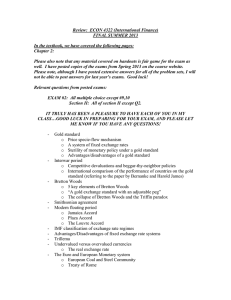

Three Perspectives on the Bretton Woods System

advertisement