Indian non-electrical machinery industry

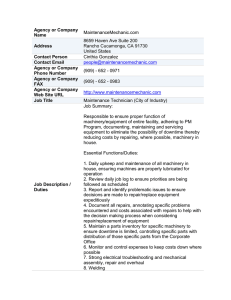

advertisement