ELEMENTS OF MODERN COURT REFORM The story of America`s

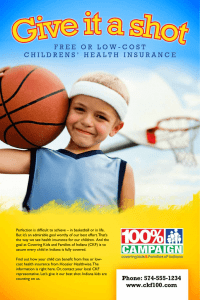

advertisement