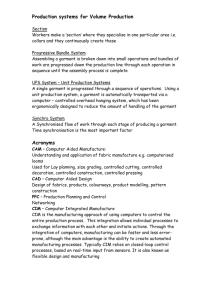

Electronic Supply Chain Management and Model Development

advertisement