ONE-YEAR FIXED INCOME PORTFOLIO (I)

AS OF JUNE 30, 2016

ABOUT DIMENSIONAL *

Dimensional is a leading global investment firm that has been translating academic research into practical investment solutions since 1981. Guided by a

strong belief in markets, Dimensional offers strategies that focus on the drivers of expected returns. The firm applies a dynamic implementation process

that integrates advanced research, methodical portfolio design, and careful execution, while balancing risks, costs, and other tradeoffs that may impact

performance. This approach is applied across a full suite of investment strategies to help meet the needs of investors worldwide.

OVERVIEW

Benchmark

Benchmark 2

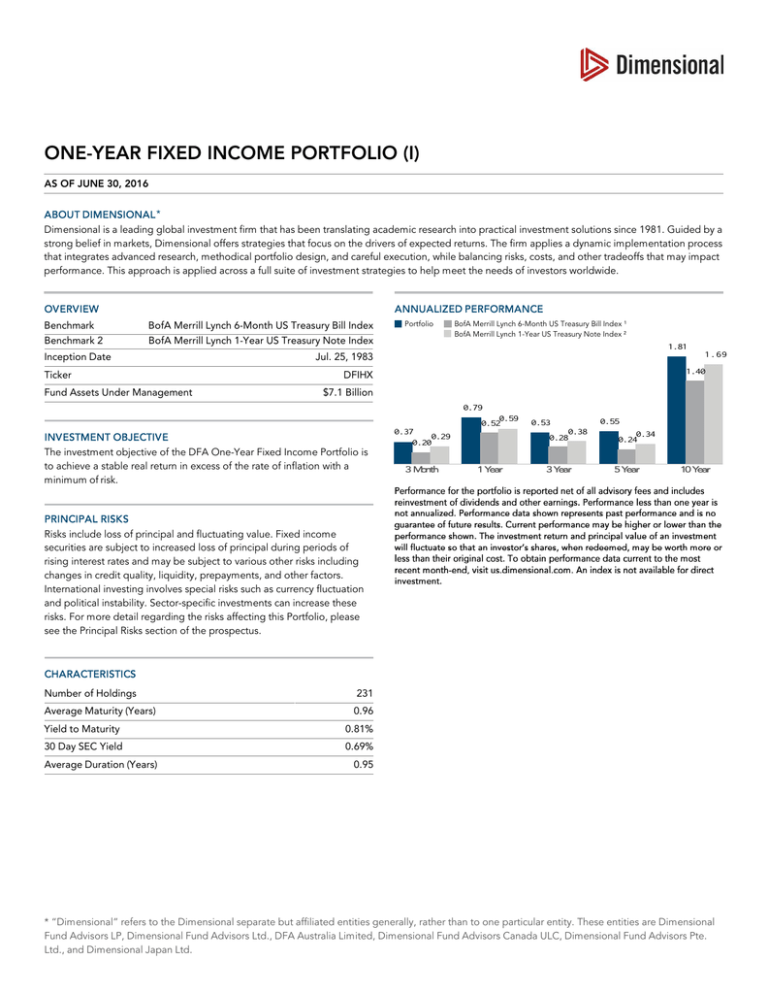

ANNUALIZED PERFORMANCE

BofA Merrill Lynch 6-Month US Treasury Bill Index

BofA Merrill Lynch 1-Year US Treasury Note Index

Inception Date

Ticker

Fund Assets Under Management

Portfolio

BofA Merrill Lynch 6-Month US Treasury Bill Index ¹

BofA Merrill Lynch 1-Year US Treasury Note Index ²

1.81

1.69

Jul. 25, 1983

1.40

DFIHX

$7.1 Billion

0.79

0.59

0.52

INVESTMENT OBJECTIVE

The investment objective of the DFA One-Year Fixed Income Portfolio is

to achieve a stable real return in excess of the rate of inflation with a

minimum of risk.

0.37

0.29

0.20

3 Month

0.53

0.38

0.28

1 Year

3 Year

0.55

0.34

0.24

5 Year

10 Year

PRINCIPAL RISKS

Risks include loss of principal and fluctuating value. Fixed income

securities are subject to increased loss of principal during periods of

rising interest rates and may be subject to various other risks including

changes in credit quality, liquidity, prepayments, and other factors.

International investing involves special risks such as currency fluctuation

and political instability. Sector-specific investments can increase these

risks. For more detail regarding the risks affecting this Portfolio, please

see the Principal Risks section of the prospectus.

CHARACTERISTICS

Number of Holdings

Average Maturity (Years)

231

0.96

Yield to Maturity

0.81%

30 Day SEC Yield

0.69%

Average Duration (Years)

0.95

* “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional

Fund Advisors LP, Dimensional Fund Advisors Ltd., DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte.

Ltd., and Dimensional Japan Ltd.

DIMENSIONAL FUND ADVISORS

2 of 2

FUND COSTS

MATURITY ALLOCATION

0 - 3 Months

21.12%

Management Fee

0.15%

3 - 6 Months

4.17%

Total Operating Expense Ratio

0.17%

6 - 9 Months

12.24%

Net Expense Ratio (to investor)

0.17%

9 - 12 Months

12.21%

1 - 3 Years

50.27%

Expense information as of 10/31/2015. The fund's prospectus contains more

information on fees and expenses.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment

objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the

Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors

collect at (512) 306-7400 or at us.dimensional.com. Dimensional funds are distributed by DFA Securities LLC. Holdings are subject to change.

Numbers may not total 100% due to rounding.

¹ The BofA Merrill Lynch Six-Month US Treasury Bill Index measures the performance of US Treasury bills. It is not an investment product available for

purchase. The BofA Merrill Lynch Indices are used with permission; copyright 2016 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights

reserved. Merrill Lynch, Pierce, Fenner & Smith Incorporated is a wholly owned subsidiary of Bank of America Corporation.

² The BofA Merrill Lynch One-Year US Treasury Note Index measures the performance of US Treasury notes. It is not an investment product available

for purchase. The BofA Merrill Lynch Indices are used with permission; copyright 2016 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights

reserved. Merrill Lynch, Pierce, Fenner & Smith Incorporated is a wholly owned subsidiary of Bank of America Corporation.

P3-7N

911364