HL ) = (XHL , RHL )

Output in Dollars (X)

contract offered

agent chooses

investigation

output

compensation

1

The high-type’s indifference curve passing through the

low-type’s contract when the principal observes a low signal.

2

The high-type’s indifference curve passing through the

low-type’s contract when the principal observes a high signal.

22

Figure 3

P rogramEx−P ost−2 Dominates P rogramEx−Ante for a Risk-Neutral Agent

(Xij , Rij ): Output-compensation pair for signal i and agent j in P rogramEx−Ante

(X̂ij , R̂ij ): Output-compensation pair for signal i and agent j in P rogramEx−P ost−2

2

1

3

Compensation (R)

(XLH , RLH )

(X̂LH , R̂LH ) = (X̂HH , R̂HH )

(X̂LL , R̂LL )

b

(XLL , RLL )

(XHL , RHL )

(XHH , RHH )

p ∗ b = (1 − p) ∗ a

a

(X̂HL , R̂HL )

Output in Dollars (X)

contract offered

agent chooses

investigation

output

compensation

1

The principal’s indifference curve.

2

The high-type’s indifference curve passing through the

low-type’s contract when the principal observes a low signal.

3

The high-type’s indifference curve passing through the

low-type’s contract when the principal observes a high signal.

23

References

Baiman, S. & Evans, J. (1983). Pre-decision information and participative management control

systems. Journal of Accounting Research, Autumn, 371–395.

Balachandran, K. R. & Radhakrishnan, S. (2004). Quality implications of warranties in a supply

chain. Working Paper, Stern School of Business, New York University.

Baron, R. & Myerson, R. (1982). Regulating a monopolist with unknown costs. Econometrica, Vol.

50:4, 911–930.

Cremer, J. & McLean, R. (1988). Full extraction of the surplus in bayesian and dominant strategy

auctions. Econometrica, Vol. 66, 1247–1257.

Demski, J. S. & Feltham, G. A. (1978). Economics incentives in budgetary control systems. The

Accounting Review, Vol. LIII, 336–359.

Demski, J. S. & Sappington, D. (1984). Optimal incentive contracts with multiple agents. Journal

of Economic Theory, 33:1, 152–71.

Demski, J. S. & Sappington, D. (1991). Resolving double moral hazard problems with buyout

agreements. Rand Journal of Economics, 22:2, 232–40.

Demski, J. S., Sappington, D., & Spiller, P. T. (1988). Incentive schemes with multiple agents and

bankruptcy constraints. Journal of Economic Theory, 44:1, 156–67.

Fellingham, J. & Young, R. (1990). The value of self-reported costs in repeated invest- ment

decisions. The Accounting Review, October, 837–856.

Kanodia, C. (1993). Participative budgets as coordination and motivational devices. Journal of

Accounting Research, 31:2, 172–89.

Kerschbamer, R. (1994). Destroying the “Pretending” equilibria in the Demski-Sappington-Spiller

model. Journal of Economic Theory, 62:1, 230–237.

Kirby, A., Reichelstein, S., Sen, P., & Paik, T. (1991). Partcipation, slack, and budget-based

performance evaluation. Journal of Accounting Research, Vol. 29, 109–128.

24

Ledyard, J. (1986). The scope of the hypothesis of bayesian equilibrium. Journal of Economic

Theory, 39, 59–82.

Melumad, N. D. & Reichelstein, S. (1987). Centralization versus delegation and the value of

communication. Journal of Accounting Research, 25, 1–18.

Melumad, N. D. & Thoman, L. (1990). On auditors and the courts in an adverse selection setting.

Journal of Accounting Research, Vol. 28, No. 1, Spring, 77–120.

Myerson, R. (1983). Mechanism design by an informed principal. Econometrica, 51:6, 1767–97.

Reichelstein, S. (1992). Constructing incentive schemes for government contracts: An application

of agency theory. Accounting Review, 67:4, 712–31.

25