PATENT DAMAGES REFORM AND THE SHAPE OF PATENT LAW

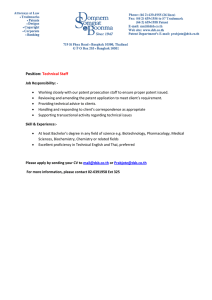

advertisement