Union Budget 2012

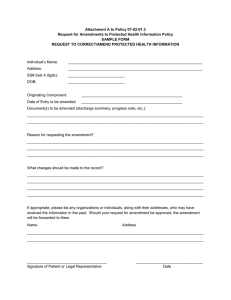

advertisement