Roadmap Semiconductor Equipment

advertisement

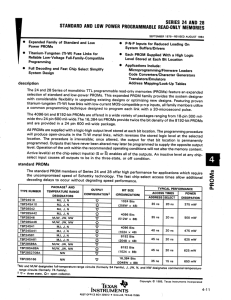

Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 1. Societal and economic relevance It is difficult to imagine the modern world without electronics. The internet, electronic banking, mobile telephony, GPS, digital archiving and retrieval, and surveillance, to name a few, rely on advanced electronic circuitry, particularly integrated circuits (chips). Chips advance at a rapid pace. The introduction of digital photography, car navigation systems, notebooks, and 3D games, are recent manifestations of progress in microchips. With further microchip advancements, we anticipate that electronics will enable a more sustainable society in many ways. Electronics consuming less power, or improving power efficiency in e.g. gsm base stations and street lighting, are foreseen to contribute to a less power hungry developed world. Electronics are a key enabler of teleworking. Wireless network systems will gather and deliver ambient information to foster safety and security, for instance in automated dike monitoring and airport security; and enable “smart buildings” where climate control is automatically adjusted to real demand. New electronic systems for point-of-care medication and diagnosis will contribute to the needs of an ageing society. How electronic circuits will evolve to contribute to these societal needs is further detailed in the “components and circuits” roadmap. The aforementioned rapid advancement of microchips is described by Moore’s Law (1965). Intel cofounder Gordon Moore recognized that technology progress allows us to double the number of components on a chip every 18-24 months. Three mechanisms make this possible: the miniaturization of components, the increasing size of chips and substrates (wafers), and the advancement of fabrication technology. The roadmap for R&D in Semiconductor Equipment is dominated by the same three driving forces. The bi-annually updated International Technology Roadmap of Semiconductors (ITRS – www.itrs.net) describes the worldwide R&D agenda for this sector. Of the ~ 30.2 B$ (2012, est VLSI) global Semiconductor Equipment market about one fifth is delivered from the Netherlands, mostly to Asia. Consequently virtually all State-of-the-Art chips in the world contain Dutch IP and are manufactured on some Dutch tools. The market is extremely volatile; recently year-to-year variation has been a factor of three. It is likely that the total market size over time will grow at least by 50% (2020 – 45 B$) due to the increased complexity at future nodes. The litho content now at 7 B$ (2015) is likely to double since it is the most complex equipment defining the critical dimension needed. Moore’s law is from a technical viewpoint continuing at least five years. The total R&D investment in this sector in the Netherlands by the industry is less cyclic and estimated over 1 B€, more than one sixth of the Dutch private R&D. In some areas the Dutch industry is dominant, like in lithography, where ASML has a market share in excess of 80%, in other areas significant, especially at the high-end side (high resolution imaging, atomic layer depositions, etc.). 2. Application and technology challenges 2.1 State of the art for industry The forefront of semiconductor manufacturing, regarding lithography is flash memory, which is used mainly in portable devices. Currently, double patterning immersion lithography is used at line widths of 20 nm. The reduction of line widths is a major drive in the industry, since it reduces production cost and improves the quality of the manufactured products: they 1 of 7 Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 can operate at a higher clock rate, while consuming less energy. Continuous shrinking of the dimension is the first business principle that makes commercial success in the semiconductor industry possible. Furthermore, the introduction of 3D structures, like FinFETs, poses new challenges to the industry. The 14nm technology node is about to be introduced by market leaders. Preparations for 10nm node and beyond are ongoing and demands amongst others the introduction of several new materials (especially to further increase the speed of reading/writing and to reduce memory cell size), technologies for low temperature processing (e.g. lowtemperature conformal atomic layer deposition), and introduction of new lithography technologies like Extreme Ultraviolet (EUV) lithography. The current mainstream wafer size in the industry is a diameter of 300mm. Each ten to fifteen years the wafer size is increased by a factor of 1.5, giving a cost reduction of at least 30%. This cost reduction due to increase in wafer size is the second business principle, however it requires a high investment in totally new factories and a totally new set of equipment. Productivity improvement is a constant drive in the industry, the number of wafers that are processed per hour is constantly pushed upwards to reduce production cost. For instance lithography machines now run at 250 300mm wafers per hour, next year at 275. This productivity increase is realized almost without additional investment in the factory. In the display area a move to flexible substrates is expected in the next 10 years. Lithography on flexible substrates will give serious challenges, requiring adaptive printing. Another driving force in the display marketplace is the introduction of displays for improved display qualities and reduced power consumption. This requires new thin film and deposition technologies that are compatible with the vulnerable functional layers and smaller feature sizes and more flexible substrates. In this context the now accelerating evolution of printed electronics as in smart watches or on stressable foils will require new semicon equipment (for the backend industry). 2.2 Future outlook, in present and emerging markets In the next ten years the semiconductor market is likely to continue growing by approximately 14% per year in silicon area, while the complexity will keep increasing with a rapid pace. The number of process steps and use of diverse materials will increase. This is all good news for the equipment industry. While the transition to 450mm wafer sizes is currently on hold, and fewer “super” semi-conductor companies will continue to control a larger part of the market, smaller players can be involved in the introduction of EUV or create new niche markets. These new markets will show a high level of “More than Moore” and a high package diversification. 2.3 Major industry challenges Continuous miniaturization The reduction in feature size as well as the application of 3D structures will continue to be further pursued by industry for at least the next 10 years. This will drive the development of production and metrology equipment, but also the synthesis of new materials as well as atomic deposition control as well as the quality of chip factories. Processes like double patterning, pitch division or directed self assembly will become more important in the 2 of 7 Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 reduction in feature size. But also materials, previously forbidden in a CMOS environment today become necessary. Practically the complete periodic system appears in the fabs and all kind of e.g. avoidance of contamination measurements are needed. This has great consequences for the whole chain of semiconductor equipment from lithography and processing to inspection. Most obvious is the development in lithography, where in the next few years the introduction of Extreme UV wavelengths in mass fabrication is scheduled. Main challenges in the EUV are the availability of high-brightness EUV light sources and optics and defect free reticles with or without pellicle with high reflectivity and prolonged lifetimes. Thermal loading and energy usage in future systems also require innovations. Higher productivity For economic reasons a high throughput and ease of use and service of the production machines is needed. This leads to lightweight designs and optimal user interfaces. The mechatronic control of such constructions demands for new control and measurement strategies to improve the position accuracy down to the picometer level. It can also be economically advantageous to use thinner substrates. Due to their fragility, breakthroughs in substrate handling are a prerequisite. Furthermore, throughout the processing chain, minienvironment control by e.g. FOUP purge for batch systems, increased productivity by higher load sizes and faster temperature control will be required to meet the productivity demands. Improving yield with contamination control With the continuous shrinking nodes and thinner layers used in the industry the need for Contamination Control becomes more important to keep up yield in the production, which is a pre requisite for affordable chips. The presence of 10 nm particles on a wafer will result in bad dies (yield loss) while at the moment it is not possible to detect those particles. The same goes for molecular contamination at the level of sub monolayer concentrations. There is a need in the industry for better detection methods, prevention strategies and cleaning technologies to maintain the necessary yield. Improving the accuracy of production equipment by minimizing thermal effects For many years the control of dynamics and disturbances has been the competitive element in precision equipment. The next limit to performance is caused by temperature-induced effects on the pattern fidelity and overlay accuracy, which have to be in the range of few nm. Understanding the flow of energy at the milli-Kelvin level both in time and space is needed to enable the design of next generation tools. The challenges for lithography is in a lightweight, but stiff wafer stage, requiring new technology with active dimension control, with increased light levels and improved wafer handling. Product metrology As a result of “more Moore”, metrology and characterization of semiconductor products become more critical since the features to be observed are becoming so small that imaging requires new technology like Transmission Electron Microscopy (TEM) or high-throughput electron beam inspection. Next to that the move to 3D structures and device integration will lead to the application of new technologies like high-throughput Scanning Probe Microscopy. Affordable high-end, low volume production. 3 of 7 Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 The start-up costs for a new chip (design, masks, tool costs) at the high end have become prohibitively high for small series as required in specialty products and scientific research for "more than Moore". New tools (such as direct write lithography) and processes (open source design software) are needed. Flexible printing New substrates will require litho machines where the image can be adapted to the deformation of the substrate. III-V materials Given the developments at the Dutch academia also the recent developments regarding III-V materials are to be mentioned. This development, today on 2-4-6 inch wafers is evolving towards industrial use. In the context of semiconductor equipment this does not require specific attention. It is more the broad use of more exotic materials has an impact on new equipment in general. 2.4 Future technology outlook The semiconductor equipment roadmap is driven by the developments in semiconductor technology. In the coming 3 to 15 years, we distinguish two trends: 1. Further miniaturization of integrated circuits with basically the same functionality as today: processors, memory, logic, etc. At the pace set by Moore’s law, this puts extreme demands on innovations concerning existing equipment. Often it requires the use of new materials (e.g. ultra thin Si-On-Insulator (SOI), nickel silicide, hafnium based dielectrics) or new instrument principles (for example transmission electron microscopy instead of light microscopy for inspection). Some call this “more Moore”. 2. Introduction of new physical principles in chips and packages: optical and wireless communication, graphene-based conduction, on-chip sensing, actuation, energy harvesting, etc. Those chips may be more application-specific, such that smaller series must be produced with equipment that provides greater manufacturing flexibility. This requires totally new types of semiconductor equipment. Some call this “more than Moore”. 4 of 7 Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 The diagram illustrates three possible approaches towards achieving the necessary innovations in the area of semiconductor equipment: 1. Understanding and improving existing equipment that has already been introduced into the market. 2. The development of new fabrication processes and tools motivated and necessitated by the introduction of new materials and device concepts. 3. Innovations regarding process- and equipment concepts can expand the boundaries of manufacturability of new devices. 3. Priorities and implementation The two pillars of the strong position of the Semi-Conductor Equipment industry is the knowledge base and the excellent and world class supply chain. The knowledge base includes fields such as light-, electron- and EUV-optics, plasma physics, surface physics and chemistry, heat- and fluid-transport, precision mechanics, electronics, applied mathematics, materials science, vacuum technology, contamination control, embedded system technology, thin film technology, fast data processing, etc. The supply chain has exceptional strength in complicated electro mechanical assemblies and control. However, the supply chain is not very strong in initiating its own R&D for the development of products for the future. The goal of the programs in this roadmap is to strengthen and focus the activities in these fields, guided by the following priorities: Involving the supply chain in an integrated R&D and supply position. For instance in Germany, it is very common, that suppliers perform the necessary R&D for the subsystem delivered on their own risk, unfortunately much less so in the Netherlands. Involving the supply chain in International R&D projects will assist them to improve this situation. Modeling, understanding and controlling the physics, chemistry, mechanics and electronics of existing types of equipment (Innovating equipment for “more Moore”). Control of surface processes in (vacuum) tools. Complex equipment components enabling the sub-14 nm and beyond (i.e. 10 en 7 nm) generations of semiconductor equipment and tooling. Computational models and algorithms for wafer processing and inspection. Higher throughput equipment for the inspection requirements of the sub-22 nm generations. Thermo-mechanical models for interaction of high intensity laser beams with multimaterial composites in dicing and additive manufacturing Understanding the interaction between light, EUV or electrons with resist materials. Understanding, modeling and controlling the processes for volume production of new materials or functions in chips or in packages Processes for further miniaturization, compatible with volume manufacturing (processes for “more Moore”). Processes for the introduction of new functions in volume manufacturing (processes for “more than Moore”). 5 of 7 Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 Translating desired processes into principles and architectures of new equipment and testing the basic functionality of these new instruments. New principles in manufacturing equipment necessary for further miniaturization (new equipment for “more Moore”). Equipment for devices with new functionality (new equipment for “more than Moore”). New principles in inspection and metrology equipment. Pick-and-place e.g. on thin wafers. A new entity in the Dutch R&D environment is the Advanced Research Center for Nanolithography (ARCNL) focusing on the fundamental physics involved in current and future key technologies in nanolithography, primarily for the semiconductor industry. This novel form of PPP has especially been established to maximize the opportunities in the longer term for the Dutch industry, in particular for ASML. The initial emphasis of ARCNL’s research program is on EUV lithography. 3.1 TKI program The best possible institute should be charged with executing work under the TKI program, not necessarily the institute that provides the base for the TKI. Application of the TKI funds as counter financing source for institutes and universities might improve quality and solve the problem of financing in international programs. Quite a diverse group of projects take place under the SCE TKI programme, many litho related: regarding immersion lithography, EUV, mirror technology, E-beam litho technology, improved and plasma resistant mirrors, alignment technologies to assure an overlay substantially less than 1 nm and a wafer stage capable of 300 wafers/hour and if feasible the realisation of a technology demonstrator for a flexible printer. In order to advance the capabilities in the supply base a major program on 3D printing is underway. Advanced imaging and power electronics are other subjects. 3.2 European program Focus in the SCE Roadmap for the International cooperation is on the realisation of enabling equipment and processes for 10nm and beyond on 300mm wafers is first focus now. The Dutch supply chain will broadly participate in the Dutch contingent of this large international project. Project will be submitted in ECSEL. The ultimate goal is to realize a 7nm node pilot facility, maximally equipped with European generated equipment. Application of TKI funding for institutes and universities should be promoted. 4. Partners and process Some thirty Dutch OEMs, like ASM, ASML, Mapper and FIE and smaller companies like BESI, ALSI, SolMateS and Bronkhorst are all active in the SCE sector, while a very large number are active in the supply chain. This dynamic group of more than 200 companies is committed to actively participate in the SCE program. Also Carl Zeiss SMT is a major investor in Dutch R&D, presently mainly in EUV mirror program at the UTwente. Prime scientific participants are ARCNL, UT, TUD, TU/e, DIFFER, while RUG, UU, UL, VU, SRON, ASTRON, Nikhef are also participating. Important institutes are M2I, ESI and TNO. 6 of 7 Roadmap Semiconductor Equipment Innovation Agenda 2016-2019 5. Investments The SCE sector is by far the largest private R&D investor in the Netherlands, more than 1 B€ yearly or more than one sixth of the total Dutch private R&D investment and better than one third of the R&D investment in the HTSM sector. Contributions from RDA and TKI in the sector appear to be lagging somewhat, so a challenge to bring this to proportional levels, compared to the total investment. Roadmap Industry TNO ECN NWO Universities Departments1 and regions2 Grand total 2015 120 4 .5 1 10 23 158.5 2016 120 4 1 1 10 23 159 2017 120 4 1 1 10 23 159 2018 120 3 1 1 10 24 159 2019 120 3 1 1 10 24 159 European agenda within roadmap Industry TNO ECN NWO Universities Co-financing of European programs3 European Commission 2015 100 1 .5 2016 100 2 .5 2017 100 2 .5 2018 100 2 .5 2019 100 2 .5 1 15 15 2 15 15 2 15 15 2 15 15 2 15 15 1 Ministries, excluding contributions to TKI HTSM Regional and Local Authorities 3 Ministry of Economic Affairs contributions to JU ECSEL and EUREKA clusters 2 7 of 7