The Korean system of innovation and the semiconductor

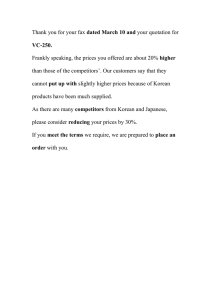

advertisement